Following several positive news, the crypto market had a bangbuster week, with the price of BTC jumping almost 20% to pierce through the $30,000 level like a phoenix rising from the ashes. Altcoins that had been badly bruised by the SEC bombshell recovered mightily by between 20% to 100%.

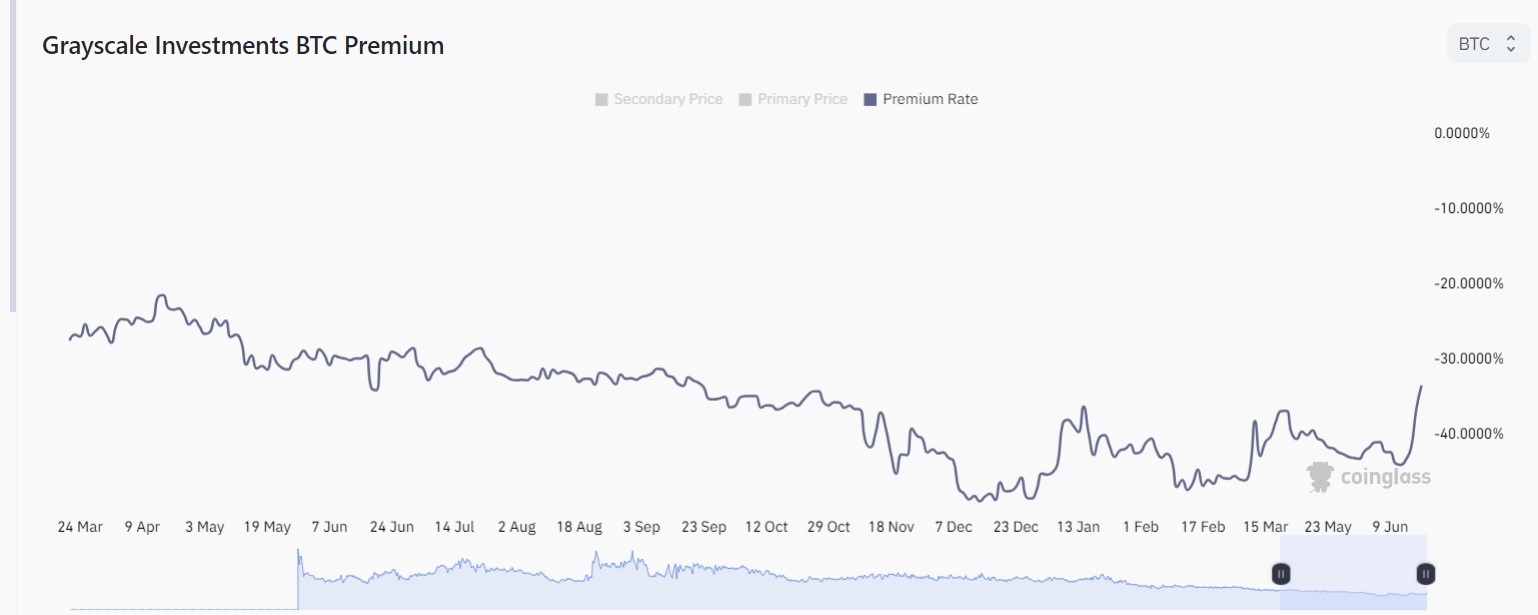

The jump in price was attributed to two main factors. Firstly, following in the footsteps of Blackrock, at least three other prominent investment funds, including WisdomTree, Invesco and Valkyrie, have also filed applications to launch their spot BTC ETF last week. News of these large investment funds wanting to have a spot BTC product has caused a 400% overnight jump in the premium of GBTC. While the premium is still a negative number, the moves by these funds have intensified expectations of a fight for BTC supply should these applications be approved, which experts have think will have a high chance this time.

The jump in GBTC’s premium also coincided with a large purchase of around 130,600 BTC by a whale account, which could be possibly linked to a new purchase by either the above-mentioned funds or new crypto exchanges.

Other than announcements about the spot BTC ETF, large financial institutions also revealed their thirst to get into the crypto market.

TradFi setting up crypto exchange pops prices

Deutsche Bank was the first off the block to announce that they have applied for a digital asset licence in Europe, while a new crypto exchange named EDX, which is co-founded by Citadel, Fidelity and Charles Schwab started operations on Tuesday out of the blue after being postponed indefinitely late last year due the to FTX scandal. From the way it looks, there appears to be a fight for market share between the traditional financial market titans and native crypto exchanges, where regulator preference could give the traditional finance boys the edge.

