The week in crypto started with yet another Binance FUD, with the latest installment alleging Binance of selling their BTC reserve to defend the price of BNB, the native token for the Binance and BNB Chain universe, which has been falling after Binance’s recent run-ins with the regulators.

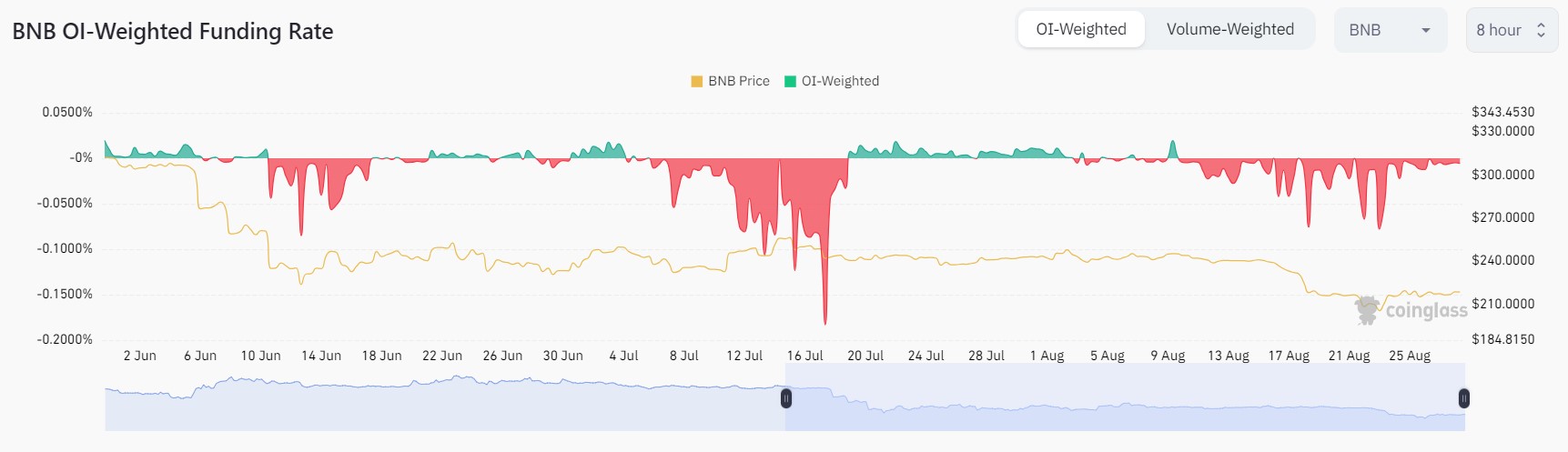

However, despite rumors circulating, there has been no evidence that this was indeed the case, and as the rumor unfolded, the funding rate of BNB has started falling into the red. As such, traders ought to be wary of a possible contrarian snap back in price since it is evident that shorting BNB has become a crowded trade and most traders are on the short side.

Other than BNB, there was also FUD on popular meme coin PEPE, where the founding team was observed to have sent about 16 trillion PEPE tokens (about $15.08m) to 4 exchanges for sale. Affected by this, the price of PEPE fell by around 20%. The team subsequently clarified that the sale was due to three former team members logging in to multi-signature and stealing 60% of the tokens in the wallet, and then deleted themselves and all social accounts, it was not a case of the team abandoning the project. The price of PEPE stabilized after the clarification.

On the macro front, comments by FED Chair Powell at Jackson Hole initially sent the price of BTC breaking below $26,000 when he said that the FED may need additional rate hikes as inflation was still too high. However, he made up for the hawkishness by complimenting the US economy, citing the “especially robust” consumer spending and early signs of a recovery in the housing market, which is giving him confidence that the economy will ride out the additional rate hikes without any problem. This comment managed to bring BTC back near $26,000 after the stock market staged a reversal. A lack of sellers after dipping the week before may have also contributed to BTC’s inability to sustain a downward move at the moment.

