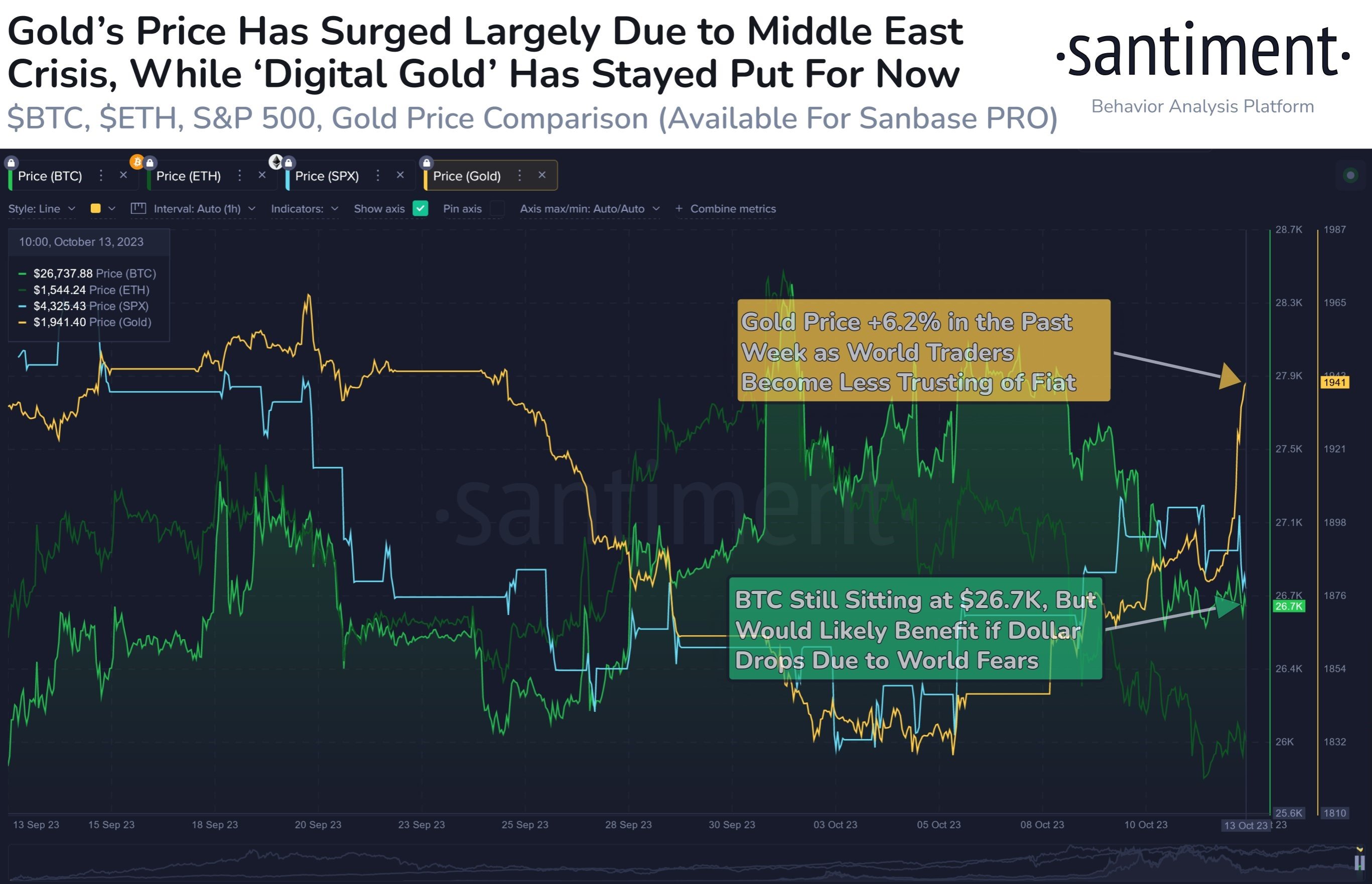

The price of BTC dipped last week as the worsening geopolitical situation in the middle east led to the selling off of some risky assets.

