US stocks had a good week after Q42022 GDP figures came in better than expected, rising 2.9% versus expectation of 2.8%. However, the growth rate was slightly slower than the 3.2% pace set in 3Q2022, which could mean that the economy was slowing down. This was evident in the consumer spending data, which only increased 2.1% for the same period, down slightly from 2.3% in the previous period. While the better GDP number put off fears of recession for some investors, the fact that the economy slowed down gave others a reason to be cautious, resulting in a mixed showing in the stock market until after the PCE price index was released on Friday.

The Fed’s favorite inflation gauge, the PCE index, came in-line with expectations, confirming that the rate of inflation has eased again to its lowest point since November 2021. The PCE index slowed to 4.4% on a year-over-year basis from 5% in the previous quarter, which boosted the chances of only a 25-bps rate hike in this upcoming Fed meeting on Wednesday.

Expectations of a lower rate hike buoyed stocks, with all the major US stock averages putting in another positive week and are on pace for a month of gains in January. Tech stocks were the outperformers, with the Nasdaq rising 4.32% to carve out its fourth week of gains after better-than-expected results from Tesla, while the S&P and Dow added 2.47% and 1.81% respectively.

The USD however, remained mixed as the 10-year Treasury yield rose slightly to 3.52% by the close of Friday after finding support around the 3.4% level, which managed to keep the DXY above the 101 level. The mixed showing of the USD led to some profit-taking on precious metals, which saw Gold and Silver lose about an inch, even though their rising trends appear to remain intact.

As for oil, prices rose early in the week on expectations that global demand will strengthen as top oil importer China reopens its economy and as US crude inventories rose less than expected. According to the EIA, US crude inventories edged up by 533,000 barrels to 448.5 million barrels in the week ending January, way below expectations for a 1 million barrel increase. Furthermore, the upcoming OPEC+ meeting on February 1 is likely to continue to endorse a tight supply output by the middle eastern nations. However, as the USD dollar rose slightly towards the end of the week, oil prices ended the week unchanged. Brent closed the week at $86 while the WTI ended the week at $79.50. Both distillates are opening the new week around 0.4% higher.

Cryptocurrencies, which had a blast for the previous two weeks, had a relatively quiet week, with the price of BTC looking hesitant at around the $24,000 level after finding sellers twice there. However, the price is also not falling and is merely consolidating above the $23,000 level. ETH also had a relatively boring week, coiling between a 3% range after an exciting second week of January 2023. While both leading cryptos have not yet managed to break significantly higher at the time of writing, it has to be noted that buyers kept their prices supported as every small dip has been bought back in earnest. This shows that there is strong underlying demand for these cryptos even after having risen by more than 40% over January.

Institutional Participation in BTC Picking Up

Market experts would not deny that an institutional-led upswing in price has traditionally had more longevity as compared with retail investor or speculator-led rallies which were often more short-term in nature. The good news regarding the recent BTC price rally is that data is suggesting that the rally could be institutional-led.

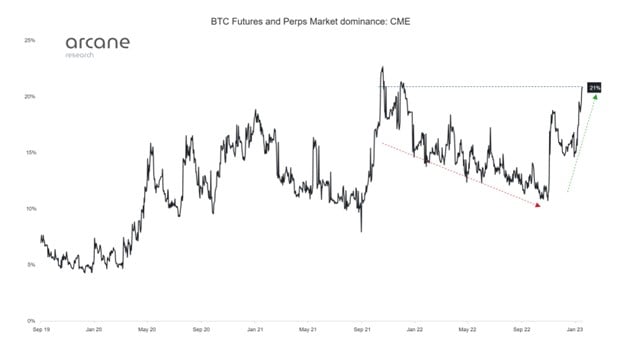

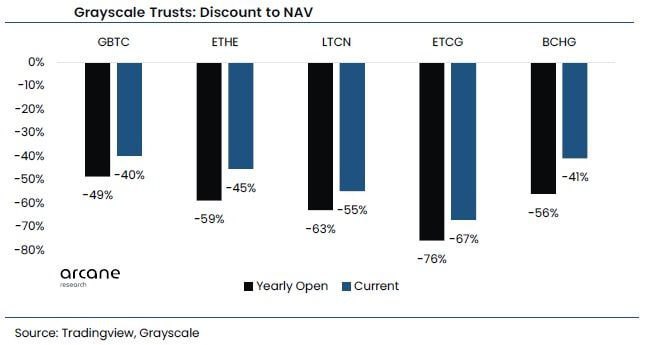

Return of the Bull RunThis can be seen in both the CME futures and Grayscale discounts, which are showing that institutional participation has increased ever since the November 2022 FTX-led selloff.

