Bitcoin fell 1.8% last week. The price started last week at 90.9k and dropped sharply on Monday, 1 December, to a weekly low of 83.5k before recovering to 94k by Thursday. BTC gave up those gains, dropping to 87k over the weekend before rising to 92k at the start of the week. But can this recovery continue?

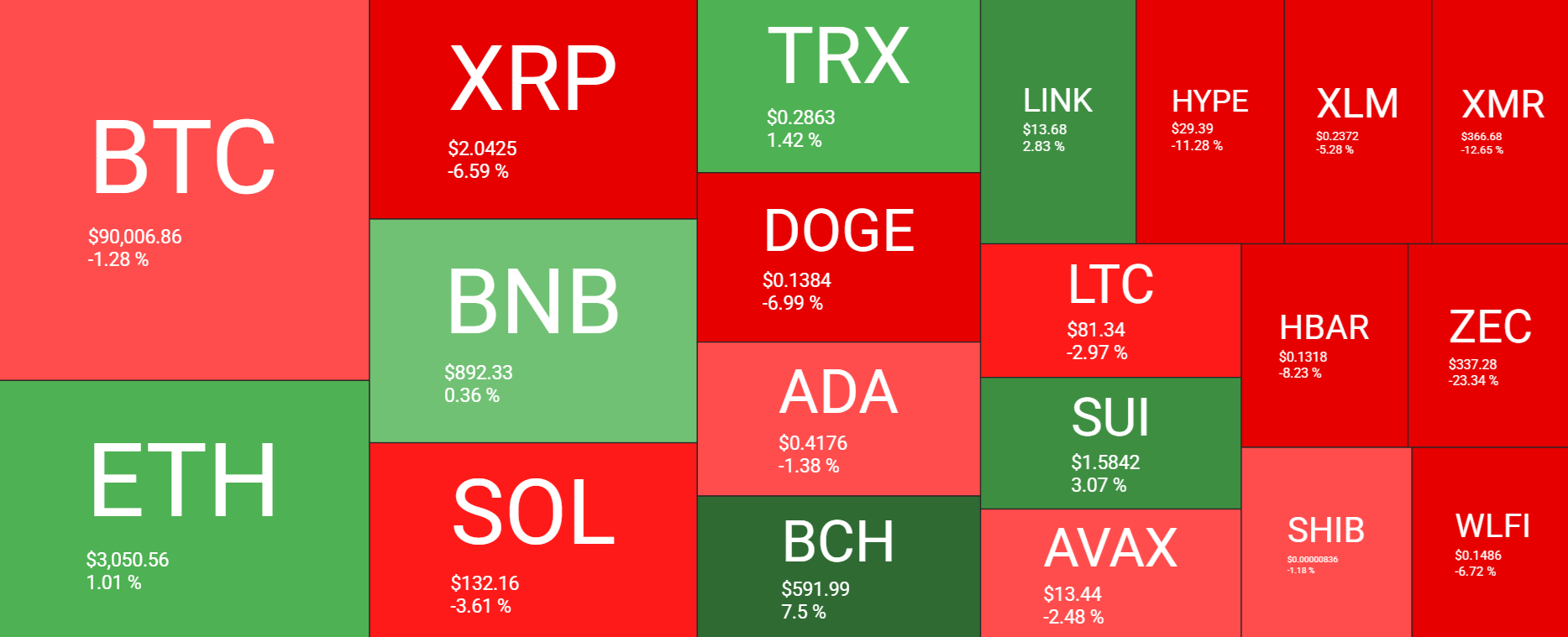

While Bitcoin fell over the week, the broader crypto space was a mixed bag. Ethereum booked gains of 1% over the past 7 days. BNB, TRX, and SUI all booked gains. Meanwhile, XRP lost 6% over the past week, SOL fell 3.6%, and other altcoins were also under pressure.