Things were worse for crypto compared to the other safe haven like gold as it had been reported that the Israeli government had found cryptocurrency wallets and accounts that belonged to the terrorist groups, suggesting that the terror groups were using cryptocurrency to transport money to fund their operations. This revelation has given crypto a bad name in light of the current geopolitical tensions and could dent crypto sentiment compared with other assets.

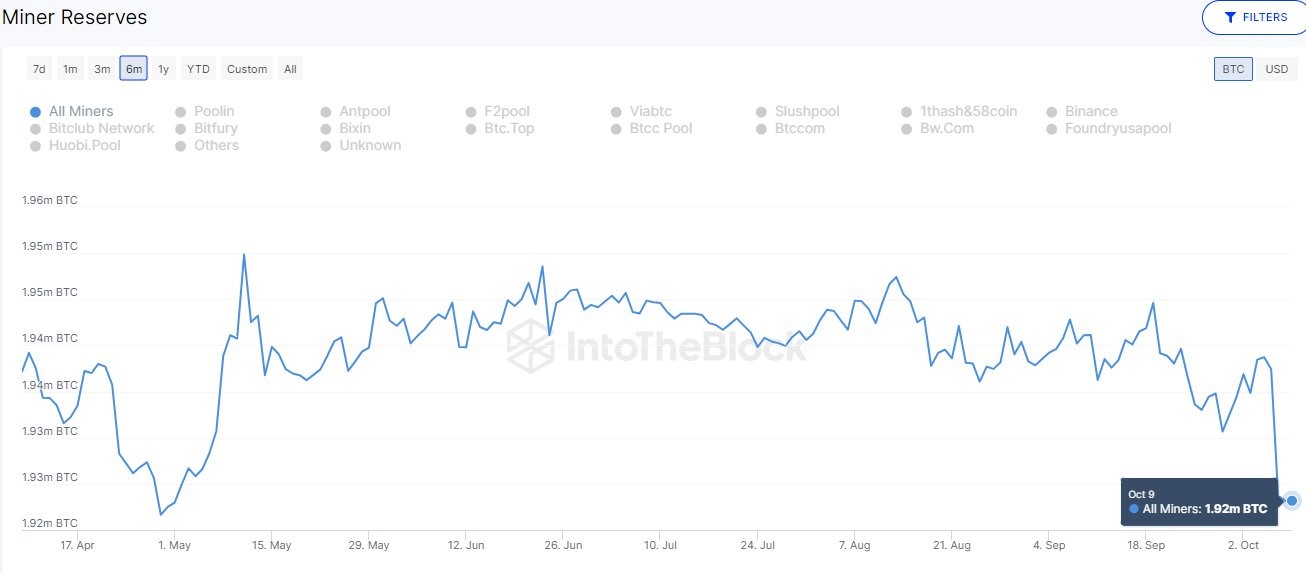

While most savvy investors would not be put off by such findings, nonetheless, BTC miners did however sell their BTC when it was learnt that the war in Israel would drag. Last Monday, BTC miners sold around 20,000 BTC the moment the traditional markets opened, in a sign that either miners were worried that the price of BTC would fall due to the war or that they simply had to sell to pay for their expenses. Eitherway, the sale did not come at the best of times and this caused the price of BTC to dip by around 3% from $28,000 to below $27,000 by the end of the week.

BTC not without good news

While the price action last week for BTC was mostly negative, the week was not without good news. At least some reputable people in the investment space made bullish remarks about BTC.

Paul Tudor Jones, one of the world’s richest hedge fund founders, said in an interview with CNBC on Tuesday that factors such as broad geopolitical risks and rising US government debt levels make it difficult to own stocks, but that BTC and gold are attractive options.

