Following rumors that both the SEC and the FBI are launching investigations into Digital Currency Group (DCG), the crypto market gave up a small mid-week gain to close the week yet again in the same consolidation zone. BTC briefly broke $26,300 on Wednesday but has since been back to the $25,700 level, while ETH has remained stuck at around $1,630 throughout the week, not even bouncing after ARK Investments filed a spot ETH ETF.

Market sentiment has remained pessimistic as the US stock market has also traded lower, with risky assets not faring particularly well against the backdrop of a persistently strong dollar.

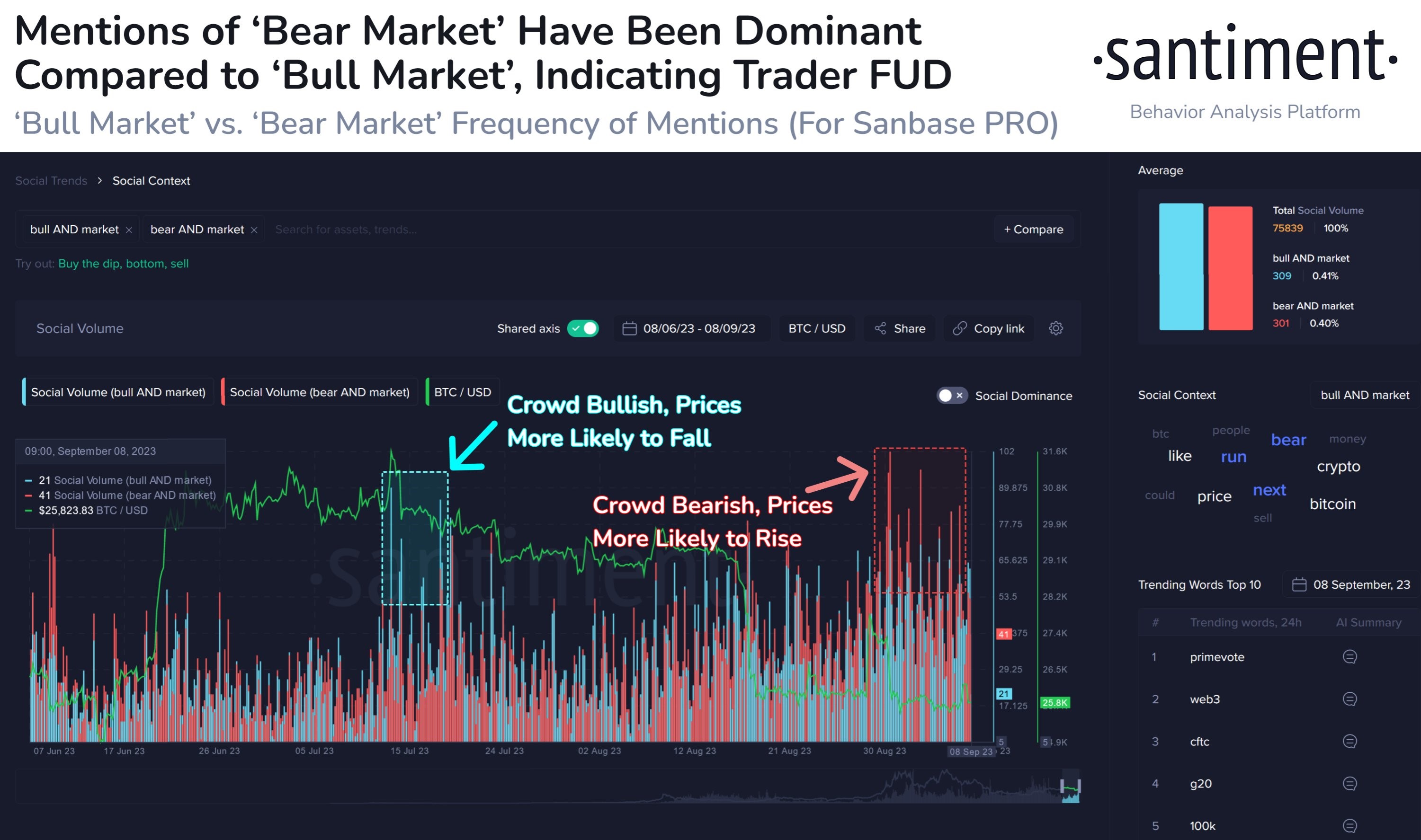

A check on social metrics also shows that trader sentiment is getting increasingly bearish, which historically, could be a contrarian indication if the bearish sentiment continues to worsen.

