The week began with positive outlook guidance from China and even the IMF. First off, China’s improving manufacturing numbers gave a boost to risky assets early on Tuesday, with its manufacturing PMI rising to 50.1 versus December’s 47, while non-manufacturing PMI came in far better-than-expected, rising to 54.4 from December’s 41.6, when expectations were for it to rise to only 52. The most important takeaway was that these readings were above 50, which is a sign of expansion, prompting experts to regain optimism about more positive effects from China’s opening up to come post its harsh zero-COVID policies of last year.

The IMF has upgraded this year’s global outlook due to cooling inflation and a higher-than-expected household spending. The IMF now expects the global economy to grow 2.9% this year, up from its October expectation of 2.7%.

Central banks also delivered in line with market expectations, with the Fed raising interest rates by 25-bps and the ECB and BoE each raising 50-bps. While the central banks continued to guide towards more rate hikes this year, citing a persistent high level of inflation, the markets did not seem to believe their view and consensus read these moves, especially that coming from the Fed, as a dovish hike.

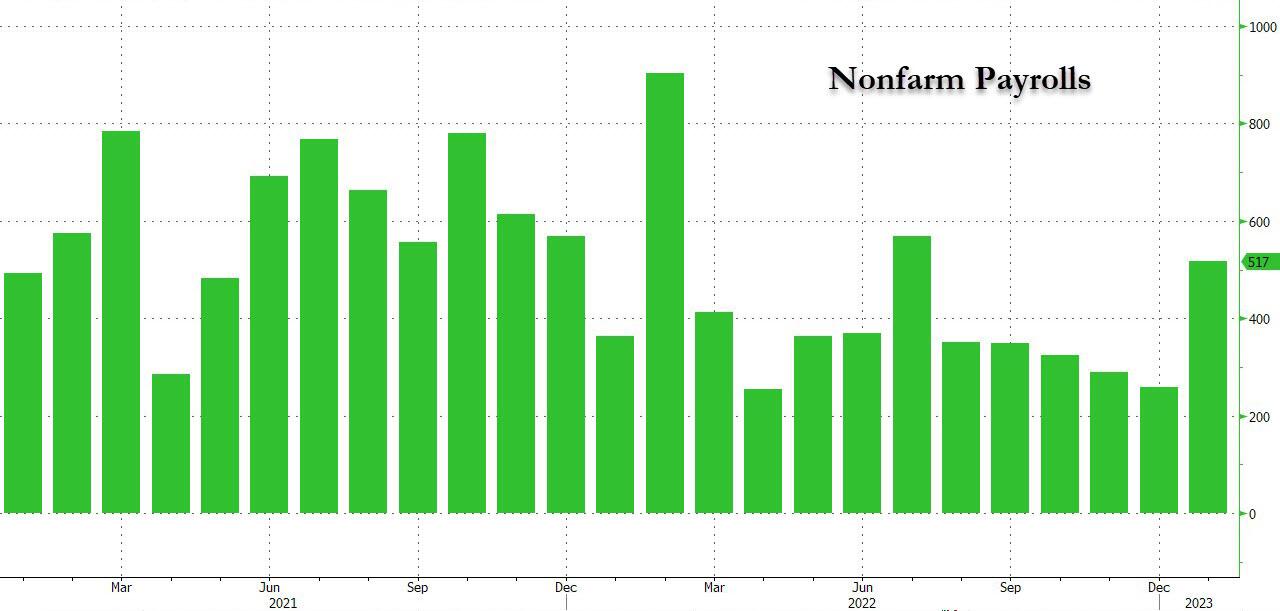

As a result, markets continued to edge higher after the non-farm payrolls came in well-above expectations on Friday, clocking a gain of 517,000 jobs versus expectation of only 187,000.

While US stocks did retrace on Friday due to some investors’ concern that the strong payrolls number would give the Fed reason to be more hawkish, key indices still closed the week positive. The S&P closed the week higher by 1.62%, the Nasdaq gained 3.31%, posting its fifth-straight winning week even as large tech companies reported below-par results. Only the Dow was the outlier, ending the week lower by around 0.15%.

The explosive US payrolls number, coupled with China’s better-than-expected manufacturing expansion gave further credence to a shift in narrative from recession to growth, letting investors breathe a sigh of relief after being bombarded by weeks of retrenchment news.

