The US stock market closed the week positive at a new ATH again as worse than expected jobless claims data signalled the urgency to get Biden’s proposed $1.9 trillion stimulus bill passed. Democrats are pushing for the bill to be passed by the end of the month, and for benefits to go out in time on 14 March to replace the expiring Pandemic Unemployment Compensation (PUC).

An improvement in the COVID situation in the USA also fuelled optimism as new cases fell for the first-time last week since the end of last year. All 3 major US indices made new ATHs, the Dow closed at 31,458, the S&P 3,935, and Nasdaq 13,808, up modestly for the week.

On currencies, the pound broke above $1.39 against the US Dollar on the back of upbeat UK GDP data and improvement in the COVID situation in the UK. At the same time, stimulus expectations saw the USD dollar give back most of its gains made the week before. With a weakened USD, Gold and Silver saw some light, in particular Silver, which managed to start the week a notch higher at $27.60.

Traditional markets have been subdued ever since the Gamestop saga, with many investors still licking their wounds. Opportunities abound in the cryptocurrency market could also explain the lack of movement in the traditional markets as traders moved en masse to trade cryptocurrencies instead of the traditional asset classes.

The cryptocurrency space has been very exciting, with rotational plays among the smaller-capitalisation tokens as well as old name crypto currencies like DASH, ADA and even XRP. Despite being plagued with the SEC lawsuit, XRP posted strong gains, rising above $0.60 as the hearing date drew near.

Bitcoin also made some good progress over the week, inching closer to $50,000. As the new week starts though, we are seeing some big profit taking with most altcoins posting around 10-20% losses after BTC failed to touch $50,000. Maybe we need a weekday when funds are at work to see BTC clear $50,000, which makes this week an anticipated one.

Trilogy of Good News Sends BTC Teasing $50,000

After rising significantly from $38,000 to $48,000 due to the good news that Tesla has bought $1.5 billion worth of BTC, the price of BTC consolidated for a few days with selling pressure coming from Asia ahead of the Lunar New Year long weekend. However, BTC price finally made a 2 ATHs of $48,985 and $49,400 during the week, led by a trilogy of positive adoption news coming from Mastercard, BNY Mellon, as well as the SEC, sending investors rushing to purchase BTC.

First, Mastercard announced that it will let merchants accept payments in cryptocurrencies this year. It plans to support digital currency transactions directly on its network. After that, BNY Mellon, well known for its prime brokerage services, also announced that it will start a cryptocurrency custody department, citing relentless requests from institutional clients. Third, the SEC then topped off the icing on the cake by revealing that the time is now ripe for a BTC ETF. Indeed, the first North America BTC ETF has just been approved in Canada and will trade on the Toronto Stock Exchange. Is the SEC being pressured by competition?