The total cryptocurrency market capitalisation is at $3.13 trillion at the time of writing, up 2.9% over the past 24 hours and up strongly from last Monday’s low of $2.87 trillion. The market cap is still down over $1 trillion from the October high of $4.20 trillion.

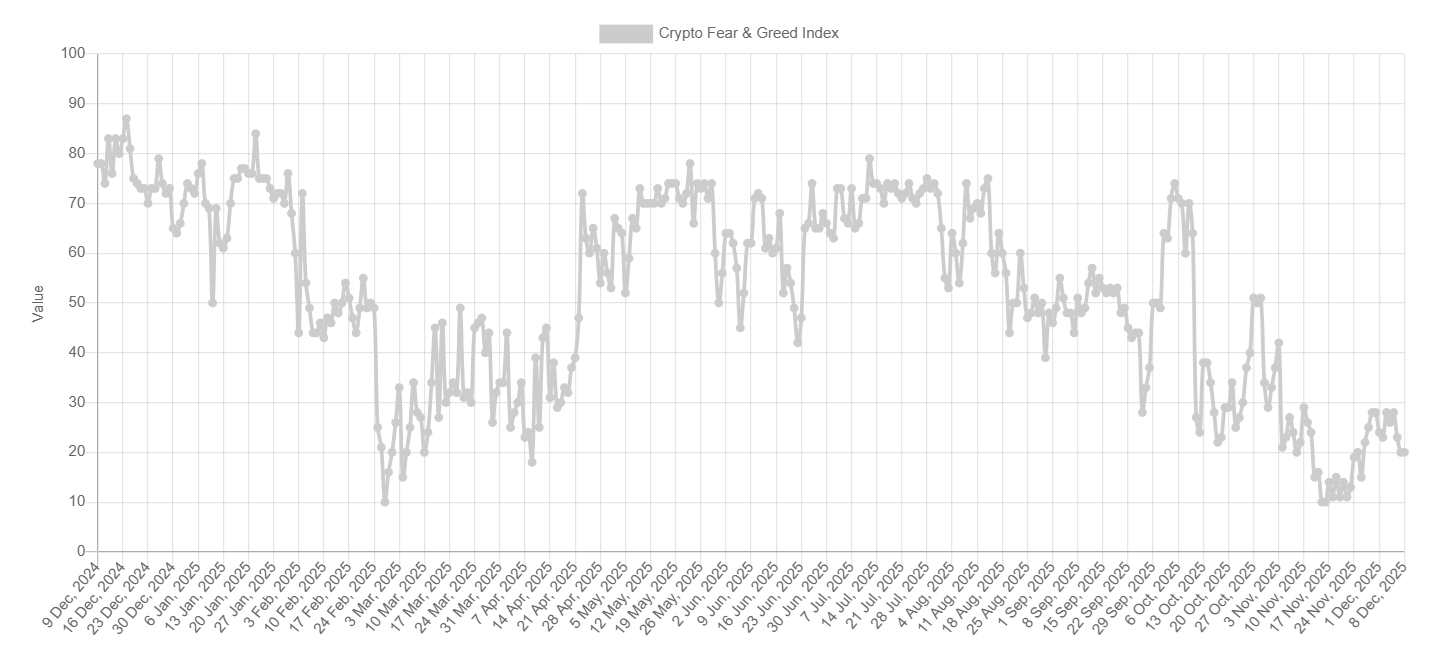

Sentiment analysis shows that sentiment has taken a turn for the worse. The Fear and Greed index has plunged back to 20, re-entering the Extreme Fear territory after briefly rising to 28 (Fear) last Monday.