Long-term holders holding steady despite price drop

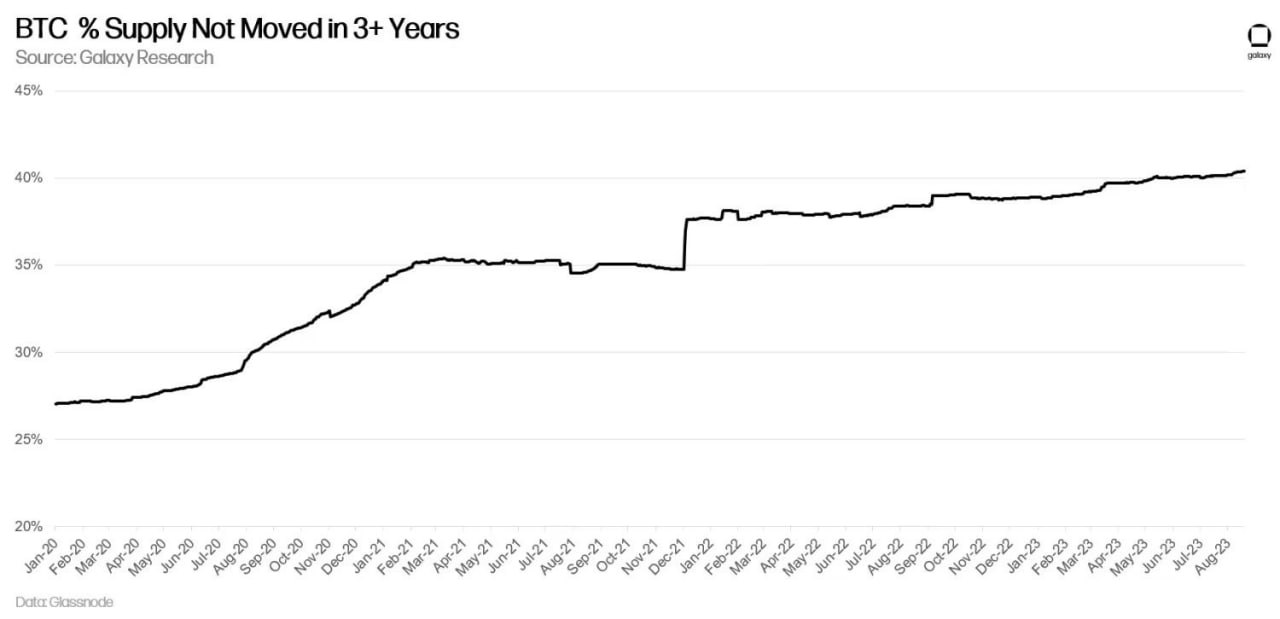

While the current trajectory of BTC is not particularly bullish and the futures open interest has dropped by around 30% (which means that the amount of leveraged trades have fallen by 30%), the amount of BTC that has changed hands in the spot market remains at a low level. The supply of BTC that has not moved for more than 3 years has continued to climb even as the price of BTC drops, which means that long-term holders are undeterred by the recent dip in price. This could support a stabilization in price in the short-term as leveraged traders have not yet re-entered the market to try and force the market in any particular direction. However, things could change if the macro situation globally deteriorates.