The CME futures, after declining for about 11 months since December 2021, spiked much higher in December 2022 and began an uptrend in January 2023.

The Grayscale discount, which has traditionally been used to gauge institutional demand for cryptocurrencies, has also staged a rebound after falling deeper into the negative in December 2022.

The discount for the ETH product has improved the most, although that for BTC and all other products are also showing a remarkable improvement, with the discount now recovering to levels before the FTX debacle, in a hint that institutions may have stealthily acquired these products during the quiet downturn in December 2022.

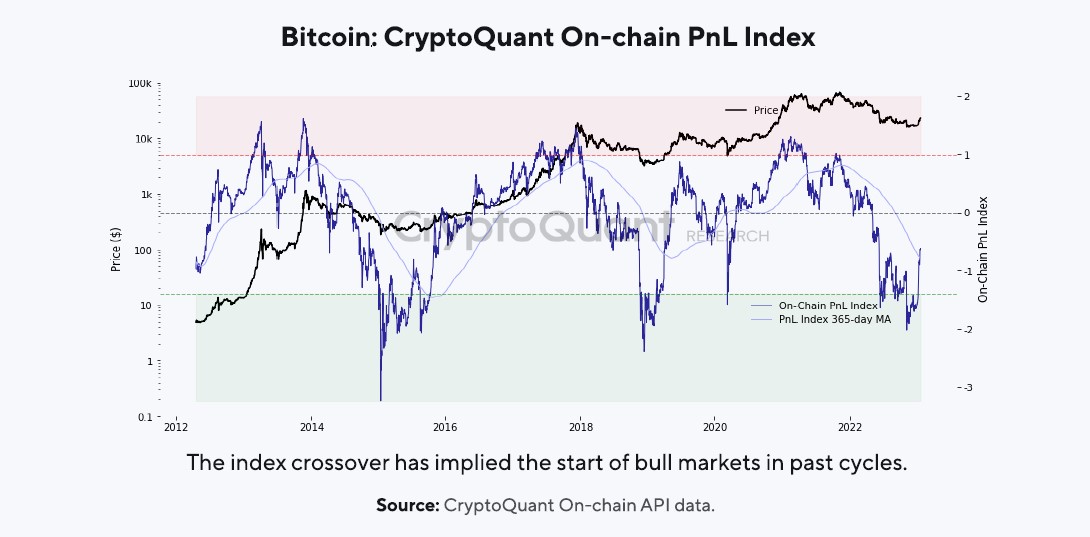

Onchain Metric Suggests BTC Transitioning to Bull Market

One metric followed by on-chain data provider, Cryptoquant, has indicated that BTC has moved into the early stages of a new bull market. As can be seen below, the Cryptoquant PnL index (dark blue line chart) has crossed over its 365-day MA (light blue line). According to Cryptoquant, in previous cycles, such a crossover has signalled the beginning of bull markets.

BTC Puell Multiple Shows Miner Stress is Abating

Similarly, the Puell Multiple, which has traditionally been used to gauge miner stress levels, has rebounded strongly off its lowest level, which is a sign that miner’s profitability is improving. This improvement of fate could reduce the amount of forced selling by miners, which will reduce the supply of BTC coming into the open market.