The USD rose significantly after the better payrolls, with the DXY jumping back above 102, led by rising yields. The 10-year US Treasury yield topped 3.5% after jumping more than 12-bps following the report, while the 2-year yield jumped to 4.2%. Naturally, the USD/JPY popped higher, reclaiming the 130 level after reeling around 128 to close the week at 131.20. The EUR/USD fell by 0.73% to 1.0800 while the GBPUSD dipped by 2.8% to 1.2050 for the week even after the two central banks raised rates by 50-bps on Thursday.

As we head into this new week, dollar strength is still apparent and the USD/JPY is building on Friday’s gain to trade above 132 at the time of writing, while EUR/USD and GBP/USD are trading flat. This goes to show that the main contributor to the dollar’s strength at the moment is a weakening yen, with the Nikkei 225 popping higher by about 1% as risk-on sentiment resumes in Asia.

Gold and Silver fell in tandem with the stronger dollar, with Gold falling below $1,900 to close down 3.3% to $1,865, while Silver lost 5.4% to $22.35. In early Asia trading today, both precious metals are retracing some losses, each gaining about 0.3%.

Oil fell the most on relative terms last week, with the WTI Crude losing 8.9% to $73.18 while Brent lost 8.5% for the week to close at $79.75. Both distillates are following the path of precious metals, gaining about 0.2% in the new week as renewed optimism about the global economy puts a bid under the price of oil as demand is expected to increase.

The stronger dollar did not impact cryptocurrencies as much as it did other assets, with the price of BTC hovering around $23,000 even as the dollar spiked higher after Friday’s payrolls report. However, some exhaustion could be felt as BTC did not manage to break its overhead resistance of $24,000 on Thursday after the Fed meeting, which could have caused some traders to take profit, resulting in the leading crypto remaining stuck within a consolidation zone.

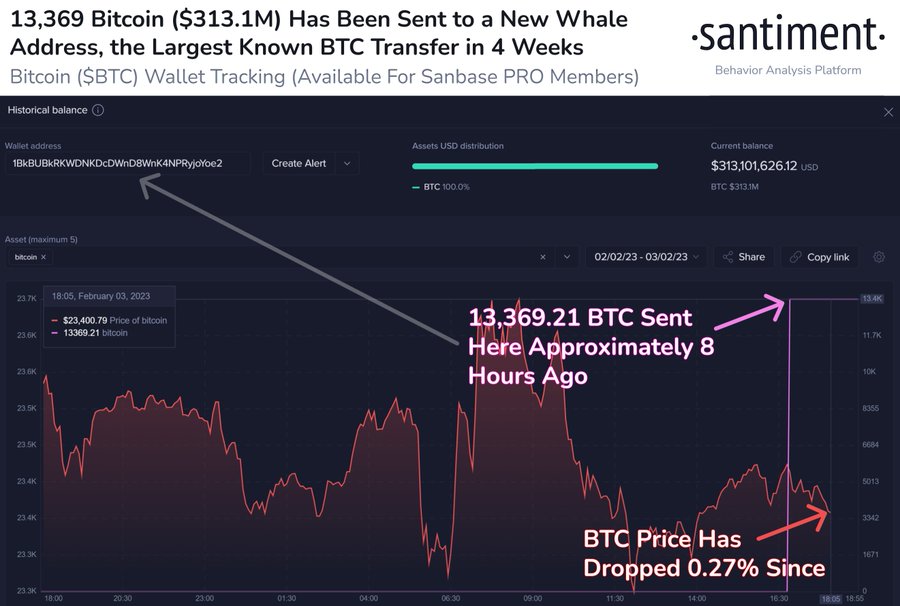

New BTC Whale Emerges After Largest Transfer in a Month

Even as BTC remained stuck in a rut, a new whale emerged on Friday after the biggest transfer of BTC in a month took place. What made the transfer of 13,369 BTC even more intriguing was the fact that the receiving wallet was a brand new wallet with no pre-existing holding of BTC, which means that BTC has welcomed a new whale. The identity of the new whale has not yet been revealed at the time of writing, however, this BTC transaction has not been actively discussed by market participants, who have been more attracted to the price action by altcoins.

