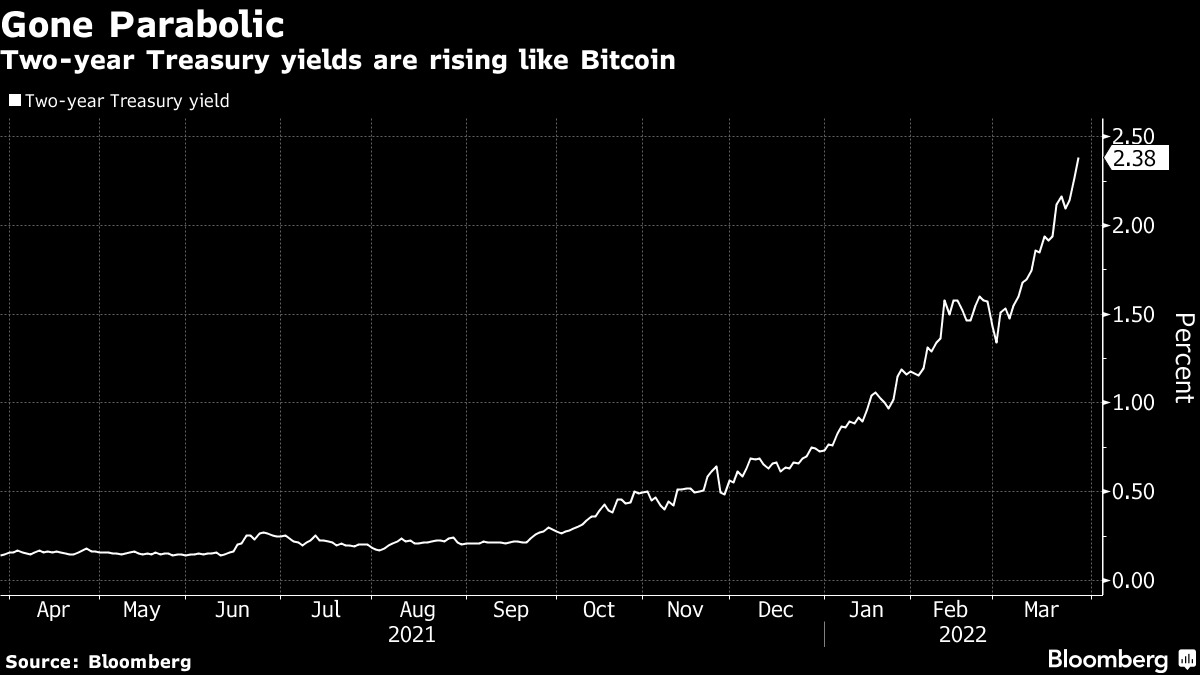

US stocks managed to recover slightly from a Thursday sell-off caused by the yield curve inversion confirming that the USA would be heading into a recession in the months ahead. The 2-year and 10-year Treasury yields inverted for the first time since 2019, sending chills down investors’ spine as they braced for the worst to come, with the war in Ukraine and the impact of COVID lockdown in Shanghai likely to worsen the situation, but yet continue to fan inflation.

Even though employment numbers released on Friday further showed signs of a slowdown, investors managed to shake off pessimism as US stocks rebounded slightly by the close on Friday. Nonfarm payrolls grew by 431,000 in March, a bit below the 490,000 estimate and well under February’s upwardly revised 750,000, while the unemployment rate declined to 3.6%, below expectations.

For the week, the S&P 500 squeaked out a slight gain while the Dow declined 0.12%. The Nasdaq added 0.65%.

Not counting the gain on Friday as it was already the month of April, the Dow and the S&P 500 index ended the first quarter of 2022 down nearly 4.6% and 4.9% respectively. The Nasdaq was a big loser, having dropped more than 9% in 1Q2022, leaving investors uncertain of what the second quarter would bring.

