Following renowned private investor Max Keiser’s report of rumors that Qatar’s Sovereign Wealth Fund has entered the “Bitcoin market” and could be interested in purchasing up to $500 billion worth of BTC, the price of BTC went straight up to almost $45,000 last week.

Bloomberg analyst James Seyffart’s update that said that BlackRock has once again submitted a revised BTC spot ETFS-1 document to the US SEC also helped string hopes along. The SEC apparently issued identical or very similar instructions to multiple issuers. Previously, Bitwise also submitted a second revised S-1 document. These frequent meetings and updates manifest that the SEC and these issuers are working hard to resolve whatever issues that are standing in the way, which gives room for optimism. With James also having pushed the ETF approval window to between 8 and 10 January next year without the market having any kind of negative reaction, it shows a very strong underlying strength in the BTC market that is not likely to go away anytime soon until there is some concrete news about the ETFs.

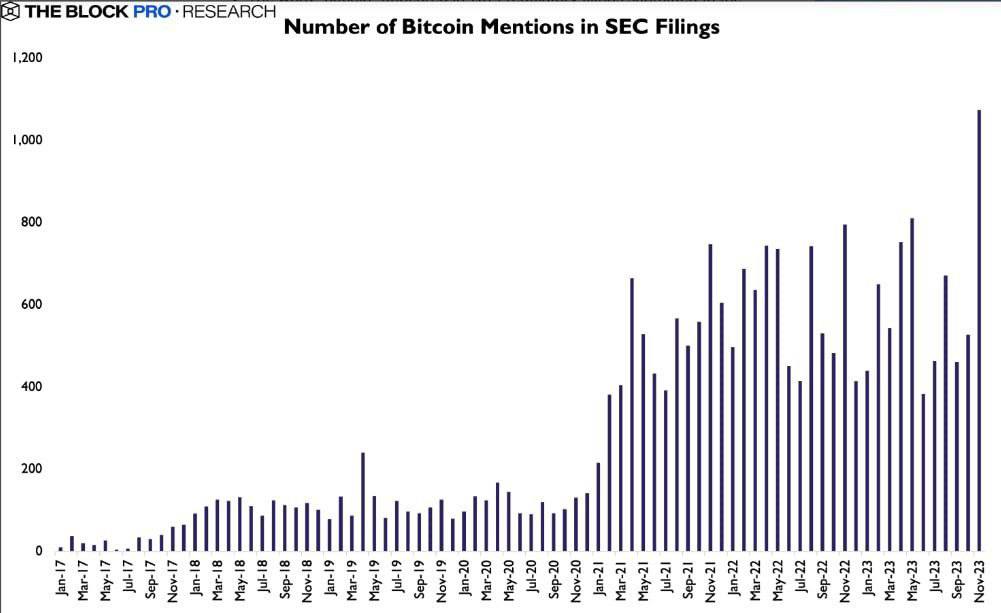

Institutions FOMO to launch BTC products

As a demonstration of how bullish traditional finance investors and firms are about the prospects of BTC, the number of times BTC has been mentioned in November filings at the SEC doubled from that in September, reaching an all-time-high of 1,074 times as more and more institutional firms try to launch a BTC spot ETF.

Not only are traditional finance guys bullish, BTC miners are also turning increasingly bullish as BTC’s price finally trades firmly above their cost of production of around $36,000 after being in the doldrums for two years. This can be seen in Marathon Digital’s November update report, where the firm announced that out of 1,187 BTC that they produced last month, they only sold 700 to cover expenses and will be holding the rest.

Retail investors have barely entered the market

While the recent price action has appeared to be frothy to some conservative investors, the fact remains that the market is not yet overheated since the retail market has barely entered. Thus far, inflows to the crypto space have largely been institutional flows centred on BTC due to the spot ETF draw, and the man on the street has not yet caught on the trend.

This can be seen in the number of downloads for crypto apps in the US, where the number of downloads has barely climbed. As retail investors are normally the last to enter, this lack of retail participation is a sign that we are still early, which could mean that the current rally may have more room to continue running.

