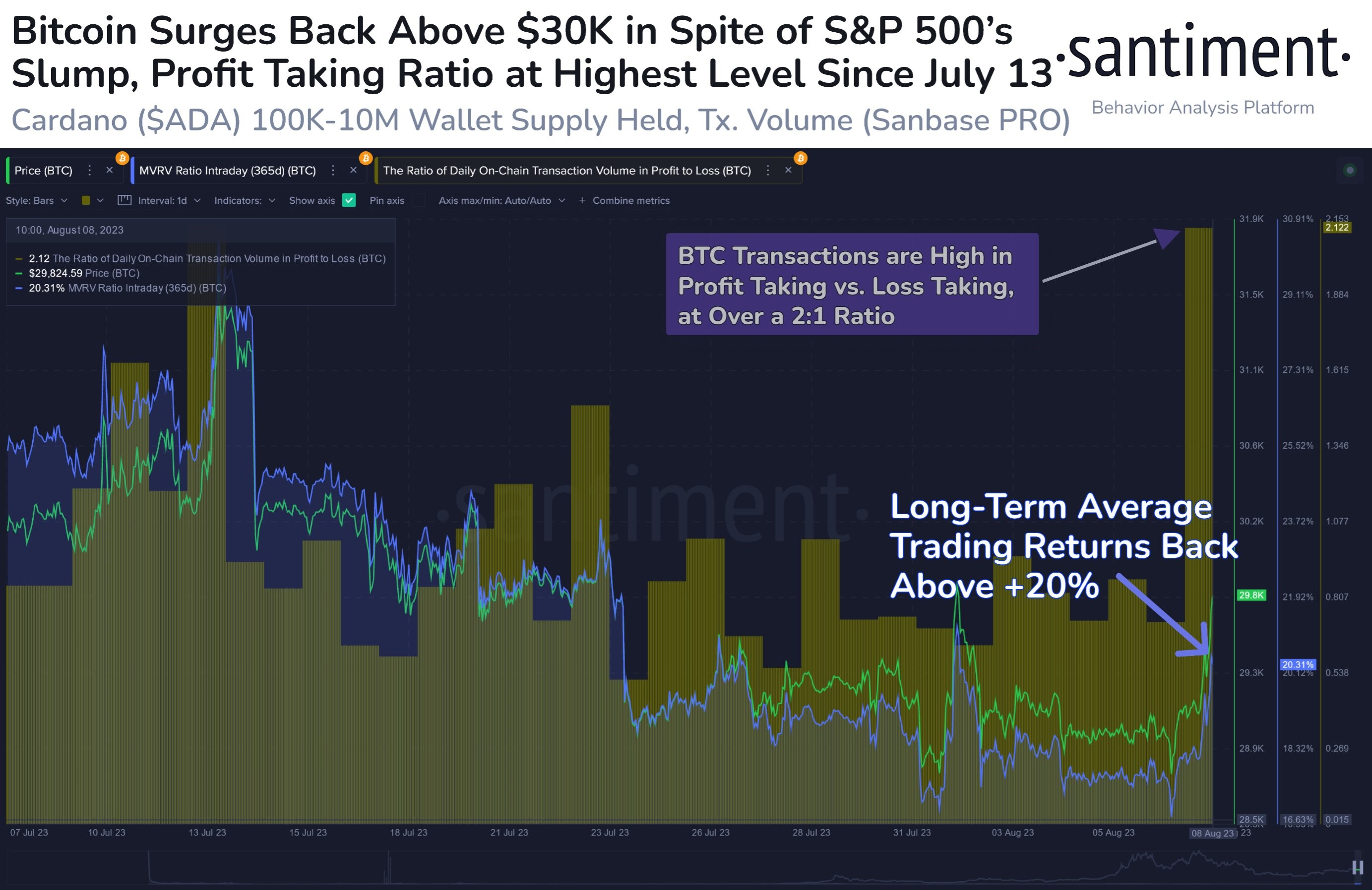

Just as we had foretold last week, crypto markets bounced early last week after a credit rating downgrade on US banks by Moody’s, with the price of BTC briefing passing $30,000 on Tuesday as US stocks crumbled.

However, many investors took the opportunity to take profit as the price of BTC revisited $30,000. This could be witnessed by the ratio of transactions sold in profit outweighing those sold at a loss, which was the highest in three weeks. This showed that BTC holders were not willing to sell at a loss but were price sensitive only at higher prices. While in the short-term such action may cap further increases in the price of BTC, it also proves that BTC holders were less willing to sell at a loss, which could prevent a large drop in price from occurring due to a lack of sellers at lower prices.

