Exciting action in crypto started very early last week as the price of BTC did a lap dance the moment the US markets opened on Monday. Breaking news was made out of Cointelegraph’s X.com account that claimed that the SEC had approved Blackrock’s spot BTC ETF. The price of BTC popped higher to hit $30,000 before retracing the entire move fully merely minutes later when Blackrock denied the news.

Around $100 million worth of positions were liquidated in that 30 minutes, with around $65 million of those being short positions. Some US whales could have either been caught by the news or could be the culprit of the pump and dump as the Coinbase premium spiked in tandem with the price of BTC at first, but later dipped deep into negative territory almost immediately, showing that this whale was at first deeply long, but immediately dumped all his BTC subsequently, causing the price of BTC to fall sharply within minutes.

Regardless of the objective of the fake news, BTC managed to find support around the $28,000 level and once again broke the $30,000 psychological handle on Friday, albeit momentarily, proving that the $30,000 mark was still not an easy resistance to cross, being near to $31,8000, the highest the price of BTC has been this year.

While BTC has crossed above the $30,000 level at the start of this new week, chances are, it may need to consolidate and build a strong base before it could muster enough momentum to break above the strong resistance overhead. However, this juncture is giving altcoins lots of room to join in the action, as many altcoins have shown remarkable growth in the latter half of last week.

Spot BTC ETF results postponed again

One possible reason for the difficulty of crossing above $30,000 last week was that the deadline for a bunch of spot ETF applications had been postponed yet again. However, this time around, sentiments are much more bullish as Bloomberg Intelligence estimates that there is a 90% chance an approval could come by 10 January 2024. Hence, the price of BTC has managed to remain well supported, as hope has been running high after the SEC decided not to appeal against the ruling that it has to more seriously consider Grayscale’s ETF conversion.

Furthermore, the SEC last week also dropped its lawsuit against the Ripple executives, a sign that the SEC could be relaxing its previous hard stance on the nascent industry. These moves greatly increase the possibility of the regulator approving the spot BTC ETFs very soon. Note that while the deadline for the next approval is mid January next year, the SEC does not need to wait until then to approve any ETF; an approval could be imminent anytime as long as the regulator has completed its assessment of any of the applications. Thus, this positive expectation could continue to support the price of BTC in the days ahead. With one more week to go before the traditionally bullish month of October comes to an end, traders are hopeful for the price of BTC to carve out a new high of the year before the month is over.

XRP price buoyed by lawsuit drop

Coming back to XRP, the token enjoyed its first jump above $0.53 in 10 days after the SEC dropped its lawsuit against the Ripple founders, paving the way for XRP to finally have a chance at catching up with the rest of the market, having missed the entire 2021 bull run.

Wallets holding between 10,000 to 10 million XRP have started accumulating again after the news was made. Collectively, these wallets hold around 29.5% of the supply of XRP and thus, if this accumulation continues, the price of XRP could see better days after having retraced in full its rise when Ripple Labs won the lawsuit against the SEC.

DMCC puts SOL on good stead

Even in a rising market, SOL, which was the star of 2021 but had been under negative pressure ever since the FTX debacle, managed to outperform the rest of the market, gaining one of the most amongst the entire crypto universe last week, and putting in a gain of around 170% for the year. This clearly shows that the worst is over for SOL after its unlucky streak with FTX.

The token rose almost 30% after the Solana Foundation announced that the Dubai Multi Commodities Centre (DMCC) has appointed Solana as its official ecosystem partner. This partnership would expand SOL’s footprint into the middle east area and would benefit all projects within the Solana ecosystem as the DMCC has pledged to provide complimentary setup and business licensing for Solana ecosystem projects.

DMCC has established relationships with significant players in the blockchain and crypto space, and this appointment of Solana as their official ecosystem partner will very much propel Solana to be the most commonly used blockchain in the middle east.

Furthermore, the FTX bankruptcy team have been noted to have staked their MATIC and ETH tokens, a total of over $170 million in cryptocurrency has been staked by the FTX bankruptcy team, which greatly reduces selling pressure on the tokens it holds, one of which is SOL.

