The crypto market was quiet last week as most market participants paused to take stock ahead of the FED meeting that is to take place this week. With some bids coming in for the dollar as traders repositioned for a 25-bps rate hike, crypto prices across the board retreated, especially after SEC chief Gary Gensler reportedly said that the regulator would be appealing against the judge’s decisions on the XRP ruling, which caused the price of XRP to retreat from its high, however, the token is still trading above $0.70 as at the time of writing, far higher than the mid $0.40s it was at before the court ruling.

Celsius, which was supposed to start switching their altcoins into BTC and ETH from July, had begun to sell their altcoins, but had not yet used the proceeds to purchase BTC and ETH as promised, putting a cloud of uncertainty over the broad crypto market.

Traders’ attention was mostly on LINK and MATIC, which Celsius had the largest holdings, worth around $20 million and $14 million respectively. Interestingly, these two tokens ended up not being the worst hit as their prices remained well supported.

In fact, LINK, rose more than 20% in price to become one of the best performers (with the other being MKR, which rose 28% before retreating after the protocol started its governance token buyback) after the chain launched its Cross-Chain Interoperability Protocol (CCIP) on its mainnet. The CCIP creates a standard communication system that links applications across both public and private blockchains, allowing them to be interoperable. The upgrade caused the price of LINK to surge, not only offsetting the negative price impact the sale Celsius would otherwise have had on the token, but instead rose more than 20%.

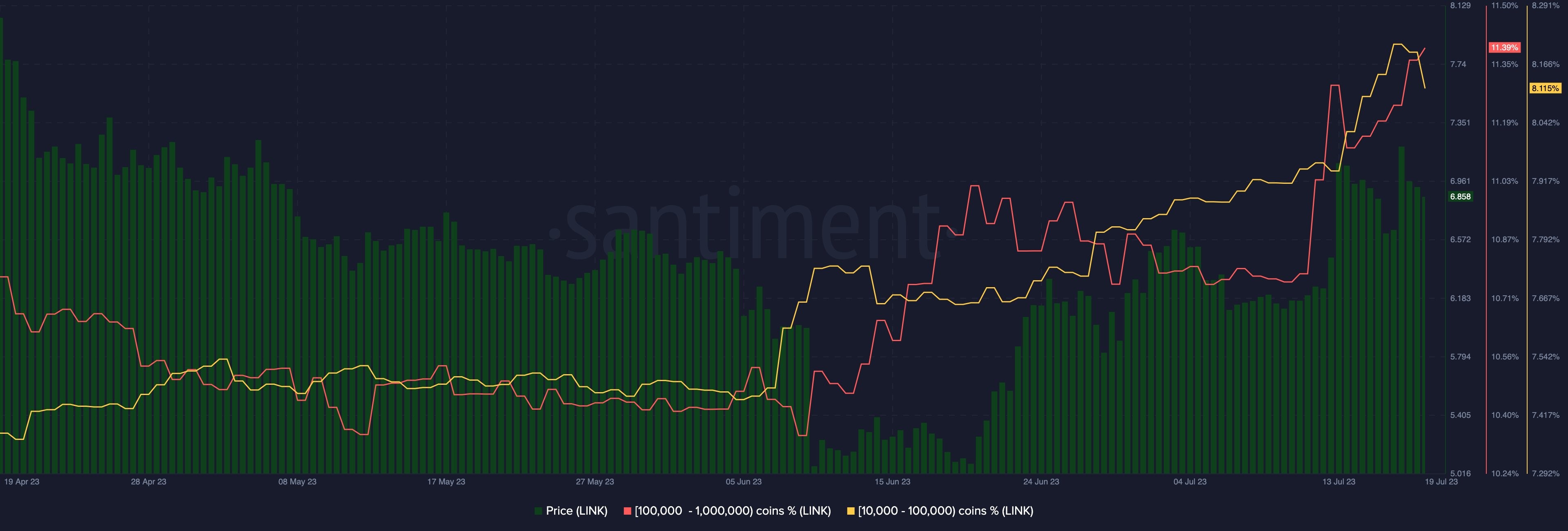

Large wallets accumulate LINK ahead of CCIP

Accumulation by large wallets had been on-going since 13 July as followers of LINK were prepping themselves for the mainnet launch of the CCIP, and the buying continued to increase after the CCIP was successfully launched on mainnet last Monday.