Furthermore, there has been a small improvement in the corporate uptake of BTC as a reserve asset, as Boyaa Interactive, a Hong Kong-listed company, announced that it will use $5 million to purchase BTC and ETH to strengthen its layout in the Web3 field. Buying and holding crypto as a reserve asset was one of the main themes that ignited the bull market of 2021 and thus, should the trend return, demand for crypto could increase and bring about higher prices. The Hong Kong market is one segment that should be keenly watched as the Hong Kong government has recently legalised crypto investment for all classes of investors to purchase crypto beginning June 2023. While one company does not make a trend, it is nonetheless an encouraging sign coming merely two months after Hong Kong has officially legalised crypto investment in the city-state.

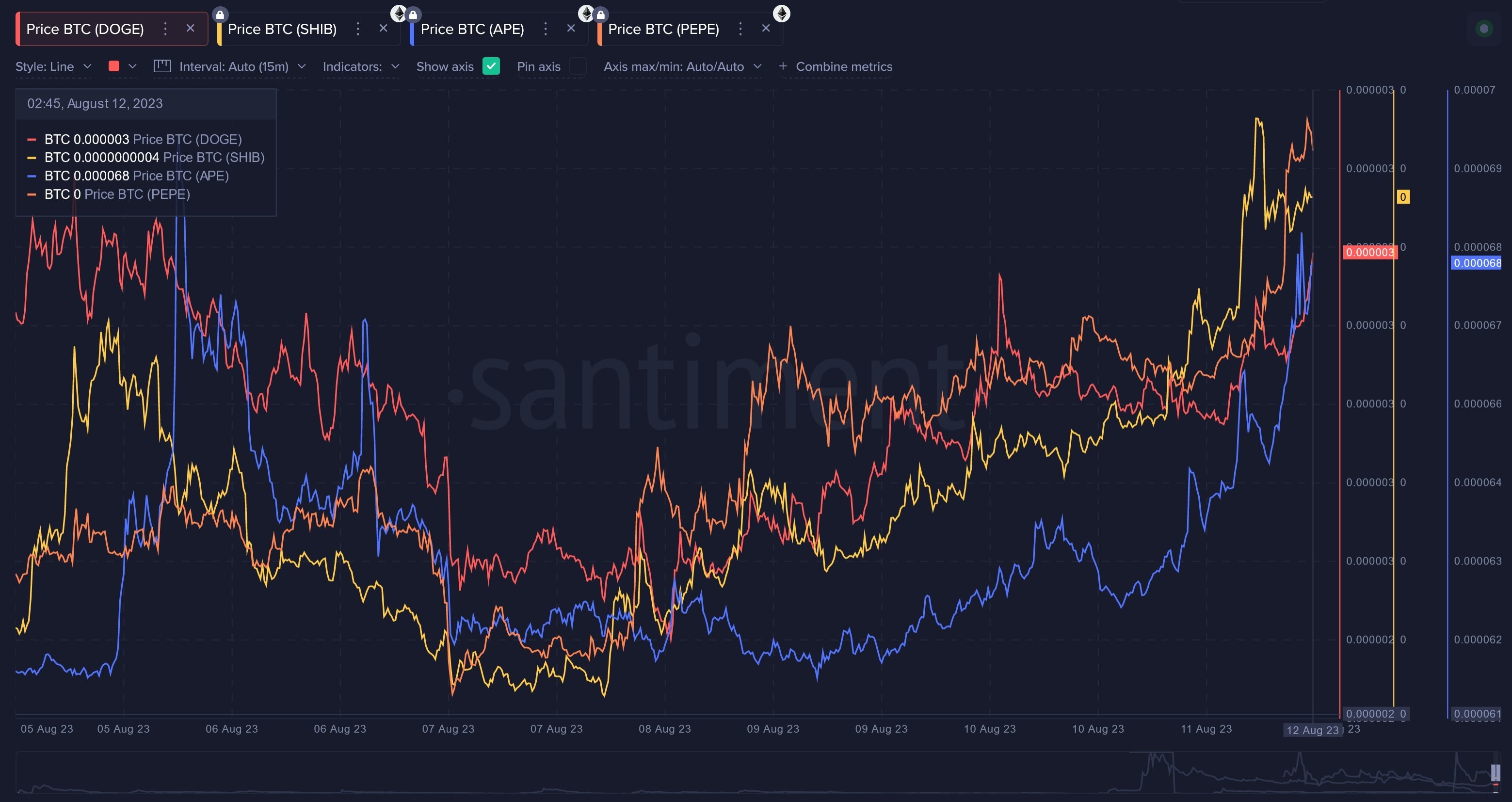

As King BTC continues to fixate itself around the $29,000 mark, altcoins, in particular meme coins, have taken the opportunity to provide some much-needed market action. As we had noted last week, SHIB has continued to provide the best trading opportunity, rising another 20% after a brief consolidation early week, breaking into a new local high as the SHIB army speculates that the launch of Shibarium would be on 16 August, this Wednesday. PEPE has also shown notable interest, gaining around 15% on good volume. Other meme coins like DOGE and APE also posted commendable gains, especially when comparing against BTC.