Buy the dip of US indicesMost of the volatility last week was seen in the energy sector. In its regular monthly meeting, OPEC+ agrees to a modest oil output hike of 432,000 barrels per day effective May 1. This comes after US President Biden announced an unprecedented release of 1 million barrels a day from its oil reserves for the next 6 months mid-week, which sent the price of oil plunging. In the past week alone, Brent Crude fell 9.6% to $104.30, while Crude Oil lost 10% and is now back below $100, closing the week at $98.90. For the new week, both distillates have started off around 0.8% lower.

Precious metals were a lot more subdued compared with Oil, although Silver fell 4%, while Gold only lost 1% after being locked in a tight range all week. Both metals are opening the week relatively unchanged.

Cryptocurrency was the best performing asset class, with the price of BTC seemingly unaffected by the selling pressure in tech stocks. Many crypto traders are hoping that this could finally be the start of the decoupling of BTC’s trajectory from that of the stock market. With the price of the leading crypto asset holding well, altcoins were out to play, with many altcoins registering good gains over the week. New concept Move-to-Earn platform Stepn, saw its native token GMT rise 300% last week from $0.80 to a high of $3.13 before profit-taking set in, while old names like ZIL also clocked more than 100% gain on hype surrounding the launch of a new metaverse platform on the ZIL blockchain on April 2, before succumbing to profit-taking by the end of the week. SOL also had a great week, gaining 40% to $143 after Rich Dad Poor Dad author Robert Kiyosaki strongly recommended it to his followers.