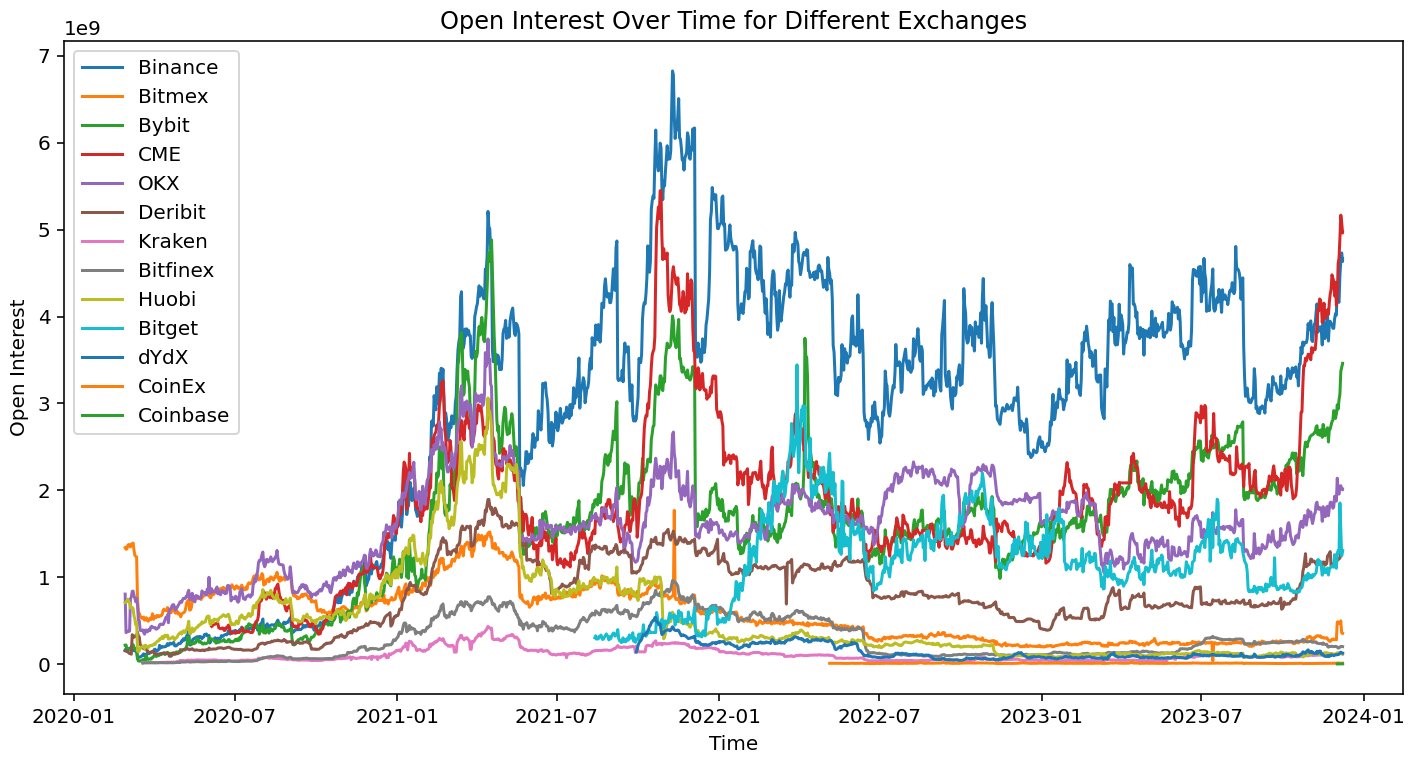

Another way to show that the current rise in prices is backed by institutional investors and not retail investors is by looking at the BTC futures open interest. According to the data below, the CME futures which institutional investors trade on has been the venue witnessing the sharpest increase in open interest, showing that it is institutional FOMO that has been driving the recent jump in BTC’s price. With institutions putting up strong bids, the price of BTC could remain elevated until there is a concrete update from the SEC regarding the spot BTC applications.

