Last week started the same way it ended the week before – with stocks and risky-assets crashing, yields spiked as traders bet that the FED would need to hike more to stem inflation. The Treasury yield curves in the US inverted on Monday, where the interest rate for the 2-year was higher than the 10-year. This indicates a recession as it shows the near-term interest rate higher than the long end.

Stocks were crushed, with the Nasdaq losing more than 4% on Monday to kick-start a week of weak economic numbers and a well-anticipated 75-bps rate hike by the FED on Wednesday, which briefly sent stocks higher after FED Chair Powell said more hikes of 75-bps would not be the norm. However, Powell also reiterated that the FED was committed to returning inflation to 2%. And as other economic data released on Thursday further disappointed, the markets sold off again as an economic recession in the face of rising rates appear to stare at investors in the face.

Specifically, retail sales posted its first drop in 5 months, led by a drop in auto sales, as consumers cut back on vehicle purchases as a reaction to the surge in gasoline prices. Value of purchases fell 0.3% overall in May, with electronics, furniture and e-commerce also posting declines.

The property market showed signs of stress as well, as Housing Starts slumped 14.4% month-over-month and New Housing Permits plunged 7.0% month-over-month, well over analysts’ expectation of a 1.8% and 2.5% drop respectively.

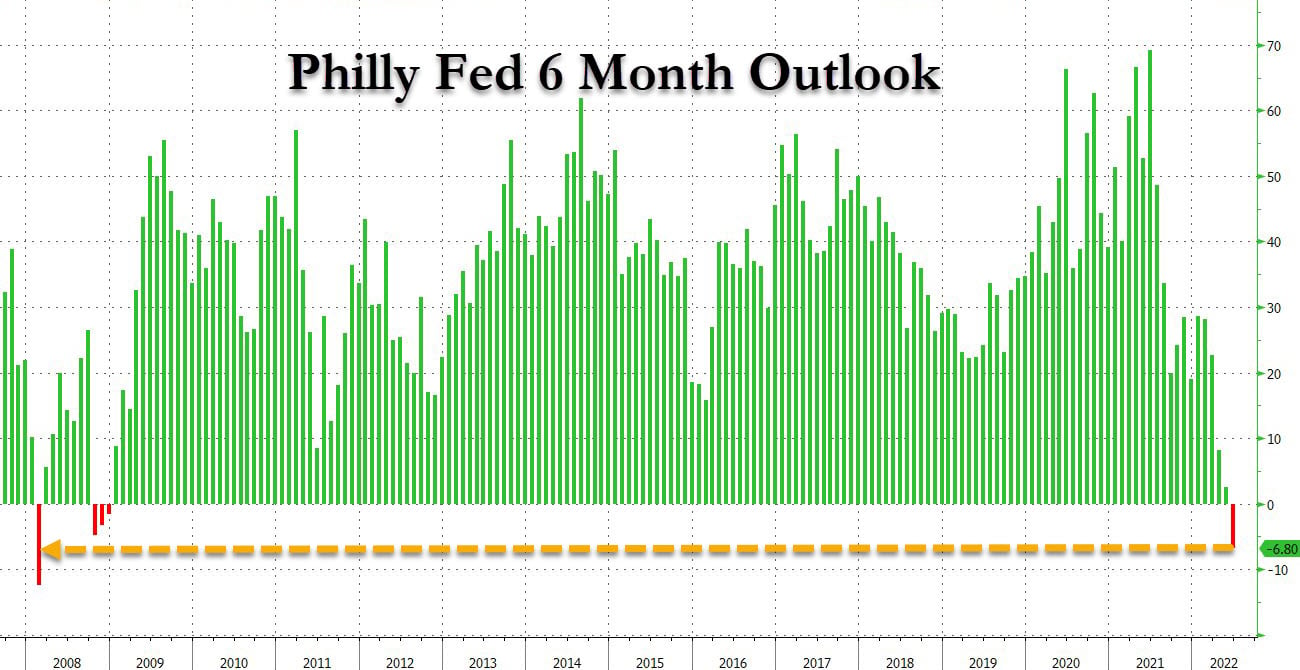

The Philly Fed Manufacturing Outlook Survey also posted a shocking dip to -6.8, surprising analysts who were expecting a +5 reading. This shows that business outlook is deteriorating faster than expected. The outlook was not this bad even during the COVID slump in 2020.