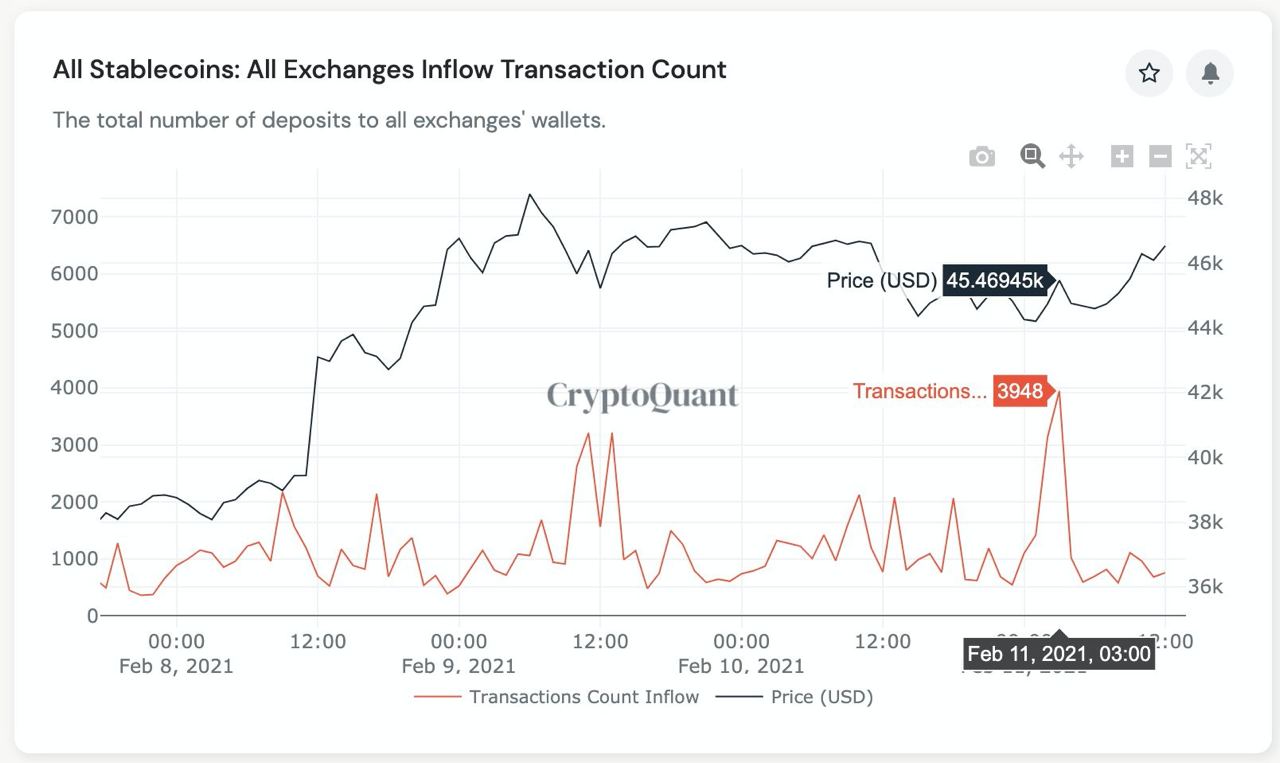

Nonetheless, the good news sent investors mopping up BTC and on Thursday, a big inflow of stablecoin went into various exchanges, which coincided with the rise in BTC price.

According to market rumour, there is still a surplus of $1 billion in stablecoins parked at various exchanges to buy BTC, with the objective of sending it to $100,000 within the next 30 to 60 days.

