Why is equity in Forex trading important?

Because it’s all your trades, profits, losses from open positions and funds you trade with. As asset rates fluctuate, obviously, the value of your equity changes as well. Your “Balance”, on the other hand, only changes when you deposit, open or close trades and if you are using leverage. If you are trading with leverage, then you also have to calculate how much of your funds are dedicated to margin.

If you are unfamiliar with the terms we used above, it might be a good idea to go back and read What is Margin Trading and What is leverage in trading.

If you are already familiar with those concepts, then we can move on to find out what is equity in Forex.

Key takeaways:

- Equity in Forex trading or Forex equity is the sum of all of your funds, plus unrealized profits or losses on open positions and minus any margin needed for leveraged trades open.

- Balance does not change unless you deposit, open or close a trade or if you have leveraged trades open.

- Forex equity also includes margin which is dedicated to open positions that have leverage applied to them.

What is equity?

Forex equity reflects all funds; real and unrealized in a Forex trader’s account. This includes free margin, trading balance, the value of all open positions profit or losses and margin dedicated to open positions.

If you do not have any positions open, then your account equity is the same as your trading account balance. If you have open positions without leverage then your account equity is your trading balance, plus any “unrealized profit” or “unrealized losses”, plus margin that may tied up to keep leveraged trades open.

If you are still having trouble understanding the difference between balance and equity – Balance is the funds as a result of your closed positions where equity is your balance plus the profits and losses of open positions and reflect your assets in real time as the rate of your positions change.

How to calculate equity?

