Friday’s non-farm payrolls beat gave stocks a great positive start to the year 2023 as US indices rallied in the first trading week of the year.

Friday in particular, saw the best gains for both the Dow and S&P since November 30 as every Dow component ended up. For the week, the Dow and S&P each rose about 1.5%, and the Nasdaq gained 1%.

The December nonfarm payrolls report showed the US economy added 223,000 jobs last month, slightly higher than the expected 200,000 jobs economists expected. In addition, wages grew slower than anticipated, increasing 0.3% on the month where economists expected 0.4%, which the markets cheered.

Investors appeared to like opening the year with optimism as even the slowdown in the ISM services PMI was viewed as a positive instead of a negative as fears of recession were put on the backfoot. Experts chose to see this as a sign that the Fed’s past rate hikes was showing its impact instead of viewing it as a sign of economic slowdown. Cooling CPI data coming out of both the US as well as Europe in recent times has also signaled that inflation is slowing down, to the relief of market participants who feel that global central banks will have reason to slow down their rate hikes going forward.

The USD weakened after the jobs report sent the DXY back down to the 103 level after a brief rally earlier in the week which sent it above 105. Gold rose 2.4% because of the weaker dollar while Silver was pretty much unchanged as traders were undecided over which driving force of the industrial metal would be more dominant – the fear of COVID cases in China or the weaker dollar. Both metals are opening the new week around 0.5% higher as the dollar continues to weaken.

Oil fell for the first trading week in the new year due to the effect of the surge in China’s COVID cases and fears of a global recession even in spite of a weaker dollar. Brent Crude fell 8% and the WTI fell almost 10% as the fear of demand destruction sent prices tumbling before rumors that OPEC+ could cut production in the following months managed to curtail the fall and stabilize prices at the end of the week. In early Asia trading today, oil is up by about 1% in line with the weaker dollar.

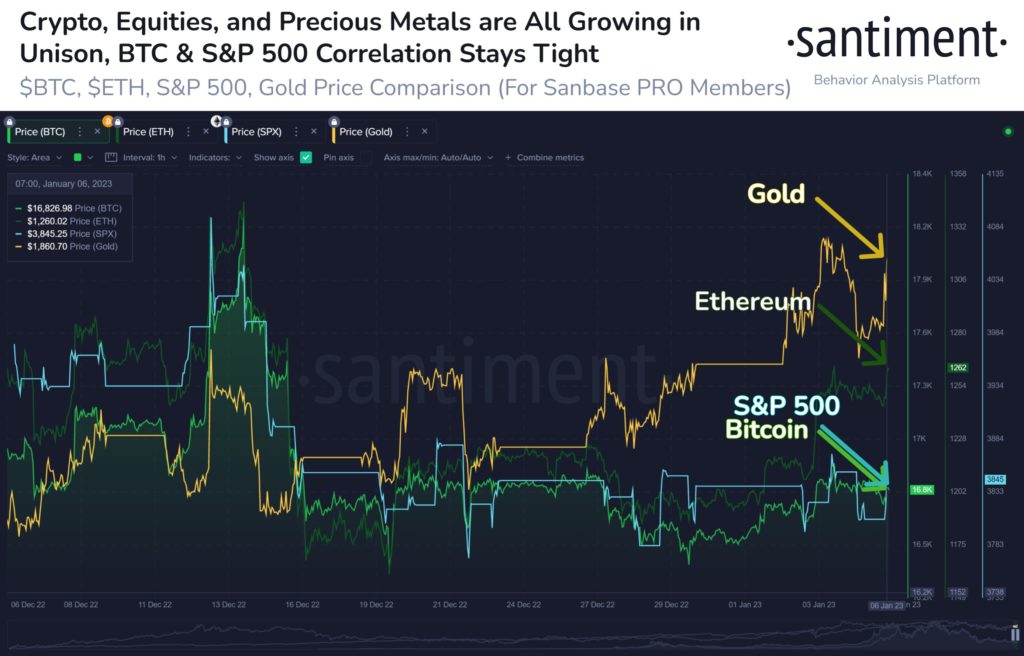

Cryptocurrencies, after going through a dark final two months of 2022, are back trading more like stocks in this new year, following in the footsteps of equities and gold to trade higher. BTC finally managed to peek above $17,000 on Sunday, while ETH and altcoins fared better. ETH rose 7% for the week, unperturbed by news that crypto giant Digital Currency Group (DCG) is being investigated by the US Department of Justice over dubious financial transfers between itself and its subsidiary, Genesis Trading.

The impact DCG could have on crypto prices could be limited as investors had already been prepared for the worst for the firm which has been making one negative headline after another since November. Crypto investors seem to have developed immunity towards similar types of headlines after being heavily bombarded by them in 2022.