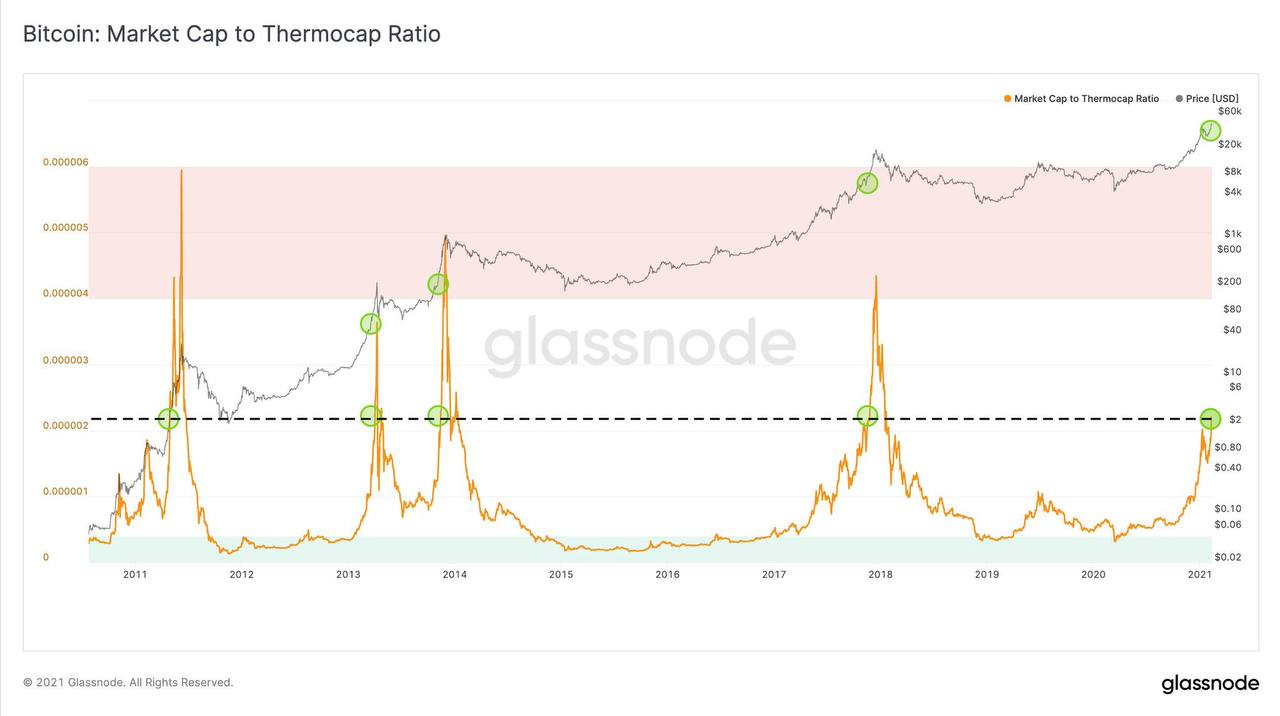

The rumour may have some data to back it up, as an analysis called the “Market Cap to Thermocap Ratio”, is flashing a potential 135% parabolic upward movement for BTC in the next 1 month.

This data plot, which has been accurate in predicting BTC parabolic movements since its inception, has just signalled an upcoming 135% move within the coming month, translating to a target of around $110,000 from the current $47,000.