BTC profits rotating into ETH a precursor to altseason

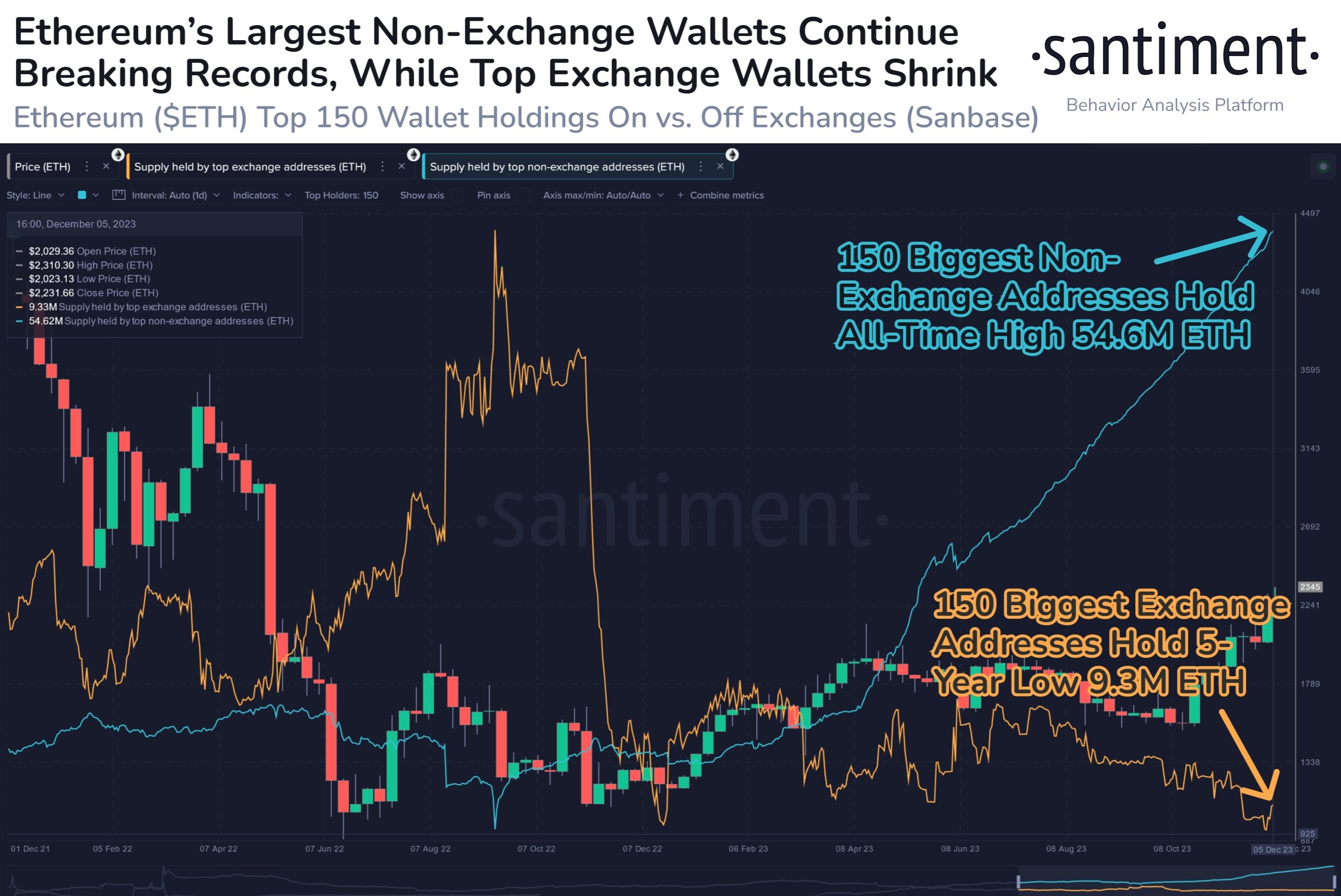

As the open interest of BTC shot to a high and while its price neared the major $48,000 resistance, institutional investors’ attention naturally turned to ETH, which had been lagging in this run up. As the risk:reward for buying BTC started to narrow, investors have rotated into ETH, which is also pending a couple of spot ETF approvals.

The price of ETH exploded near the end of the week, rising more than 20% after the accumulation of ETH picked up pace in the month of December. Notably, the amount of ETH held at exchanges is now at a 5-year low, with only around 9,300 ETH held in aggregate. This supply tightness could continue to propel the price of ETH upwards as an increasing number of investors are getting bullish over its upcoming Cancun upgrade that is slated for 1Q24 where sharding could be introduced.