Furthermore, the correlation between crypto, gold and stocks is back on track in the new year after the crypto market appears to have shaken off the impact of the FTX implosion. The correlation between BTC and the S&P index appears to be the strongest, with both trading neck and neck together while Gold appears to be leading gains as the main asset trading in negative correlation with the dollar. From what markets have been doing in the first week of 2023, gold appears to be the main dollar hedge, while stocks and crypto are trading more like risk assets, which will do well should the Fed start pivoting.

SOL Late Shorts Punished as Price Jumped Started 2023

Towards the end of last year, as traders began to get bored over a lack of price action in the market, many took to shorting the FTX related coins in hopes of making a quick buck as the revelations of the court proceedings of FTX’s management became the only key event that was happening. However, as the trade became more and more crowded, the funding rate for SOL collapsed through the basement to a historical low of -240%, which was a ridiculously dangerous level for shorts as that made it a prime candidate for a short squeeze. Indeed, from the lows of $8.00, the price of SOL shot up to a high of $16.50, doubling in the first week of 2023, liquidating many shorts who were not fast enough to have covered their positions. However, since most of the shorts have been liquidated, it remains to be seen if SOL can maintain its recovery or if the price jump was simply a squeeze due to an extremely overcrowded trade. However, investors ought to bear in mind that even Vitalik Buterin of ETH has spoken out in favor of the long-term viability of SOL, which was the catalyst that caused the price of SOL to pump.

Mt Gox Distribution Postponement Could Support Crypto

As crypto investors get tired of bad news after two whole months of non-stop negativity, the impact of any small positive news could be amplified, and the postponement of the Mt Gox BTC distribution could be one reason why cryptos may continue to be buoyed higher in the new year.

On January 6, the team managing the Mt Gox distribution announced that the registration deadline for creditors would be extended to March 10 from January 10, while the distribution date would be postponed from July 31 to September 30. Speculation for the reason for delay is because Kraken, one of the major exchanges that will be used for the distribution, has terminated its Japanese operations and thus the rehabilitation team will need time to procure another distributor.

While not necessarily a piece of news worth celebrating since the distribution would still eventually be done, this at least buys some time for investors worried that creditors would dump their regained BTC by two more months.

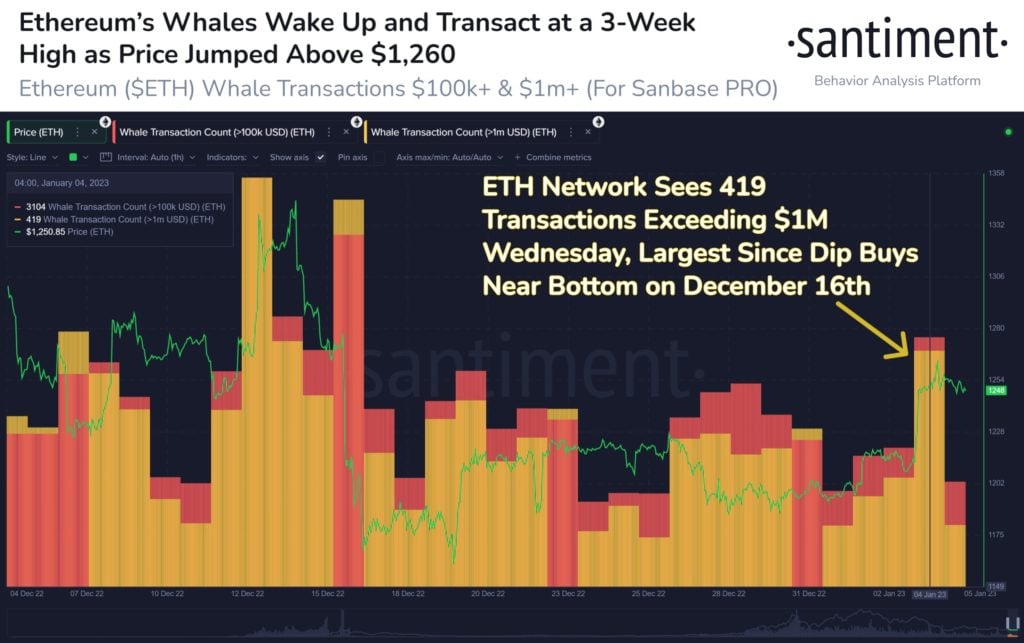

ETH Whale Interest Comes Back as Transaction Volume Spikes

With a new year comes new hope as investors shrug off the unfortunate events of 2022 and look ahead for a better year. ETH whales seem to be in this category as ETH’s large whale transactions have shown a gain in momentum since mid-week when traders are back from the new year long weekend. ETH transaction volumes have surged to their highest since mid-December, showing that whales could be back in action after a hiatus at the end of the year, and having had time to take stock of what happened, are back on a buying spree, which has led the price of ETH higher by about 7% last week, and is continuing to inch higher as the new week beckons.