Regardless of who this whale was, as we had predicted in our last week’s report, the final two weeks of a quarter could see crypto prices jump and this has indeed come to pass last week, as another $250 million worth of stablecoin was added into circulation on Tuesday after the $1 billion injection in the week before, which continued to drive crypto prices higher, liquidating about $200 million worth of shorts between Tuesday and Wednesday.

Notably, coins that the new exchange EDX have listed were the top gainers, and these are, BTC, ETH, LTC and BCH. BCH was the star of the week, rising 100% to hit $200 after traders piled in to buy BCH because it is the most under-the-radar crypto amongst the four. LTC was not far behind, rising more than 20% back into the $90s, with its halving less than 40 days away.

ETH May play catch up after Justin Sun scare subsides

ETH, on the other hand, appeared to be the weaker amongst the listed coins, even as it has recovered 10% back near the $1,900 region. Rumors that Tron Founder Justin Sun unstaked 15,805 ETH presumably for sale may have contributed to the relative “weakness” in the price of ETH. Regardless, the 10% gain had completely erased ETH’s loss as a result of the SEC lawsuit on Binance two weeks ago, which was still a commendable recovery.

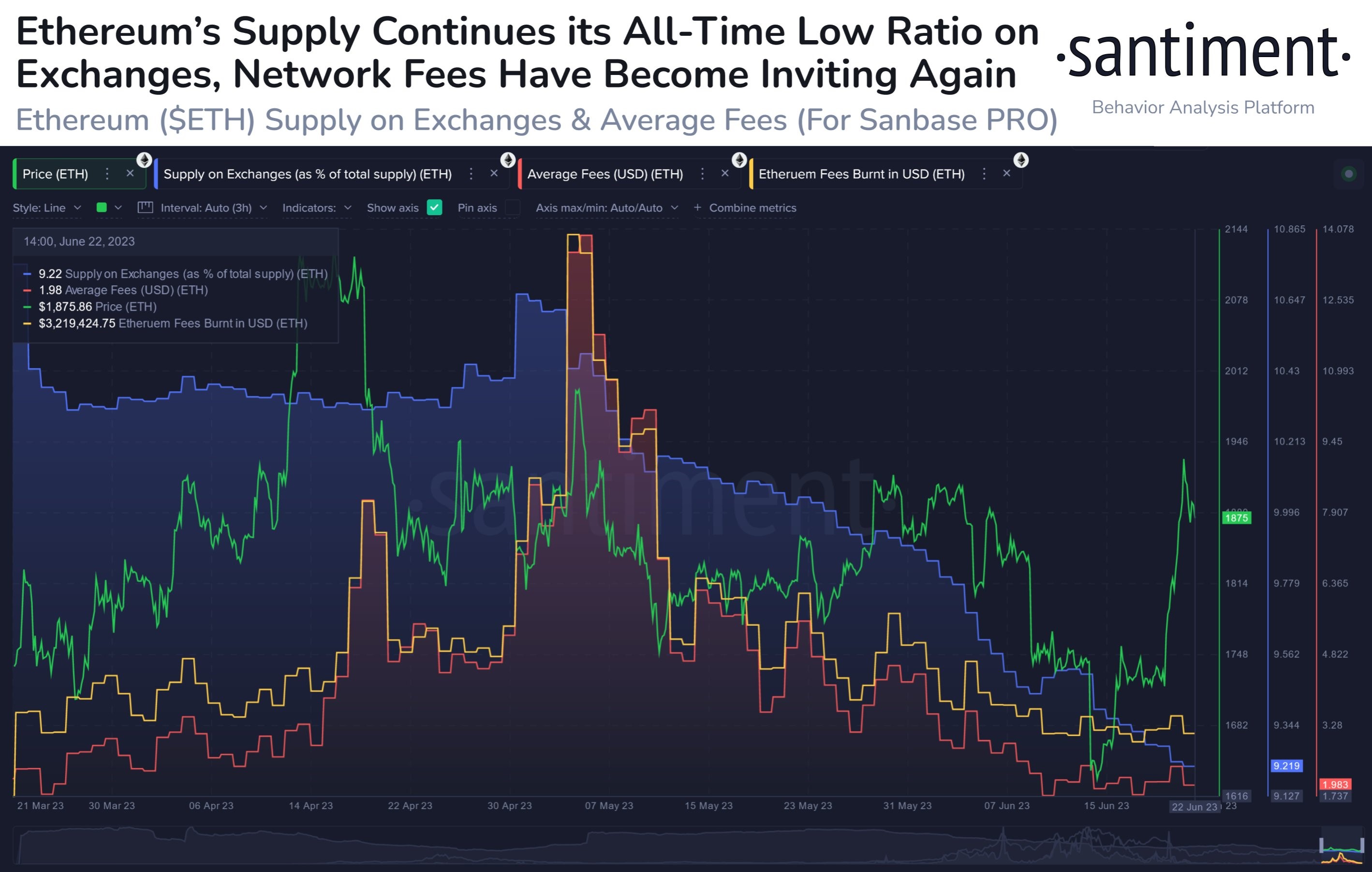

Despite the relative weakness in price, ETH’s exchange supply continues to fall drastically and its average fees are back to levels last seen in March just prior to its price ascension to $2,100. Thus, once the Justin Sun sale is over, ETH could play catch up with the rest of the market. However, as Justin Sun still owns a considerable amount of ETH, the price of ETH could underperform the market should he or the ETH Foundation reduce their holdings.

Regulators suddenly start to like crypto

While the two main reasons above were the initial sparks that propelled the explosive move in crypto prices, comments made by several heavyweight traditional finance regulators gave crypto the propelling power for another upward thrust towards the end of the week.

First, FED Chair Powell, in his testimony at Capitol Hill, gave the already quick gaining prices another boost on Wednesday. While Powell said the usual remarks about more hikes to come in the year, he signalled that the hikes would be slower and the FED has transitioned into a “wait and see” position now. What sparked the crypto market’s cheer was to come next as the FED Chair said crypto appears to have staying power as an asset class, perhaps hinting to regulators that they should at least approve one of the newly filed applications for a spot BTC ETF.

Next came endorsement by the International Monetary Fund (IMF). A paper released by the IMF criticised the few countries that have completely banned crypto assets and warned that this approach may not be effective in the long run, almost directly taking a jibe at the US SEC. The organization then suggested that countries should instead focus on addressing the drivers of crypto demand, including citizens’ unmet digital payment needs, and on improving transparency, by recording crypto asset transactions in national statistics. Such recommendations made by the IMF are seen by market experts as a sign that the IMF is looking to push for the global legalisation of cryptocurrencies.