However, considering the current macroeconomic and geopolitical environment, it may be prudent to not be overly hopeful for a contrarian bounce to happen, or for any bounce to be sustainable, as even BTC metrics are beginning to show signs of deterioration.

BTC metrics showing signs of weakness

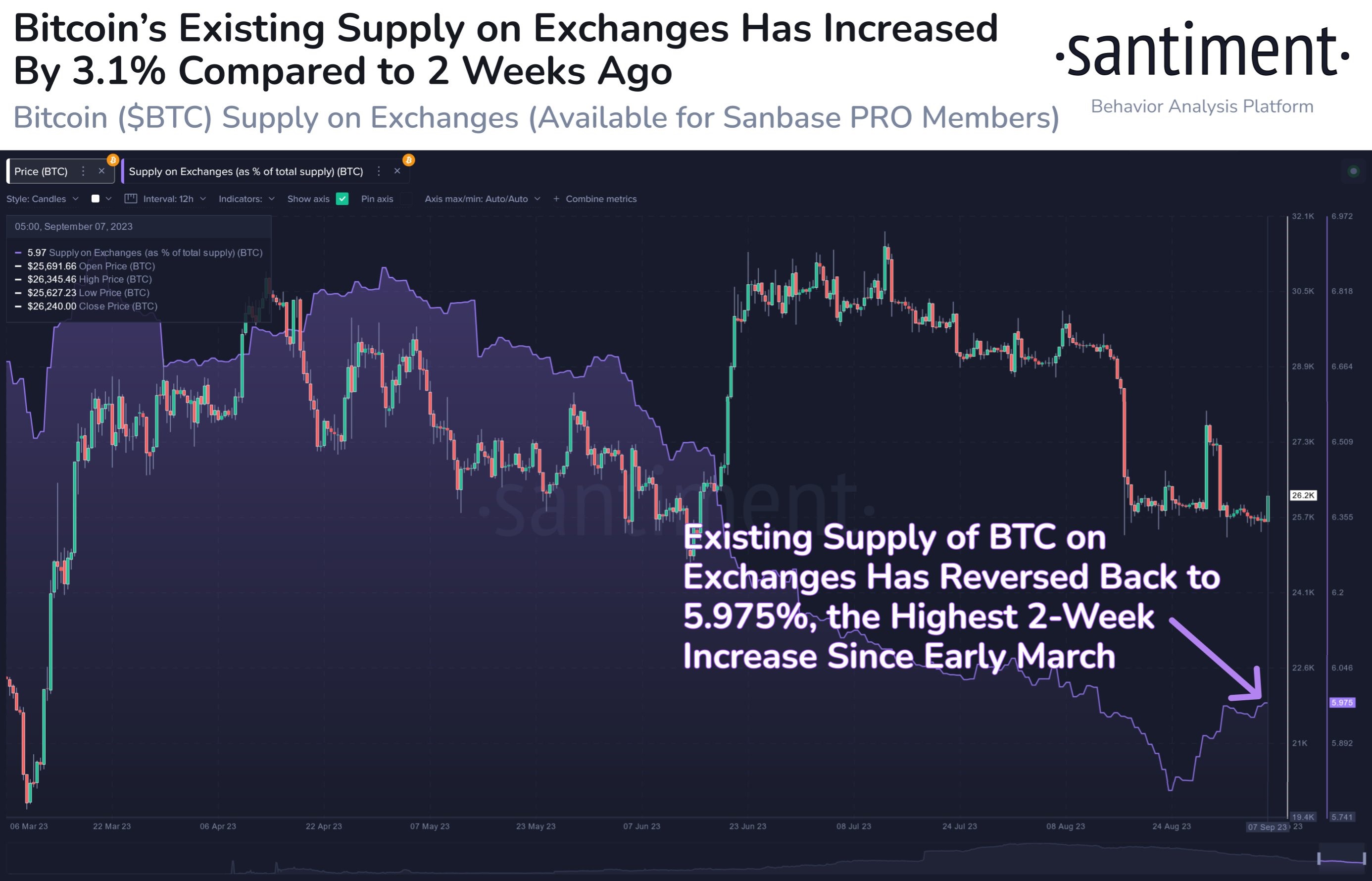

Lately, the metrics for BTC have been worsening. While it may not necessarily mean that a crash is coming, it nonetheless may foreshadow a possible period of price weakness ahead.