With Thursday’s drop, the S&P 500 eventually closed 5.8% lower for the week, with all 11 of its sectors finishing more than 15% below their recent highs. The Dow closed under 30,000, down 4.8% for the week, its 11th negative week in 12, while the Nasdaq slipped 4.8%. The selling appears more broad-based than previous weeks as fears of recession hit every sector hard. As traders anticipate a recession, 10-year US Treasury yields retreated to around 3.23% from its mid-week high of almost 3.5%.

Hedge downside risk with leverageOther Central Banks Actions Last Week

The ECB, after an emergency meeting on Wednesday, announced that it plans to create a new tool to tackle the risk of euro zone fragmentation, in a move designed to assuage fears of a fresh debt crisis, after European yields started surging rapidly after the ECB suggested a more aggressive policy tightening during its regular policy meeting, but failed to deliver any new measures to support highly indebted nations in the bloc. The new plan prevented the EUR/USD from breaking its 5-year low of $1.034 for a rebound to $1.049.

The Swiss National Bank raised rates by 50-bps for the first time in 15 years on Thursday, sending the Swiss Franc higher. This was followed by the Bank of England, which raised rates for the fifth time in a row.

On the contrary, the Bank of Japan remains the only central bank that has remained dovish. In its regular monetary meeting on Friday, the BOJ reiterated its dovish stance but mentioned that they would be observing fluctuations in the Yen exchange rate to prevent excessive exchange rate fluctuation from affecting the Japanese economy. The Yen fell as a result, losing almost 2% against all other currency majors on Friday as the interest rate differentials would mean traders could be able to continue borrowing cheaply in yen to purchase other currencies who are still expected to hike interest rates. This bided the USDJPY higher, as after the FED raised 75-bps on Wednesday, the interest rate difference between the USD and the JPY now makes doing the USD/JPY carry trade attractive. As we speak, the USD/JPY is hovering at a 40-year high.

As a result of monetary tightening by various central banks and more notably, the slowing down of the China, US and European economies as revealed by last week’s data, oil prices finally eased for the first time in weeks, with Brent and WTI Crude both falling around 5.3% for the week to settle at $113.5 and $108.8 respectively. This was the lowest close for Brent since May 20 and the lowest for WTI since May 12. Oil has started the new week retreating another 0.5% in Asian trading.

Gold and Silver lost some ground as the USD strengthened, losing around 2% each in line with the USD’s advance and is still showing signs of pressure in the new week. Silver is particularly weak, opening down 0.7% as an economic slowdown would dampen demand for Silver.

Meltdown As Liquidity Crisis Hits Crypto

As for cryptocurrencies, a liquidity crunch inherent within the crypto space has caused crypto prices to plummet even before the FED hiked rates on Wednesday. This time around, it was the liquidation of large positions held by a renowned crypto hedge fund causing contagion to spread to several DeFi platforms. The “shit started hitting the fan” as early as last Monday even before the US markets started trading.

