Early last week on Tuesday, Fed Chair Powell again reiterated the same thing he said in the post Fed meeting press conference, emphasizing that more rate hikes may need to be done even though the economy is showing signs of disinflation. Market participants however, decided to take it as a dovish signal, with stocks and crypto bouncing higher after the speech.

However, by mid-week, a series of earnings disappointments and a new wave of retrenchment from companies sent stock prices lower again, as jitters about a corporate earnings disaster started to take effect after the January rally. Shares of Alphabet was one of the bell-weather that led the declines after its AI bot Bart coughed out a wrong response during a corporate presentation to introduce the firm’s new AI innovation.

As a result, the Dow ended the week lower by 0.17%, while the Nasdaq and S&P lost 1.11% and 2.41%, respectively, in what was their worst week since December. US dollar strength continued on from the week before, with the DXY inching closer to the 104 overhead resistance as both the euro and pound showed signs of weakening against the greenback, while USD/JPY managed to stay above the 130 level for another week to close at 131.43.

With more Fed speakers taking to the media to speak hawkishly over the week, traders are beginning to buy into the higher rate narrative, as can be seen in the marked increase in expected fed fund rates. Terminal rate expectations have now risen to 5.16% from 4.9% just a week ago, and the 10-year Treasury yield has climbed to 3.743% as at the close of Friday, from 3.65% at the start of the week.

While the dollar was stronger, Gold only lost 0.02%. Silver however, gave back a bit more, losing around 1.3% over the week. At the start of this new week, the dollar has continued its upward trajectory and may continue to put on more strength ahead of the January CPI data that will be due out on Tuesday. As a result of the dollar’s strength, previous metals have started the new week around 0.3% lower.

Oil was the outlier, putting in its best week since last October, after Russia announced that it will cut output by 500,000 barrels per day in March. This amount would translate to around 5% of its regular output. The news sent the WTI rising by around 8.63%, while Brent Crude gained 8.1% as a result. However, with the current dollar strength, oil has started the new week pulling back by around 0.7%.

Cryptocurrencies dropped for the first time in a month after regulatory FUD out of the USA again, once again reminding crypto investors of the difficult regulatory environment that they could be under this year after January’s rally made traders briefly forget about the situation.

The price of BTC declined 6.6% last week, putting it on pace for its largest weekly loss since the week of November 7 when the FTX fallout sent the price of the leading crypto declining by almost 21%. Even though BTC declined by 6.6% and altcoins lost an average of 20%, the amount of liquidations was not a large amount, with 24-hour long liquidations of only around $250 million, sentiment in the short-term has definitely been impacted as investors ponder over what other regulatory actions could come to hinder the industry.

Regulatory Actions Send Crypto Prices Reeling

As a hint of what kind of regulatory environment crypto investors may need to put up with this year, mid last week saw two serious developments regarding regulation enforcement out of the USA that would impact crypto adoption.

First to start things off was a note from Coinbase CEO Brian Armstrong about a rumor he heard regarding the banning of staking for crypto users from the USA. In a tweet shown to Armstrong’s 1 million followers, he spelled out that the folks at Coinbase have heard a rumor that the SEC would be clamping down on crypto staking in the USA. This rumor was verified just a couple of hours later when Kraken, one of the crypto exchanges operating in the USA, was ordered to shut its staking program for all USA users with immediate effect so as to settle a lawsuit filed by the SEC against the company for granting USA users access to unregistered securities.

While Coinbase did clarify that their staking product offering had not been impacted, the exchange was observed to have burned $4.7 billion USDC into fiat, in what was suspected to be a huge influx of redemption from panicked users on the platform.

The second FUD involves the de-banking of crypto assets, where the SEC and the FED are on a massive mission to disable fiat ramps for crypto exchanges. Rumors are rife that US banking regulators are sending ultimatums to US banks to cut crypto exchanges from using their banking services, effectively cutting off the crypto-fiat on and off ramps to the crypto space, by the end of this week, or risk getting their banking licenses revoked, or applications to join the banking charter rejected. With Silvergate bank, one of the largest providers of fiat-crypto ramp to the crypto space in recent years recently terminating its fiat service to Binance, the rumor appears to be substantiated.

The SEC appears to be hot on its heels, riding on the sails of its latest “Kraken-win” to sue Paxos for issuing the BUSD stablecoin, claiming that it is a security. At the rate the SEC is going, many crypto firms could be targeted for various reasons in time to come, as SEC chief Gary Gensler has already warned that the Kraken enforcement was a prelude as to what is to come.