Of particular note were 2 whale accounts which bought a total of 788,977 LINK on Thursday, causing its price to spike thereafter. The purchase was funded from redemption of staked ETH into LINK, showing that the whales are now more confident of LINK than of ETH. As a result of the action by these two whale accounts, the price of LINK surged beyond $8, its highest in three months, while its onchain volume also surged to the highest of the year.

As the market has been relatively quiet, LINK naturally took all the spotlight, resulting in a big surge in its social volume. This congregation of attention may become a stumbling block for its price in the near-term as a sudden spike in social volume has usually ended with a large price pullback. Hence, traders who wish to accumulate the token could wait for its social volume to die down instead of FOMO-ing in with the rest of the market.

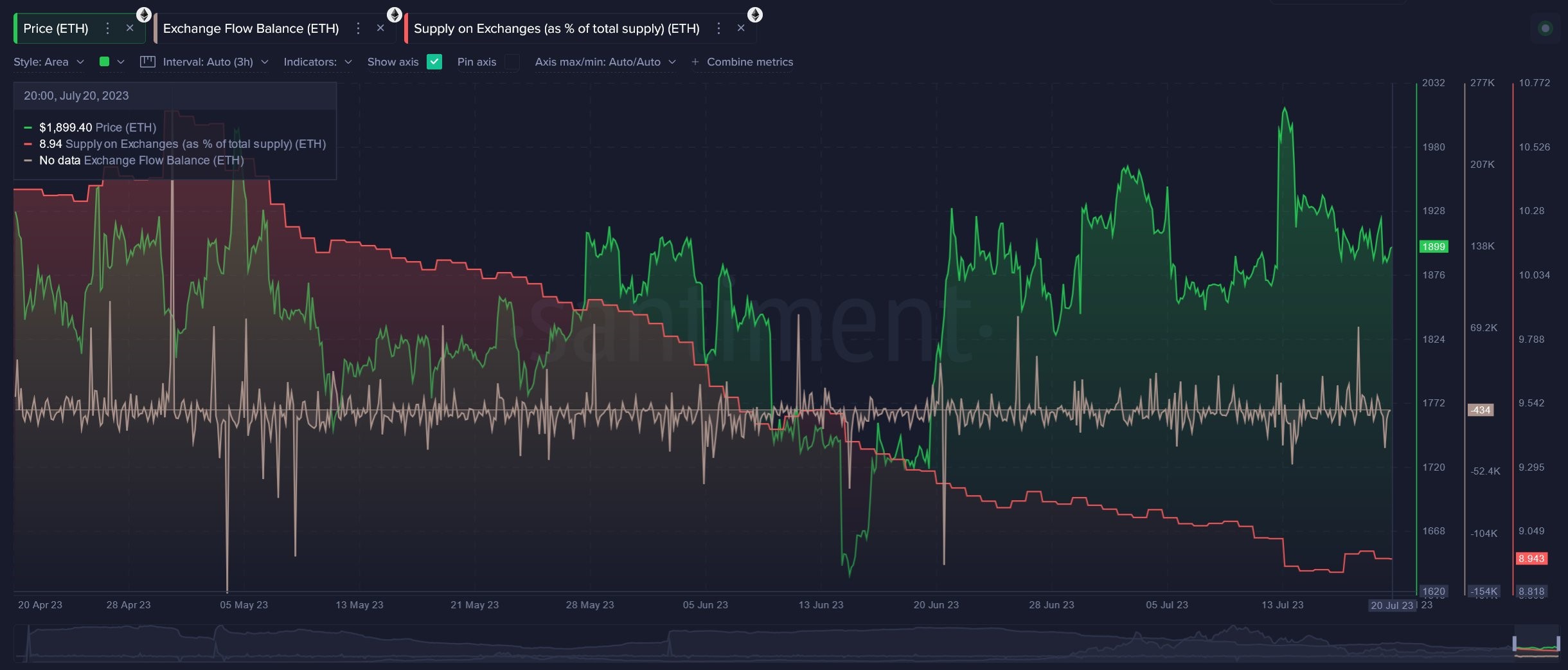

Long-term ETH holders selling token

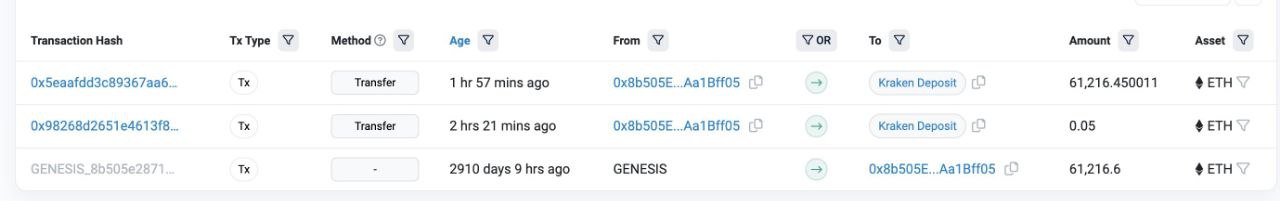

The 2 whales mentioned above who switched into LINK were not the only sellers of ETH last week. Even before these two whale accounts started selling their ETH for LINK, another long-term ETH holder sold his stash of ETH held for eight years since its genesis. This whale account woke up after eight years of inactivity and sent all its 61,216 ETH to an exchange for sale late on Tuesday night.

This whale received 61,216 ETH at the Ethereum genesis block when the ETH ICO price was $0.31.

The sale by such long-term holders of ETH could affect sentiment surrounding ETH in the near-term.

As can be seen in the above ETH exchange inflow chart, the balance of ETH on exchanges has increased last week as a result of whale accounts sending ETH to exchanges for sale. This increase in exchange reserves has been the largest since April 2023 when ETH fell from its year-to-date top of $2,100 to $1,850. Until the exchange balance falls, the short-term trajectory of ETH may not be very positive.