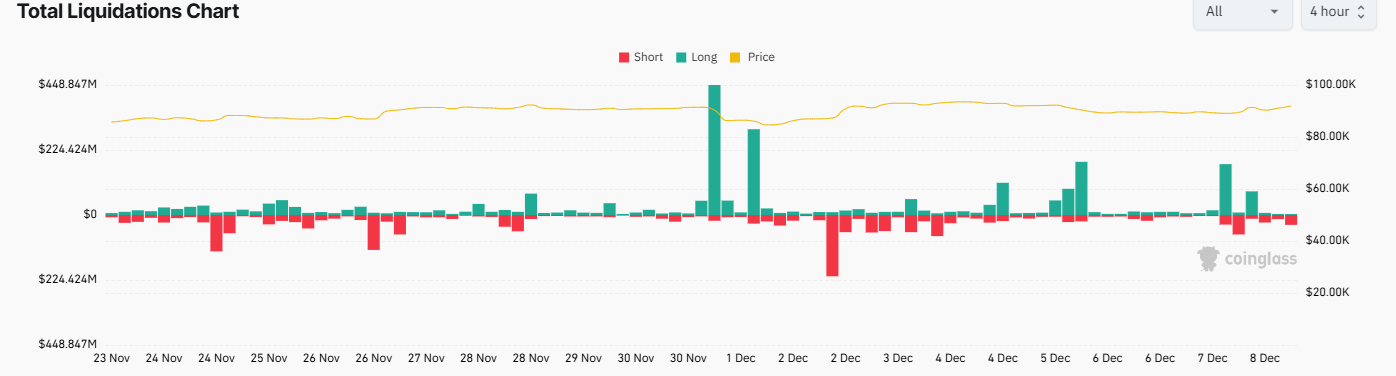

Liquidations steady

BTC liquidations totaled $956 million on 1 December when the price plunged from 90k to 83.5k. However, liquidations remained below $500 million per day for the remainder of the week.

Macro backdrop

Bitcoin fell last week as investors weighed up several competing factors. Firstly, hawkish comments from BoJ Governor Ueda sparked concerns about the unwinding of the yen carry trade, which could withdraw liquidity from global markets. With the BoJ meeting on 18 December, these concerns could linger. The market is pricing in an 81% probability of a rate cut in December. BTC has fallen sharply in the month following BoJ rate hikes.

Furthermore, Japanese 20-year bond yields hit 2.94%m, its highest level since 1998, adding to worries over the repatriation of capital to Japan. Should Japan start selling US treasuries, this could pressure Tether in turn, driving Bitcoin lower.

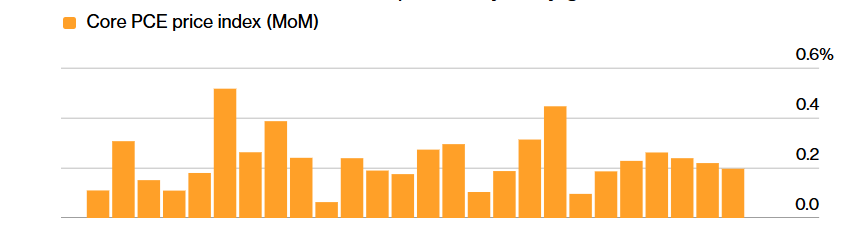

US economic data last week was mixed. ADP private payrolls fell by -32k, the most significant decline in 18 months. Manufacturing activity also contracted at a faster pace. However, the services PMI showed activity was stronger than forecast, while prices paid eased to the coolest level since April. Core PCE, the Fed’s preferred gauge for inflation, eased to 2.8%, down from 2.9% and remained unchanged at 0.2% on a monthly basis.

All eyes on the FOMC rate decision

Bitcoin is rising ahead of this week’s FOMC meeting, with the market pricing in an 87% probability of a 25-basis-point rate cut. Given that the rate cut is almost fully priced, it’s not expected to bring significant volatility; instead, attention will be firmly on Federal Reserve chair Jerome Powell’s tone in the upcoming press conference and the Fed’s latest projections, particularly regarding rate cuts in 2026.

The markets are pricing in two more rate cuts and potentially a third, while the Fed’s September dot plot pointed to just one rate cut next year. Should the Fed raise its projections, this could support BTC. However, a hawkish cut from Fed Chair Powell, or signaling for a few rate cuts next year, could pull riskier assets such as Bitcoin and stocks lower.