Jones first made known his bullishness on BTC in May 2020, saying then that he had put 1%-2% of his assets in BTC. Earlier in 2023, Jones sounded less bullish, saying that an unfriendly regulatory picture and the FED’s determination to squelch inflation were likely to be headwinds for BTC. However, now he is back to being bullish on BTC again due to the change in the macro picture as well as the geopolitical scene.

Another interesting call was made by Standard Chartered bank, which predicted that BTC could reach $50,000 by the end of this year and $120,000 by the end of 2024. The bank also thinks that ETH could rise from around $1,500 currently to $8,000 by the end of 2026.

The bigger news which could have a positive impact on the price of BTC however, came on Friday. It was revealed via the expiry of a deadline that the SEC does not plan to appeal the court decision that imposed on the SEC to reconsider Grayscale’s application to convert the GBTC Trust into a spot ETF. This decision makes it compulsory for the SEC to have to seriously review Grayscale’s application. While it is still not a “go” at this point, at least this gives BTC bulls one more thing to be hopeful about. People in the crypto legal profession are expecting that the SEC will need to have a detailed report explaining why they accept or decline Grayscale’s application within the coming two weeks.

As a result of this development, the GBTC discount has narrowed to about 16.5%, showing bullish expectations that the application to convert would be successful. In mid-June, the discount was 43%.

BTC offers the best risk-reward currently

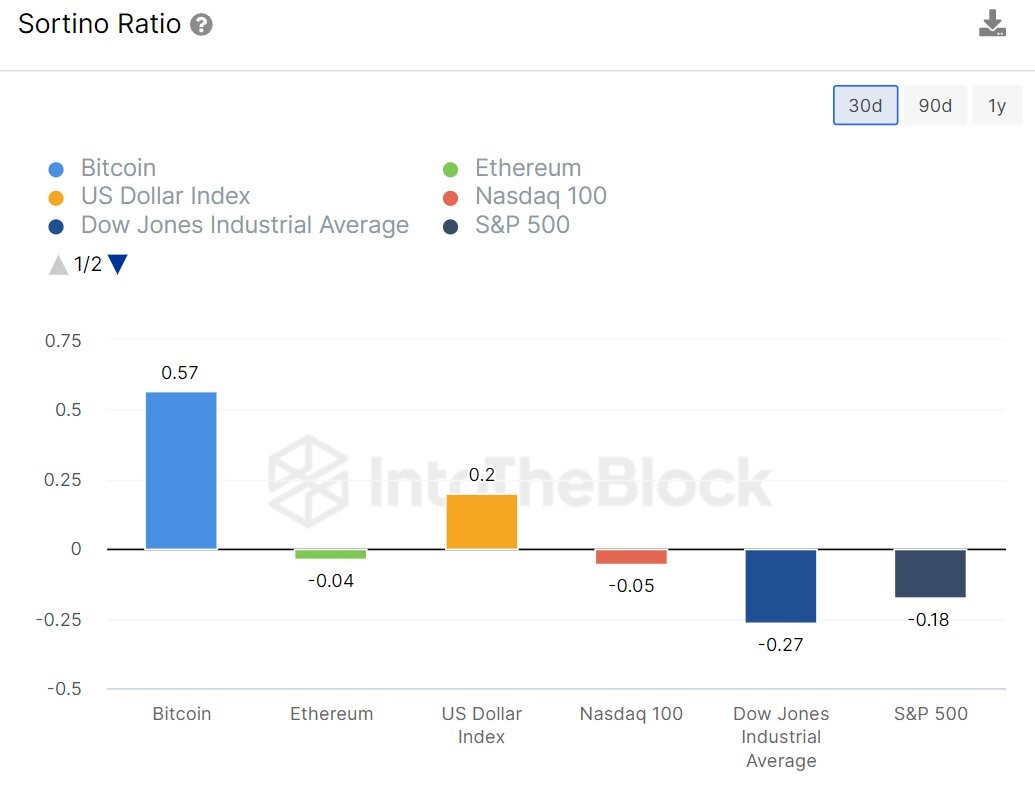

According to the Sortino ratio, which measures the risk-adjusted return of investment assets, BTC currently offers a more favorable risk-adjusted return than other traditional financial assets.