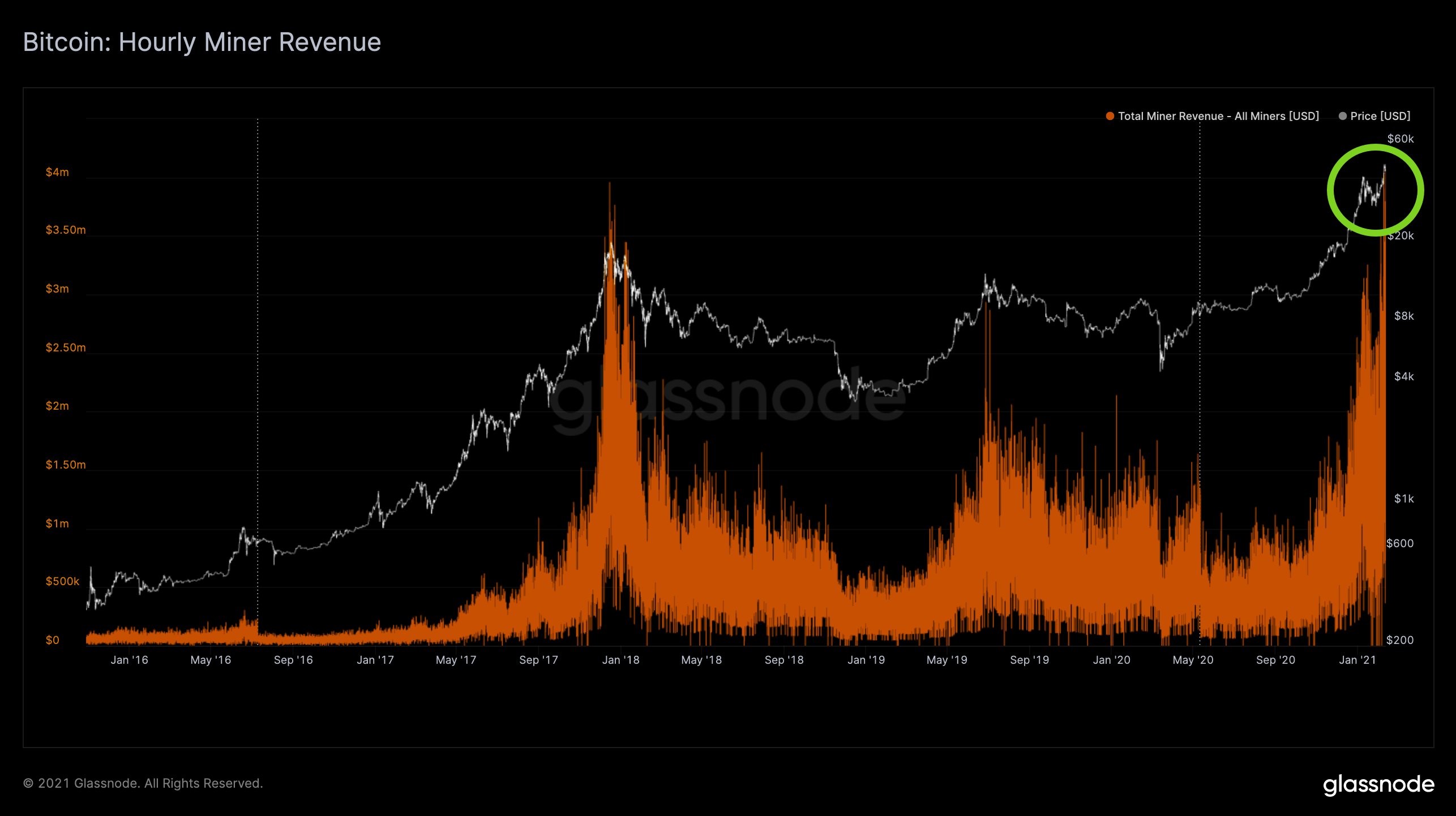

According to experts, every time the Thermocap hit the green circled zone in the below chart, the price of BTC rallies intensively, and they believe this time to be no different.

With more large corporates expected to follow in the footsteps of Tesla to put part of their cash hoard in BTC, at the same time when the circulating supply is dwindling, it is a matter of time the price target of $110,000 gets hit, or even exceeded.

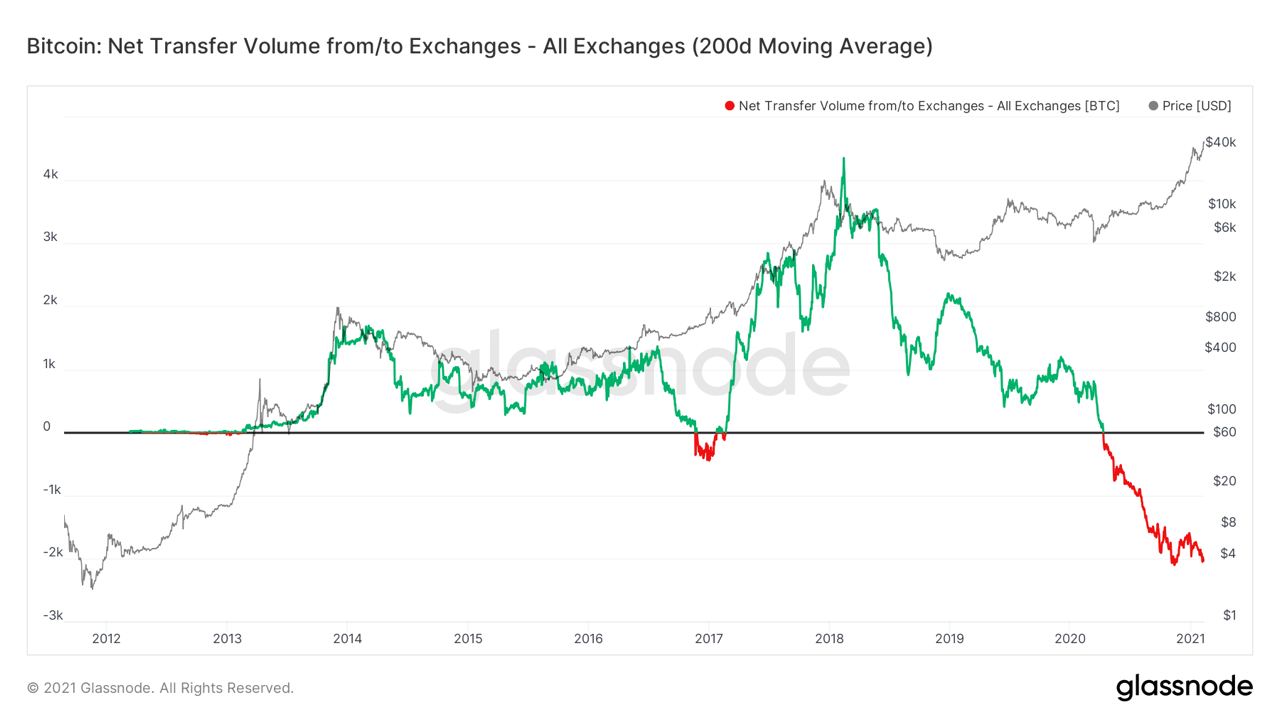

BTC Outflow Vs Inflow from exchanges continues to increase again after decreasing for a while due to massive selling by miners. The net outflow increasing again may be a sign that the selling by miners has abated, which makes sense since the Lunar New Year is recently over, and Chinese miners who always sell ahead of this festival, still account for around 65% of the total BTC hashrate.