Institutional demand remains weak

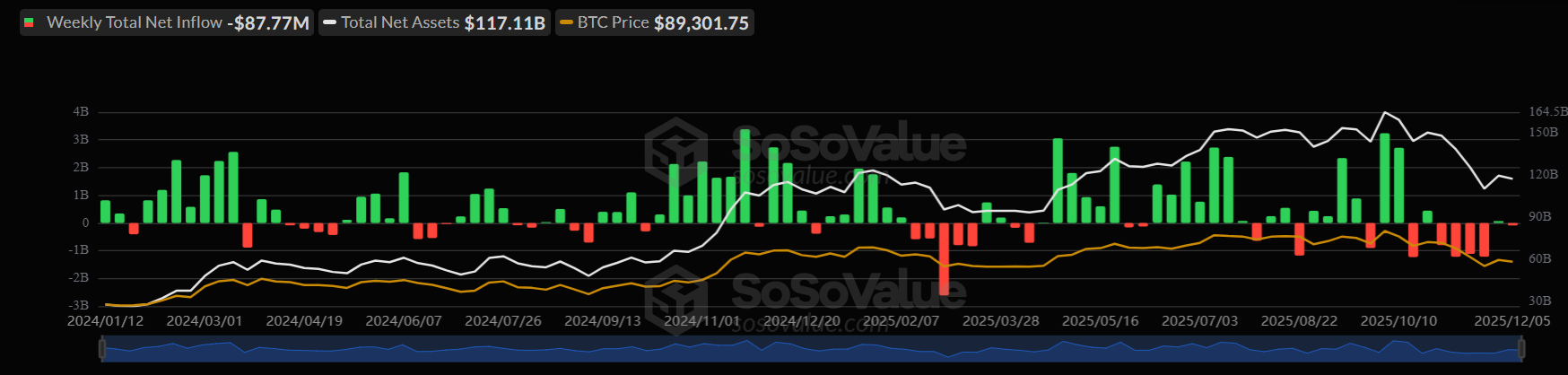

Bitcoin ETFs saw $87.7 million in net outflows last week, after inflows of just $70 million in the previous week.

Spot Bitcoin ETF demand remains weak after recording $3.48 billion in net outflows in November. While institutional demand helped to drive BTC to record highs, the outflows are now meaning that BTC is struggling to hold above $90,000. Institutional demand must pick up for BTC to sustain a move higher.

Short-term holders dominate profits

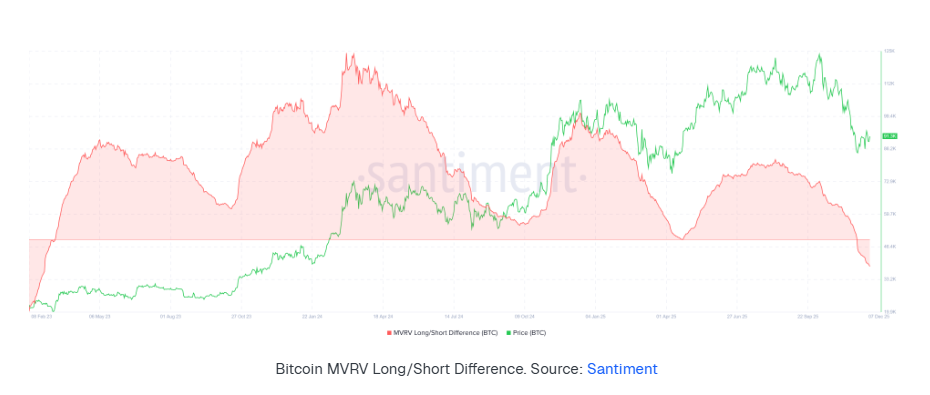

For the first time in 2.5 years, short-term holders have surpassed long-term holders in realised profits, creating opportunities and risks for BTC.