One such metric is the exchange reserve of BTC. The supply of BTC on exchanges has risen by 3.1% over the last two weeks, showing that some holders could be looking to sell their BTC. This increase in exchange supply could lead to a drop in price in the days to come.

Another noteworthy metric is the MVRV.

BTC’s MVRV has fallen back near a crucial support level of 1.2. Typically, an MVRV reading of less than 1 presents a good buying opportunity for long-term holders as it historically signaled a price bottoming zone. As the price of BTC had rebounded higher earlier in the year and has been falling back lower, there is a chance that the MVRV could revisit the lows formed late last year should the 1.2 level of support, which held prices up in May as shown in the diagram, does not hold. However, if the 1.2 level holds, it could signify that support around $25,000 is strong and prices could move higher. The coming two weeks could be crucial as we approach the FED meeting scheduled for 19-20 September.

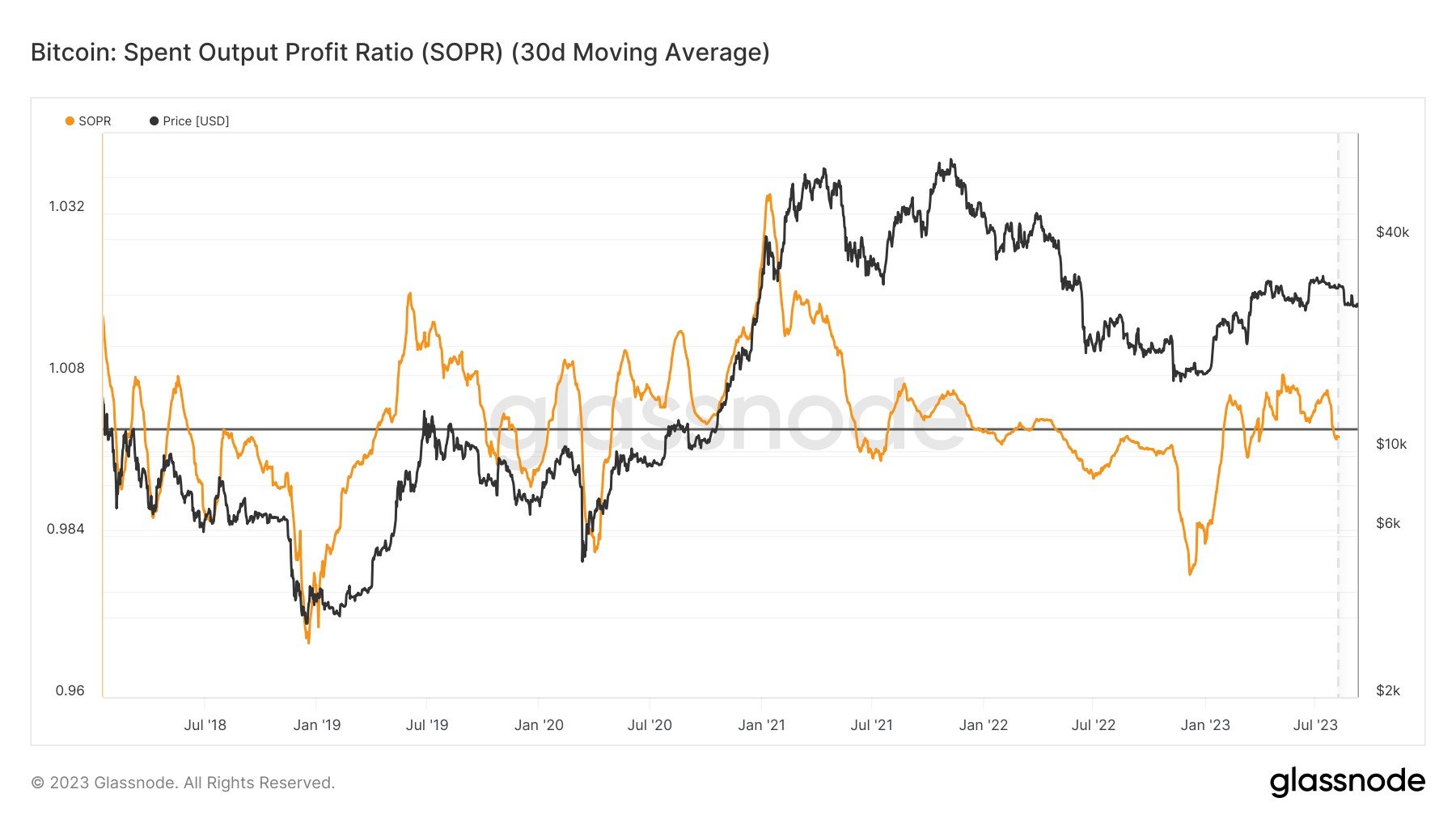

Last but not least, the BTC SOPR has also just broken the 1 level of equilibrium, which means that the average holders are selling at a loss. The SOPR rising higher than 1 typically reflects a period of rising price momentum, while a drop below 1 has historically been followed by a period of price declines. With the SOPR having broken this crucial level, traders ought to be prepared for the possibility of lower prices ahead.

FTX upcoming disposal crushing altcoins

Over the weekend, a circulating update that FTX will very likely be getting approval to dispose of their crypto wallet on 13 September has caused prices to dip further, worsening the already weak sentiment. It is said that FTX has around $3.4 billion worth of cryptocurrencies as of April, and that the proposed disposal plan is to sell up to $200 million worth of crypto per week. Assuming this comes true, it would imply that FTX would be dumping coins for around 4.5 months. According to data, the FTX wallet still contains a substantial amount of FTT and SOL, which have already taken a hit over the weekend. Other crypto that is held in lesser amounts include BTC, ETH, APT, XRP, DOGE, MATIC, BIT and TON. The market could continue to be under pressure until the court approval results are out on Wednesday, 13 September, which coincides with the release of the August US CPI data. As such, traders ought to be prepared for heightened two-way volatility on Wednesday.

Dollar strength starts to weigh on risky assets

US stocks sold off last week as rate hike fears revisited the market after the ISM Services index rose a lot more than expected, reporting a figure of 54.5 against an estimated 52.5. The prices component of the index rose 2.1% to 58.9% in August, showing that price pressures are beginning to creep into the business sector once again. This caused US Treasury yields to rise again, taking the 2-year yield above 5%.