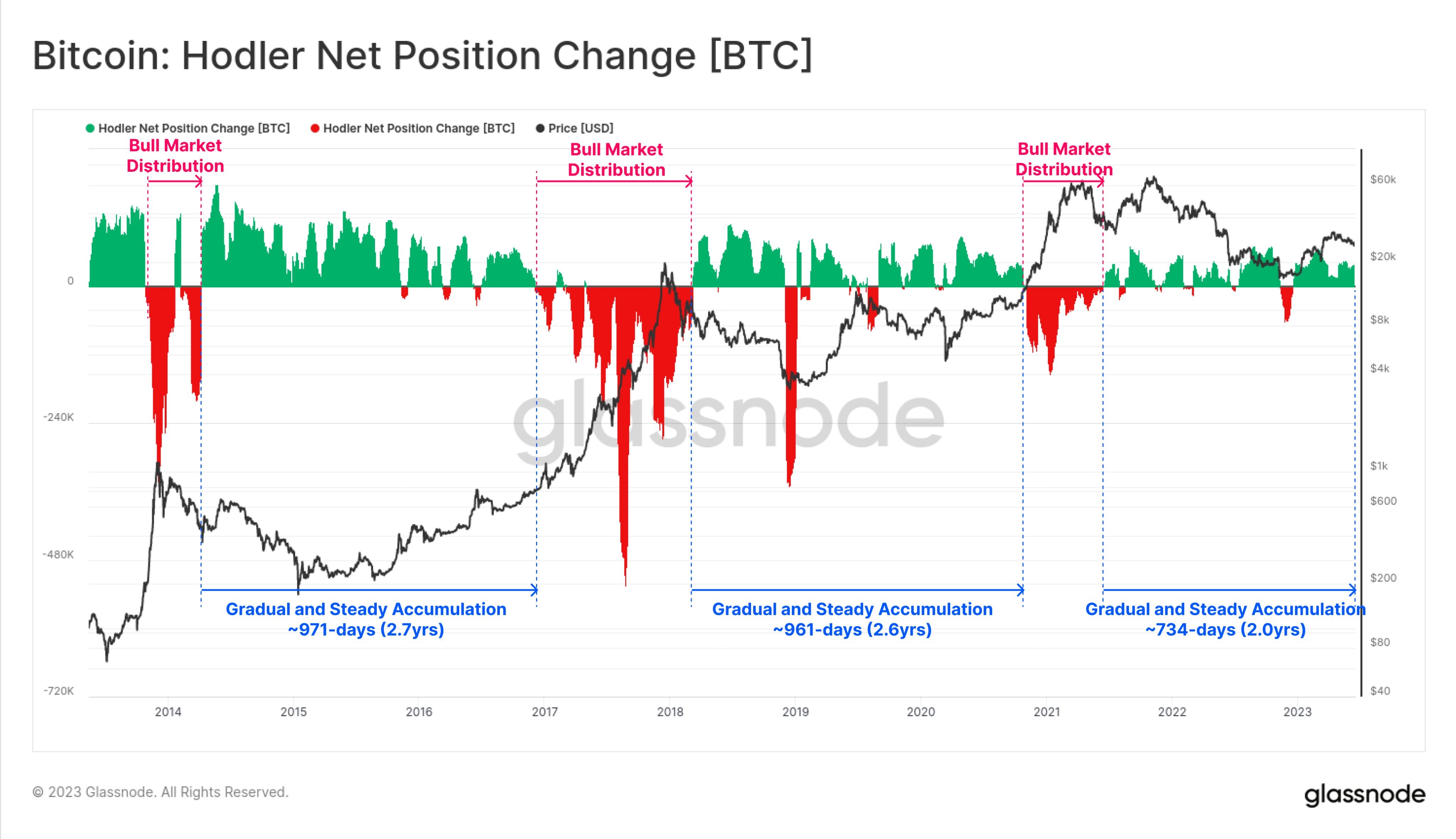

BTC NPC suggests bull still 200 days away

Despite the current buoyant sentiment, investors should not get overly carried away thinking that the bull market has started and the price of BTC would be breaking ATH soon. Although BTC’s price is displaying an upward trend, there remains chances of big dips along the way. As can be seen in the below diagram, the accumulation phase before an actual bull run has typically been around 960-970 days in the past two cycles. Our current cycle has only seen around 737 days of accumulation, which means there could be another at least 200 more days to go before the price of BTC starts its stage of parabolic increase. Hence, traders who do not have a long-term view of more than one-year from now ought to remember to take profits after large increases to buy back again during dips for better returns.

Interestingly, the SEC approved the first leveraged BTC futures ETF on Friday and this will start trading on Tuesday. The ETF will offer traders a 2x leverage on the price of BTC. While we are not saying that this would cause the price of BTC to correct, it is worth recalling that the launch of the first BTC futures contract by the CME at the peak of the 2017 bull run was followed by a subsequent dip in the price of BTC, which eventually materialised into the bear market.

Another potential negative catalyst worth keeping in mind is the possibility of a forthcoming dip if asset prices start to sell off in the event of a global recession or another black-swan incident, which traders in the traditional finance space are beginning to get increasingly worried about.