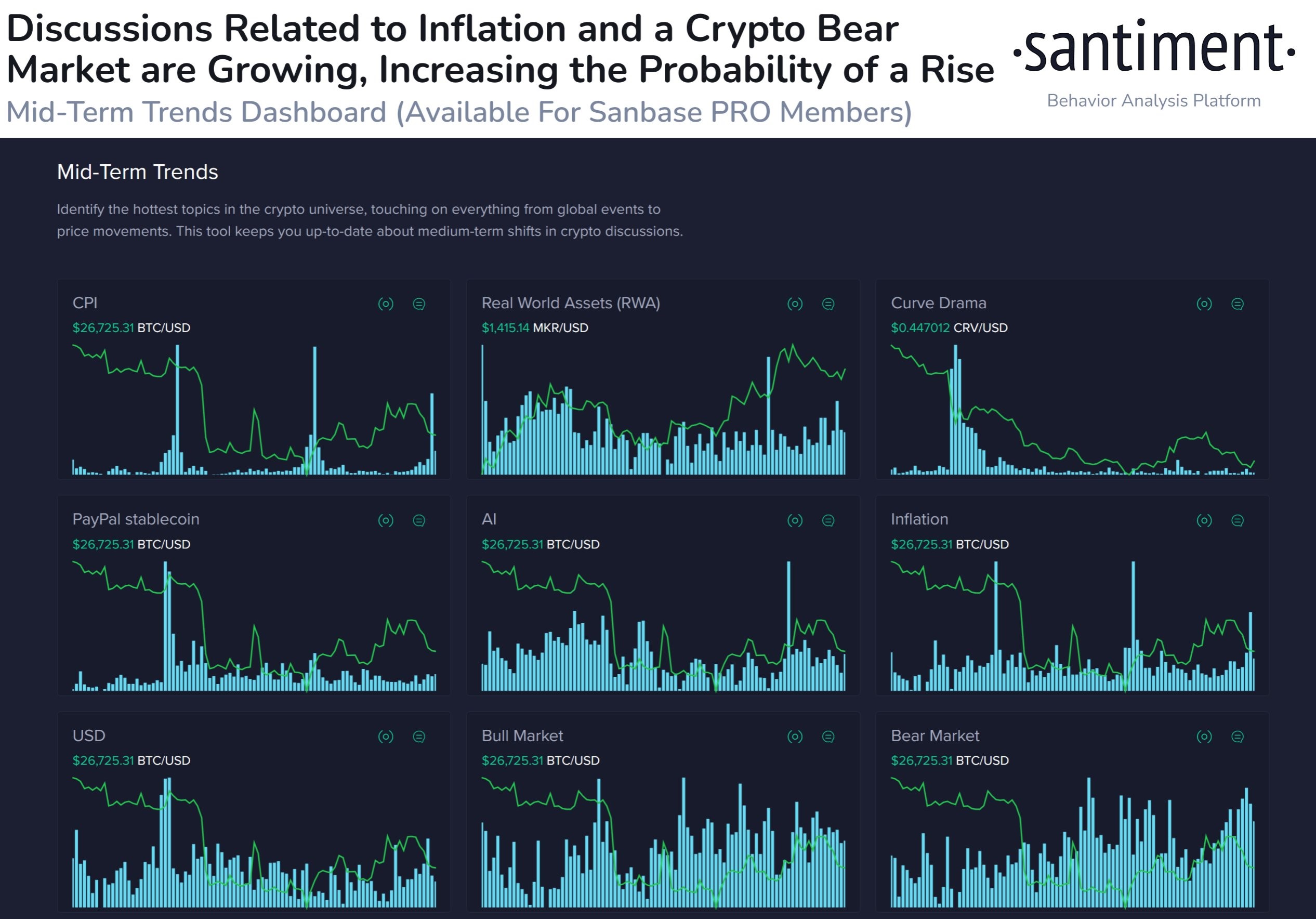

At the moment, the crypto market looks oversold as well, with the funding rate falling. This could indicate that retail traders are putting up more short positions than long trades. The general sentiment amongst traders is also negative, with discussions about inflation and a crypto bear market growing in intensity. This could increase the possibility of at least a short-term bounce in price.

