Bitcoin has risen above 97,000 after extending gains yesterday from a low of 90k earlier in the week. The mood is cautious ahead of US inflation data, which could bring some volatility to BTC price action.

How might US inflation data impact BTC?

US CPI is expected to rise 2.9% in December, up from 2.7% in the previous month, while core inflation is expected to hold steady at 3.3%. Hotter-than-expected inflation could see the market push back Fed rate cut expectations. Currently, the market is pricing in just one 25-basis-point rate cut from the Federal Reserve in December.

Inflation trending away from the Federal Reserve’s 2% target even before President-elect Trump moves into the White House will concern Fed policymakers. Trump is expected to implement inflationary measures such as tax cuts and trade tariffs, which could see inflation rise further in the coming month.

Higher sensitivity to interest rates over the past month has increased the importance of today’s inflation data. Rising 10-year yields, a stronger USD, and reduced Fed rate cut expectations have weighed on BTC momentum in recent weeks, keeping Bitcoin below 100k and to lower levels of 90k earlier in the week,

A higher interest rate environment tends to be less beneficial for risk assets such as Bitcoin and stocks, given it reduces liquidity.

Bitcoin – Nasdaq 100 correlation at a 2-year high

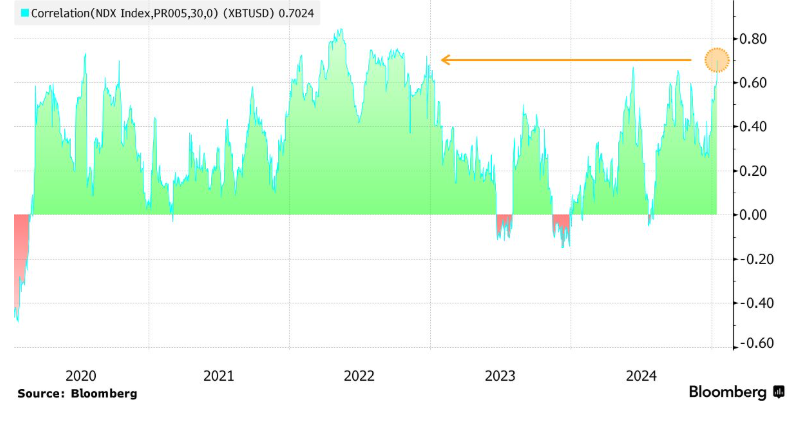

Inflation data comes as the correlation between Bitcoin and the gauge of US technology stocks hits a two-year high. This suggests that the equity markets’ reaction to US inflation data may set the tone for Bitcoin and other digital tokens.

The 30-day correlation coefficient is efficient for the largest cryptocurrency, and the NASDAQ 100 index is around resort 0.7, according to Bloomberg data. A reading of 1 signals that the assets are moving perfectly in line. A reading of -1 signals a perfectly inverse relationship.

Hotter-than-expected inflation data could raise bond yields, which were already elevated, putting pressure on stocks and crypto. Meanwhile, cooler-than-expected inflation could see Bitcoin rise, similar to yesterday’s reaction to the US wholesale inflation release. US PPI was weaker than expected, rising 3.3% vs. the forecast 3.4%, helping to boost risk assets and Bitcoin.

Mixed on-chain data

On-chain data has painted a mixed picture, with data from CrytoQuant showing whale inactivity as a major contributor to Bitcoin’s limited recovery. While the Coinbase Premium Gap (CPG) data highlighted significant selling activity in whale entities, there was no corresponding buying action to absorb the drop. This suggests caution by large-scale investors.

Separately, open interest, a measure of the total number of outstanding derivatives contracts, rose by 2.09% over the last 24 hours, signaling a renewed appetite for trading activity that could raise speculation over bitcoin’s future price movements.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.