Kiyosaki recommends SOLNew Purchases Keep BTC Well-Bid

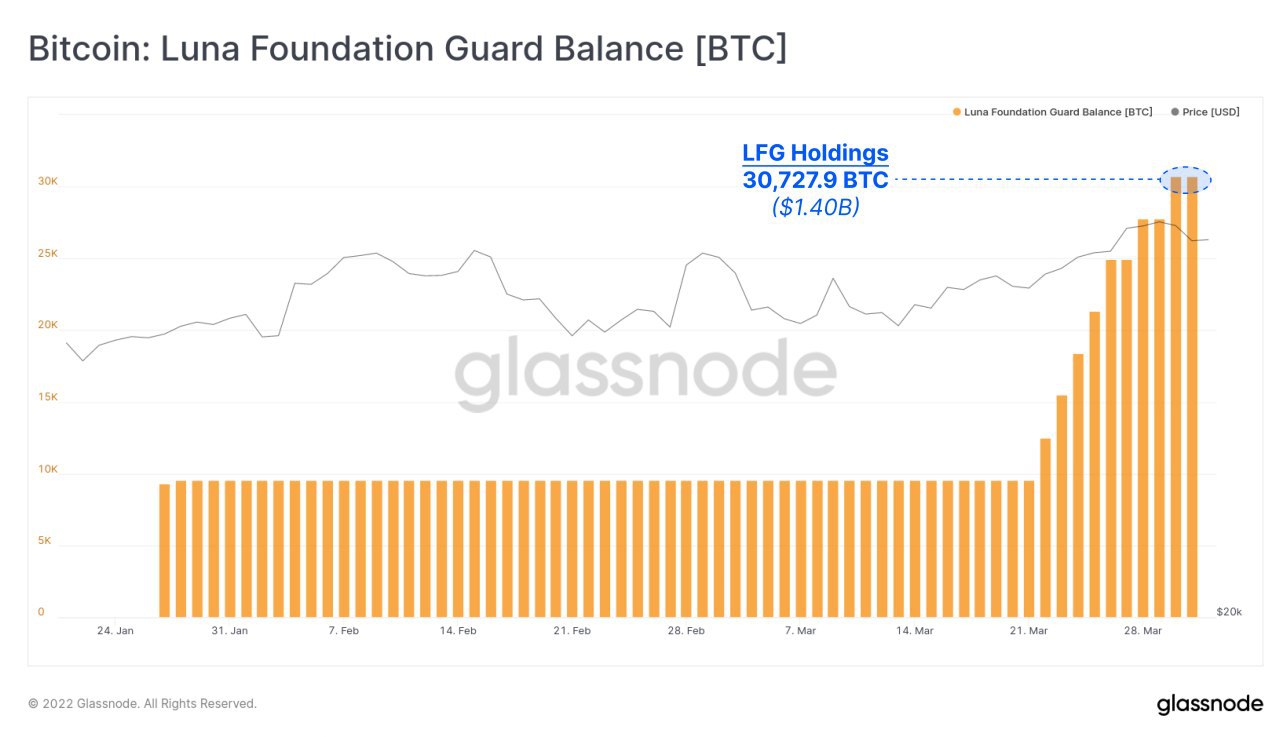

The price of BTC rose to a 3-month high last Monday on news that LUNA had increased the pace of its BTC accumulation. The surge brought the price of BTC past $48,000 before it settled back to around $47,000, liquidating more than $300 million worth of short positions.

By the end of March, the LUNA Foundation has accumulated more than 30,000 BTC worth around $1.4 billion.

News that MicroStrategy created a subsidiary called MacroStrategy to obtain a fresh loan of $200 million to purchase more BTC kept the price of BTC well-bid until Thursday, after the European Parliament voted in favor of outlawing ‘unhosted wallets’ within the European Union. This move will undoubtedly harm crypto innovation and is a direct threat to the growth of DeFi and other decentralized applications. That said, companies will still have nine months to adapt to the new ruling and then 18 months to ensure they fully comply with the new regulations.