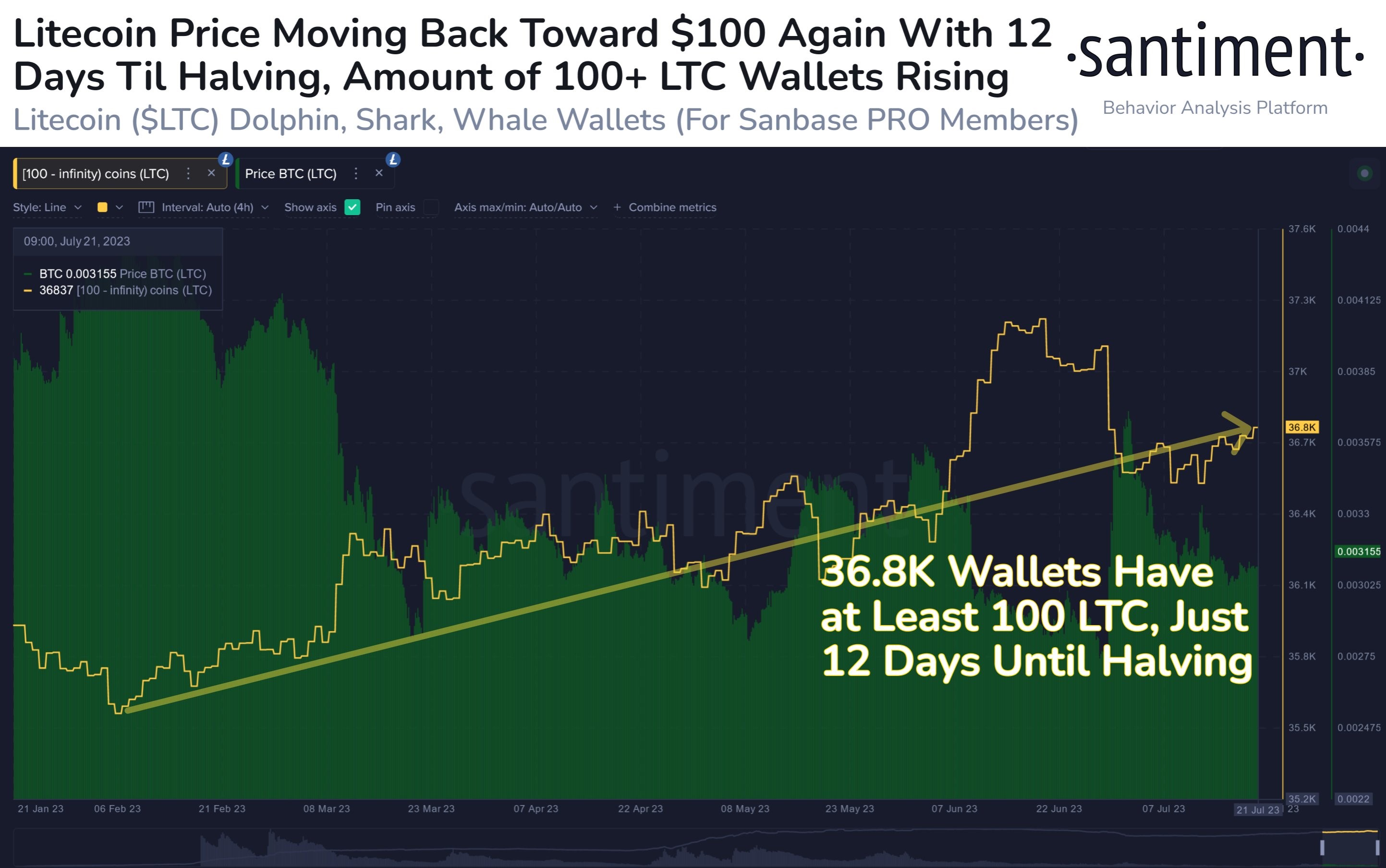

Traders adding LTC as halving approaches

With its expected halving of block rewards slightly a week away on 02 August, traders have been accumulating more LTC on the dips over the past weeks. However, whether these traders will be handsomely rewarded remains to be seen as historically, the price of LTC topped out around 50 days before the halving, as opposed to BTC which tops out around a year after its halving. That said, there is nothing that would prevent a new trend to emerge, as LTC, which is a PoW coin, is now viewed as being a safer bet for investors who are afraid of investing in PoS coins due to the allegations by the US SEC that they could be securities. Moreover, as the price of LTC has retreated by more than 20% since making its high in mid-June, the possibility of a rebound is there.

Watch out for the yen as central banks meet this week

As for the traditional markets, even though economic numbers out of the USA for the most part of the week were weaker than anticipated, a better-than-expected unemployment claims report released on Thursday managed to prop the dollar higher as traders repositioned themselves to be long dollar heading into the FED meeting this week since the FED is almost certain to raise rates by another 25-bps.

As the markets fully price in the upcoming FED hike, stocks put in a mixed performance last week, with the Dow gaining 2.08%, rising for the tenth consecutive day. The S&P added 0.7% while the Nasdaq fell 0.57%. Even though the corporate earnings season has so far come in slightly better than expectations, economic numbers have begun to deteriorate, which may imply that future earnings by companies could be impacted. However, market sentiment going into the FED meeting remains upbeat and the forward trajectory could depend on FED Chair Powell’s guidance in the post meeting conference.