While market action on BTC was lacklustre and did not offer a lot of excitement for traders, this was more than compensated by the magnificent performance from altcoins, with many managing to continue climbing higher even in spite of the stronger dollar on Friday. Worth mentioning first is FTM, which we had already highlighted in last week’s report. The token rose another resounding 30% to hit a high of $0.64 even after tearing the charts thus far in 2023 with a 150% gain in January.

FTM On A Tear As Cronje’s Return Sparks Optimism

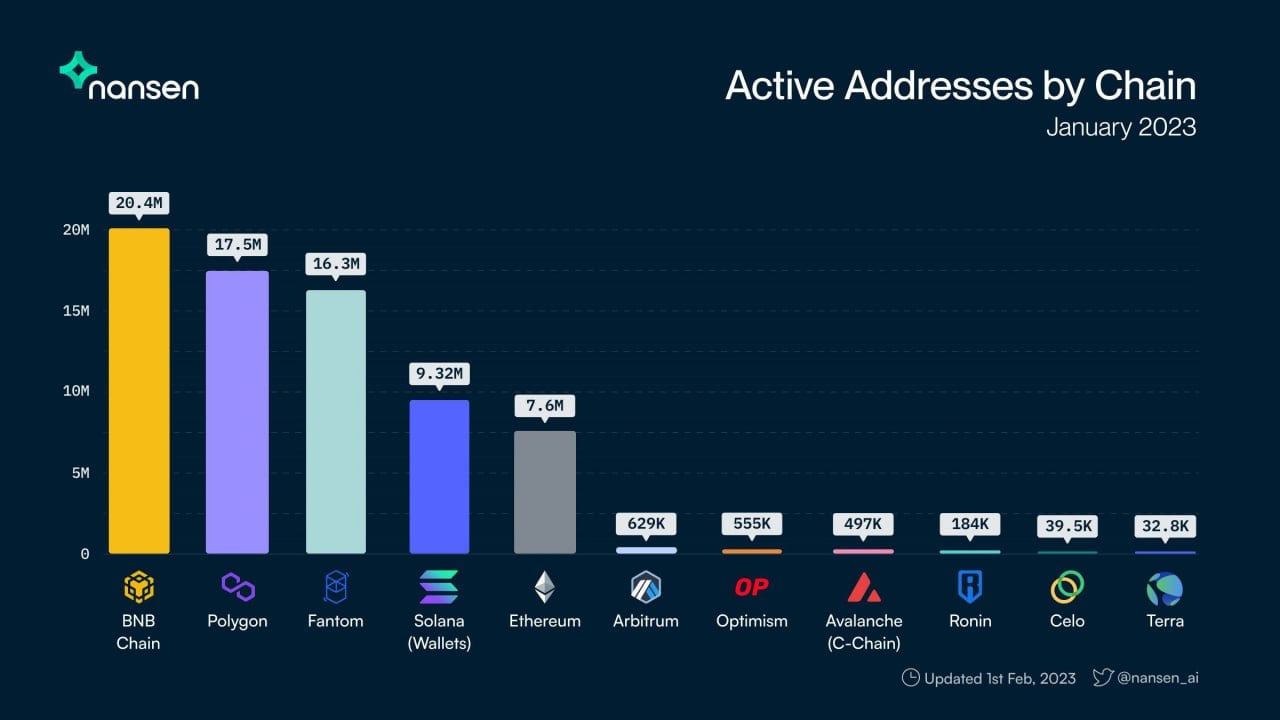

The rise of FTM is not without reason, as metrics suggests that the chain has seen adoption rise phenomenally in January, where its number of active addresses surged to 16.3 million, becoming the blockchain with the third highest number of active addresses, up from not being even in the top ten barely a month ago. The Father of DeFi, who founded Yearn Financial and also happens to be the co-founder of FTM, Andre Cronje, took to twitter to promote the blockchain in the middle of last week after returning to work on it late last year after an almost one-year hiatus. Cronje, who has a cult-like following in the world of DeFi, has promised a series of upgrades for FTM which has given many investors reasons to be very excited. Since Cronje’s return in December last year, FTM’s price has risen by more than 200%.

