If you have been paying attention to the crypto markets for any length of time, you have likely come across the term “NFT,” especially as there have been headlines of these tokens selling for tens of millions of dollars. However, before you get involved with them, you need to understand several things. In this guide, we hope to provide an excellent foundation to start.

What is an NFT?

An “NFT” or “non-fungible token” is a unique token on the blockchain that cannot be replaced with something else. The opposite is a fungible token. Ethereum is fungible. It does not matter if you have any coin over another, as they have the same value.

Think of an NFT as a trading card. One of the most common examples would be a baseball trading card, some of which are much more valuable than others. Even if you have the “same thing,” the reality is that not all cards will be valued the same. For example, you must consider the condition, scarcity, etc. The same thing can be said for an NFT. This guide will teach you how to invest in NFT tokens.

Learn more about NFTsWhat Makes an NFT Valuable

Investing in NFTs for beginners can be difficult. Learning how to invest in non-fungible tokens can be a bit tricky. This is because an NFT is valuable only if the marketplace deems so. Much of this comes down to the scarcity and desirability of whatever project we are discussing. Currently, the most common NFT collections involve artwork and are treated as such. Quite frankly, it’s difficult to tell when an artist is suddenly going to become very popular, but if they have an NFT collection, it can increase in value quite drastically.

The idea is that each token proves ownership of a “one-of-a-kind” asset. In the future, the NFT marketplace may likely be a way to show ownership of real-world assets such as the deed to a house, ownership of a business, and even ownership of a company.

Where to Invest in NFTs

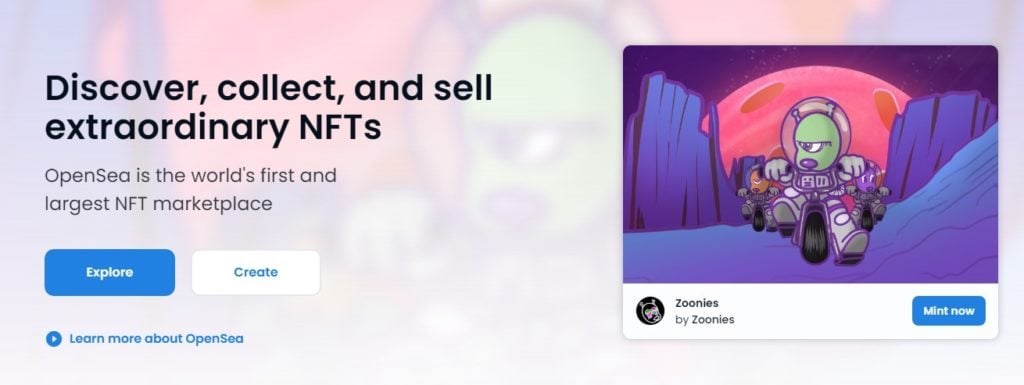

There are a lot of places where you can invest in NFTs. Some common sites include the NFT marketplace OpenSea, Rarible, and SuperRare. You can also get involved in venture capital funds looking to open up NFT marketplaces. There are multiple ways to invest in NFT tokens.

A “backdoor” way of investing in the NFT marketplace is to invest in some of the tokens marketplaces use. This would include Ethereum, Solana, Polygon, and several others. The idea is that if the NFT marketplace suddenly takes off, the token’s demand will also increase.

How to Invest in NFTs

To take advantage of the NFT marketplace and the potential profits involved, you will need to understand how to make your first purchase and take ownership of your new and unique token. When you invest in NFTs directly, you are hoping to generate as much Alpha as possible.

Do your research

Before putting any money at risk, you need to research what collection or NFT you wish to invest in. You need to choose an NFT with excellent upside potential because, at this point, the NFT market continues to be highly speculative. Popularity is a massive driver of value.

Select an exchange

To claim ownership of an NFT, you must select an exchange to start buying from. There are several big ones, including OpenSea, Rarible, and even some brokers. However, whatever NFT you buy will probably limit which exchange you can use.

It is at this point that you need to buy the necessary crypto to purchase the NFT. For example, if it is an Ethereum-based marketplace, you will need to buy Ethereum.

Purchase your NFT

At this point, you can browse the website and make the exchange of your crypto for the NFT, thereby allowing you to pull it off of the exchange and put it in your cold storage wallet. You should never leave your NFT on an exchange if you plan on holding it.

What You Need to Know Before You Invest in NFTs

There are a lot of different things that you should know before you start to invest money in the NFT markets, just like any other investment. Because of this, you need to ask yourself some fundamental questions.

How much money do you need to buy an NFT?

The question of how much money you need to buy in NFT is somewhat open-ended. This is because the gamut of costs can be anything from a few dollars to millions. That said, the market will likely continue to see massive swings in valuation, so you need to be cautious about what you buy.

What are the best NFTs? How to choose an NFT to buy?

The best NFT selection is a mixture of popularity and personal taste. After all, the market should be enjoyable, especially if you are taking a “flyer” on some type of new NFT or perhaps even a collection. On the other hand, if you want to invest in and make a significant amount of money, you need to find something that will be popular.