ETH showing signs of recovery

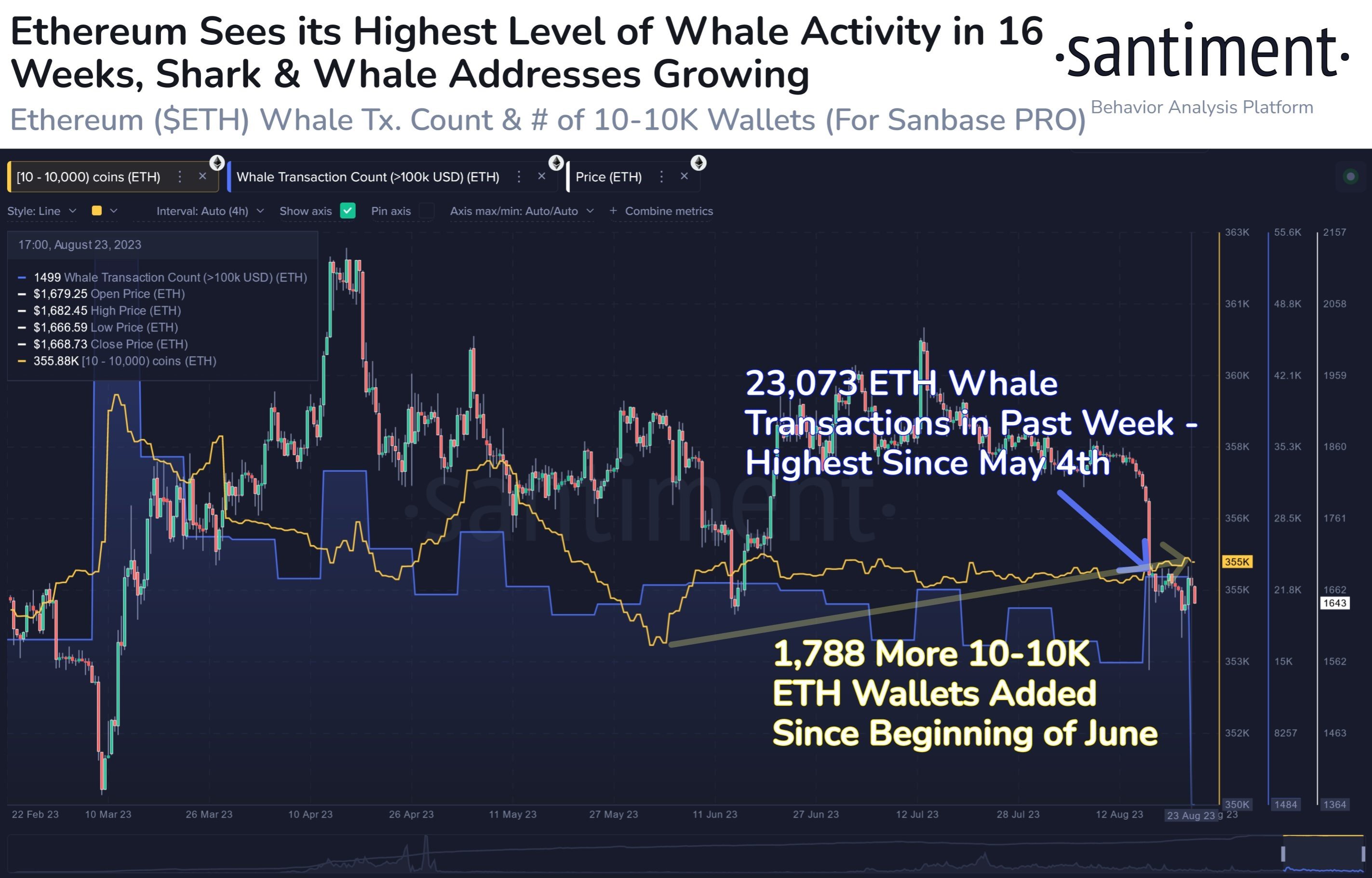

After a dismal showing thus far this year, the fundamental picture appears to be improving for ETH. For one, ETH’s network has picked up in large address activity after its drop below $1,650. The number of wallets holding between 10 and 10,000 ETH has risen back up to 355,000, and transactions above $100,000 in value have similarly surged. This shows that new investors are making use of the current market weakness to start accumulating ETH.