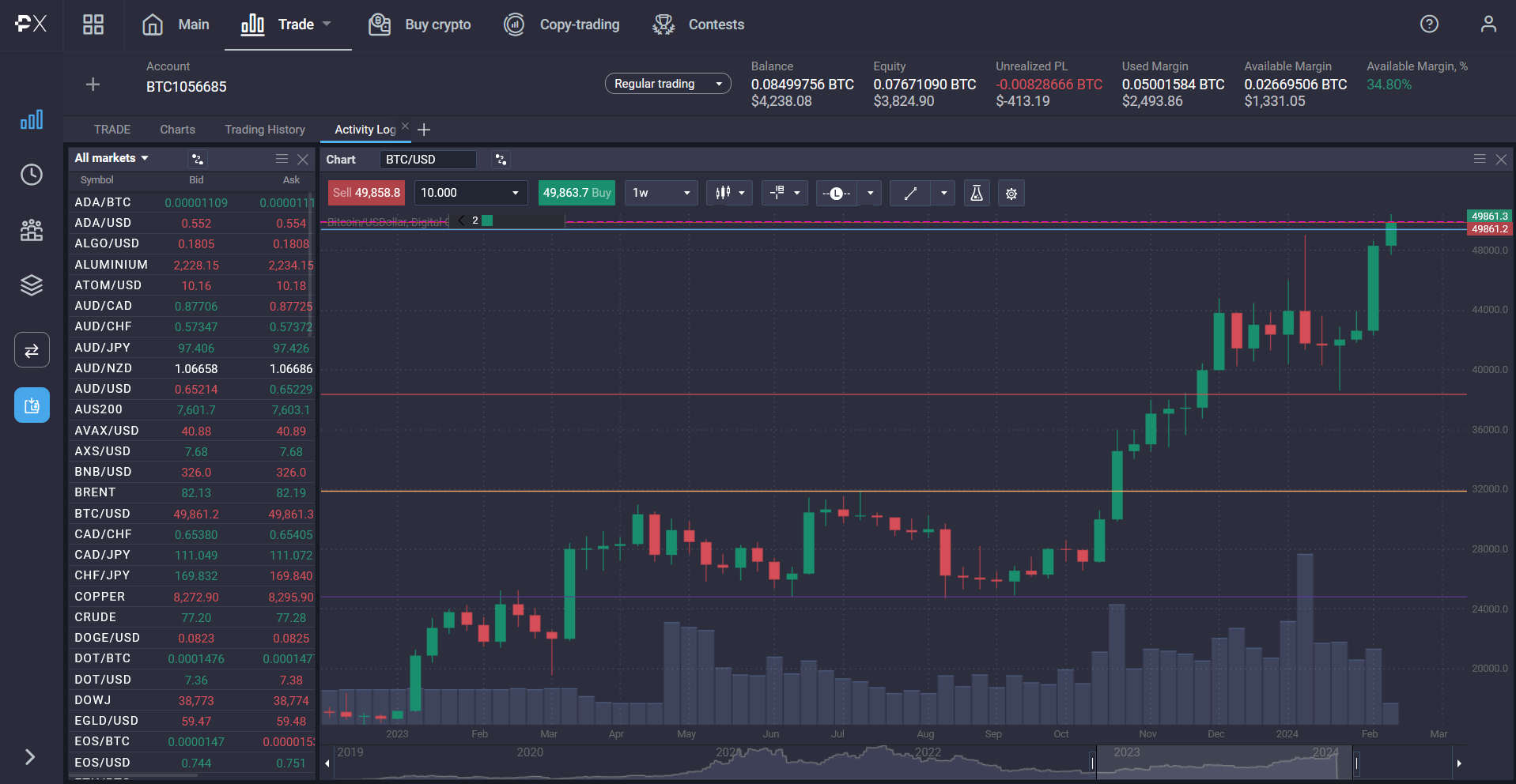

Again if you don’t have any open positions, then your account equity is equal to your trading account balance. Here you can see that Balance and Equity are equal (0.09 BTC or $4507.78), whereas Unrealized PL and Used Margin are zero. As expected, Available Margin is the same as Balance and Equity and Available Margin, % is 100%.

Once you open positions this will change. Here you see long BTC position open, the Balance is less, as is the Equity. Additionally Unrealized PL shows the profit and losses the open positions have incurred. Used Margin shows how much is used for the open positions, Available Margin shows how much of your funds are still available to trade with leverage and the percentage of Margin available.

After opening additional trades, you can see that the Balance now becomes the sum of the open positions PL, the margin and available margin.

What is the difference between balance and equity in Forex?

Account balance represents the funds that remain from account equity when you subtract the PL (Profit/Loss) and the margin used for open trades.

The role of equity in Forex trading

Knowing how to calculate equity in Forex is very important, especially when trading with leverage. Your equity can help you estimate your free margin and avoid a margin call on open positions. If you are not familiar with it, a margin call happens when there isn’t enough margin to keep a leveraged position open when the market is moving against the trade. When this occurs, the trade is closed, usually at a loss.

Risk management

Over leveraging is a common mistake made by most traders. What is over leveraging though? It’s opening a trade with so much leverage that you do not have enough funds in your account to cover margin, causing the trade to reach margin level or be closed in loss due to margin call.

Over leveraging can also cause other leveraged trades you have open to close, regardless if they are profitable.

Knowing how much account equity you need to keep your trades open, can help you avoid negative equity because of margin stop out.

Trading decisions

Your trading strategy can include the type of assets and the size of the trades that you will open. This can help you calculate equity needed in your trading account – depending on your leverage, you will also need to calculate the margin level of each trade you will open in addition to the trading balance you need.

To calculate the margin level required for a certain trade:

Margin = (volume × contract size × asset price) ÷ leverage

You can use an on-balance volume indicator to calculate volume. The other numbers needed are relatively straight forward.

Factors that affect equity

Hopefully you are now relatively familiar with what is equity in Forex, but you also need to consider all the things that may affect your equity.

The first and primary thing you’ll see affecting your equity are open trades, especially trades that are leveraged. If you look at your trading account and see that your free margin is the same, but your account equity is much higher, then your positions are in profit.

Those unrealized profits in your Forex trading account, will be added to your balance when your open trades are closed.

Another, less optimistic case is when you have multiple open positions, or have over leveraged your account and not have enough free margin to open a new position when an opportunity presents itself. Leaving you with only a few options – liquidating closed positions to free up margin or depositing more to increase your account equity.

The worst scenario is when you incur negative equity, i.e. you must deposit a certain amount to bring your account to zero and then deposit the amount you’d like to use for trading into your trading account.

Managing equity in Forex trading

There are ways to both manage your account equity effectively, and best of all many of these tools are available on a powerful trading platform like PrimeXBT’s.

Equity strategies – What are they, types, risks

Trading strategies should include information related to trading equity, i.e. position size, leverage used and assets you’d like to trade.

Equity, showcased on your trading platform, is shown at the top. But fixating on these numbers can be a pretty big mistake. Success means focusing on price action, technical, and fundamental analysis — not equity. Don’t linger on single positions, hoping the market will turn in your favour. This can drain your trading balance. Optimal trading emerges from constant market analysis, seizing opportunities while managing multiple orders with precision risk management. Shifting focus from equity to seizing new opportunities is the best path to success.