The MVRV long-short difference highlights a notable change in Bitcoin’s profit distribution. A positive reading usually signals long-term holders hold more unrealized gains, while a negative value indicates short-term holders are ahead. In Bitcoin’s case, the difference has dipped into negative territory for the first time since March 2023. This marks 30 months since short-term holders last led in profits.

This dominance raises some concerns as short-term holders often sell aggressively when volatility increases. That profit-taking behaviour could add pressure to BTC’s price if the broader market weakens.

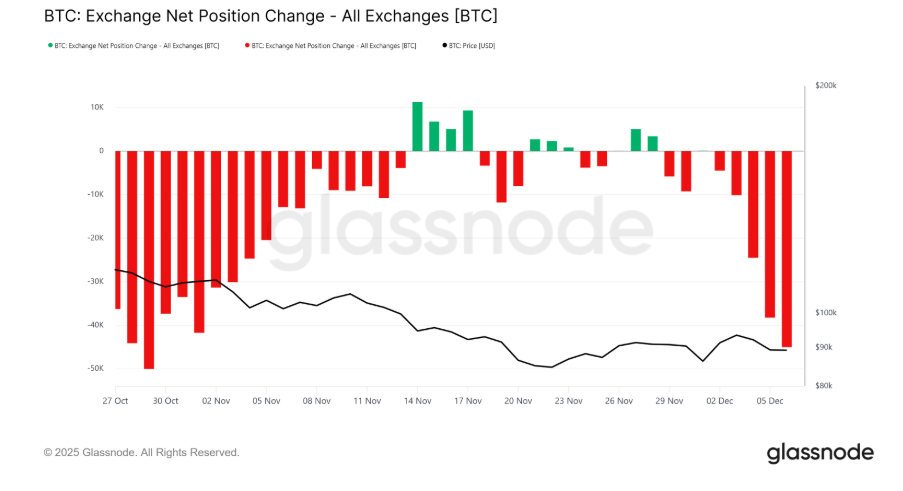

However, it’s not all bad news. Bitcoin’s broad momentum is showing some more encouraging signs. Exchange net position change data confirms rising outflows across major platforms, signalling a shift in investor accumulation.

BTC leaving exchanges is often treated as a bullish indicator reflecting confidence in long-term appreciation. This trend suggests that traders view the 90K range as a reasonable bottom, potentially signaling a recovery. Outflows support price stability and increase the likelihood of BTC breaking above immediate resistance levels.

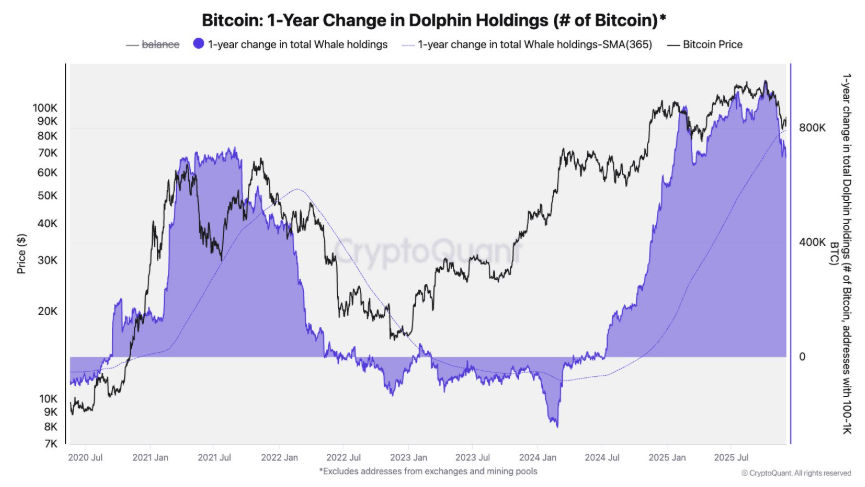

Dolphins’ balance growth slows

While Bitcoin is edging higher, there are some reasons to remain cautious. One such reason is the slowdown in dolphin balanced growth; these are wallets holding between 100 and 1000 BTC.