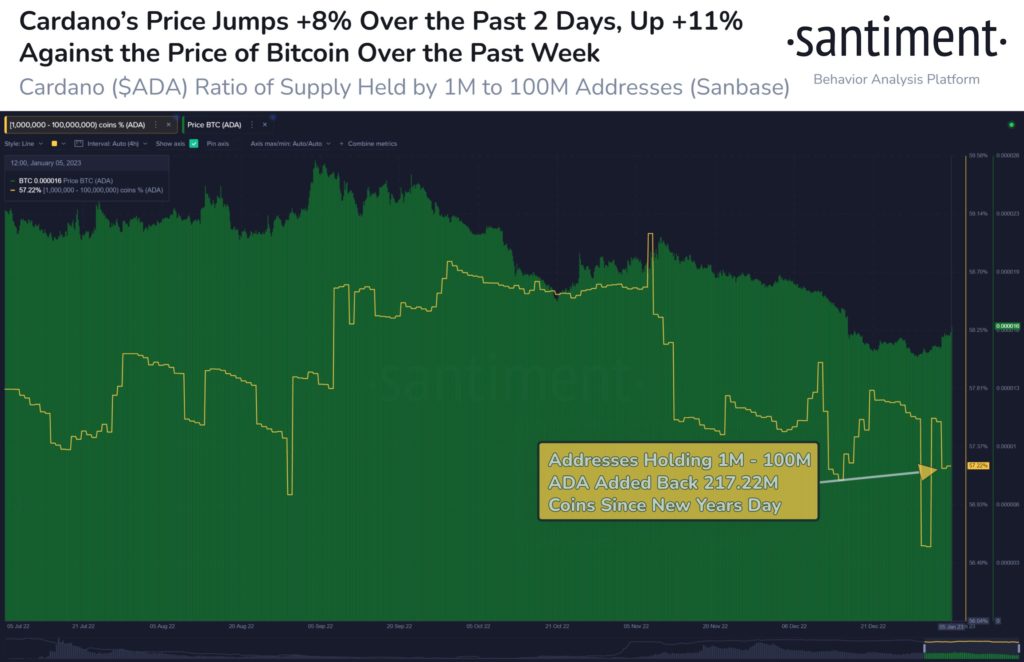

ADA and LTC Surges to Start the Year as Whales Add Coins

Other than ETH, other altcoins are also seeing better fortunes so far this year. As we have previously mentioned before, ADA, together with LTC, was beginning to see renewed interest post the FTX implosion selloff at the latter part of December last year. Indeed, as the new year arrived, the price of ADA has surged around 8% as addresses holding 1 million to 100 million units of ADA take to the market dip to accumulate more ADA.

After dumping 568.4 million ADA in the final two months of 2022 as a result of the FTX scandal, these whales have collectively added back 217.2 million ADA, around half of the amount they had sold, in under a quarter of the time last week. The speed and volume of the accumulation makes this worth keeping an eye on.

Over the past two days, ADA has jumped by a whopping 30% as news of the accumulation got picked up by crypto investors.

LTC isn’t very far behind, jumping more than 20% the moment 2023 arrived. As mentioned in one of our previous reports, historically, the positive price effect of LTC’s halving typically started around eight months before the actual event, which would translate to December last year. Even though the price of LTC pulled back after a big jump in December to $85, after some consolidation, the positive price action of LTC appears to be back as investors rush to purchase the coin presumably after returning from the year-end holidays. With seven more months to go before the actual halving event this August, should LTC were to indeed follow its historical trajectory, the first half of 2023 could be fruitful for LTC investors. LTC has recovered back to almost the recent high of $85 as we move into the new week.

As activity in the crypto markets starts 2023 on an encouraging note, a generally negative funding rate could still bolster crypto prices for a bit longer this week. However, the main direction for the week could still hinge on how the stock markets perform after they return from the weekend. The key risk event for the markets this week would be the Fed Chairman Powell’s speech at the Riksbank’s International Symposium on Central Bank Independence in Stockholm on Tuesday. What he says could determine the view on the dollar this year, which is the main ingredient that could swing markets this year, at least based on available information now. Other than Powell’s speech, the CPI release on Thursday could also move the markets this week. A continued easing of the data would be viewed as very beneficial for the markets.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.