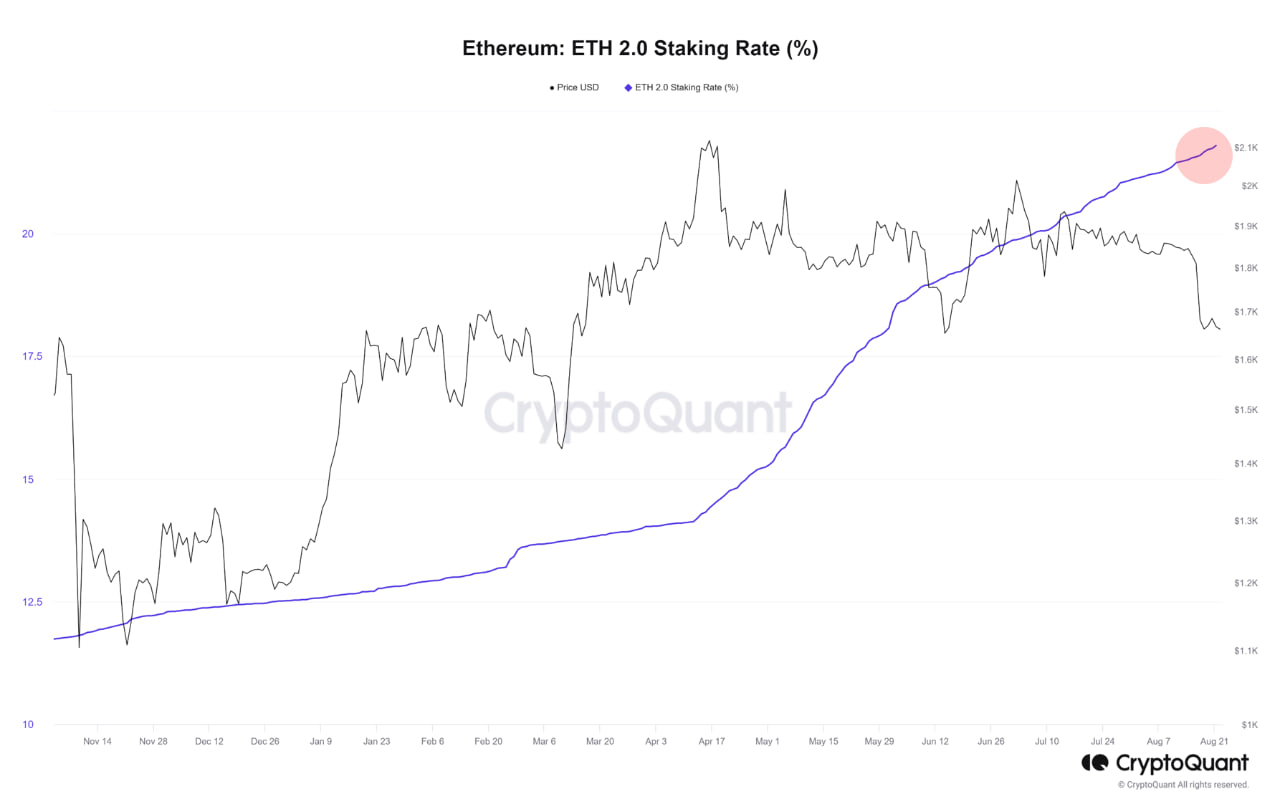

Staking in ETH has also been continuously rising, a sign that in spite of the increasing interest rate in US dollar, investors are still finding ETH staking rewards to be desirable and have continued to stake their ETH. This is also another sign that long-term holders in ETH are not deterred by its recent poor price performance, preferring to stake and wait out rather than sell.

Altcoins could outdo BTC as Bitcoin dominance drops

As BTC could be locked in a period of consolidation with a weakening Bitcoin Dominance, traders who find the market action in BTC boring could look into trading altcoins.

Below we highlight a couple of networks that had some interesting updates last week.

While investors who had hoped for a halving rally in LTC were sorely disappointed, the patient and loyal holder may eventually get rewarded for staying with the network as LTC’s onchain metrics and usage data have been consistently improving over the year, even as its price is not giving traders any excitement. However, as metrics is a leading indicator, what transpires onchain will eventually be reflected in prices and thus, the patient investor may want to consider LTC as a value buy during this time of market weakness.

According to the Litecoin Foundation, the network processed its 46 millionth transaction this year, which is its highest rate of utilisation in any given year with four more months to go till the year ends. To put this in perspective, the entire year of 2022 witnessed a total of only 39 million transactions, showing clearly that the momentum of LTC’s usage and popularity has surged significantly this year despite being in a bear market with a less than encouraging move in its price. Should such high rates of utilisation continue, the price of LTC would eventually start creeping higher as sentiment within the crypto market improves.

The team from Chainlink announced that it will launch the Chainlink staking v0.2 version in Q4 of this year, with an initial expansion pool size of 45 million LINK. Migration of existing stakers is prioritized and gradually opened to more participants. The modular architecture iterates to support future improvements and additions with a dynamic reward mechanism. Historically, most networks have witnessed some form of a pre-launch rally whenever new upgrades were introduced. As this LINK upgrade news has not yet caused any movement in the price of LINK, investors could make use of the current market lull to collect LINK on dips to take profit should the community hype up the token when the staking upgrade is launched.

Blowout tech results buoy stock prices

Blowout earnings from Nvidia and benign comments from FED Chair Powell at Jackson Hole managed to keep stock prices elevated even as US yields and the dollar continue to move higher. Powell’s comments that he was confident that the US economy can stomach more rate hikes brought about a sense of optimism from investors, who chose to believe him at this point in time.

While investors were bracing themselves for bombshell news out of the BRICS Summit, nothing of any imminent threat to the US economy or the US dollar came out of it, which supported a risk-on sentiment further. Jackson Hole similarly did not deliver anything out of the ordinary. In the end, US stocks closed higher for the week, led by Nasdaq which rose 1.24%. The S&P increased by 0.9% while the Dow only moved higher by 0.1%.

The dollar continues to inch higher, with the DXY rising 0.75% over the past week. Gold as a safety hedge finally bounced as the BRICS Summit went underway, gaining 1.3% as the confederate welcomed Saudi Arabia and five other new members. Silver gained 6.6% as supply shortage rumors continue to prop the price of the shiny metal higher.

Oil lost a bit of ground, with both WTI and Brent losing 0.8% each.

This week thus far, the markets have not moved much in early Asian trading. On the economic front, we will see employment data come out of the US, with the ADP on Wednesday and the non-farm payrolls on Friday. In between them on Thursday, the FED’s favourite inflation gauge, the PCE index, will be released. Unemployment claims will also be released on Thursday. While most market participants already know what the FED would be doing for the rest of the year, any larger than expected move in the above data points could still provide the market with tradable volatility.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.