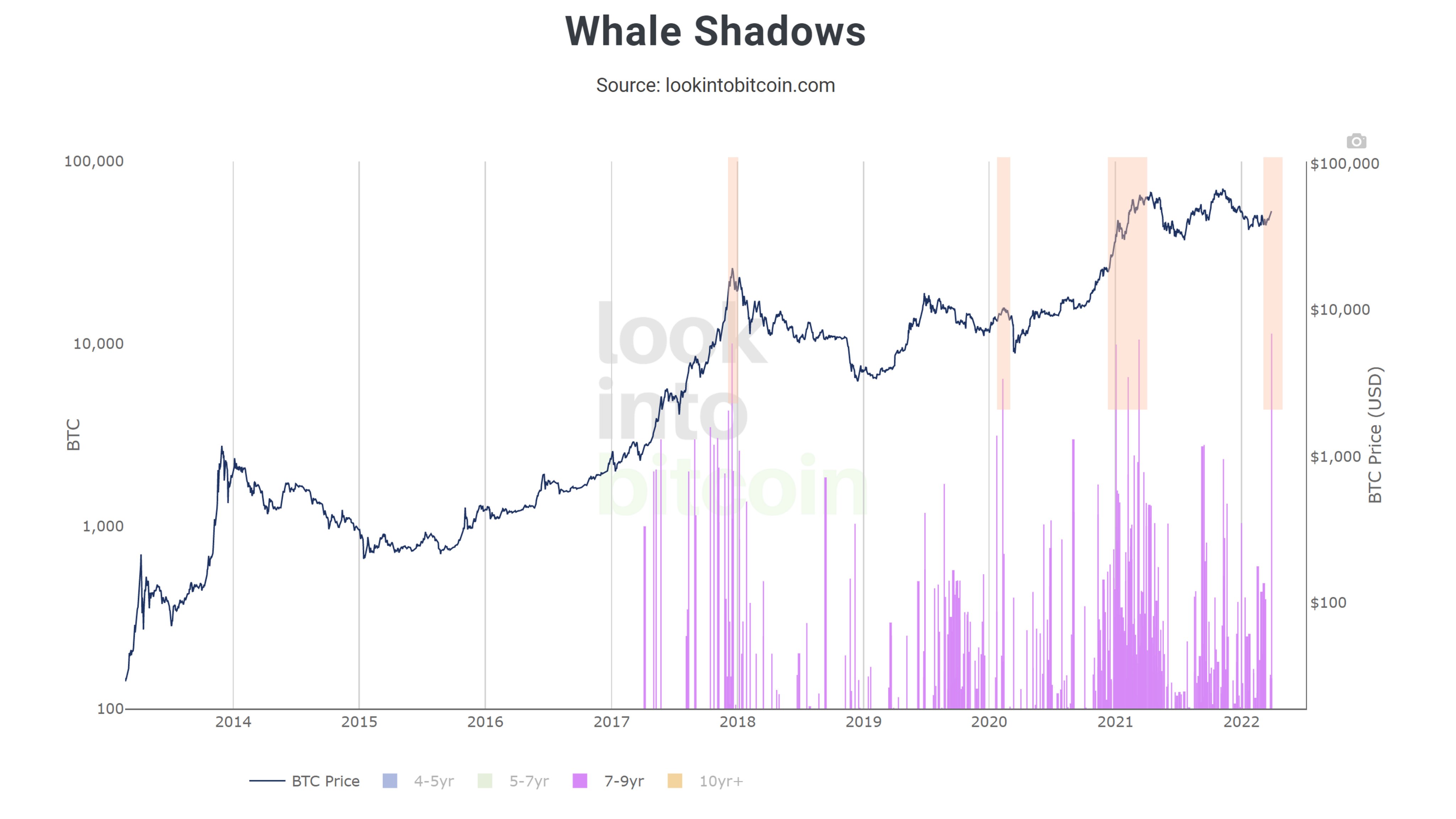

Move Of 11,325 Dormant BTC Shook Markets A Little

Interestingly, around the time that the vote was finalised, a batch of 11,325 dormant BTC had been spotted to be distributed to a large number of wallets presumably for sale. Some experts have speculated that the large number of BTC is linked to the Cryptsy theft in 2014 and the thieves could possibly be trying to dispose of their stolen BTC. However, others disagreed, as such movements were also spotted just before last year’s BTC price top. The timing of this movement also makes it suspicious since it happened exactly at the time when the EU voted to ban unhosted wallets. Could this wallet then belong to some officials within the EU?

With the impact of the double dose of negatives, the price of BTC fell around 5% within 4 hours, from above $48,000 to around $45,000, where BTC found support and has been consolidating around $46,000 ever since.

Even though it caused a retracement, 11,325 BTC is by no means an exceedingly large amount in the current market. More bad news may be required to be able to keep the price of BTC depressed, due to the aggressive demand for BTC by various investor groups.

Traditional Finance Accumulating BTC

Let us take a look at the different investor groups that are seen to be accumulating BTC.

