After several months of stagnant price action, last week the cryptocurrency market exploded, putting an end to the boring sideways trend. It also sent Bitcoin skyrocketing through resistance at $10,000 and potentially started a new uptrend. A rejection at $12,000 has stopped the advance for now, but while the leading crypto asset cooled off, major altcoins like XRP and Ethereum went on a run of their own.

Here are all the most important breaking news, trends, and changes that happened across the crypto space over the last seven days.

Bitcoin’s Monthly And Weekly Close Set Records For Highest In Years

Bitcoin price this week closed the highest weekly candle in over a year. The asset hasn’t traded at such levels since the summer of 2019. After topping out at $14,000, the cryptocurrency market began the second phase of its downtrend. This latest breakout could be the start of a new uptrend forming, but the current economic uncertainty has resulted in a hesitance from investors.

On monthly timeframes, the July candle close was the highest since Bitcoin’s peak in 2017. A pullback to retest $10,500 as support on weekly timeframes is possible and would be healthy before the advance continues. The cryptocurrency will have resistance above at $14,000 to beat before a retest of the former all-time high of $20,000 is possible.

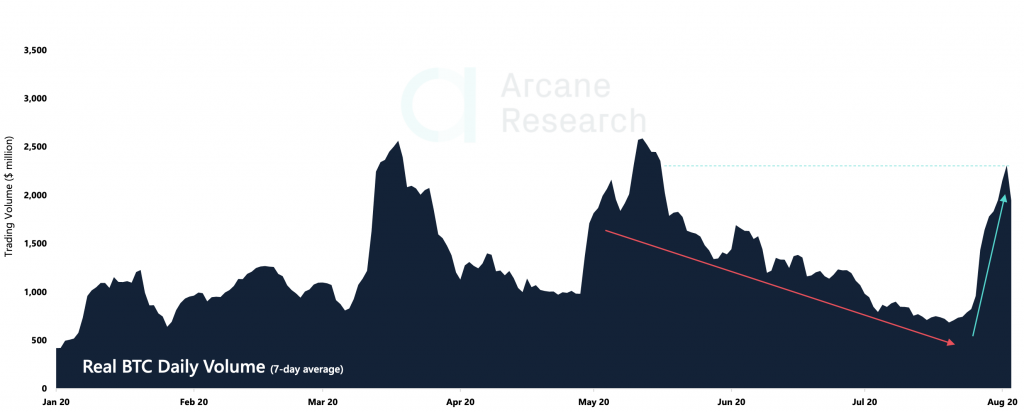

Trading Volume and Greed Returns, Closes In On New Yearly Highs

BTC total daily trading volume had long been in a steady downtrend, declining week over week since early May following a break above $9,000. Suddenly after the breakout this week, volume is now approaching yearly highs, and could soon set a new record for 2020 if interest in Bitcoin continues to pick up.

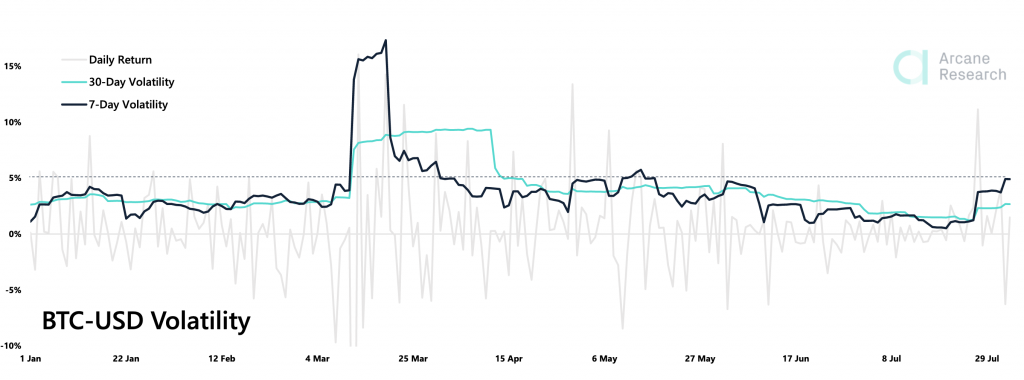

Volatility is also back, as expected. The cryptocurrency asset class couldn’t stay calm for much longer, and a return to the signature volatility is welcomed. It means asset prices are soaring once again, and although there are plenty of pullbacks and crashes in between, it is just another chance to profit from each market peak and trough. 7-day volatility has now pushed higher than 30-day volatility, depicting an uptrend forming in price action explosiveness.