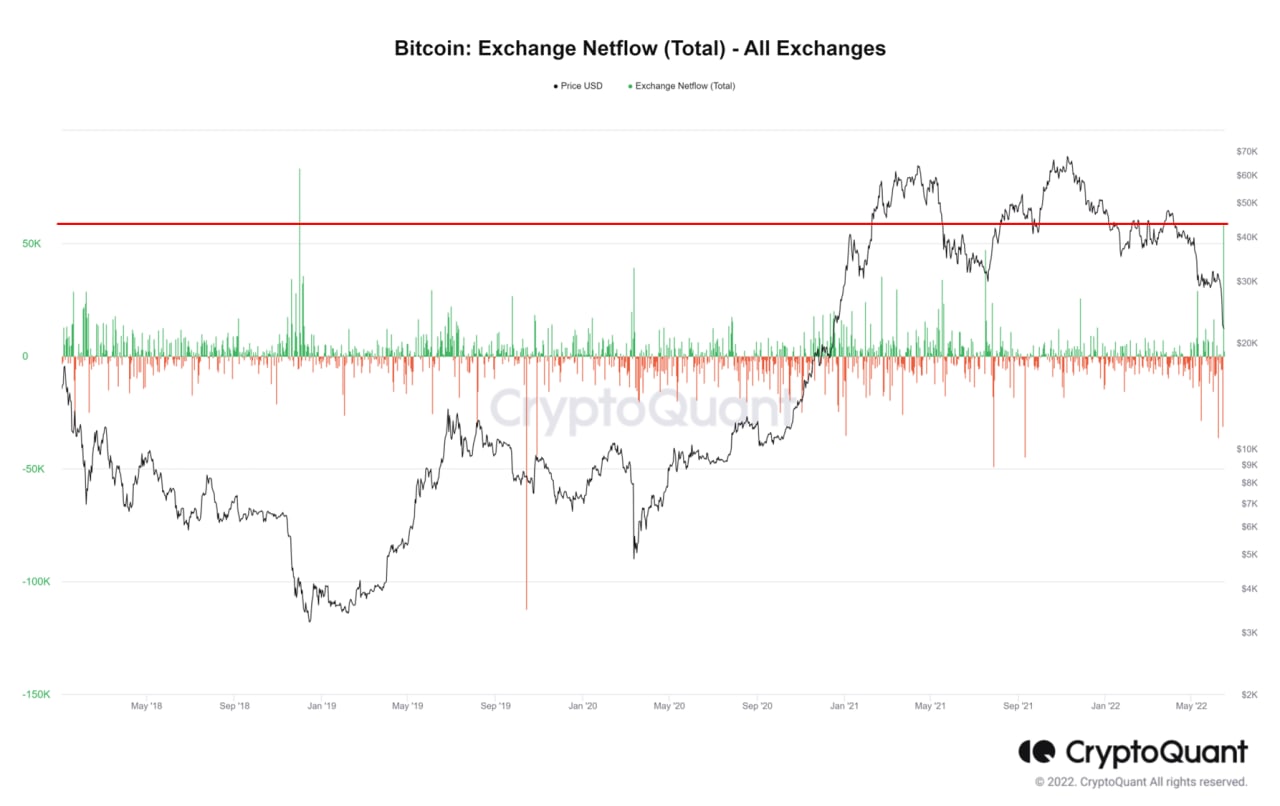

The moment Asian markets opened the week, heavily selling was seen as large volumes of BTC and ETH were sent to exchanges for sale.

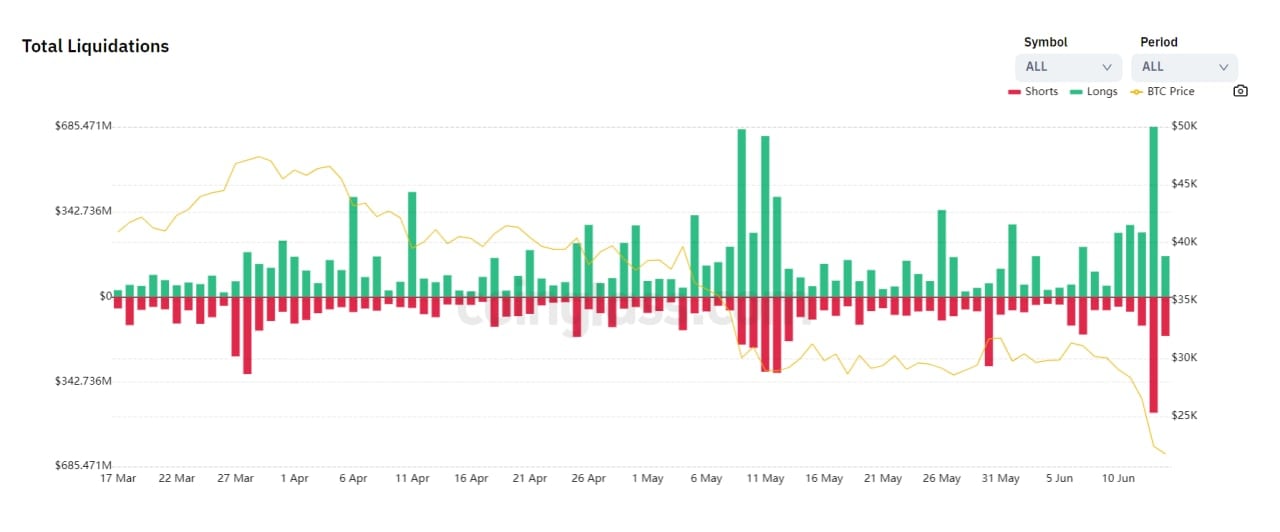

Futures markets liquidation was more than $1.3 billion as both longs and shorts got liquidated during bouts of volatility as prices plunged last Monday.