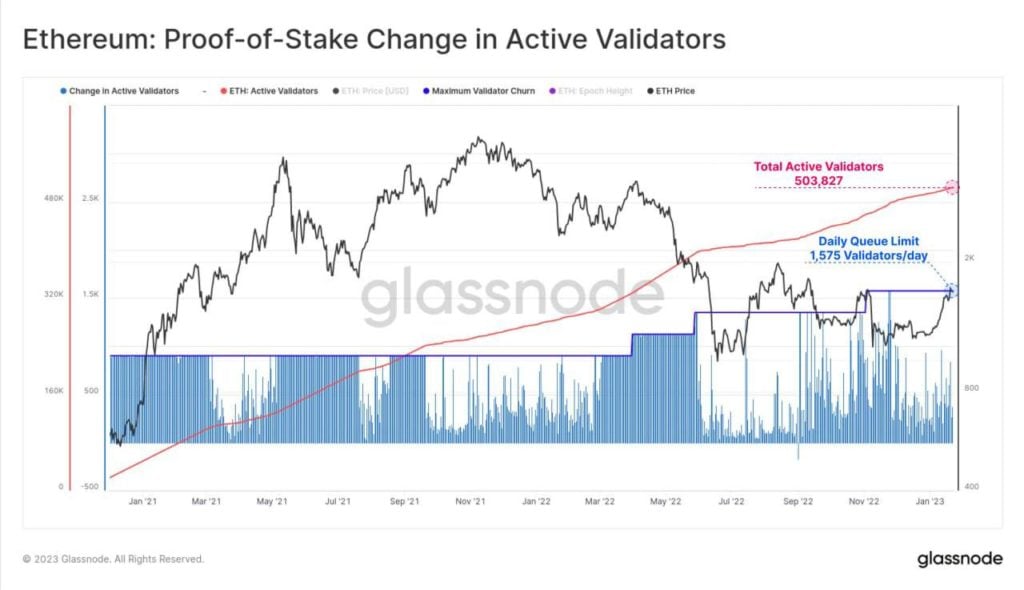

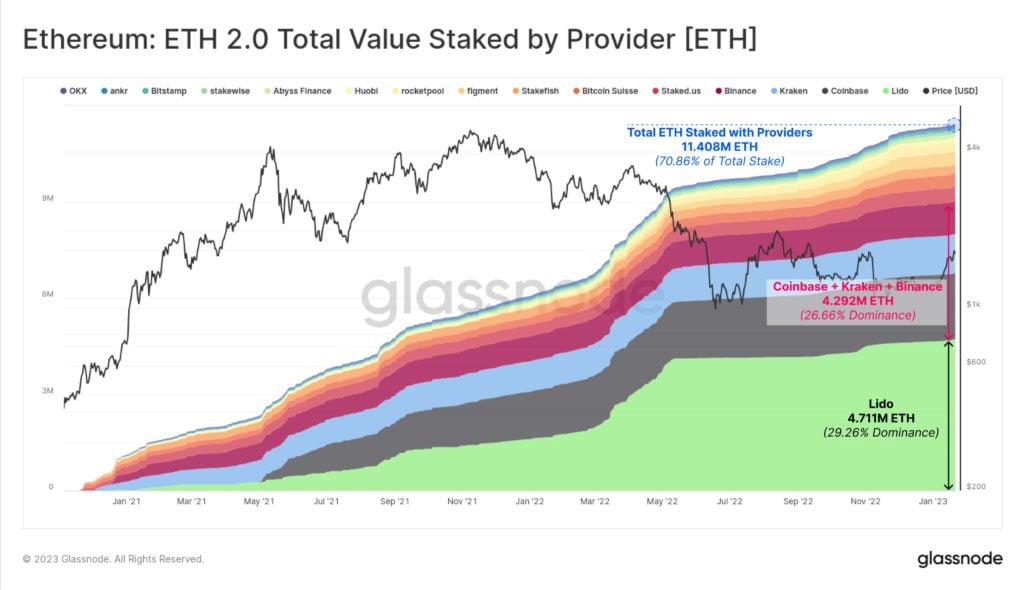

Number of ETH Validators Rises to 503,000

Early last week, ETH developers successfully completed the implementation of the “shadow fork”, which is a test version of the key Shanghai upgrade slated for March. Good news has been coming for ETH investors ever since the network successfully moved from the old PoW to its new PoS consensus mechanism last September, and confidence in the network has been increasing. This can be seen from the steadily climbing number of validators joining the network to stake their ETH. At the moment, the number of validators has climbed to over 503,000, and the number is still climbing.