While FTM clearly shone, other altcoins were not very far behind either, with ETH Layer-2s one of the strongest segments amongst altcoins. Newer listed names like IMX and OP outperformed the broad market with similar gains. Incumbent ETH layer-2 MATIC also rose by around 10% for the week while ETH itself managed to gain by slightly more than 5% even in spite of the stronger dollar.

MATIC’s OpenSea Usership Back to Bull Market Levels

As a testament to the recovering NFT market segment, the number of users on Polygon’s version of OpenSea has risen to levels last seen in September 2021 during the bull market.

The fast rising usage of Polygon bodes well for the price of its native token MATIC, although it also faces competition from newer layer-2s like IMX, Arbitrum and OP which are also fast gaining traction, although their number of active users in January is still quite some distance from the 17.5 million that MATIC had, which put it at a firm second place after BNB. That said however, FTM is fast catching up, with 16.3 million active users. This seems to suggest that FTM could have more leeway to gain further should its current trend of a fast accelerating usership number continue.

While altcoins are seeing very positive uptick in users in 2023, the leading altcoin ETH is not faring badly either. The price of ETH even managed to hit a new high of this year on Thursday, briefly breaching $1,700 at a time when BTC was looking hesitant.

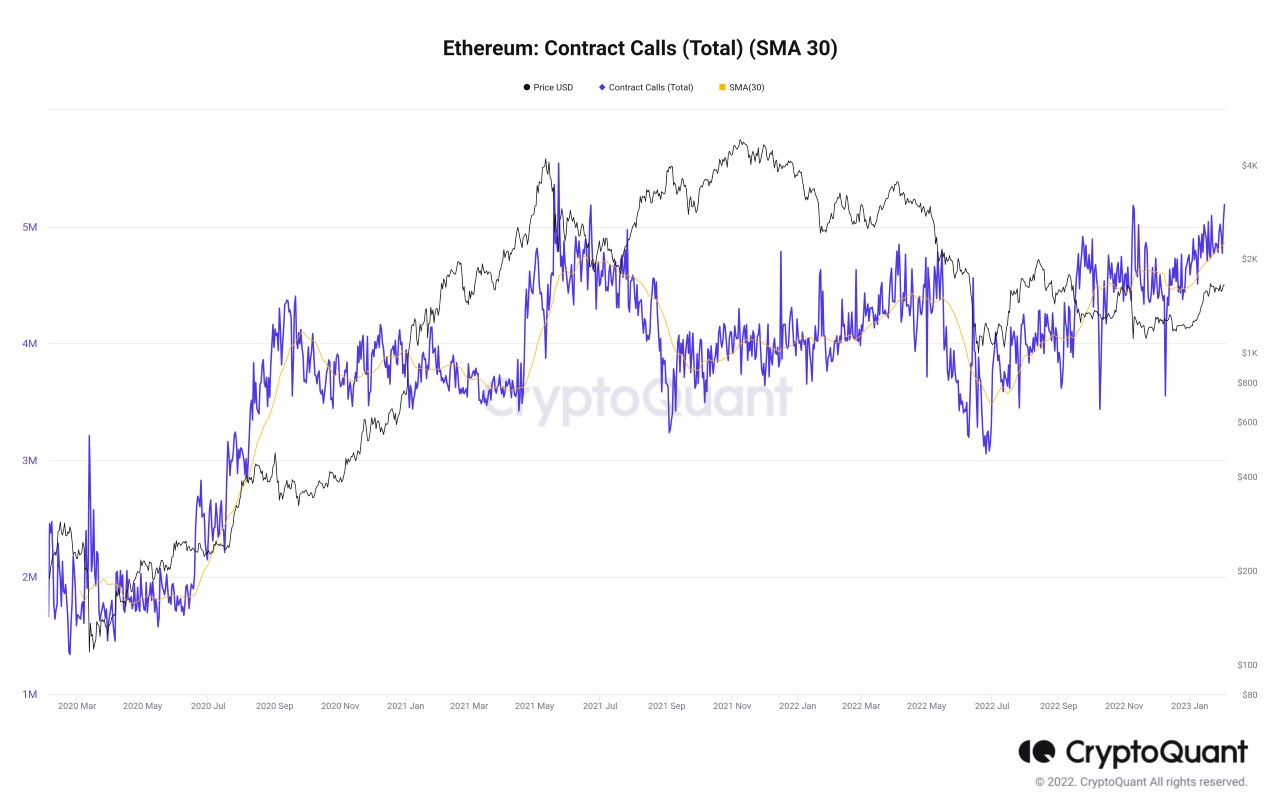

Higher ETH Price Underpinned by Stronger Fundamentals