According to CryptoQuant, these addresses added as much as 965,000 BTC year over year at the peak, and at the time of writing, that growth has slowed to 694,000 BTC.

This cohort includes ETFs and public companies, meaning that some of the market’s most influential buyers have pulled back, and the very group that fueled the rally has stopped accumulating, making it harder for Bitcoin to rise.

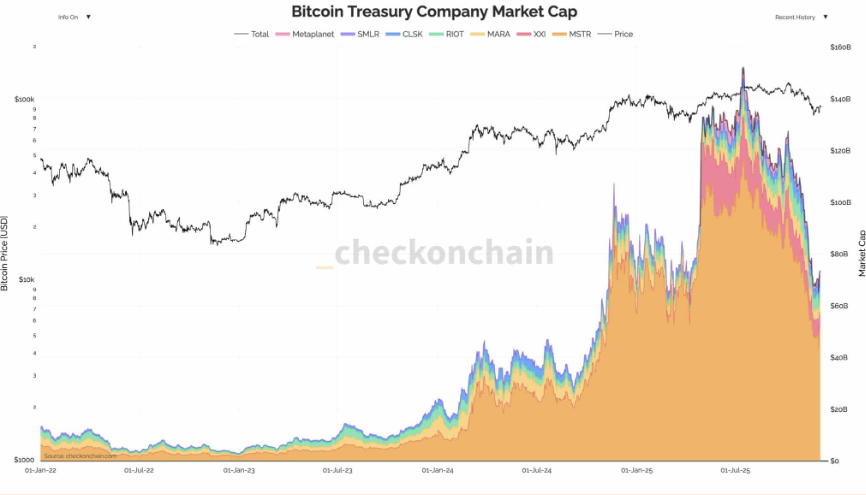

The slowdown comes at a time as corporate treasuries’ holding of Bitcoin is under visible strain. The combined market cap of major BTC-heavy firms, such as Strategy and MetaPlanet, and others has dropped sharply, from around $152 billion in mid-July to $73.5 billion. However, it’s worth noting that these companies are holding their Bitcoin positions steady even as the market tests them.

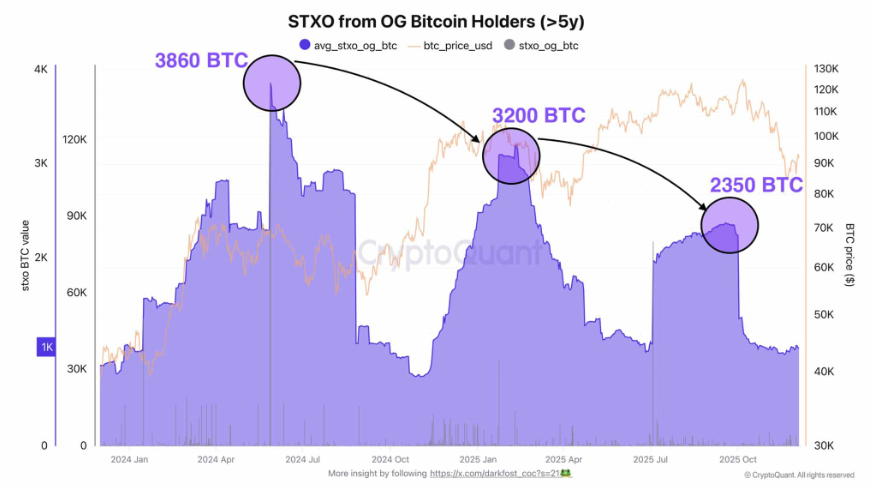

Meanwhile, long-term holders have pulled back on the selling. The 90-day daily average of spend STXOs from coins older than five years has dropped from around 2350 BTC to 1000 BTC. These are coins originally purchased for around $30,000, and when they move, it’s typically to sell. However, with their activity now reduced, one of the market’s largest sources of selling pressure is beginning to ease.

