GOLD (XAU/USD):

GOLD has been a fascinating asset to watch and trade in recent weeks. After breaking into new price territory, it has continued to climb, reaching new all-time highs. Given the current macroeconomic landscape and rising tensions in the Middle East, risk assets like Gold, often viewed as “safe havens,” tend to trade higher.

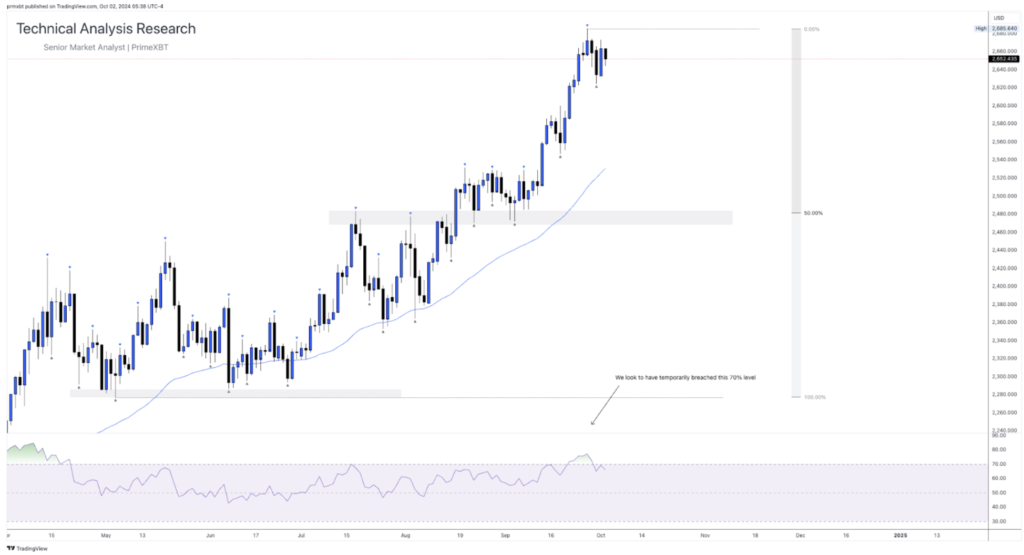

When price action enters new discovery areas, it can be challenging to predict where it might move next. This is where indicators like the RSI become useful, as they can help identify potential overbought or oversold conditions. Looking closely at the RSI applied to Gold’s recent price action, we briefly crossed above the key 70% level, indicating a temporary “overbought” state. Shortly after, a minor price correction to the downside followed.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.