However, SHIB traders may need to remember to take some profits off the table as over the weekend, bankrupt crypto firm Voyager Digital was seen to have transferred some 250 billion SHIB tokens ($2.7 million) to Coinbase. Other than SHIB, Voyager also transferred 1,500 ETH ($2.77 million) and is also reportedly in the midst of sending all its other remaining crypto holdings to Coinbase, presumably for sale.

While not exactly good news, Voyager does not hold a large quantity of crypto to be able to have a significant impact and may not necessarily affect the market hugely in a negative way, especially when a number of altcoins are beginning to show signs of a positive increase in interest. For instance, RUNE rose more than 50% to become one of the top gainers in the market after the team introduced a new burn feature which would make the supply of RUNE deflationary.

As more altcoins begin to decouple from King BTC due to their respective fundamental growth stories, we highlight a couple of interesting ones worth noting below.

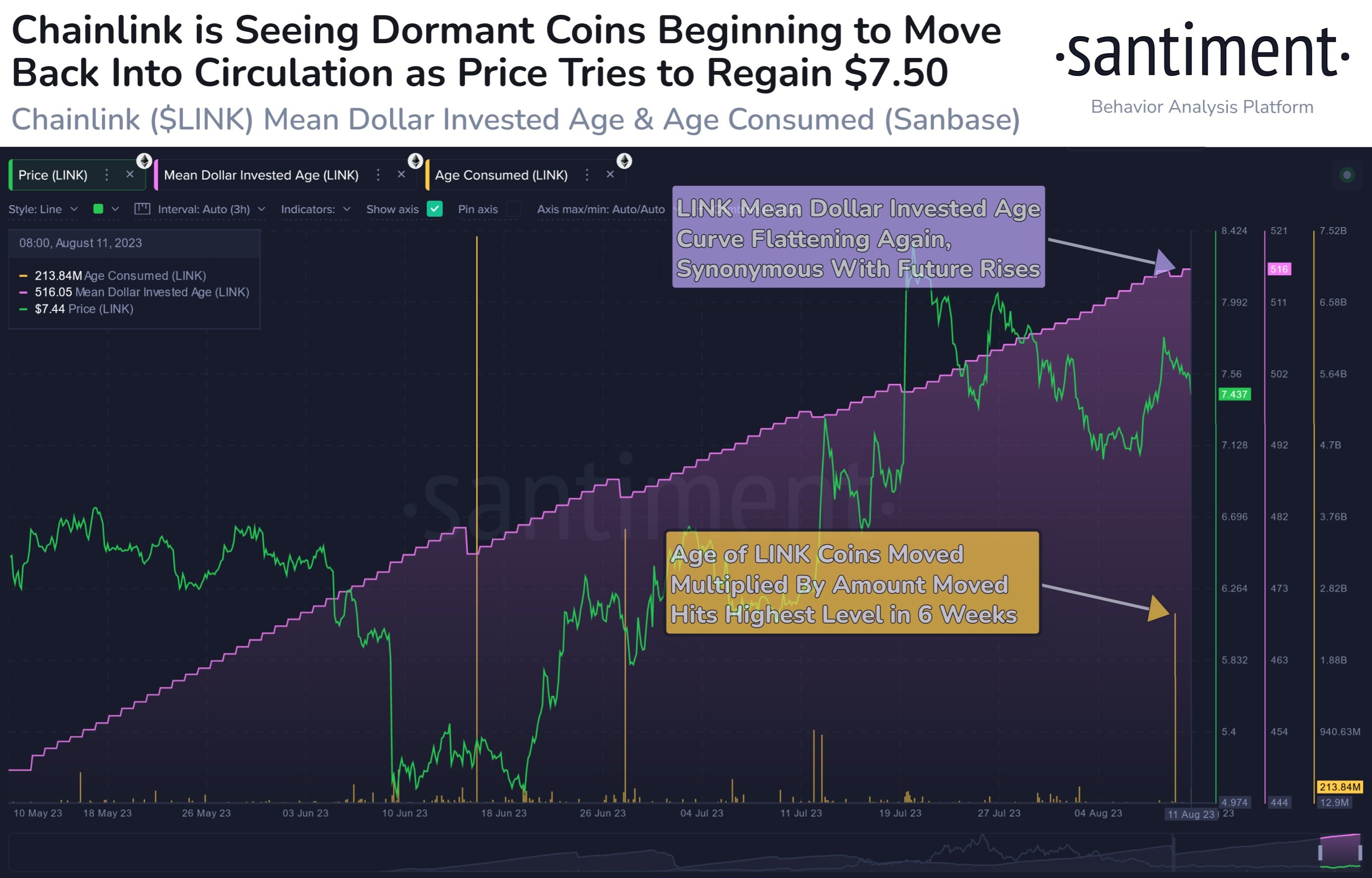

LINK and ADA whales appear to be onto something

LINK whales moved the highest amount of the LINK token in six weeks as its price neared $8, an action which presumably was a sell since the price of LINK retreated to below $7.50 subsequently. However, the tokens were quickly absorbed by new buyers, which was a sign that old coins were shifting hands to new buyers. While Santiment, an onchain analysis platform appears to have a positive view on the situation, we remain cautious and will advise more observation on the activities of LINK before deciding if it is positive or negative.

