The crypto market started on a strong footing last week, led by several key positive news.

First, according to a court filing on Tuesday, Digital Currency Group (DCG) reached an in-principle agreement with Genesis creditors to resolve the claims brought up in Genesis’ bankruptcy. This plan could result in the recoveries of 70%-90% in USD equivalent for unsecured creditors and 65%-90% recovery on an in-kind basis depending on the denomination of the digital asset.

The second news, which was the main market mover that caused the price of BTC to jump 6% immediately, was a US court ruling that Grayscale’s petition for the SEC to review its GBTC Trust conversion application to be effective. According to the ruling, the SEC must review its rejection and give clear reasons why Grayscale’s request to convert the GBTC into a spot BTC ETF was rejected.

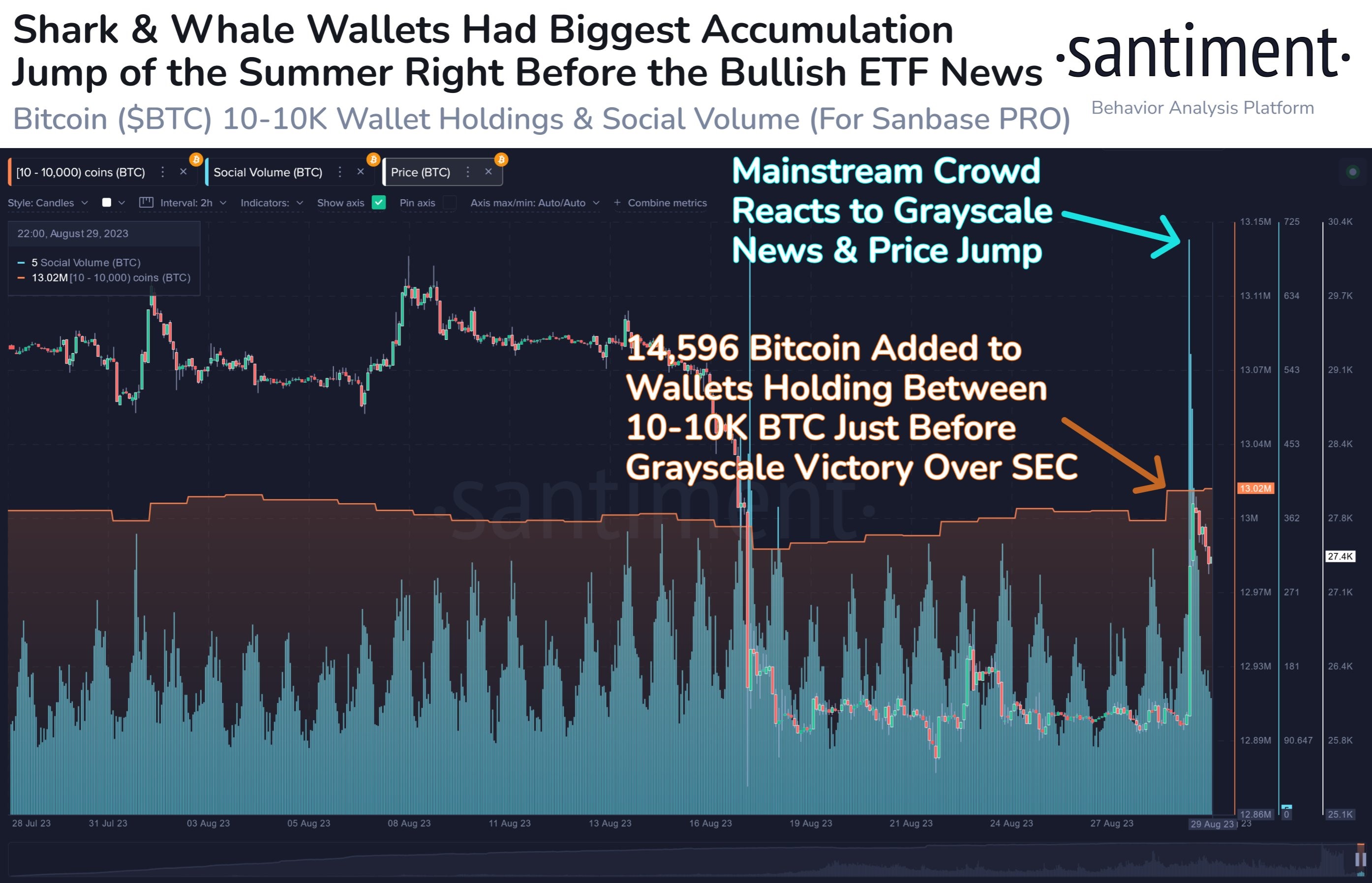

Some sharks may have gotten wind of the news ahead of the market, as wallets with between 10 to 10,000 BTC accumulated a collective $388.3M worth of BTC in the day leading up to the news.