Even as the total crypto market cap broke below the $1 trillion mark on the back of the relentless selling, the bearish sentiment was made worse after a popular CeFi wallet paused trading and withdrawals due to it not having enough liquidity to support client redemptions. When world’s biggest crypto exchange Binance also paused BTC withdrawals for several hours on Monday, fear was at one of its worst as the price of BTC dumped to $20,500 but managed to stage a quick reversal after Binance resumed BTC withdrawals, citing problems in a node upgrade and not that the firm was facing any liquidity issues. This assurance managed to restore some faith and the price of crypto recovered in the early hours of Tuesday before the European session. However, the temporary respite did not last long as the market continued to drift lower throughout the week as worries of more insolvencies prompted investors to get out of the market while they still could.

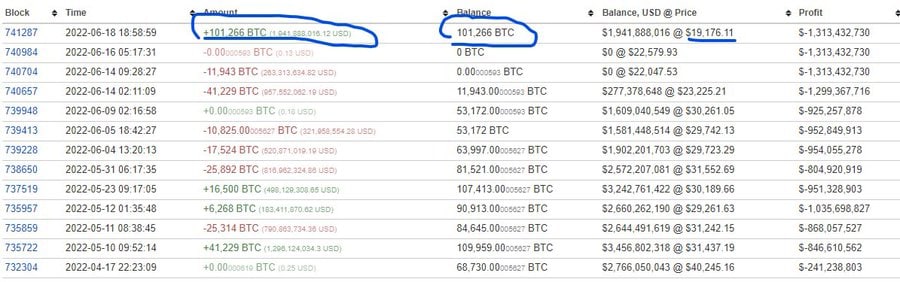

Indeed, prices dipped further into the weekend as more traders turned to shorting the market, and BTC dipped to a low of $17,600 for a loss of 32% and ETH tanked 40% to $880 within the week before a large purchase of 101,266 BTC by a large whale managed to stem the market’s decline.

BTC Exchange Inflow Hits Highs As Old Coins Start Getting Sold

The events last week played out as BTC exchange inflows hit a 3.5-year high of more than 59,000 units of BTC sent to exchanges for sale on Tuesday.