Minor activity hints at a rebound

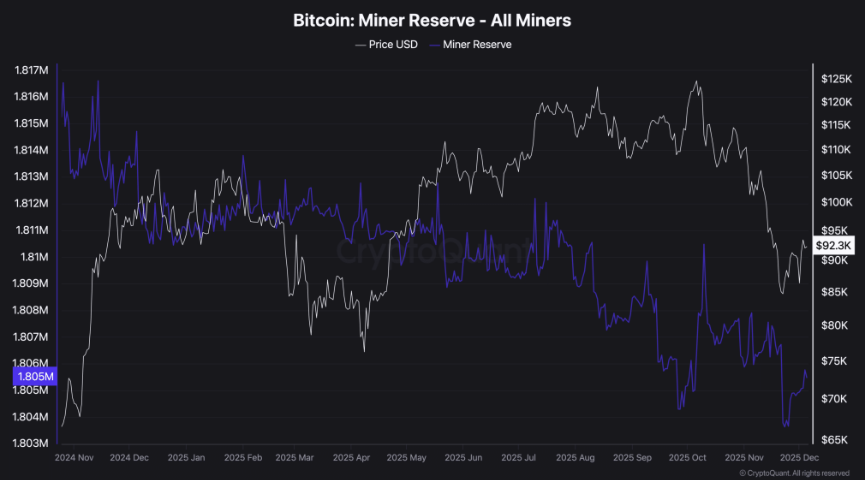

Miners are signalling a potential Bitcoin recovery. Previously, this same group contributed to the recent price decline when the 30-day mean hash rate crossed below the 60-day and 100-day averages. This shift often reflects reduced minor activity and low exposure to Bitcoin and historically has weighed negatively on price action.

However, this has changed, as confidence appears to be returning among miners, as evidenced by the recent shift in their Bitcoin reserves.

Miner reserves provide insight into what this group is doing with its holdings. A rising reserve points to lower selling pressure, which in turn reduces the amount of Bitcoin in circulation and strengthens the broader outlook. Between 26 November and 5 December, miner reserves have climbed to a new high of 1.8 million BTC.

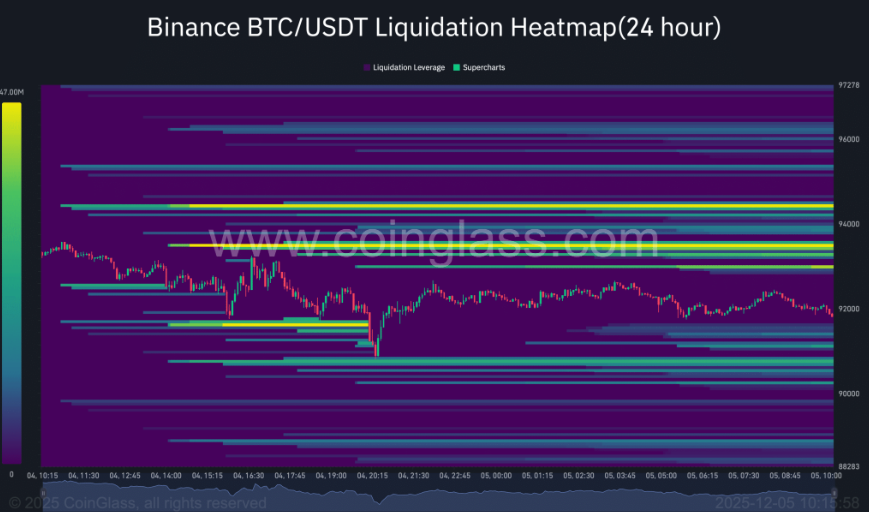

Pressure above

However, whether Bitcoin can sustain a rally will depend heavily on its ability to overcome intense selling pressure at current levels. Liquidity clusters are seen at 93k and 95k, areas dominated by sell orders from traders betting on a pullback. Failure to break above these supply zones could push BTC back to the 90K level.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.