While the price of cryptocurrencies indeed jumped fervently, liquidating about $120 million worth of long positions in BTC, it is important to not get carried away since the SEC still has to issue another order with a deadline of 45 days or 60 days. This ruling in no way is an automatic grant of Grayscale’s application and we can expect the SEC to come up with a strong defense.

That said however, the new twist has narrowed the Grayscale discount in NAV from -45% early this year to just -19% currently. According to data, around 75% of market participants now expect Grayscale’s application to convert the GBTC into spot BTC ETF to be accepted by the SEC, which may be a little too bullish.

Indeed, the rebound did not last long. After the SEC came out to postpone the decision on seven other spot BTC ETF applications on Thursday, BTC fell back below $26,000, dragging the broad crypto market back lower to where they started, liquidating around $100 million worth of long positions.

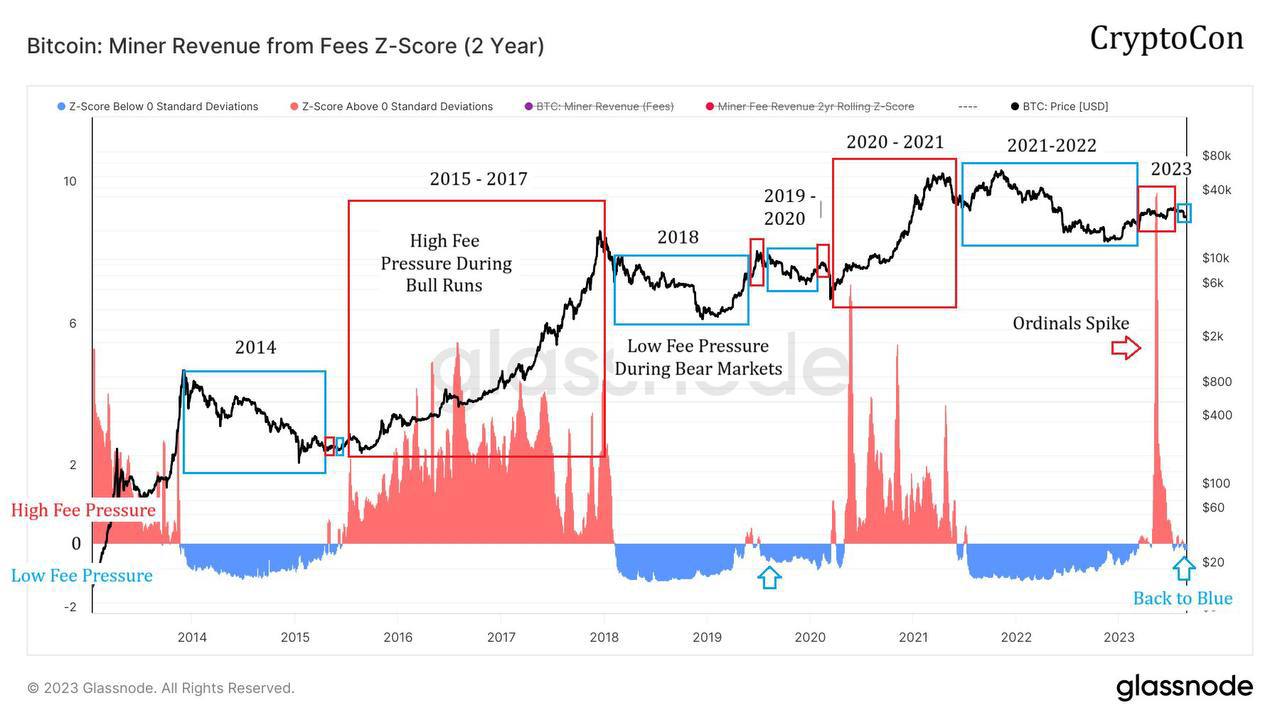

The complete reversal of a bounce within such a short period of time does not look like a positive sign, as this could signal that the underlying structure of the market is deteriorating. One signal that shows the weakening market dynamics for BTC is the Z-score, which has fallen back into a bearish “blue zone” after having entered the bullish “red zone” since the beginning of 2023.