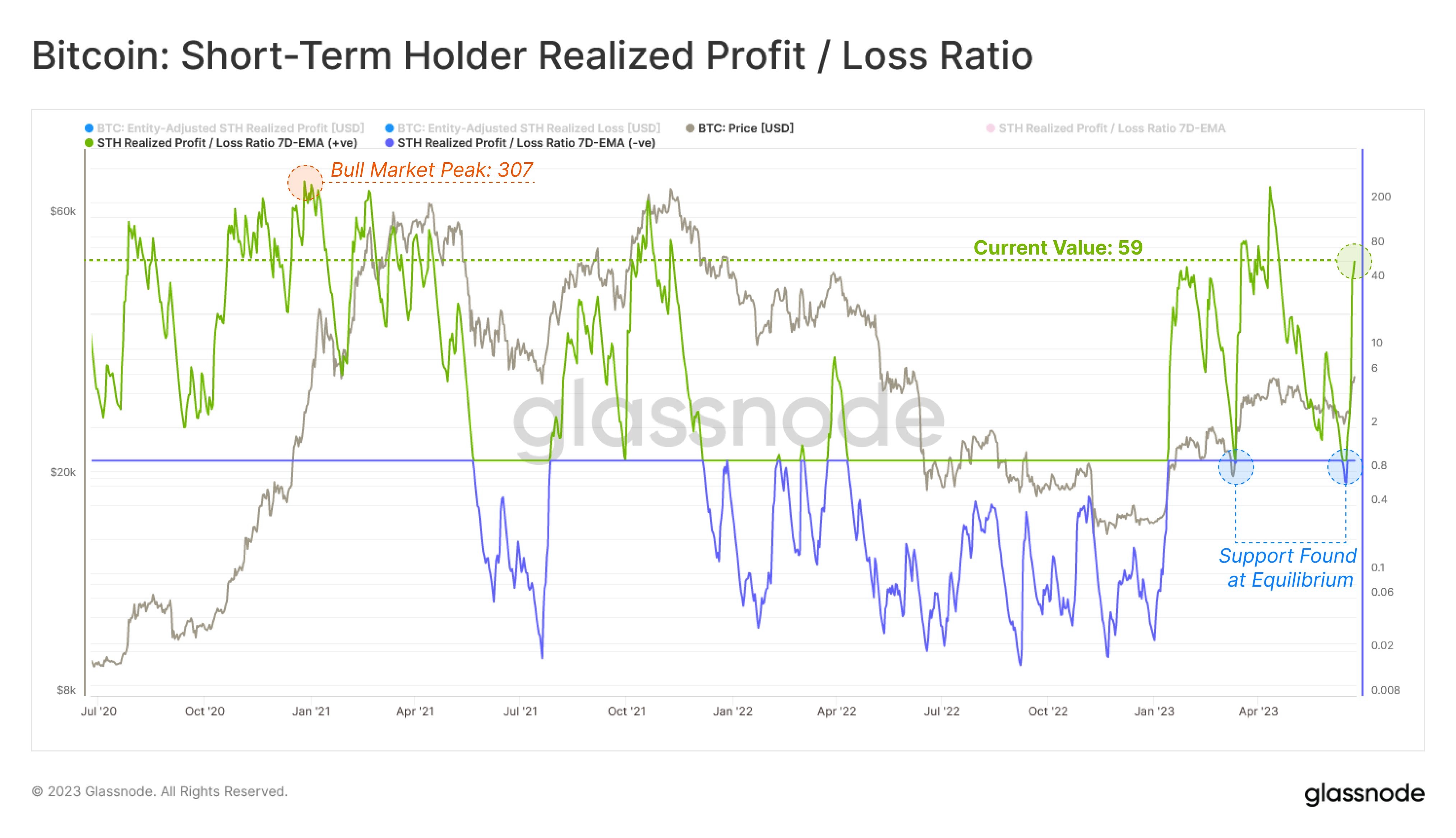

Crypto market appears overbought

Furthermore, as prices rose sharply within a short span of time last week, the current crypto market appears a tad overbought, with the short-term holder profit ratio surging to 59 from 0 barely two weeks ago. While we do not discount the possibility of more price rises in the days ahead, in the short-term, the chances of a consolidation or retracement for prices to cool off is there.

Stocks dip on return of the recession narrative

Almost in tune with what we had pointed out in last week’s report, stocks were weaker last week while crypto prices levitated, making crypto outperform stocks by a big margin as we head into the final week of Q2.

US stock traders were starting to get worried about recession again as new data points released last week suggested that the US economy was showing many signs of a cool off. Bond yields, not just in the USA but also in Europe, inverted to their highest magnitude since the 1980s, suggesting that a credit event may not be too far off.

With the change in narrative from growth to recession, all US stock majors dipped last week, breaking their multi-week winning streaks. The Dow lost 1.7%, the S&P was about 1.4% weaker, while the Nasdaq posted its worst weekly performance since March, losing around 1.4% to end its run of eight consecutive winning weeks.

Despite the fear of a US recession, the US dollar was still the most highly sought after asset in the traditional markets, as a flight to the dollar was underway due to worse problems brewing in Europe and other developed nations, even when some economies appear to be adopting an even more hawkish stance than the FED.

Plagued with a persistently high inflation rate even having hiked rates for 12 times in the past year, the BoE was forced to hike rates by another 50-bps last week. It was reported that the UK’s core inflation remained at a high 7.1% year-on-year in May, still rising from the 6.8% reading in April, and was the highest rate since March 1992.

The pound however, dipped as traders positioned themselves for a recession and hard times ahead for the UK. This in turn affected the currency of the UK’s biggest trading partner, the Euro, which also released dismal economic numbers last week. This intensified the flight to the US dollar, which rose 0.6% even when US bond yields were declining, as the USA is now being seen as the cleanest dirty shirt in the room.

A recessionary environment would deflate commodity prices and leave them in the cold. As a result, Gold lost 1.9% and Silver slid 7%, its most hefty drop in recent days. Oil similarly came under pressure, with the WTI losing 2.8% and the Brent 2.3% weaker. Currently, most commodity prices are seeing a positive retracement, trading around 1% higher at the start of this new week as the dollar is retracing a little in the early Asian session.

As for key events to look out for, this week will see central bankers convene at the ECB’s central bank forum on Wednesday, where Fed Chair Powell, BoJ Chair Ueda and BoE Chair Bailey will be speaking. Thursday will see the release of the US actual GDP for Q2 and unemployment claims.