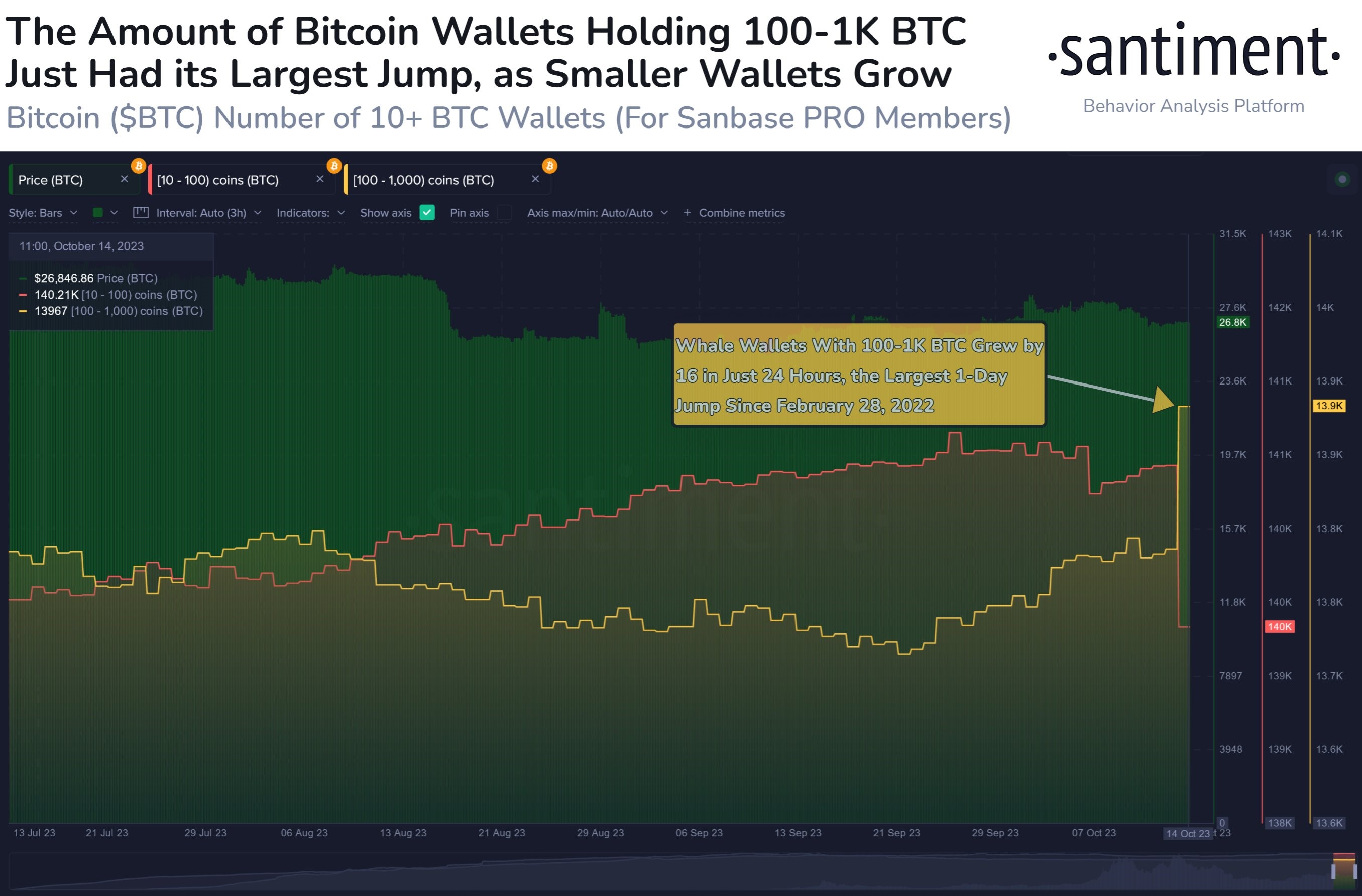

Over the weekend on Saturday, we witnessed one of the largest increase in new BTC whale wallets in 24-hours as the price of BTC hovered just below $27,000. 16 more wallets now hold between 100 to 1,000 BTC in a sign that whales have taken the dip to acquire more BTC as sentiment amongst retail traders remain in pessimism.