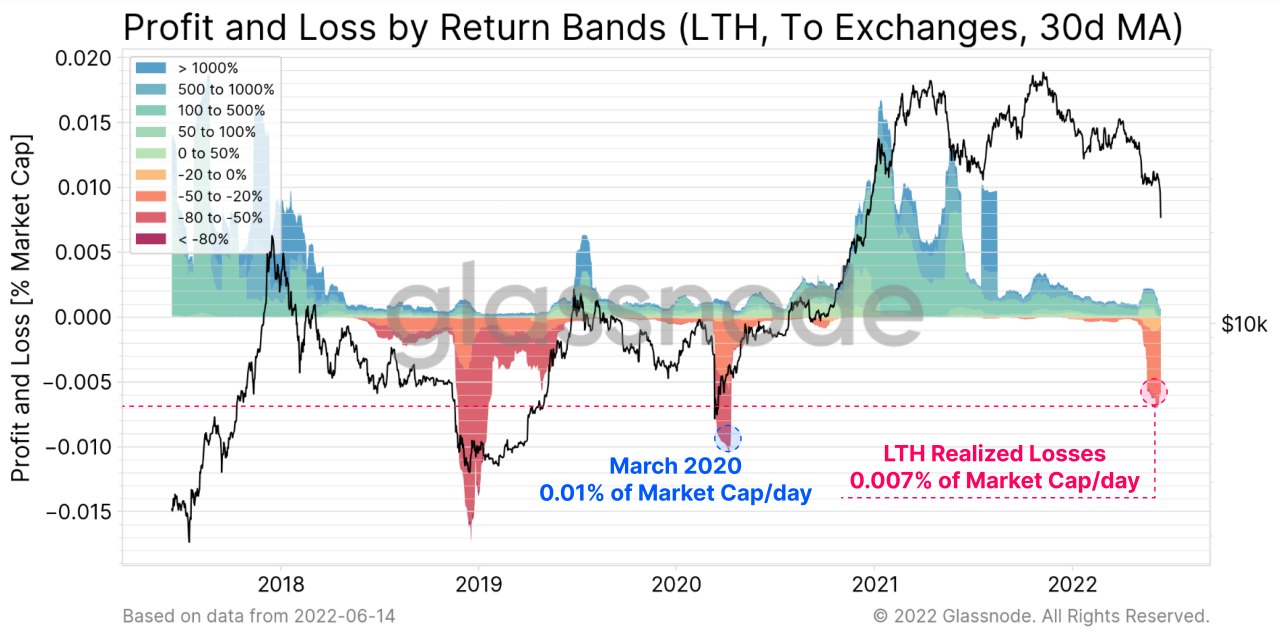

Onchain data traced that some of these inflows were old coins, meaning to say that some of the exchange inflows were coins held by long-term holders. A check on long-term holders shows that around 50% of long-term holders are dumping their coins, thereby contributing to around 0.007% of the loss in BTC market cap per day.

This selling by long-term holders is nearing the March 2020 level and is the first major long-term holder capitulation event in the current cycle. However, comparing the current situation with previous bear markets seems to suggest that more dumps could be forthcoming before a real bottom is reached. Following the pattern of the data, we may need to see around 80% of old coins dumped before we see a real market bottom.

Traders are thus reasonably concerned that more sell-side pressure will emerge in BTC over the coming days and weeks.

BTC Miners Showing Intense Stress

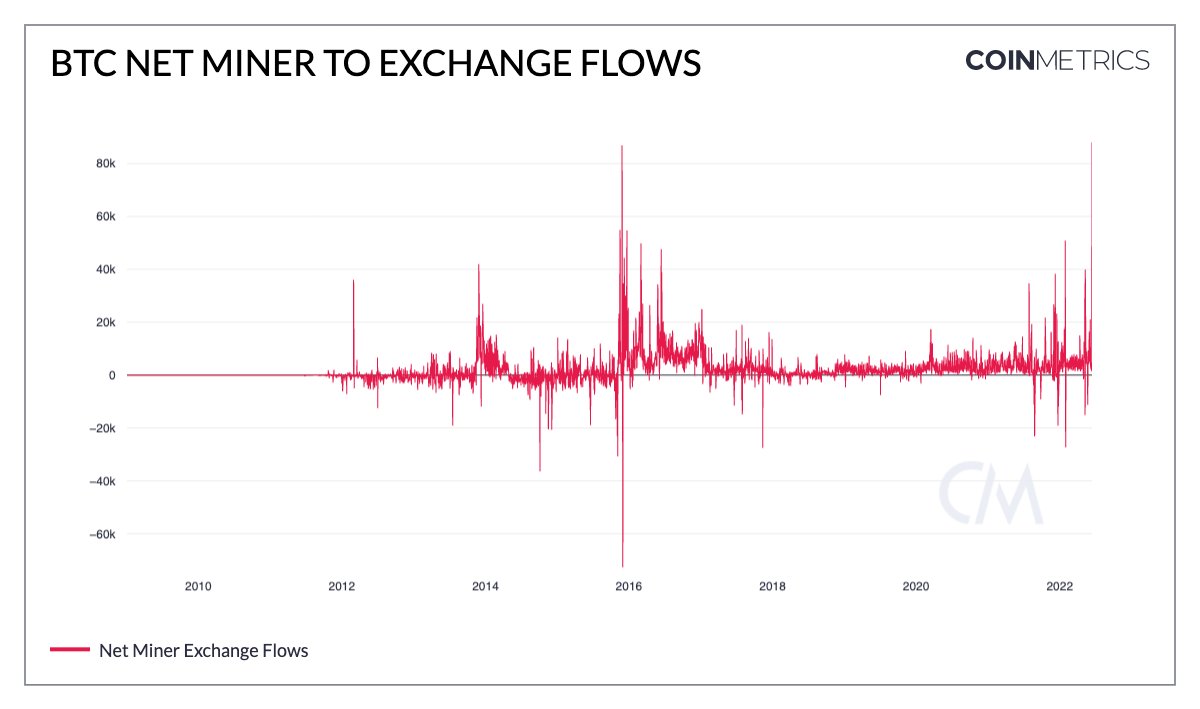

That concern has been exemplified by BTC’s biggest ever one-day exchange inflow on Wednesday, with more than 88,000 BTC sent by miners to various exchanges, with a value totalling around $1.94 billion. This number is even bigger than the historical high of 83,481 units of BTC that flowed into exchanges towards the end of 2018. In the 2018 bear market, the price of BTC retraced another 50% to hit its cycle bottom of $3,100 around a month after that particularly large inflow.