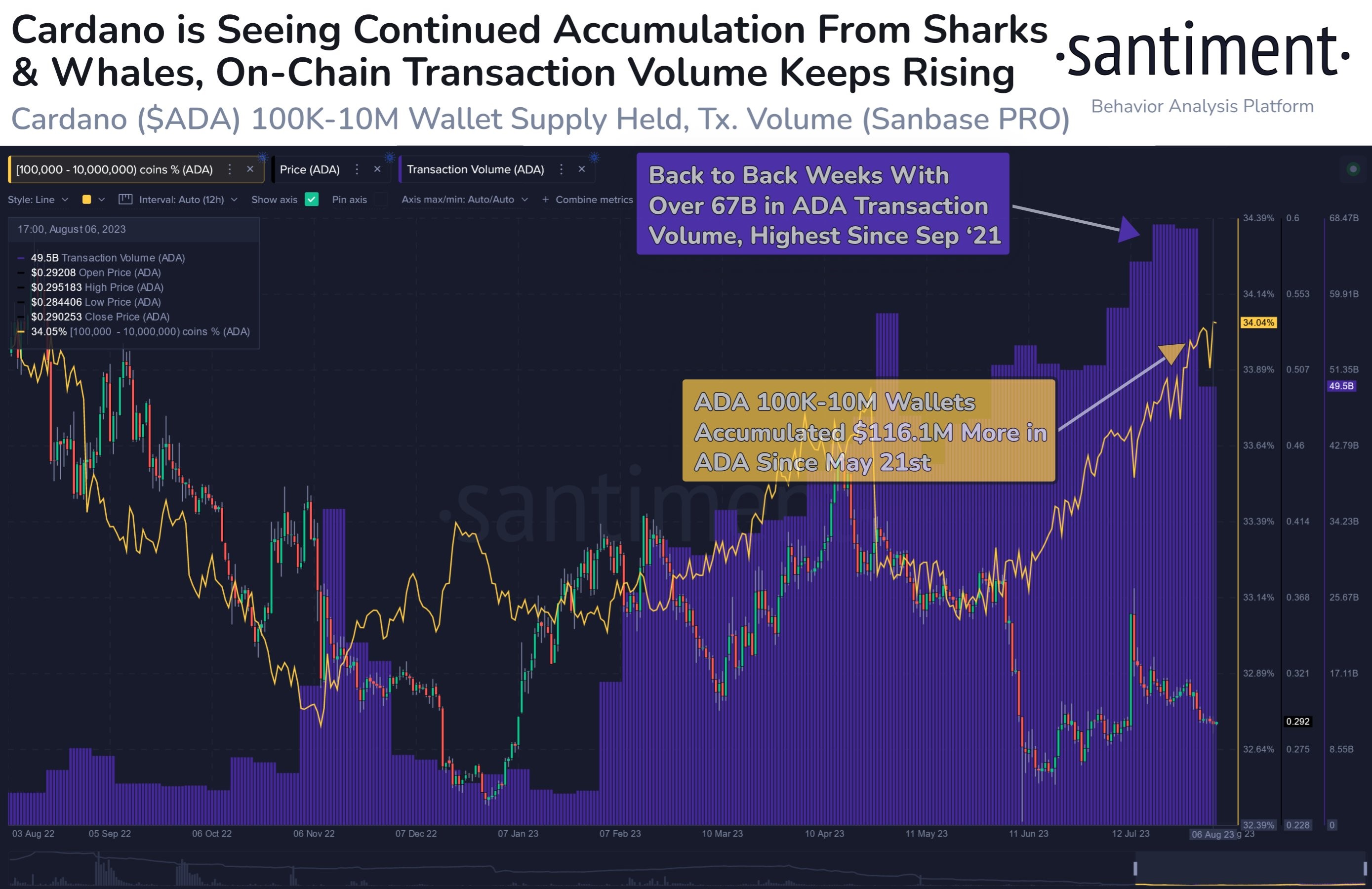

While the activities on LINK are rather baffling, action on ADA has been a lot more straightforward.

The amount of ADA held by whales and sharks holding between 100,000 to 10 million ADA is back to its highest level since September 2022 after a series of accumulation. Additionally, onchain transaction volume on the ADA blockchain has been rising nearly every week for the past six months, which is a sign of consistently increasing activity. Such metrics usually foreshadowed a subsequent rise in price in the past and thus it may be worth traders’ while to keep their eyes on ADA.

While ADA is seeing increasing whale accumulation which could boost its price, other blockchains are witnessing improvement in other metrics, which may eventually also translate into improving price performances when market sentiment improves.

TVL on DeFi platforms increasing

There is also some good news on the DeFi front, with Total Value Locked (TVL) in the top chains back to an increasing trend. After a persistent period of decline, the TVL on ETH-based protocols started increasing last week, with TVL growing from $40 billion at the end of July to $41.5 billion last week. While the increase of 3.8% is not an amount worth raving about, it nevertheless is an encouraging improvement after a period of decline. Should the TVL on ETH-based platforms continue to climb, demand for ETH could increase and thereby send its price higher.

Similarly, SOL has also seen an increase in its TVL since the end of July after its TVL fell by 20% between June to July. For the first two weeks of August, the TVL on SOL-based protocols increased by 15%, an increase far exceeding that of rival ETH. Hence, should this positive trend and pace of growth continue, the price growth of SOL could possibly outperform that of ETH.

Precious metals melt in the face of rising dollar

US stocks retreated after Moody’s downgraded the credit rating on several US regional banks, reigniting a selloff on the banking sector which dragged the entire stock market with it. China’s worsening economic numbers released over the week also added to worries that the world’s second largest economy could be slowing down faster and deeper than anticipated, which would eventually cause negative ripples to spread to other parts of the world.

There was a brief respite after the release of softer-than-expected CPI data on Thursday, however, stocks continued to retreat after Friday saw a higher-than-expected PPI release.