After teetering into extreme greed territory last week, the crypto market is now starting to hesitate, taking a step back toward greed and fear. The level of greed is still far less than what was seen a year ago at the $14,000 top. This could indicate that the rally has more left to go, or it could be a sign that a top is near, or even behind us at this point.

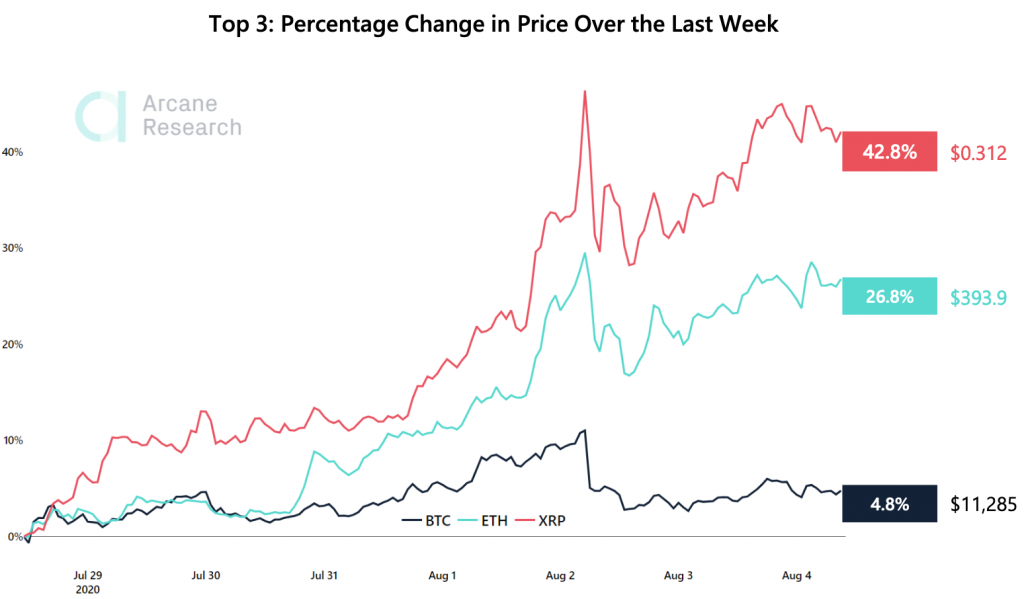

XRP Beats Bitcoin By Nearly Tenfold, Ethereum Close Behind As Crypto Market Heats Up

Although Bitcoin lit the fuse that sparked the crypto market boom this past few weeks, it is XRP and Ethereum that are now surging as a result.

Bitcoin was up only 4.8% over the last week. Meanwhile, XRP was up over 42.8% or nearly ten times Bitcoin’s performance. XRP almost doubled Ethereum, which easily bested Bitcoin with a 26.8% gain on the week.

XRP was even the best performing asset across the crypto market. This is highly unusual for the token that has been the worst performer for nearly two years running. Right behind it was Synthetix Network Token, and the altcoin superstar Chainlink, that since this report was issued has since set another new all-time high.

Crypto.com Coin fell hard after the community expressed a deep upset over shock announcement involving the MCO token. DeFi token Ampleforth took a hard fall, and altcoin Elrond also saw strong downside compared to the rest of the thriving market.