From such big transfer volumes, it is obvious that miners are getting stressed by the steep price drop and are trying to get rid of as much BTC at the best possible price to cover their mining expenses.

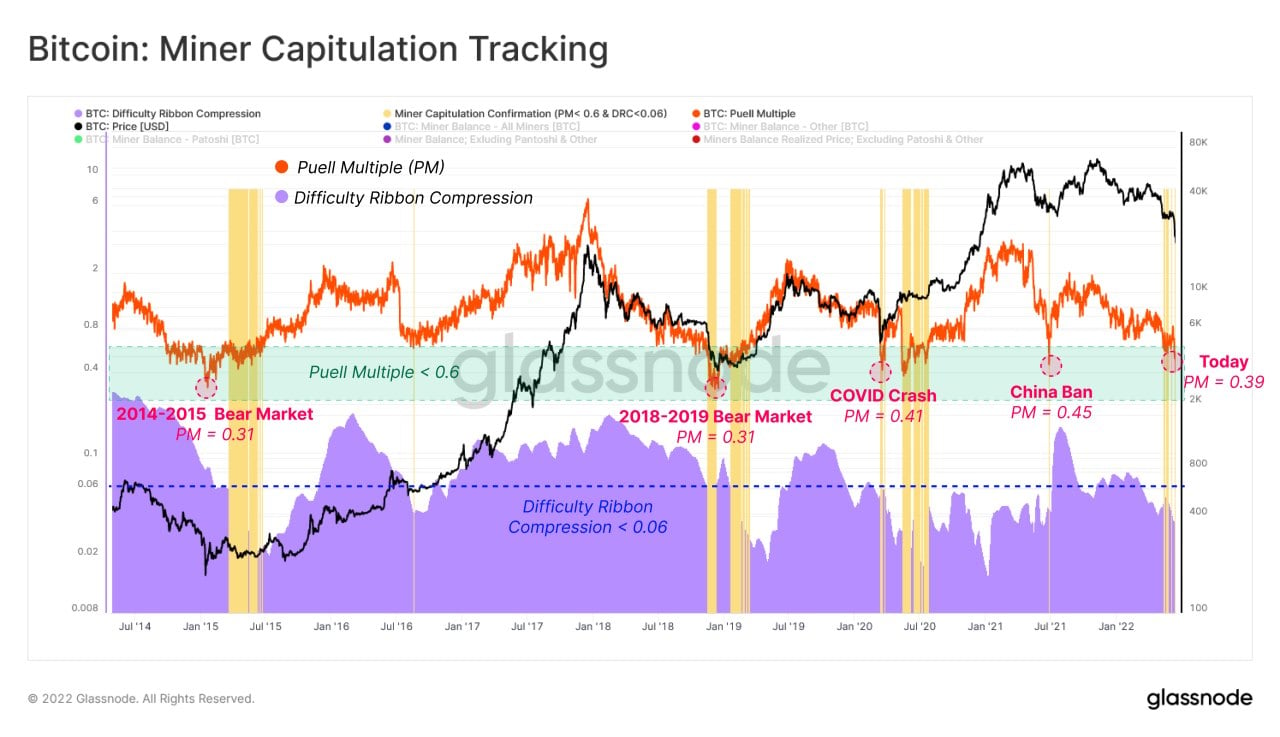

This is perfectly understandable as the Puell Multiple, which tracks miners’ profitability, has fallen to the lowest levels since the Nov 2018 bear market crash. Miners are earning only 39% of their one-year average USD returns currently.

Another miner sentiment indicator, the Difficulty Ribbon, is compressing. This signals miner stress and hints at potentially more miner capitulation on the horizon.

BTC Sets New Bearish Records

This bear market dump has seen BTC set several new bearish records. While this may not necessarily mean that the bullish BTC super cycle since 2008 is broken, it nonetheless opens up the possibility of more bearish long-term implications.