BTC Z-Score hints at a period of lull

According to the Z-score metric, BTC has returned to its low fee pressure accumulation mode (blue), which in previous market cycles, were periods of slow price declines for up to one year before BTC’s price eventually picked up momentum to rise exponentially in a new bull market.

While this period has been a good time to accumulate, some patience may be needed for investors that wish to see multifold returns as historically, BTC’s price had come under some downward pressure during this period of time.

As the price of BTC falls back into a temporary down trend, traders are beginning to place their monies on altcoins, which may give a better reward should one pick the correct coin to trade. For instance, new token CYBER managed to gain more than 100% even as the price of other coins came crashing down towards the end of last week, showing that hot money is still in the market and making quick returns is still possible. NMR also made significant gains over the week. However, traders need to be nimble and quick to take profits as both coins had succumbed to profit-taking and retreated drastically by the end of the weekend.

As the upcoming period of time could continue to see pump and dump schemes in the market, one good way to benefit could be to watch for onchain signals or coin movement to get onto a trade before its price starts to move. Interestingly, two popular altcoins have started displaying bullish divergences.

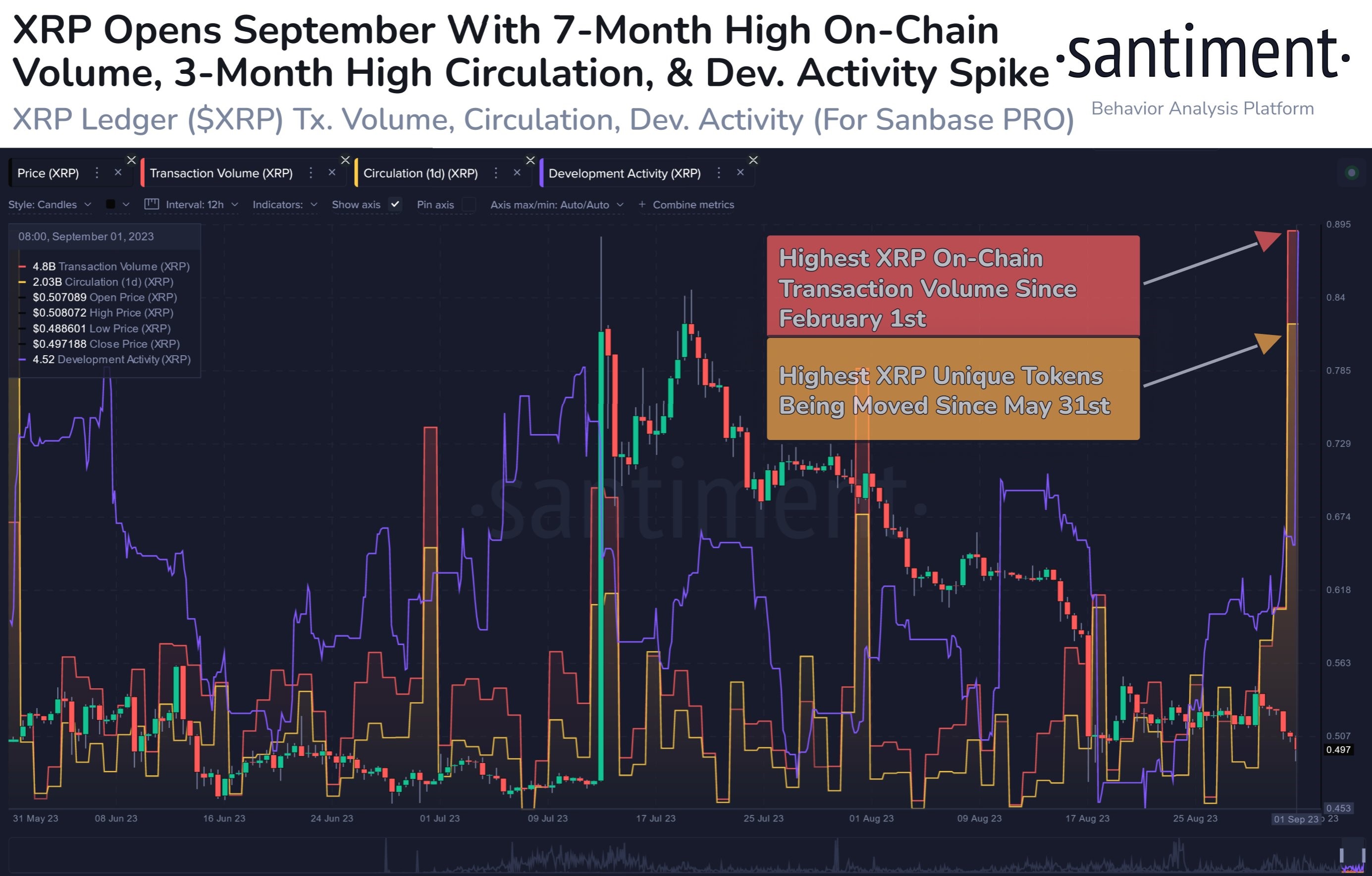

XRP and LINK start September with commendable metrics

One such coin is XRP. After retracing for a period of time post the initial euphoric reaction to Ripple’s lawsuit “win”, the price of XRP has given up all its gains and is back to where it was before the event. Since the full price retrace, the onchain metrics for XRP has recently shown some optimistic improvements.

From the start of September, XRP has seen milestone highs in both onchain transaction volume and circulation at 4.8 billion and 2.03 billion units of XRP respectively, which means that usage of XRP has increased substantially.

In addition, the development activity for XRP has been increasing significantly as well in recent times. Such improvements in metrics have historically always led to a positive move in price.

Another interesting coin worth putting on your radar is LINK. LINK has hit a key level that has historically foreshadowed a price rebound. Its recent drop in exchange supply (currently at just 15.5%) is hinting at a possible bullish divergence which may see its price recover at least in the short-term should the broad market remain stable.

Oil jumps to its highest in half a year on supply cuts