As the bellwether for altcoins, the catchup in the price of ETH is a good indicator of better times to come for altcoins, which had taken advantage of the brief consolidation in BTC to push strongly higher. This move could signify that the much-awaited mini altseason has resumed after prices consolidated for almost six weeks.

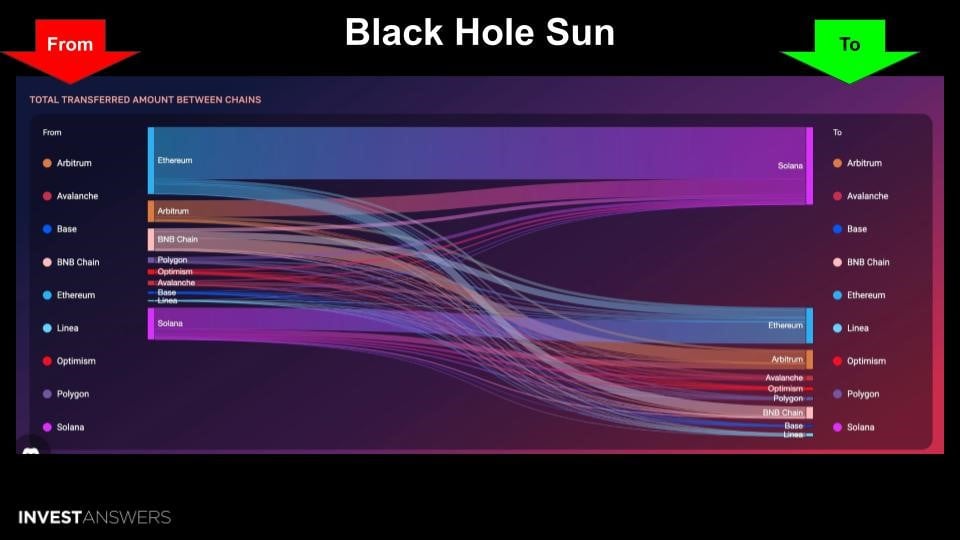

Popular top coins like AVAX, SOL and LINK that were the front runners in the October run up once again led the gainers list, with SOL displaying a magnificent recovery after an airdrop token JTO got listed at $3, driving a myriad of all kinds of investors to buy the SOL token in order to interact with the Solana ecosystem, with the hope of getting other similar airdrops.

To illustrate the extent of the rush of funds into the Solana ecosystem, check the below diagram which tracks the amount of value bridged from one chain to another. As can be seen, Friday saw a huge swing of funds moving from other blockchains into Solana. Should this trend continue, we could see more good days ahead for the price of SOL.