In the end, most US stocks closed lower for the week, with the S&P losing 0.3% and the Nasdaq dropping 1.9%. The Dow was an outlier, advancing 0.6% as investors still viewed the declining CPI print as a sign that the FED would have to pause in the upcoming September meeting. The odds for a no-hike in September has now risen to 90.5% post the release of both consumer (CPI) and producer price (PPI) gauges.

Despite everything that one throws at it, the dollar continues to gain ground, with the DXY rising 0.8% against its peers. The dollar strength was especially evident in the USD/JPY pair, which rose 2.2% over the week. The persistent dollar strength dragged precious metals lower, as Gold dropped 1.6% and Silver lost almost 4%. As the new week begins, the dollar continues to outperform even as Asian stocks and the US stock index futures fall.

The only thing remaining resilient against the rising dollar tide is Oil, which has continued to inch higher for a seventh consecutive positive week for the first time since June 2022. The WTI ended the week up 0.1%, while Brent gained 0.16%, while both are opening the new week a tad lower.

Cryptocurrencies also appear to be getting less correlated to the dollar as the strong dollar has not brought about a corresponding decline in the value of crypto. While the crypto market has continued to languish in a period of disinterest and price weakness, the week’s rising dollar tide did not appear to materially weaken crypto prices further.

However, the new week is starting out on a shaky footing as the deteriorating situation in China’s property sector is taking a hit on overall trading sentiment after Country Garden, one of China’s top property developers, is at risk of insolvency. While the impact of such news on the equity market is a definite negative, how crypto prices will be affected is unknown, as even though a risk-off sentiment would usually send all asset prices falling, a loss of faith in traditional assets could actually send capital flows into the crypto sector.

As the problems in China have gotten investors’ attention in the early part of this week, midweek may see interest return to the USA as the FED meeting minutes will be published on Wednesday. Tuesday will also be an important day for US stocks and the dollar as the retail sales number will be released.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.