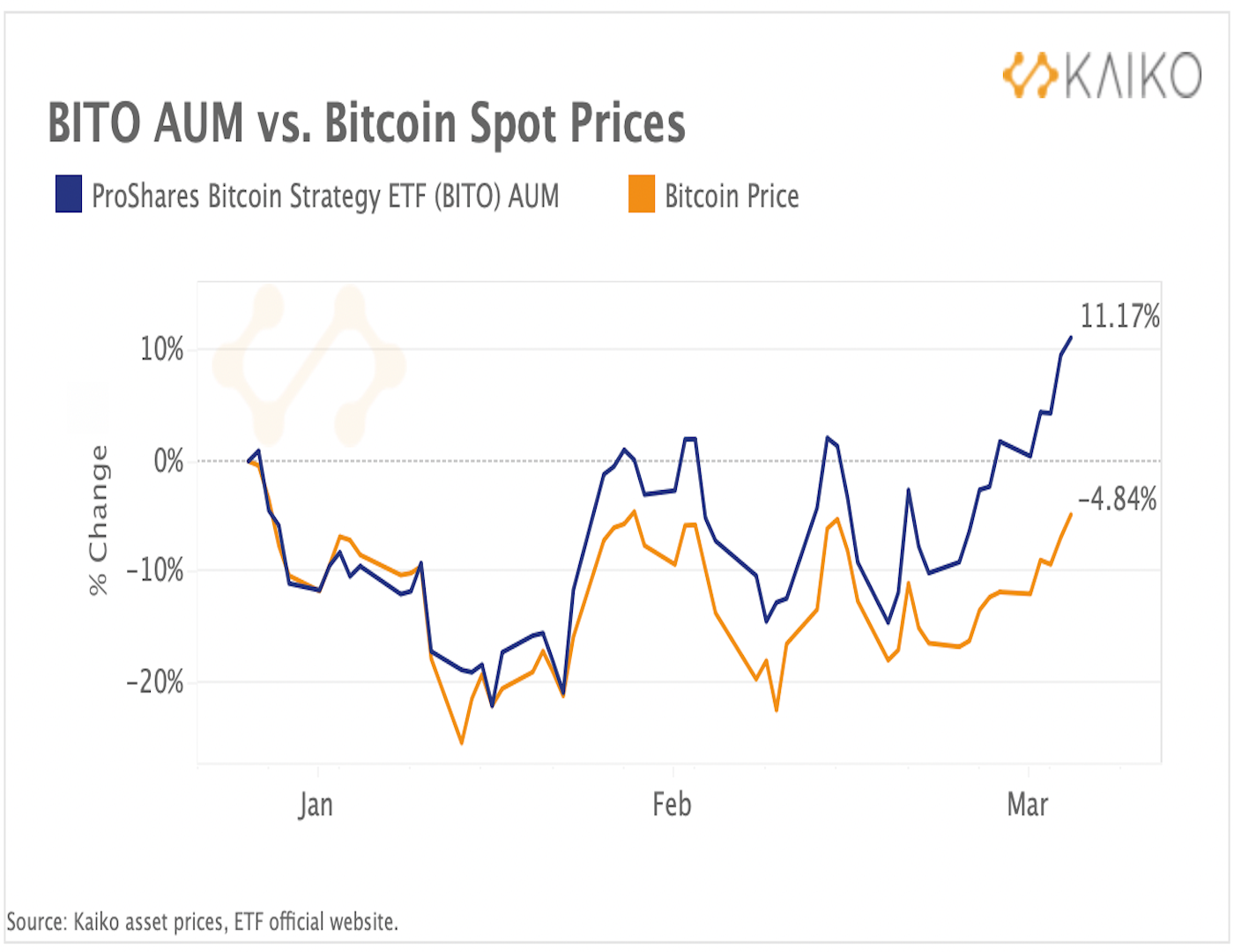

First off, inflows to BTC ETFs are back with a vengeance. Other than the Canadian listed Purpose BTC ETF which has been back accumulating BTC aggressively, US listed BTC ETF is also witnessing a significant inflow, with the ProShares BTC ETF seeing an 11% growth in its AUM in March from a negative growth since its inception.

Another group of investors that one would not normally associate with buying BTC are the bond traders. As the movement of BTC has been mirroring that of the 2-year Treasury yield very closely, market watchers are speculating that the recent strength of BTC is caused by money flowing out of front-end US Treasury bonds into BTC.