In addition to corporates, even cities are considering putting money into BTC, with the city of Miami openly considering putting funds in BTC. It will also consider accepting BTC as payment for taxes, as well as contemplating paying its employees in BTC.

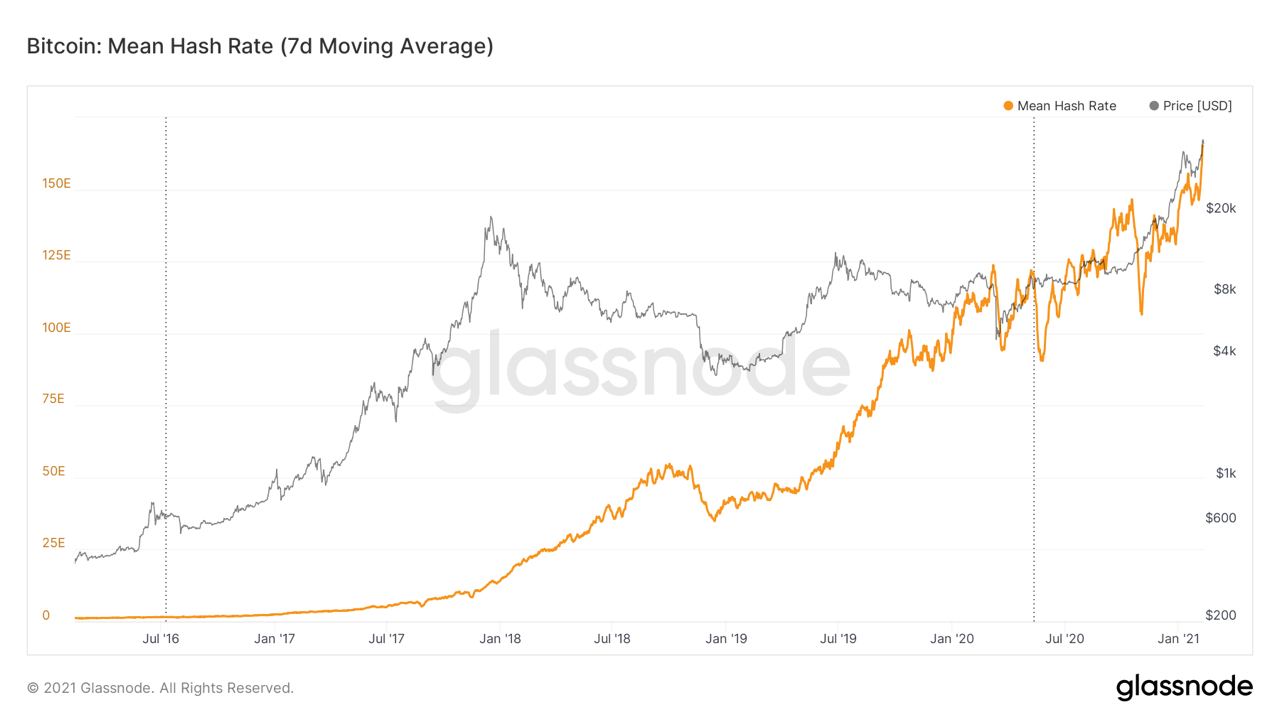

Meanwhile, with more and more participants, as well as more miners getting into BTC mining, network health is getting better and better for BTC even though fees have gone up.

BTC miners are making a killing of late, with miners pocketing $4m in fees in just 1 hour on Friday, the largest hourly revenue in history.

Meanwhile, witnessing the demand from corporates and institutions, Deutsche Bank has been quietly preparing to offer crypto custody as part of its prime brokerage business. Even Morgan Stanley’s investment arm, Counterpoint Global, which manages $150 billion in assets, is considering buying BTC.