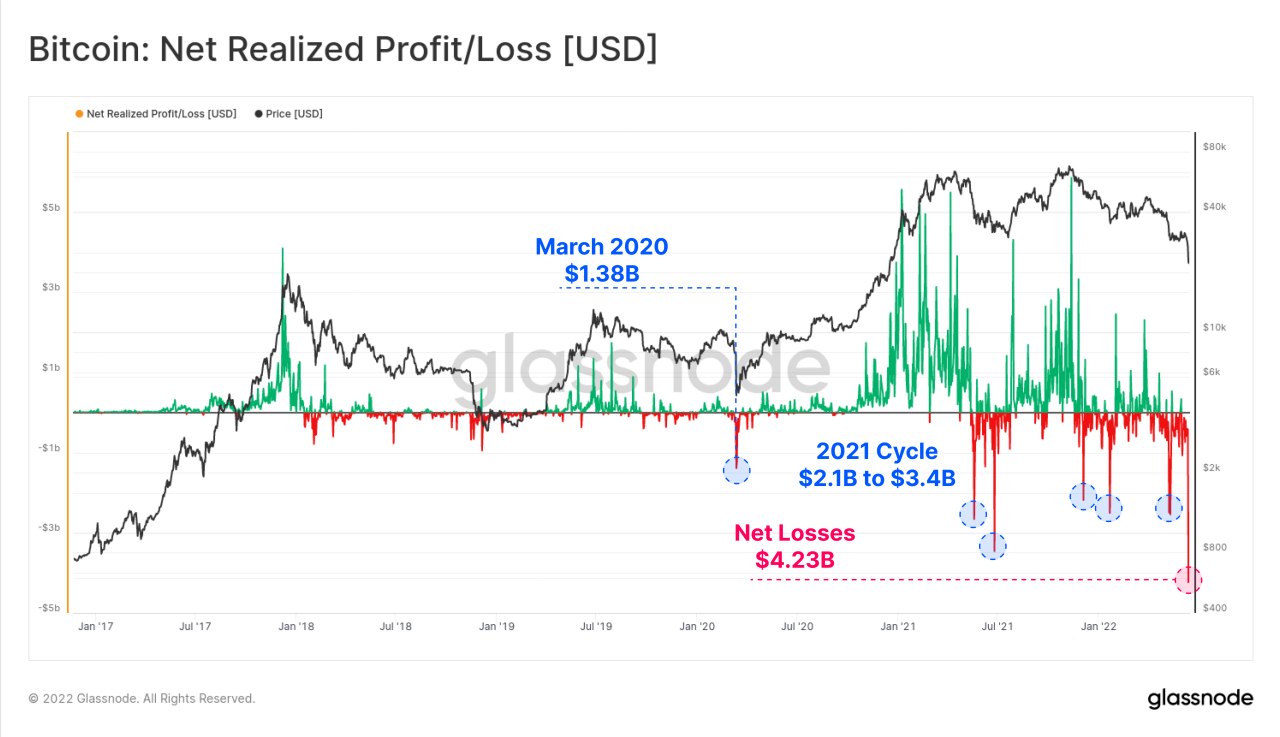

One such new record is the Net Realized Profit/Loss in USD, which has broken to a new low last week as BTC price dumped to $20,000 while the USD strengthened. BTC spent on-chain last week clocked realized net losses of over $4.23 billion, meaning that these sellers were selling at total losses of more than $4.23 billion. This value eclipses all major selloffs in BTC’s history and is 3x larger than that experienced in March 2020. While one may argue that this figure is much higher because BTC’s price is a lot higher this cycle than in the previous cycles, it nonetheless shows investors desperation to leave the scene.