The current strong price performance of ETH is led by stronger fundamental reasons which could be sustainable. First off, the number of contract calls, i.e. the usage of ETH smart contracts, has been on the rise again, which means demand for ETH is rising again. And while the demand is rising, the net supply of ETH is falling as more usage means the number of ETH used and burned is also rising in tandem, which means the scarcity value of ETH is continuing to rise.

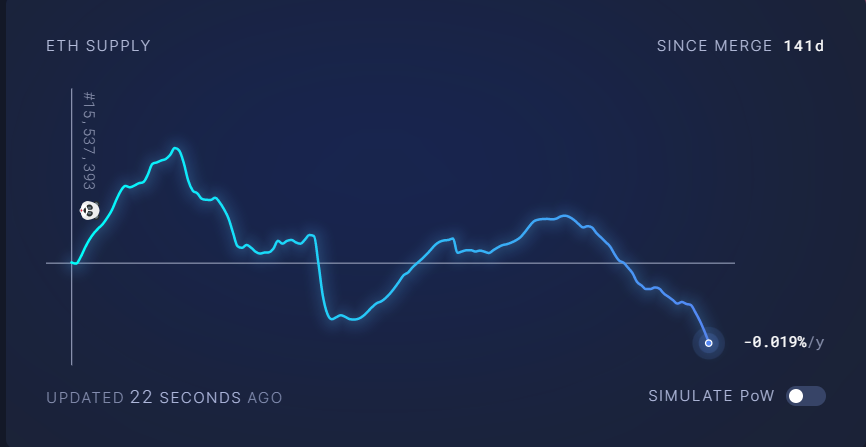

According to data from Ultrasound Money, which tracks metrics of PoS ETH since Merge, the deflation rate of ETH has hit a new all-time-low of -0.019% per annum. Friday itself saw a supply reduction of -8,749.57 units of ETH, which would translate into a reduction of around 880,000 units of ETH on an annual basis at the same rate. The previous highest burn amount was a supply reduction of around 5,000 units in mid-November last year.

According to the ETH supply chart above, the burn rate of ETH appears to be accelerating at an increasing rate, which would increase the scarcity value of ETH more and more with time.

Furthermore, ETH has positive newsflow to keep up with its strong price momentum, as the testnet for the much-anticipated Shanghai Fork, which is known as Zhejiang, has successfully gone live on Wednesday. However, the withdrawal function for staked ETH on the testnet will not be activated until this Tuesday. Should that go smoothly as well, there is good chance the price of ETH may see another uptick. In the meantime, users on the testnet can try out the interface on the platform and provide feedback to the team for improvements until the actual fork on mainnet next month.