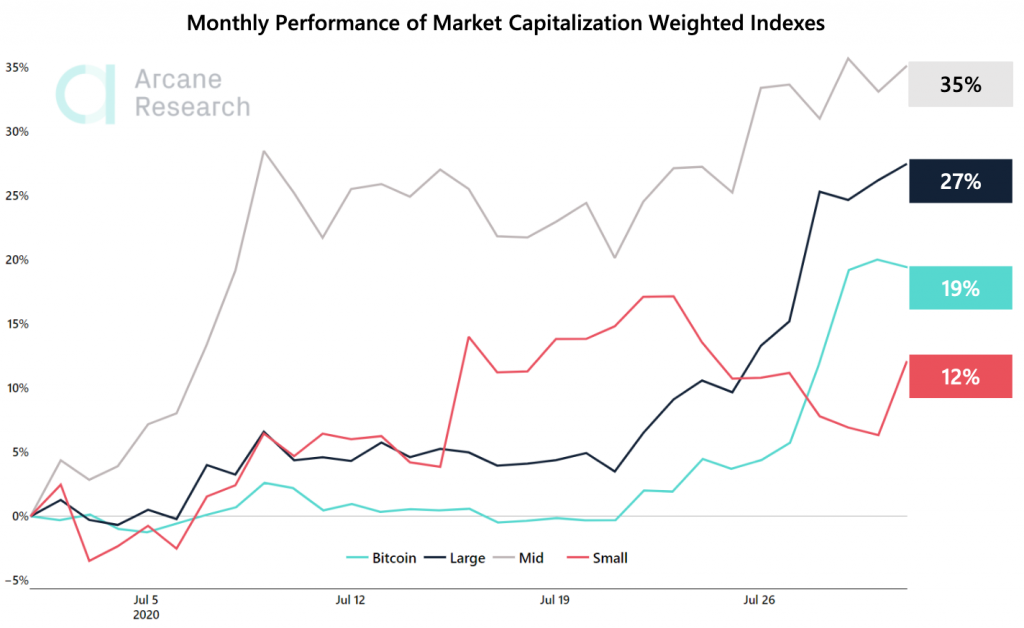

The increased performance in majors, mid-cap altcoins, and even Bitcoin, left small-cap altcoins behind. Small-cap altcoins, however, have beaten all other indexes over the last several months, so it was time for a correction and the other classes to catch up.

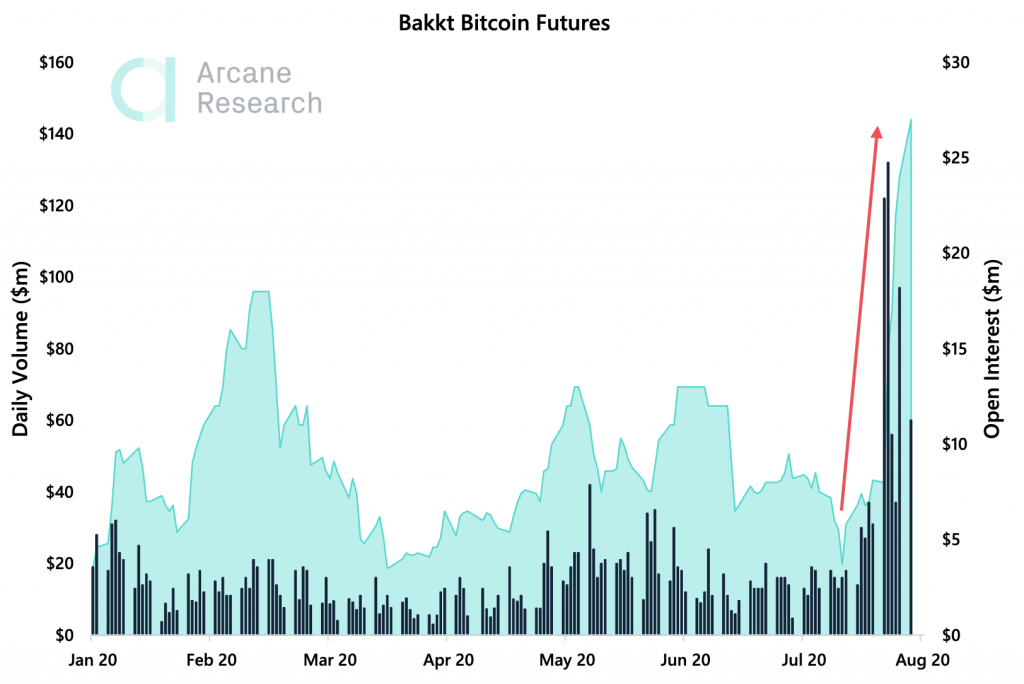

What’s Going On With Bakkt And Burgeoning CME Open Interest

In a strange twist, the physical delivery of Bitcoin to Bakkt has seen a sharp decline over the last month. While this happened, trading volume on the platform spiked to the highest level ever recorded on Bakkt after Bitcoin broke up through $10,000. It could be a sign that institutions were waiting for the resistance to break before showing strong renewed interest.