After the Shanghai upgrade, validators will be able to withdraw their rewards and staked ETH. For investors who are concerned that there may be a major dump on ETH’s price when the staked ETH are unlocked, rest assured that the team has taken this into consideration and that the number of validators leaving will be capped. Based on the current number of validator count, the number of validators that could leave the chain is limited at 1,575 per day, which will not disrupt the fundamentals of the blockchain, nor will the number of ETH withdrawn be big enough to affect the price of ETH.

Furthermore, the total number of ETH staked only accounts for about 13.4% of the total circulating supply of ETH, or 16.1 million units. This percentage of total supply, even in the impossible scenario of being all withdrawn at the same time and sold, is not likely to have a major impact on the price of ETH.

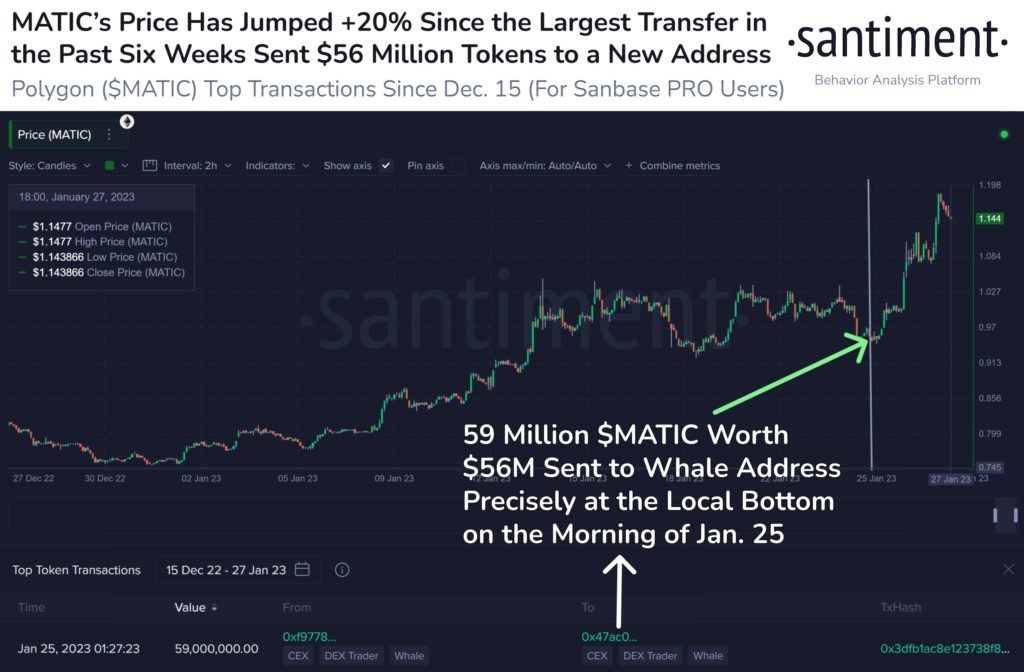

MATIC Jumps 20% After ETH Whale Makes Large Purchase

MATIC’s price jumped over 20% after the largest transfer of the year occurred on Wednesday, with 59 million units of MATIC sent to an ETH address holding 585,000 ETH. The transfer has led to speculation that the ETH whale is now accumulating MATIC, which is a layer-2 blockchain scaling solution for ETH which has been gaining traction despite the crypto market downturn last year. According to data from Token Terminal, the number of daily active users on MATIC have exceeded that of ETH, with 349,200 daily active users versus ETH’s 341,000. This catching up of MATIC may be one of the reasons why this ETH whale is also bullish on MATIC.

That said, while MATIC is gaining daily active users at top speed, it is still some distance away from BNB, which remains as the blockchain with the highest number of daily active users, with 803,700 daily active users at last count. However, recent negative news flow about the BNB Chain may have affected the price of BNB, which could be why the price of the token has remained rather subdued.