The biggest problem, of course, is that trends come and go, and that’s especially true in something new like the NFT world. Furthermore, it’s about timing because you need to get in early enough to realize gains. After all, unless you are a multimillionaire, you will not run out and buy the latest “Beeple” project for $20 million. Because of this, you need to keep an eye on rising value markets and check frequently. Beyond that, you also need to see what the overall marketplace for NFT projects behaves like. If it’s bullish, then you have a potential winner.

Understand the Risks

You simply must understand that this is a very new market, and therefore how it ends up will remain to be seen. In other words, you should not put all of your money into the markets and gamble. It is a potential part of your portfolio, but nothing more. After all, we do not know how the NFT market turns out in the long run, so that is something that you need to be prepared to see going to zero.

What You Need to Know After You Invest in NFTs

Once you buy an NFT, that does not necessarily mean everything is over. After all, the idea is to profit, and you do not benefit until you sell the NFT.

Sell or hold NFTs for the Long Term

One of the most obvious questions will be whether or not you should sell the NFT or hold it for the long term. So far, it has been proven correct to sell after huge runs higher. However, the possibility of holding onto an NFT for the long term could bring in massive amounts of profit, but the future is unclear.

How to Sell NFTs

Selling an NFT is not necessarily the easiest thing to do. After all, it’s not a fungible token, meaning that you cannot simply step into an exchange and sell right away. Somebody has to want the exact NFT that you own. Because of this, you will have to list it on an exchange explicitly made for NFT trading and hope somebody buys it.

It’s an illiquid market, much like housing. While somebody probably will buy it sooner or later, you have no real idea how much they will pay or how long it will take.

Responsibility for Taxes in your Country

As with any other investment, you must pay taxes in your home country. Because of this, the market is likely to start seeing more controls on the tax side as governments worldwide continue to pay close attention to crypto in general.

Are NFTs a Good Investment?

Quite frankly, the jury is still out. There are signs that the NFT marketplace may continue. Still, it is difficult to imagine a scenario where people were willing to pay millions of dollars for something they cannot physically hold. While perceptions may change in the future, we have seen a significant collapse in the NFT marketplace as things stand right now.

Unfortunately, in its present tense, it’s difficult to get overly bullish on the NFT market because it has not proven particularly useful. It’s simply a matter of collecting artwork and other things such as music. While that in and of itself may not be bad, it will be difficult to see the actual utility of NFTs until we begin to see real-world everyday applications.

More likely than not, we will begin to see proof of ownership in the physical world being represented by an NFT. Traders and investors will find the real value there over the longer term. Collecting digital art is one thing but paying $69 million for a piece of digital art is quite different.

Eventually, there will be daily use for an NFT. More likely than not, it will have nothing to do with art or music. While both are areas in which we will probably see the NFT use increase, they are not practical at the moment because of the extra steps involved in owning one, as opposed to perhaps downloading a .mp3 music file.

Because of this, the future is very murky, but needless to say, it is a portion of the cryptocurrency space that you need to pay attention to. Crypto is still going through major growing pains, so where this ends up is difficult to tell.

Expert Bonus: Tips for Investing in NFTs

- Keep in mind that NFTs are still extremely new. Because of this, you will have to pay close attention to existing trends and pay attention to where they may be heading toward

- NFT marketplaces that you use must be well-established so that the efficacy of the process and reliability of payment are assured

- Ensure you do not “fall in love” with the project. If you are investing, it has nothing to do with what you like and everything to do with what will sell at a higher price.

Conclusion

Because the NFT world is a relatively new one, nobody truly knows what happens next. Quite frankly, most of the uses for NFTs have been more of a demonstration than anything else. Collecting artwork is one thing, but most of it will end up being like any other artwork in the real world, low value as most people won’t know the artist involved.

That being said, there is talk of using NFTs for other transactions such as real estate and proof of ownership regarding real-world assets. This is probably where the actual value of the NFT lies, but we are nowhere near that quite yet.

Regarding investing in the current NFT iteration, you need to be cautious as we have seen wild swings in value. Most of it is based on an Ethereum network, so in a sense, you can invest in NFT marketplaces by owning Ethereum itself. There are some other coins, such as Solana and Polygon, but those are still up-and-coming in this world.

The phrase “buyer beware” is one that comes to mind.

Is it profitable to invest in NFT?

While there have been new stories of people turning a few dollars into millions, the reality is most NFT purchases do not make money over the longer term.

Can you buy your own NFT?

Yes, you can buy your own NFT. There are plenty of NFT marketplaces out there, such as OpenSea, Magic Eden, and others.

What is the most profitable NFT?

The most profitable NFT ever sold was in March 2021, titled “Everydays: The First 5000 Days.” It was created by digital artist Mike Winklemann, also known as “People.” It was sold for $69.3 million.

Can I buy NFT with Bitcoin?

Yes, there are few places that accept Bitcoin for NFTs, but the most common cryptocurrency to use is Ethereum.

How can I invest in NFT without buying NFT?

It’s possible to invest in NFTs in multiple ways. This typically means investing in a venture capital fund or some type of kickstart program.