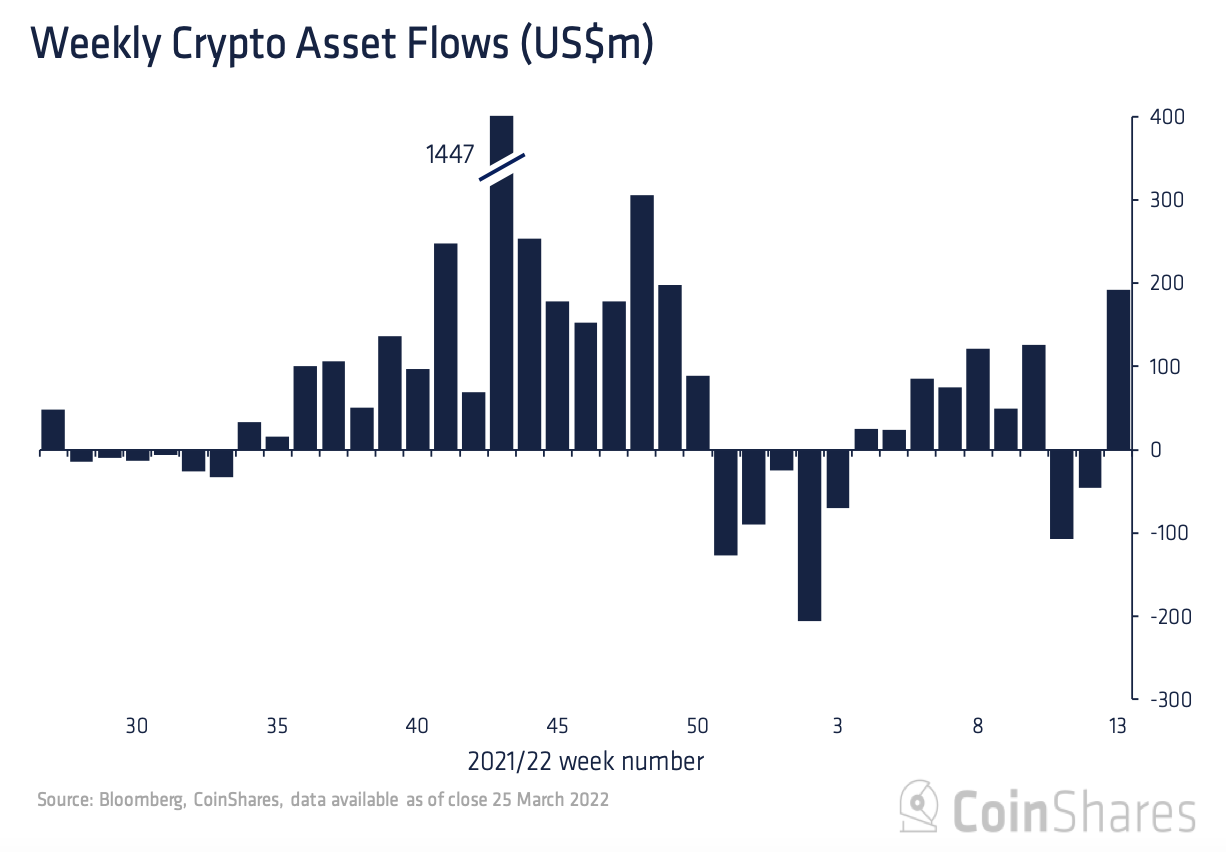

Next, after two weeks of outflow even at a time when the spot market was bullish, crypto funds finally welcomed their first inflow, underscoring it as a laggard indication.

Digital asset investment products saw inflows totalling $193 million, the largest since mid-December 2021. Interestingly, 76% of inflows came from Europe, valued at $147 million.

BTC saw the most inflow totalling $98 million, bringing its year-to-date inflow to $162 million, while SOL saw the largest single week of inflows on record totalling $87 million, representing 36% of AUM.