After comments from the BOJ mid last week that they would not tweak its ultra loose monetary policy anytime soon, the dollar strength gained momentum as traders returned to the yen carry trade, selling the yen to buy the dollar. This caused the USD/JPY to rise 2.3% and pushed the DXY back above the 101 level, gaining 1.13% against a basket of other currencies. With such strength in the dollar, Silver fell 1.35%, but Gold surprisingly still managed to eke out a slight gain, rising 0.35% for the week.

Oil was the outlier, rising against the dollar tide to put in a gain for the week as supply tightness hit the oil commodity complex after a series of output cuts by OPEC+. Furthermore, the US stockpile was also reported to have fallen again last week. Traders have begun building bullish positions in oil on expectations that China would be unleashing a series of economic stimulus to boost its weakening economy, particularly in the automobile and consumer electronic segments. As a result, Brent gained 1.7% and the WTI gained 2.4%.

So far this week, the Asian market session is seeing most asset prices trading flat, possibly waiting for the cue from the FED. However, other than the FED meeting on Wednesday, the ECB will also be having their monetary policy meeting on Thursday, while the BOJ meets on Friday. Even though BOJ Chief Ueda has signaled that they will not be making any changes to their monetary policy anytime soon, some traders still think there could be a risk that the central bank governor may give a more hawkish than expected guidance in his press conference which could cause the yen to strengthen. Being the main funding currency for risky assets due to its negative interest rate, a strengthening of the yen could have an impact on asset classes beyond the currency market, thus, action by the BOJ should not be ignored by active traders.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.