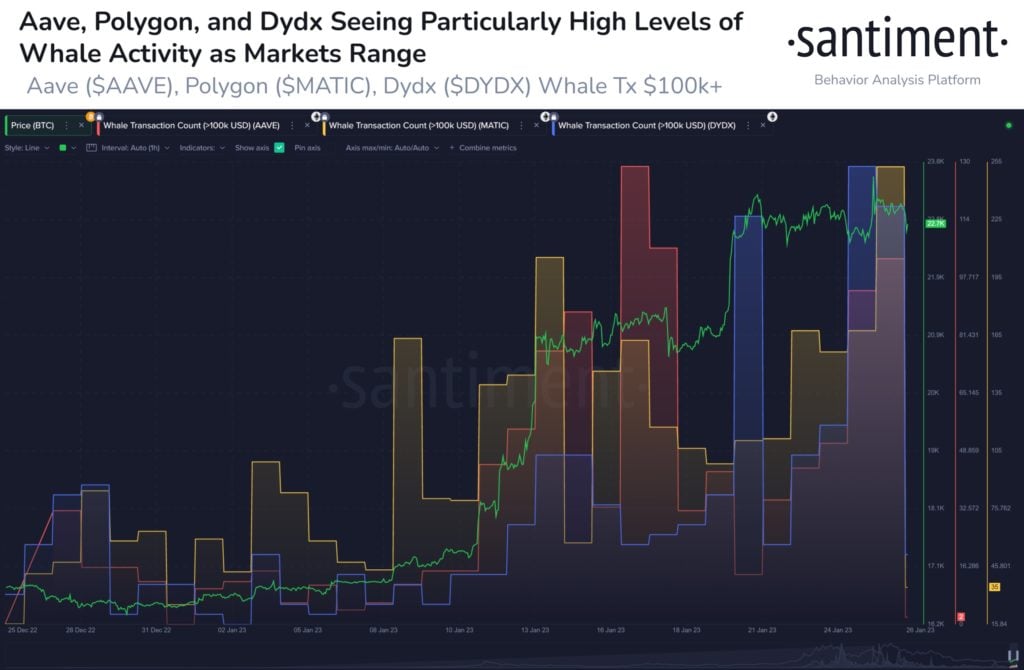

Altcoins Take Turns to Rally on Renewed Interest and Partnerships

Other than MATIC, tokens of decentralized protocols like AAVE and DyDx are also witnessing extraordinary levels of whale activity, which could mean that whales are moving in to scoop up these tokens. Decentralized exchanges could be where crypto investors would be bullish on this year as more traders move from CeFi to DeFi in the aftermath of the FTX scandal. As such, traders should not forget to put these tokens onto their radar.

Other than the above candidates, other popular cryptos which had been the key stars of the 2021 bull market, like DOGE and FTM, also saw notable gains led by news. FTM continued its ascent last week, gaining another 35% following the announcement of integrating with the Axelar network. DOGE managed to regain some composure and gained 10% for the week after Elon Musk reaffirmed his commitment to eat Mcdonald’s on TV if the fast food chain would accept DOGE. Mcdonald’s however, has not yet given any response to the challenge.

The theme play on GameFi tokens continues to gain traction as rumors about a possible Amazon investment into the metaverse made its rounds in the market. Popular GameFi tokens like MANA and GALA shot higher again over the weekend and may continue their stratospheric climb in 2023 after some consolidation last week.

Central Bank Meetings The SpotLight This Week

This week, market action is expected to be centred around central bank meetings, with the much-anticipated first Fed meeting of 2023 to be held between 31 January and 1 February. Looking at recent US economic data, traders are pricing in a 25-bps rate hike with a somewhat dovish slant when Fed Chair Powell speaks at the post meeting press conference on Wednesday. Any speech that is on the contrary could throw a spanner in the works for the markets, while the markets could continue to rise should he say what the markets expect.

On Thursday, the BoE and the ECB will also be meeting for the first time this year. Market expectation is for another 50-bps hike from both the BoE and the ECB and for the central banks to maintain a hawkish tone in spite of the recent falling rate of inflation.

Other than the key central bank meetings, the US non-farm payrolls set to be released on Friday could also cause volatility to spike higher than normal. As such, traders who are bored of the recent dull action in the markets could have some exciting moves to look forward to in the second half of this week.

In particular, currency traders should be prepared for heightened volatility in the euro and pound on Thursday due to their respective central bank meetings while also paying attention to the USD as both the euro and pound have a high weightage in the DXY index. As such, expect the EUR/USD and GBP/USD to see increased two-way volatility even after the Fed meeting that could follow into the end of the week.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.