ADA’s Algorithmic Stablecoin Djed Launches

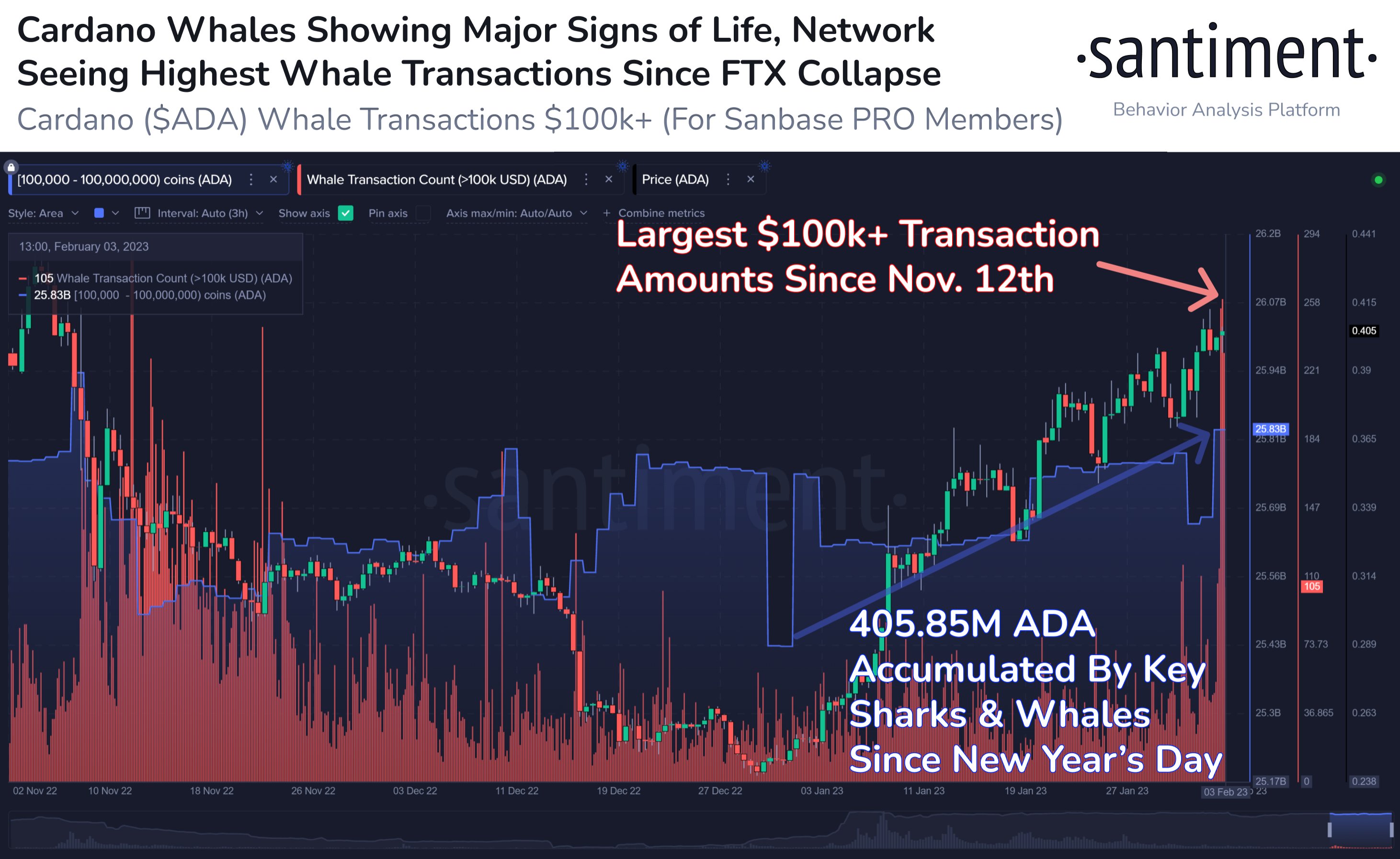

After a year of development, ADA’s algorithmic stablecoin known as Djed, has launched on the Cardano mainnet. Within a day of its launch, the TVL on the stablecoin hit $10 million. The modus operandi of the model is that when the reserve ratio drops below 400%, users can only burn Djed and mint Shen, while the opposite would occur when the balance tops 800%. This mechanism is designed to prevent another Terra-like collapse under challenging market conditions. However, it is unknown how the market would take to another algorithmic stablecoin after the huge fallout in Terra last year. The ADA token rose around 5% for the week, slightly below the average gains of altcoins post Fed meeting, a sign that either market participants were not too excited about the launch, or that the solid price run of more than a 65% gain so far in 2023 has already priced in the news. Friday saw transactions worth more than $100,000 worth in ADA tokens hit a 12-week high, which may be a sign that some whales could be taking profit.