SEC Ruling on Staking Could Put Pressure on ETH

With Kraken’s confirmed shutting of staking to USA users, and fears of the contagion spreading to other USA platforms, its impact on the staking program of ETH could become the focus of traders’ attention as the Shanghai upgrade approaches. While staking as a validator may not necessarily be disallowed by US regulators, the high market share of Kraken and Coinbase in ETH staking has brought some fear into the minds of ETH holders, especially after the SEC Chairman Gary Gensler took to CNBC to warn other crypto exchanges that the enforcement action imposed on Kraken was a notice for them to sit up.

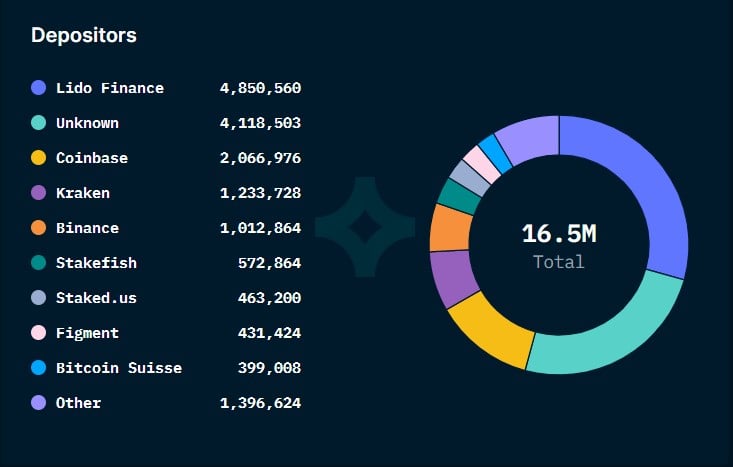

Coinbase and Kraken have been known to be amongst the top stakers of ETH, with Coinbase having 12% market share and Kraken having around 7.5% market share. Should the staking of ETH be affected, there is a chance that both exchanges may need to withdraw their staked ETH and rewards to return to users who may opt to liquidate their holdings and cause the price of ETH to dip.

While Coinbase has not yet commented on what it plans to do, Kraken has expressly revealed that it will unstake their ETH when the Shanghai upgrade is complete, expected to be in end March or early April.

Even though “Shanghai” will impose a daily limit as to the amount of ETH that can be withdrawn, the fact that both exchanges would need to withdraw all of their ETH may put a persistent overhang on the price of ETH.

Data from Nansen shows that there are currently 1,233,728 ETH staked through Kraken, and 2,066,976 ETH staked through Coinbase, which is not a small amount. Concerns around the situation may have caused ETH to lose more than 10% in the aftermath of the Kraken news, much more than the 6.6% loss that BTC has seen.