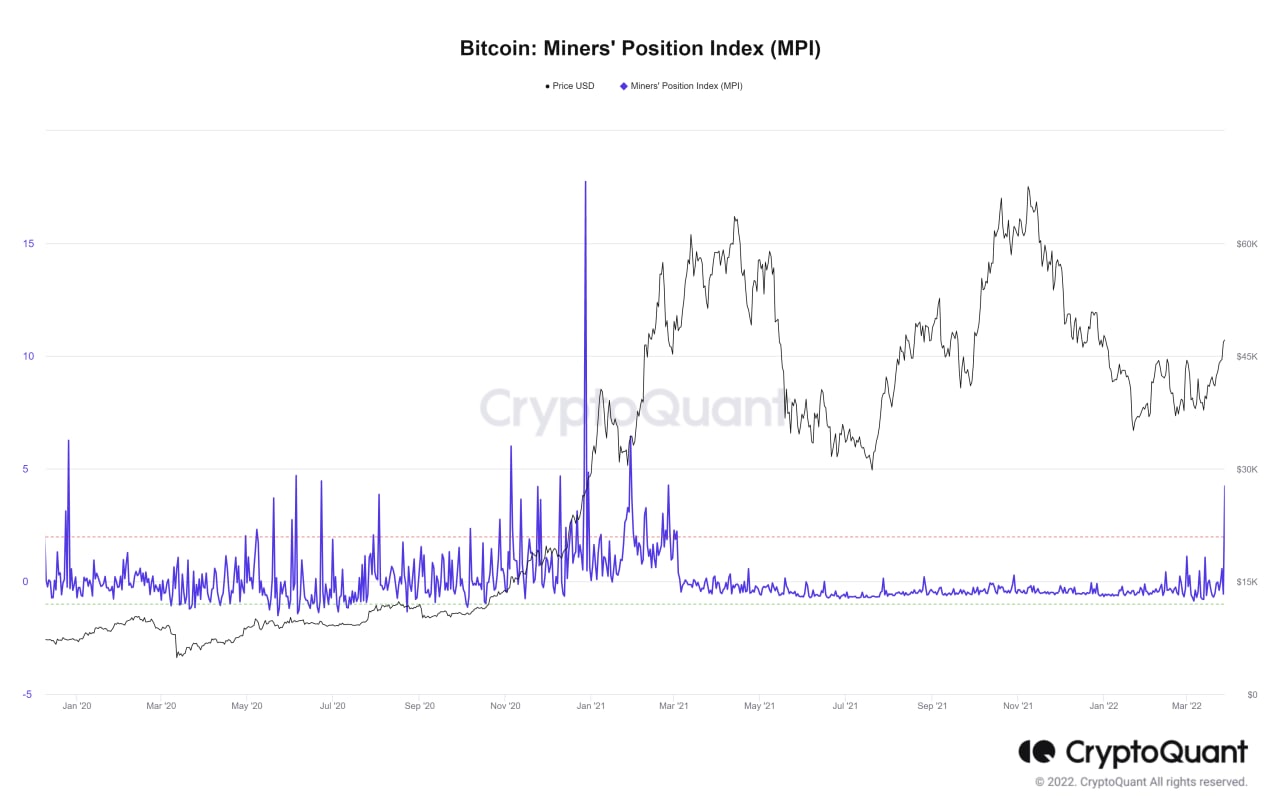

Miners Are Selling BTC

Even though flows have largely been positive, some miners are taking advantage of the current strength to sell BTC. The BTC Miners Position Index which shows miner’s selling activity, is starting to rise, suggesting that more miners are sending their BTC for sale. An Index reading of over 2 suggests that a majority of miners are selling.

In fact, on April 2, the price of BTC fell $2,000 when miner F2Pool had reportedly sent 6,800 BTC to exchanges for sale. This drop in the price of BTC led to an even larger pullback in the price of altcoins, which were shedding around 10% in part also due to the lack of liquidity on a weekend. Since the sudden dump, market sentiment has turned markedly cautious ahead of the traditional markets returning on Monday.

However, even though miners are starting to encash their mined BTC again, the MPI is still very far away from the peak seen in January 2021 when the price of BTC saw a small correction before continuing to move higher in March. Even though the number is at a reading of around 4 this time, there could still be room for BTC to move higher before huge selling pressure from miners come in. Even so, miners selling has historically never been an accurate indication of a price top. It merely shows that there is selling pressure from miners.