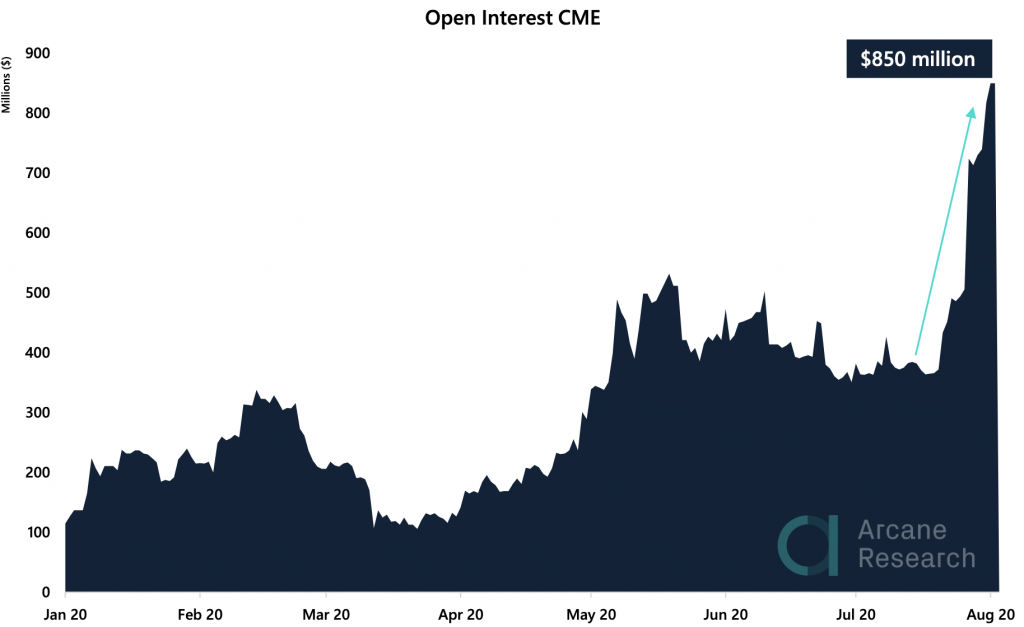

Further backing up that theory, is CME Bitcoin Futures open interest reaching an all-time high peak of $850 million. The platform caters to only a certain type of high wealth trader, over a certain income threshold, and meeting many financial requirements. CME is also dominating Bitcoin Futures trading volume, accounting for as much as 16.8% of the market.

In The News

IRS Criminal Investigations Unit Arrest Twitter Hacker and Bitcoin Scammer

17-year old and two other individuals were arrested by the IRS criminal investigations unit in relation to the high-profile Twitter hack weeks ago, where the accounts of Apple, Joe Biden, Kim and Kanye West, and several others were compromised in an attempt to scam Bitcoin from individuals. Over $120,000 in BTC was stolen in the scam.

Bitcoin Flash Crash Liquidates $1.3 Billion in Open Interest in 30 Minutes

Overnight on Saturday night, poorly timed profit-taking from a Bitcoin whale crashed the entire market. It caused a flash crash on several exchanges, causing the cryptocurrency to fall from over $12,200 to $10,500 in under 30 minutes. It also liquidated over $1.3 billion worth of open interest from the crypto space.

VISA Gives Nod To Bitcoin, Ready to Embrace Blockchain Networks

VISA recently released a report mentioning Bitcoin by name and crediting it for sparking the digital currency trend. The brand also committed to adding more crypto networks into its “network of networks” and better embrace the financial tech.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.