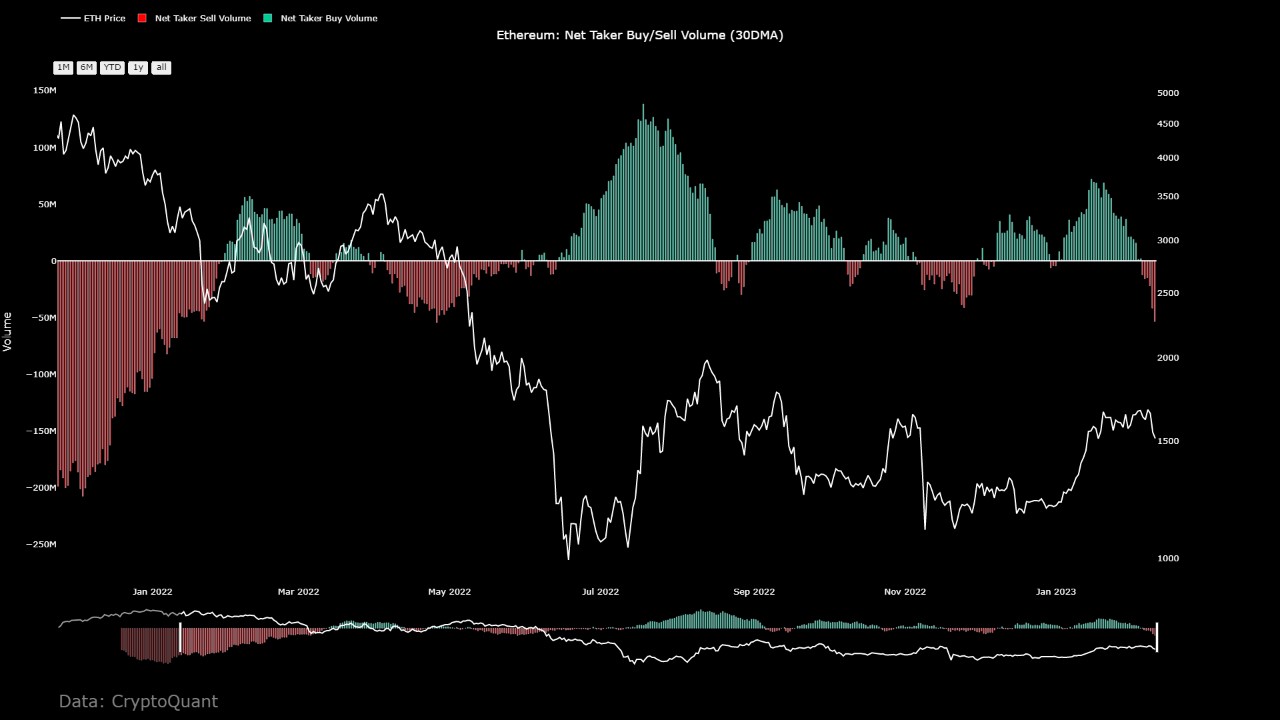

A check on the net taker buy/sell volume shows an expected result, where sellers have been far more aggressive in selling to the market than are buyers in buying from the market. While the data does not necessarily indicate that a price decline is on the way, it nonetheless reveals that there could be an exodus out of ETH long positions at the moment.