It looks like mainstream investment vehicles have started to take BTC seriously, which will certainly bring an avalanche of investments into BTC, thereby shoring up its price further.

Grayscale Adds More ETH and LTC

Other than BTC, ETH also saw institutional participation in that Grayscale (ETHE) added another 92,300 ETH during the week.

However, despite the purchases, the price of ETH has remained largely unmoved over the week, a sign that traders are investing outside of ETH into alternative blockchains that can also support smart contracts because the fees on the ETH blockchain is too expensive to make DeFi profitable for most yield-farmers.

Competing blockchains like DOT and BNB, as well as second-layer solutions like MATIC and OMG saw significant increases on the back of the ETH fee issue, leading to an explosive altcoin performance over the week. However, should the BTC price break above $50,000, the price of ETH should follow the lead and move up regardless.

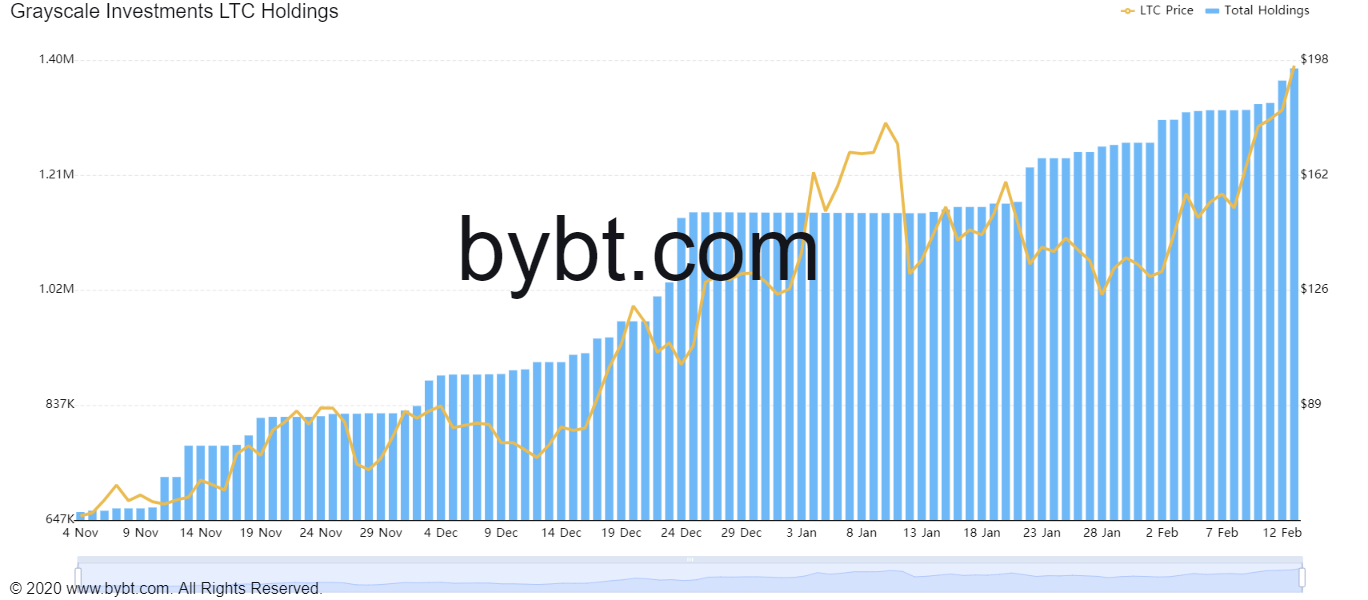

Other than ETH, LTC is also beginning to see more purchases, with Grayscale’s LTC Trust (LTCN) adding 69,030 LTC over the week, and 237,000 units in the last 30 days, which led to LTC breaking out from the $185 resistance that has kept it underperforming other cryptocurrencies.

As Asia returns after the Lunar New Year holidays over the weekend, it may be good to observe market action in Asia both in traditional and crypto markets to see action by Asian traders since they have been noted to be the main sellers in most markets since mid-January. Thus far, we are selling large bouts of selling in Asia, but could this be the drop before the next leg of rally?

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.