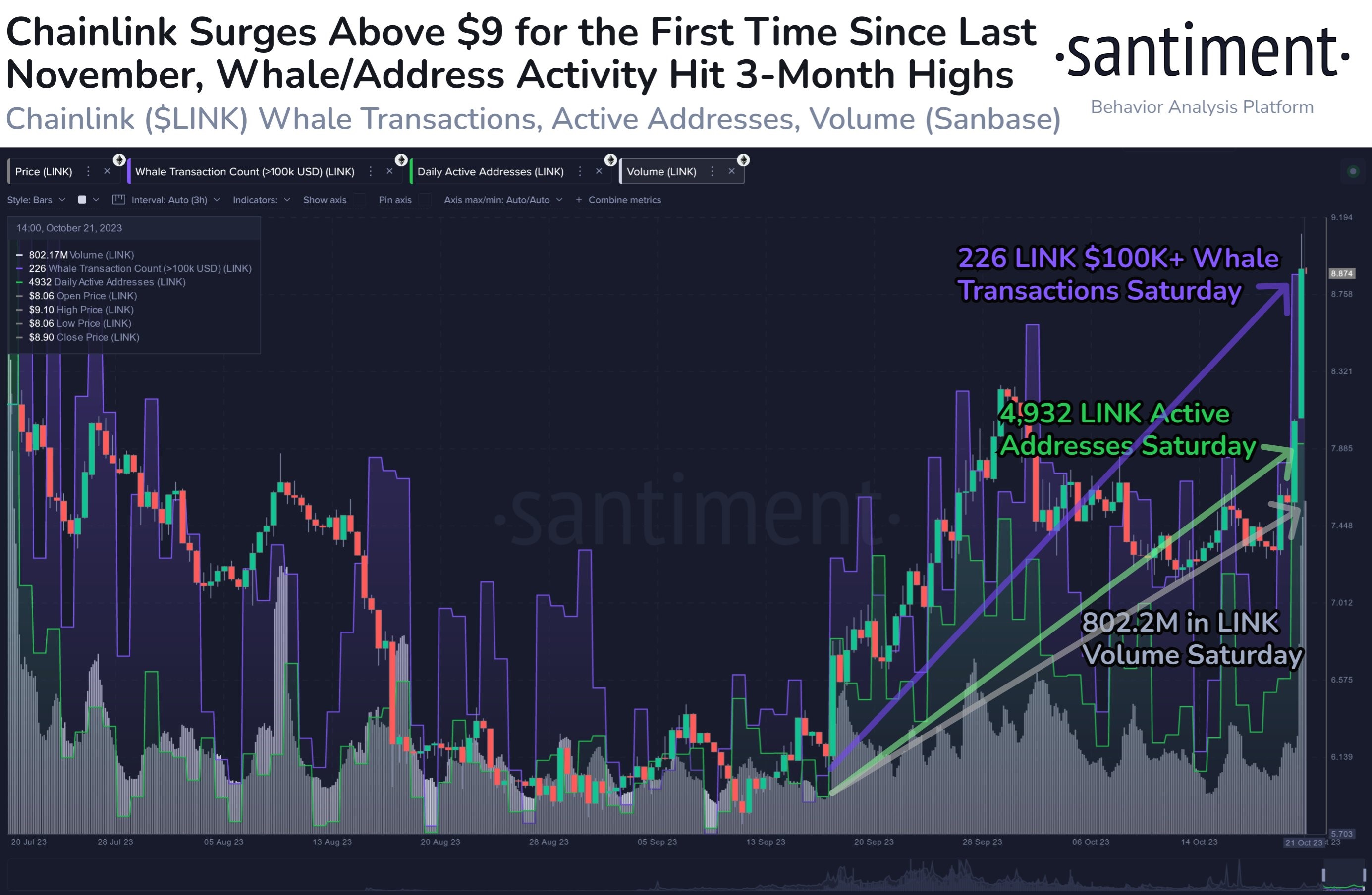

LINK on a tear as whale transactions surge

While SOL made an impressive gain over the week, it still could not beat the prowess of LINK. As one of our previous reports highlighted, whales were still accumulating LINK when its price retraced over the last couple of weeks. This stealth accumulation has yielded a price explosion as the price of LINK surged more than 40% over the weekend. The number of active addresses spiked on Saturday, leading to an increase in the number of large transactions involving more than $100,000. This was a 3-month high in network activities of LINK, which we had already predicted would surge in 4Q23 once the hype surrounding the LINK v0.2 upgrade commences.

Last Thursday, the Chainlink team announced the details of the v0.2 upgrade, which would make available 45 million LINK tokens as staking rewards, with 40,875,000 LINK going to community members and the remaining 15,000,000 LINK going to LINK node operators that are actively servicing LINK Data Feeds. This upgrade is expected to launch before the end of this year and the anticipation of it could keep the price of LINK elevated in the near future.

US stocks drops for first week in three

US stocks traded lower in their first week of decline in three despite stronger economic numbers and a more dovish FED. Initially, a stronger than expected retail sales number managed to buoy stocks higher. The retail sales growth came in at 0.7% against expectation of only 0.3%, showing that US consumers are still very much comfortable spending in spite of the elevated rates.

However, stocks started to lose steam later in the week, even with a more dovish FED as US yields continued to creep higher. On Thursday, in a speech delivered to the Economic Club of New York, FED Chair Powell reiterated that inflation is still too high and a lower economic growth is likely needed to bring it down, but gave no indication that he was leaning toward a push higher for interest rates. Other FED officials over the week also signaled towards less hawkishness, commenting that the FED could try to pause at least for a while and see if inflation creeps back in.

Even though FED officials hinted at a pause in rate hikes, US yields continued to surge, with the benchmark 10-year Treasury now crossing above 5% for the first time since 2007. The geopolitical situation and verbal attacks by middle eastern countries on the USA did not help the markets either, as investors fled risky assets and hid in the safety of precious metals.

By the end of the week, the Dow finished about 1.6% lower, the S&P 500 shed 2.4%, and the Nasdaq dropped 3.2%. Gold however, had its second week of magnificent gains on the back of the middle east conflict, gaining 2.74%, inching very close to the $2,000 level again. Silver similarly had a great week, rising 2.8%.

Oil prices also continued to rise for the second week after Iran called for an oil embargo against Israel over its air strikes on Gaza. The WTI gained 0.73% while Brent was higher by 1.6%.

This new week however, the commodity complex is having a small retracement in the Asian hours as traders await the other larger markets to open. Eyes will continue to be on the war in the middle east while on the economic front, Wednesday will see the Bank of Canada’s monetary policy meeting, while Thursday will see the meeting of the European Central Bank for their monetary policy meeting. Data will be a bit thin on the US side, with only the PMI on Tuesday and advanced GDP on Thursday to be the more crucial releases. While FED Chair Powell will be giving a speech on Wednesday, it is unlikely to defer much from what he had already mentioned last week.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.