Inflows to Crypto Fund Product Recovers

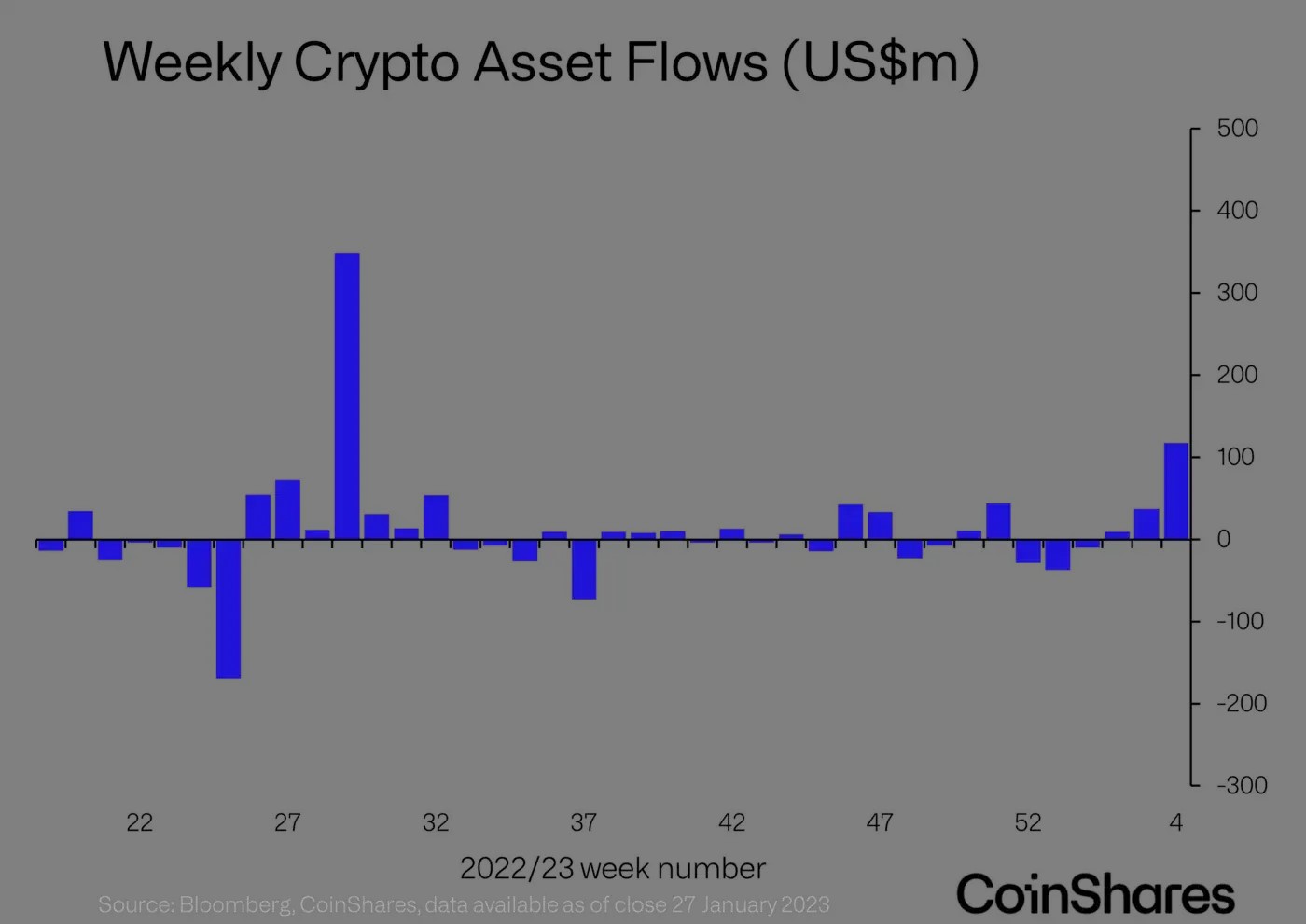

After a persistent period of outflows, CoinShares digital asset investment products finally saw a more substantial inflow of $117 million last week, the largest since July 2022, taking total asset under management (AUM) to $28 billion, up 43% from their November 2022 lows.

While BTC accounted for almost all of the inflows, around $116 million, the overall investment product volumes are improving with $1.3 billion traded for the week of January 26, up 17% compared to the YTD average, and higher than the broader digital asset market average, which has risen by only 11%.

This week, news from the economic front is quieter, with only the RBA to meet for its interest rate setting for Australia on Tuesday, while the main economic figure out of the USA would only come on Friday when the consumer sentiment report is published. However, there will be a series of Fed speeches given by Fed speakers throughout the week, with the most important likely to be from the Fed Chair Powell himself on Tuesday, which may increase two-way volatility in the US dollar and impact the prices of other assets.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.