Traders often obsess over balance and equity, refusing closure until a profit is made or recovered. But, grappling with losses by delaying action or doubling down leads to bad financial decisions. You can avoid this by embracing loss, safeguarding positions with disciplined stop loss and take profit orders. Avoid this trap that can amplify losses — opt for strategic exits and smart risk management.

That’s why equity levels play a pivotal role in risk management. With enough equity, traders can enter higher-risk positions to optimise profits. On the other hand, in scenarios of diminished equity, risk appetite tends to be more restrained.

Efficiently managing risk depends on identifying an optimal equity threshold for each trade and meticulously weighing the associated risks and rewards. By adhering to strategic equity allocation, traders safeguard their investments while mitigating the repercussions of adverse outcomes.

Tools for monitoring equity

Monitoring equity is crucial for Forex traders to assess their performance, manage risk, and make informed decisions. Several tools are available to facilitate the monitoring of equity throughout the trading process.

Trading platforms: most Forex brokers provide trading platforms with built-in features to monitor equity in real-time. These platforms often display account balances, equity, margin levels, and profit/loss for each trade.

Account statements: Forex brokers typically offer account statements that provide detailed information about account activity, including equity changes over time. Traders can regularly review these statements to track their equity performance and identify trends.

Trading journals: keeping a trading journal allows traders to record their equity levels along with other relevant data such as trade entries, exits, and strategies used. Analysing this information can help traders identify patterns, strengths, and weaknesses in their trading approach. It can also help them avoid repeating mistakes made in the past.

Third-party analytical tools: There are various third-party tools and software available for equity monitoring and analysis. These tools often offer advanced features such as performance metrics, equity curves, drawdown analysis, and tools that help you manage risk. Examples include Myfxbook, TradingView, and Trading Analytics platforms.

Risk management calculators: managing risk with purpose built calculators can help traders assess the potential impact of trades on their equity. These calculators allow traders to input trade parameters such as entry price, stop-loss, and position size to calculate risk/reward ratios and potential equity changes.

By using these tools effectively, Forex traders can monitor their equity levels, evaluate their trading performance, and implement strategies to manage risk to enhance profitability and minimise losses. Regular monitoring of equity is essential for maintaining trading discipline and achieving long-term success in Forex trading.

Common mistakes and how to avoid them

Overleveraging

Avoiding overleveraging is crucial in Forex trading and protecting a trader’s account equity. Strategies include setting a maximum leverage limit based on risk tolerance, using proper position sizing to allocate equity wisely, and adhering to the 1-2% risk rule per trade. Implementing stop-loss orders based on technical analysis or market volatility helps mitigate losses. Traders should steer clear of high-impact news events to minimize risk, while monitoring margin levels and maintaining a conservative approach to leverage and position sizing are vital. By following these strategies diligently, traders can protect their equity, ensuring long-term success in Forex trading through managing risk.

Warn against the risks of overleveraging and its impact on equity.

Ignoring equity changes

In the context of trading on the Foreign Exchange market, overlooking equity changes can lead to significant risks and losses. Traders can avoid this by incorporating several strategies into their trading routine.

Firstly, regularly monitoring equity levels is essential. Traders should frequently check their trading platform or account statements to stay updated on their current equity position. This ensures they are aware of any fluctuations and can take appropriate action when needed.

Implementing stop-loss and take profit orders is another crucial step. By setting predetermined levels for exiting trades, traders can limit potential losses and protect their equity from significant drops. Additionally, using trailing stops can help lock in profits as prices move favourably, further safeguarding equity.

Lastly, maintaining discipline and emotional control is key. Traders should not let emotions cloud their judgment or lead to impulsive decisions that could increase the risk to their equity.

Conclusion

In conclusion, understanding equity in Forex trading is very important for managing risk and optimizing profitability. Equity represents the sum of all funds, including unrealized profits or losses from open positions and margin requirements. Monitoring equity changes is crucial for informed decision-making and manage risk. By implementing strategies such as setting leverage limits, using proper position sizing, and regularly monitoring equity levels, traders can protect their equity and enhance their trading performance. Additionally, avoiding common mistakes like overleveraging and ignoring equity changes is essential for not only preserving capital but growing it as well.

What does equity mean in trading?

FX equity is the sum of the trader's account balance, including open positions and their unrealized profits and losses, in addition to any margin dedicated to leveraged positions.

How do I increase my equity in Forex?

Traders can increase their trading equity by closing leveraged trading positions or by depositing additional funds into their margin account.

Can I withdraw my equity in Forex?

Technically, yes, but you are withdrawing directly from your free margin or account balance that isn't being used for margin.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.