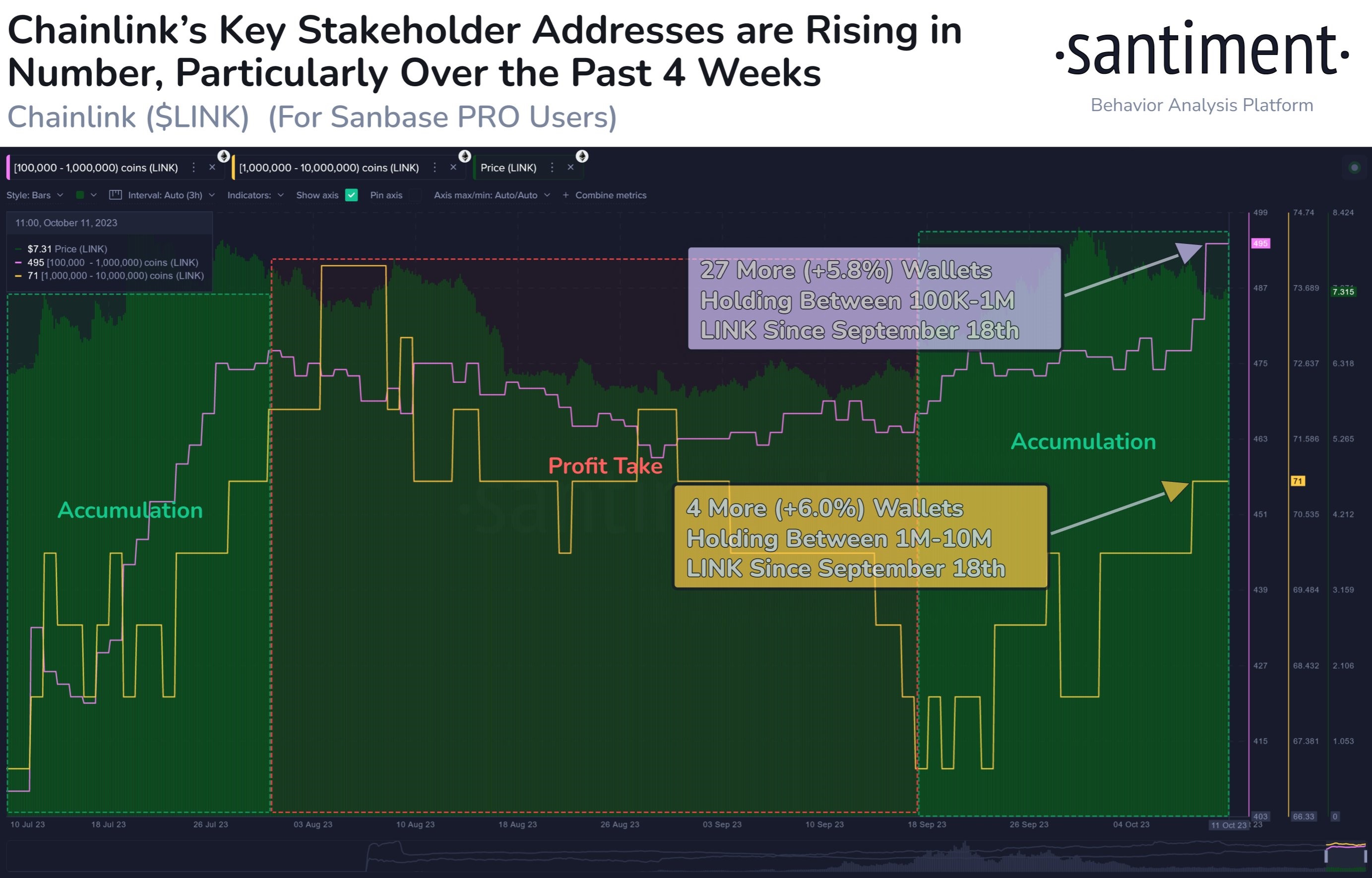

LINK accumulation picks up as price corrects

Despite an almost 20% drop in the price of LINK last week, LINK whales have not dumped the token. In fact, these whales acquired even more LINK during the dip. As the price dipped last week, whale wallets that hold between 100,000 to 10 million LINK started accumulating more aggressively. They now hold 6% more addresses in this range compared to mid-September.

Gold and oil jump as Israeli war intensifies

The stock market shrugged off revelation from last week’s FED meeting minutes that showed policy makers were still wishing for a more restrictive monetary policy until inflation eases. Furthermore, the higher than expected inflation numbers released also did nothing to roil the markets. Both the PPI and CPI released over the week were higher than expectations.

The PPI annual rate in September was 2.2%, which was expected to be 1.60%. The PPI monthly rate was 0.5%, expected to be 0.3%, while the previous value was 0.7%. PPI is considered a leading indicator of inflation and may hint that the CPI in the months to come could move higher. Later in the week, the CPI was released. The annual CPI rate in September was 3.7%, expectation was for 3.6%. Both the PPI and CPI figures released quite clearly indicate that inflation could be back on a rising trend in the days ahead.

However, the stock market was not roiled even with the war in Israel spreading, as US yields finally started to ease off their highs. The net result was that the Dow advanced 0.79%, the S&P climbed 0.45%. The Nasdaq was the lone loser, down by 0.18%.