Following the services report, renewed fears of a prolonged period of high interest rates caused stocks to fall. As a result, the S&P fell 1.3% and the Nasdaq dropped 1.9%, registering their first negative week in three. The Dow finished about 0.8% lower. The heavy drop in the Nasdaq was led by Apple shares, which plummeted after the Chinese government restricted its officials from using the iphone. With tensions between America and China heating up again, investors are once again having to deal with the added uncertainty of government policies affecting corporate profitability.

As geopolitical tensions once again resurface, the dollar has continued to benefit from being a safe haven, having been the cleanest dirty laundry in the room, as the US economy continues to be one of the strongest amongst its peers. The DXY rose 0.8%, taking the wind out of the sails of Gold, which fell 1.2% as hot monies preferred having the yield of the dollar compared with zero yield from holding gold. Silver fared even worse, dropping 5.3%.

Against this strong dollar backdrop, the only asset holding its own is oil. Saudi Arabia has announced during the OPEC+ meeting on Tuesday that it will extend a voluntary cut of 1 million barrels per day until the end of the year. The cut adds to 1.66 million barrels per day of other voluntary crude output declines that some members of OPEC have put in place until the end of 2024. With such heavy cuts in production at a time when the US stockpile is declining, it was only natural that oil prices rose. Brent rose 1.76% while the WTI gained 1.35%.

This week, much of the market action could come after Wednesday as the US CPI for August would be released that day. On Thursday, retail sales and unemployment claims will be released, while the Empire State manufacturing index and consumer sentiment will be released on Friday. Over on the currency front, the ECB will be having its monetary policy meeting on Thursday, which could impact the Euro.

Still on currencies, Japan’s benchmark 10-year government bond yield rose to its highest level since January 2014 in early Asian trading this week after Bank of Japan Governor Kazuo Ueda said in a newspaper interview published on Saturday that lifting the central bank’s negative interest rate policy is among policy options that it will be considering. This revelation has shocked some market participants who are frantically bidding up the yen when the markets opened on Monday, causing the dollar to fall in tandem. Should this trend of yen reversal persist, it could finally cause a dent in the strong dollar trend.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.