US stocks rallied as poorer than expected economic numbers released over the week gave investors hope that the FED would become more dovish. The week of poor numbers started from Tuesday with the release of disappointing consumer confidence figures and a bigger-than-forecast drop in job openings for July. The ADP employment data released on Wednesday was also below expectations, while the core PCE inflation was in line with expectations.

Only Friday’s release of August’s non-farm payrolls slightly beat expectations. However, the figures for June and July had to be revised lower, which could imply that August’s actual figure may also be eventually adjusted lower.

The key to note from Friday’s report was that the unemployment rate ticked higher to 3.8% in August, reaching its highest level in more than a year, when economists had expected it to remain at 3.5%. Average hourly earnings increased 4.3% on a year-over-year basis, less than the 4.4% increase expected by the market. All these data point to a slowing economy and easing price pressures, which indeed could make the FED rethink their current hawkish stance.

As a result of the “bad news is good news” phenomenon, the Dow added 1.4% and the Nasdaq rose 3.3% for the week, notching their best performances since July, while the S&P gained 2.5% to register its best week since June. 93% of market participants now expect a no-hike in the upcoming FED meeting on 19-20 later this month.

Despite such expectations however, the dollar continued to rise higher against its peers, as the DXY gained 0.1% for the week. However, against the commodity basket, the dollar was weaker. Gold ended the week 1.25% higher against the dollar, while Silver was 0.2% lower.

Oil was the star performer, edging out the Nasdaq, with the WTI rising 7.4% and Brent gaining 5.7%. Thursday’s EIA weekly petroleum status report revealed a massive drop of -10.584 million barrels for the week ended 25 August, much lower than the -3.267 million anticipated and -6.135 prior.

Furthermore, Saudi Arabia is widely expected to extend a voluntary 1 million barrel per day oil production cut into October, while Russia on Thursday said that it has agreed to cut oil exports next month and will reveal more details on Monday, 04 September, when the cartel meets.

Monday this week happens to be Labor Day in the US, where traditional markets will be closed for trading. The rest of the week is also less busy, with only the major economic data out of the US being the ISM Services PMI on Wednesday and unemployment claims on Thursday. Central banks in Australia and Canada will be meeting respectively on Tuesday and Wednesday to decide on their monetary policies. Throughout the week however, several FED speakers will be giving interviews. As such, any out of the ordinary comment could potentially cause volatility in the markets.