Experts Say BTC Has Bottomed Out

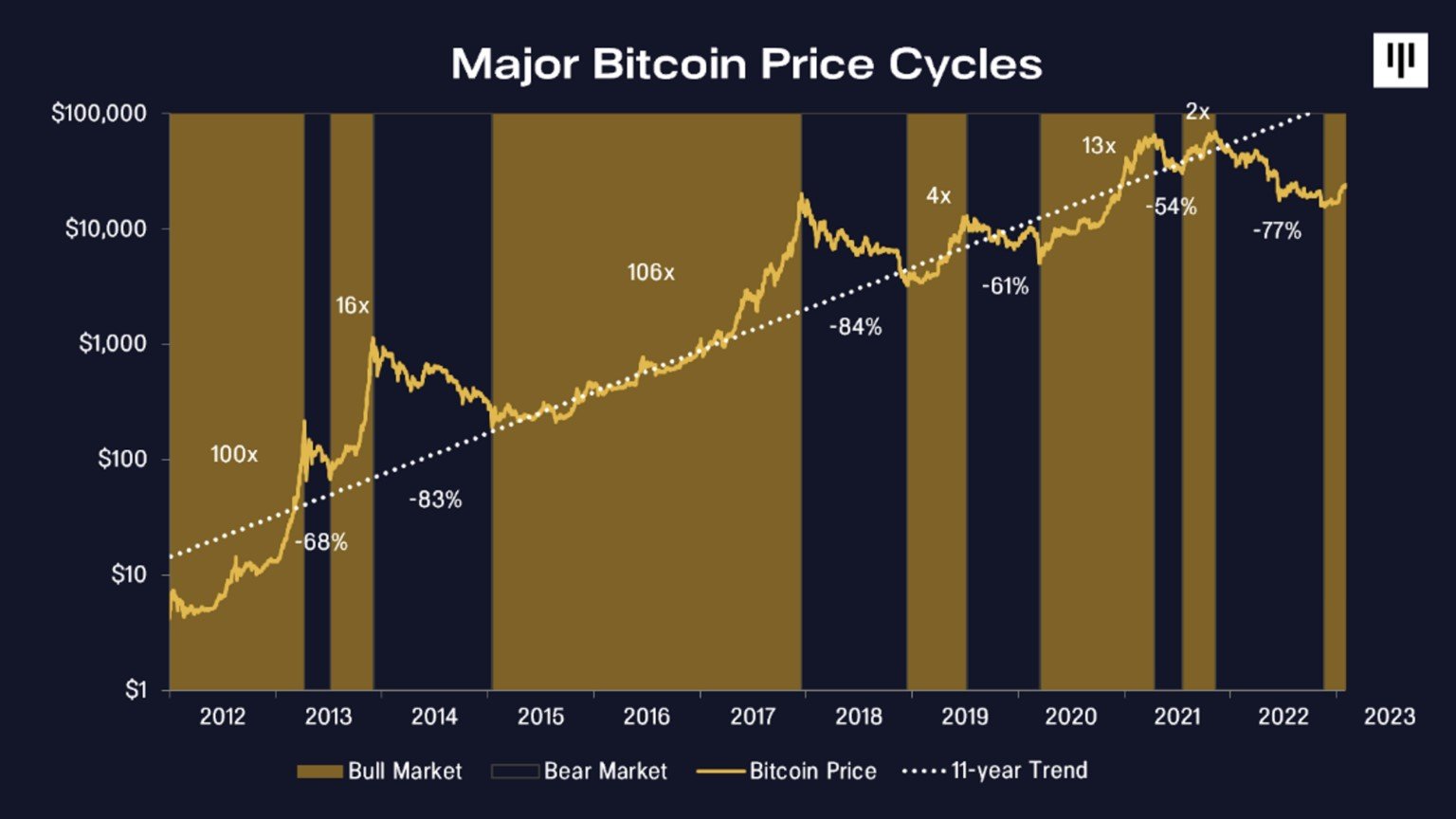

While in the near-term the regulatory landscape may not favor crypto bulls, experts are predicting that the worst of the selloff in crypto assets has been over. Pantera Capital CEO Dan Morehead and Osprey Fund’s CEO Greg King, both highly respected key opinion leaders within the crypto space, are saying that crypto prices have already bottomed out and prices would be climbing a wall of worry as is the case with the early stages of a new bull cycle.

Referencing the 12-year BTC price cycle chart above, Morehead noted that over the long-term, BTC price has been on a secular uptrend of 2.3x annually over the past 12 years, albeit with the newer peaks having a smaller magnitude of increase compared with its previous peaks.

While the latest regulatory setbacks could dent the sails a little for staking products on DeFi, other segments of the crypto market may still continue to thrive as they have not been affected by regulatory actions. One such segment could be NFTs, which is still showing a nice recovery after the lull of last year. As such, while some DeFi products could see some pressure in the days ahead, other segments like GameFi and NFT could continue to power the industry forward.

MATIC The Main Beneficiary of NFT Market Recovery

As evidence of a recovering NFT market, more prominent signs of a rebound happened again last week, as single Ethereum-based NFTs from the popular CryptoPunks and Bored Ape Yacht Club projects each sold for more than $1 million worth of ETH. Should this recovery be sustainable, it could bode well for popular NFT-chains like SOL, and especially for fast rising NFT star blockchain, Polygon.

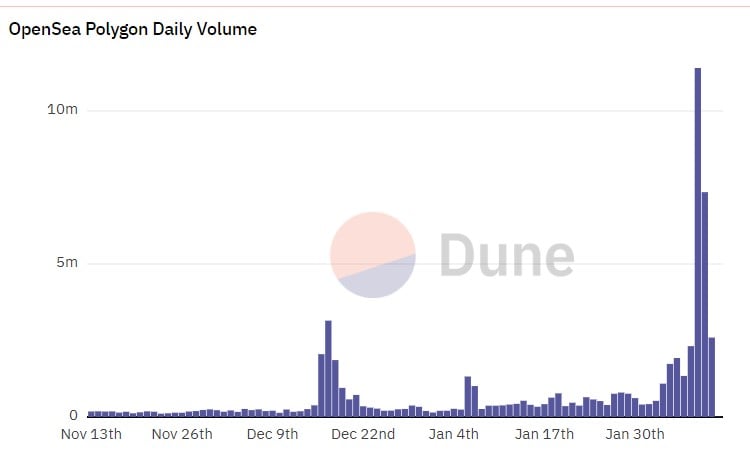

On February 8, the single-day transaction volume of NFT on OpenSea Polygon increased to $11.4 million, hitting a record high, mainly due to the Super Bowl NFT avatar minted by Reddit in cooperation with the NFL. This surge in demand could be one reason why the price of MATIC has been very resilient in the face of the market-wide selloff, declining by only 1% when the rest of the altcoin segment has declined more than 20% over the course of the week. This relative strength could see MATIC lead the NFT-specific blockchains higher when the broad market recovers.

Looking ahead this week, investors will be keenly watching the release of January’s CPI numbers on Tuesday to see if inflation has once again cooled. Market expectation is for a 0.4% increase month-over-month and a 6.2% gain from last year. If the number is lower than expected, the markets could see a reprieve while a hotter number may see risky-assets continue to sell off as a hotter number would give the Fed a reason to hike further for longer.

On the other side of the Pacific, Japan is set to announce its new BoJ chief on Tuesday, with media outlets reporting that professor Kazuo Ueda, a professor and former BoJ board member, to be the likely candidate. This new candidate will take over the retiring Kuroda who has been a dove. The new appointment would have major implications for the yen should his policies differ strongly from the incumbent. However, most market watchers do not expect a major policy shift from the new governor.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.