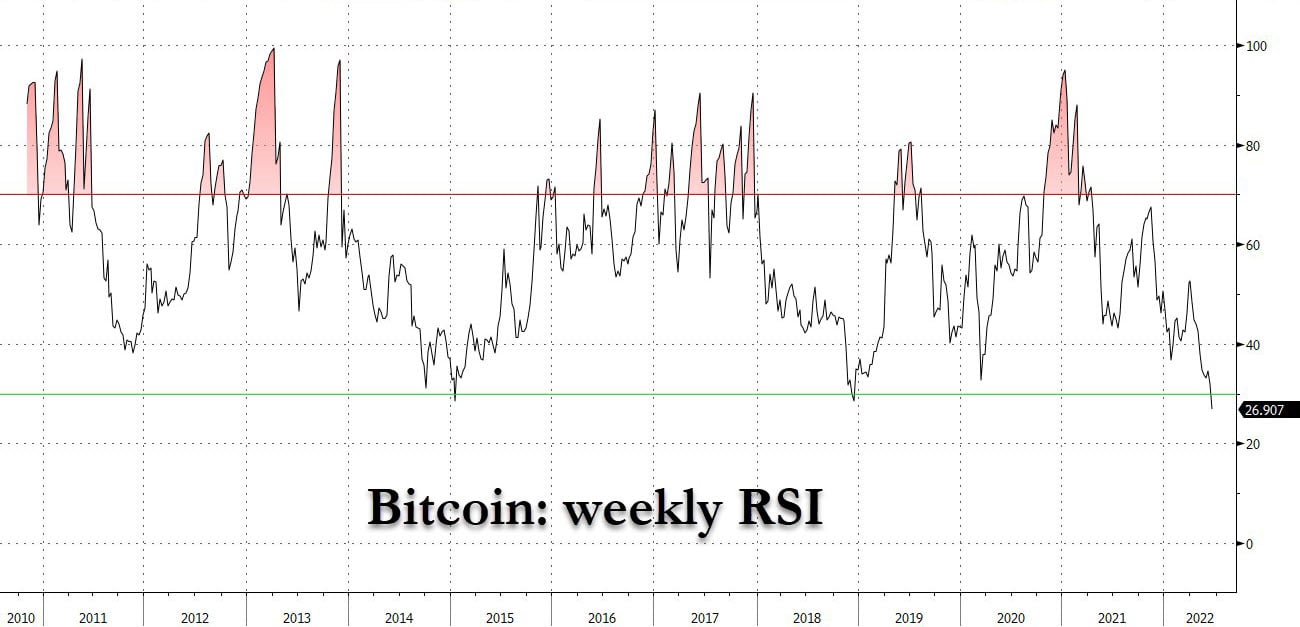

Interestingly, BTC is also currently at its most oversold level ever on the weekly charts. Even though history seems to suggest that BTC has bounced every time the weekly RSI hit this area, traders need to bear in mind that the weekly RSI still have room to roam lower.

BTC Not Without Dip Buyers

However bad the headlines may seem, BTC is not without buyers, as the Canadian Purpose BTC ETF continues to buy the dip, making its largest one-day purchase last Wednesday post Fed meeting. Purpose BTC ETF now holds the highest number of BTC in its one-year history, with around 47,908 BTC in its stash.

Another very large “buyer” appeared on Saturday when the price of BTC was cracking under intense pressure. The whale’s addition of 101,266 BTC at the average price of $19,176 managed to stop the price of BTC from tumbling further. While this wallet has been confirmed to be one of the cold wallets of the world’s largest crypto exchange, Binance, the crypto firm’s CEO has denied that the addition of these BTCs was a result of a purchase, but was instead, due to user deposits. Regardless of how this stash came about, the positive effect it had on the crypto market has been undeniable for the last 48 hours.

DeFi Liquidations Kicks ETH Down A Cliff

While BTC slipped a whopping 32% last week, ETH fared even worse, losing over 40% as its price crumbled under the weight of forced liquidations by various DeFi platforms where users pledged ETH to borrow more funds to acquire other crypto assets, or to buy more ETH. With many borrowers unable to top up their margin positions, the force closure of these positions caused ETH, which was the largest pledged asset, to be ruthlessly sold as platforms forced sold the positions. A lot of the positions were on DeFi platforms as the onchain volume of transactions taking place at a loss jumped significantly to its second highest in two months.

The last time a similar occurrence took place was between June and July of last year, where onchain losses formed a second lower spike after a huge first jump. The price of ETH formed a local double bottom subsequently and rebounded soon after. Hence, while fundamentals for ETH are still beyond desirable, a short-term oversold situation and drying up of large volume liquidations could see the price of ETH make a short-term bounce, which is already happening after the large BTC purchase by Binance.

DogeFather Elon Musk also joined in the fun, making DOGE jump around 20% off its low of $0.049 to $0.06 after he posted on twitter saying he would keep supporting the memecoin.

As we head into the new week, the crypto market is not expected to make a decisive move until Tuesday when the direction from the US stock market is clearer due to Monday being a US holiday.