Precious metals had one of their best weeks in recent times as the war in the middle east prompted investors to jump back into the physical metals trade. Gold surged by almost 6% to trade back above $1,900 and Silver gained 4.2% as a result. A similar thing happened to precious metal prices when the Russian-Ukraine war first broke out last February too.

However, this time around, crypto prices did not jump in tandem with precious metal prices like they did during the onset of the Russian-Ukraine war, perhaps due to the negative image painted by traditional media outlets that crypto has been used by the terror groups to finance this war. When the dust settles on this allegation however, crypto prices could possibly do a catch-up. As at the dawn of this new week in Asia hours, the price of BTC has already started a small rebound, having broken back above the $27,000 mark again.

As for oil, after a week of retracement, prices popped higher again after the impact of the war in the middle east was supplemented by a stricter US sanction against Russian crude exports announced on Thursday. Comments by the IEA that the oil market was fraught with uncertainty also exacerbated the fear that the middle eastern war would affect energy supply as the middle east accounts for around one-third of global oil supply. Against such a backdrop, the WTI jumped 5.8% to settle at $87.70 per barrel for its best day since 3 April. Brent Crude also climbed by 5.7% to close back above $90 again.

This week, the economic calendar is less busy, with only retail sales on Tuesday and unemployment claims on Thursday the main releases to watch. As a result, most traders’ attention would likely be on developments on the war-front to assess how events there would impact their investments.