ETH Starting To Play Catch Up

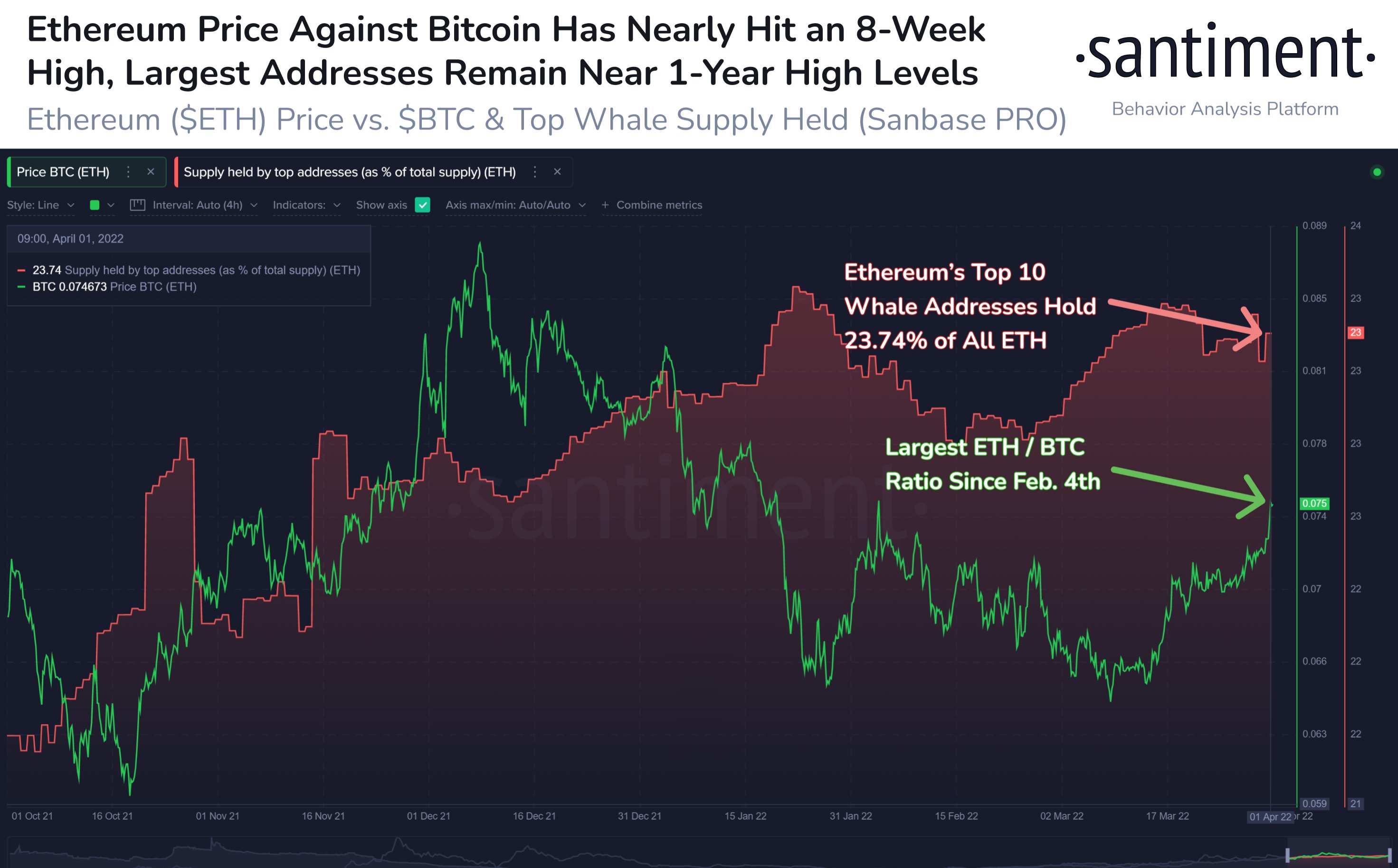

While BTC did alright last week, ETH did even better, outperforming BTC for the first time in a long time.

ETH started gaining in price dominance against BTC early in the week, leading the ETH/BTC pair to its highest point in two months. The top 10 ETH whale addresses continue to hold a significant percentage of ETH’s supply and have not been selling at all as many long-term investors firmly believe in a five-figure price in ETH by the end of the year.

Even BitMEX founder Arthur Hayes said in his new blog that the price of ETH will exceed $10,000 by the end of this year and has updated his asset allocation to be a lot more bullish on ETH than on BTC. His note prompted the price of ETH to rise sharply by 8% on Friday.

We shall see this week if ETH can continue to build on its current momentum to edge out BTC in percentage gains again, or if BTC manages to spring back into the $50,000s to take back the limelight from altcoins where many traders are already dreaming of a summer altseason.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.