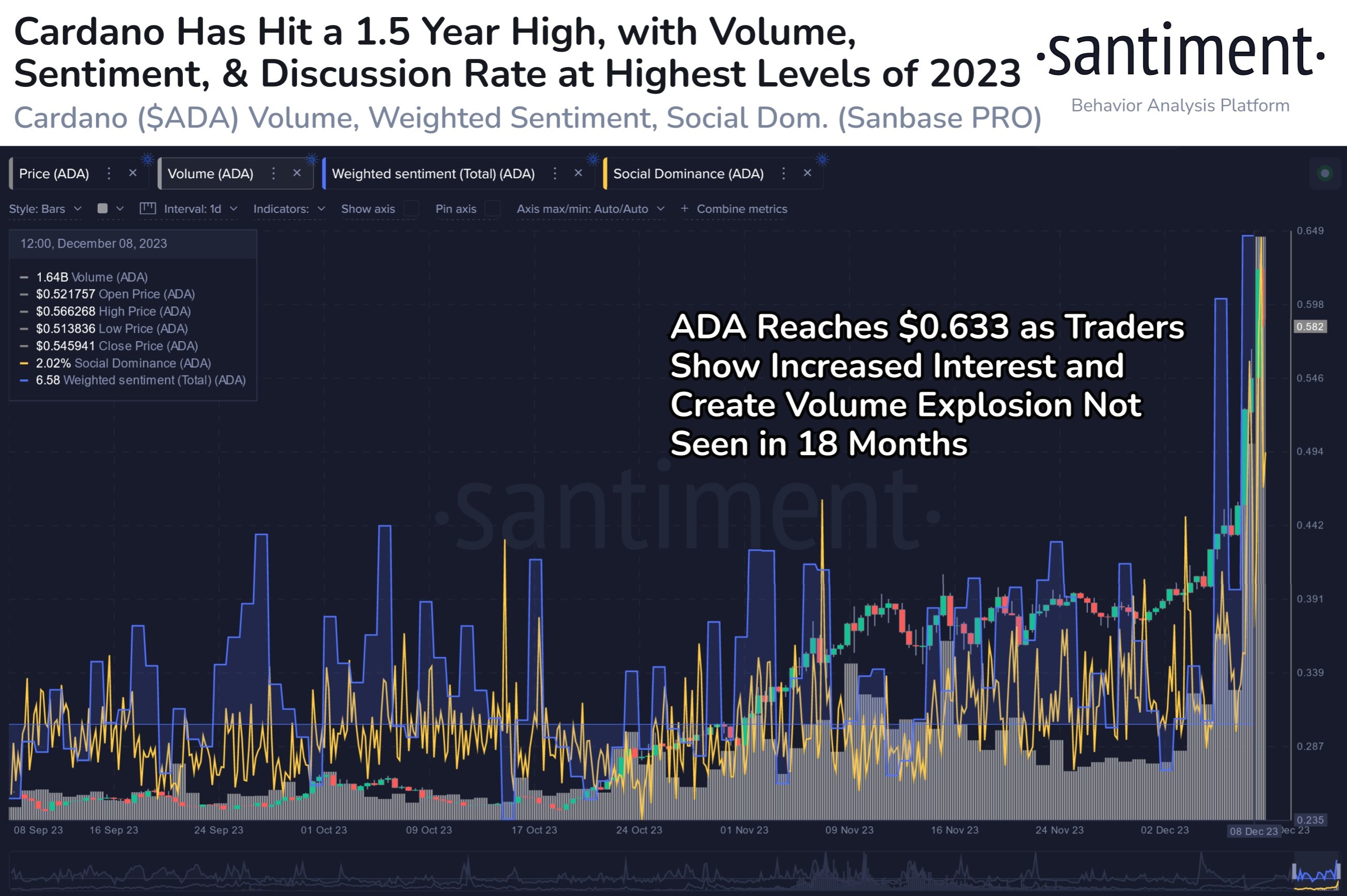

Following the popularity of airdrops, Cardano also announced that there would be airdrops for users on the protocols on the Cardano blockchain, which led to a rush of money buying the ADA token so as to be able to interact with the Cardano blockchain. As a result, ADA saw a massive trading volume expansion not seen in 18 months, which led to a price increase of almost 50% in a week, to its highest price since June 2022.

Stocks rise to new 2023 high after strong jobs report

A stronger than expected non-farm payrolls report released on Friday negated the negative effect of the private sector payroll number which came in below expectations on Wednesday, sending stocks to their highest level for the year 2023 by the end of the week.

While the ADP private payrolls report released on Wednesday showed that private sector jobs increased by only 103,000 in November, below expectations of 128,000, government sector payrolls rose by 199,000, better than the 190,000 expected. Meanwhile, the report also showed an unexpected drop in the unemployment rate from 3.9% in the previous month to 3.7% in November.

The University of Michigan consumer survey data also signaled a resilient economy and cooling inflation, fueling hopes for a soft landing.

As a result, all the major US averages finished the week with gains. The S&P jumped 0.2% while the Dow finished marginally higher. Both indexes wrapped six winning weeks, their longest run since 2019. The Nasdaq advanced 0.7%.

With the dollar managing a strong rebound by around 0.8% for the week on stabilizing yields, Gold price witnessed a blowoff top once again near the big resistance of $2,150 and closed 3.3% lower, threatening to go below the $2,000 level. Silver too had a nasty week, dropping by almost 10%.

Oil had a lousy week as well on weak demand expected from China following economic figures that showed a less than anticipated recovery in most sectors in the world’s second largest economic power. With Saudi Arabia cutting cash crude prices to China for next month, the market is worried about demand even as oversupply concerns continue to exacerbate. The EIA data last week showed US gasoline stockpiles rising by more than 5 million barrels versus estimates of a build of 1.3 million, intensifying concerns of an oversupply. As a result, oil prices fell around 4% last week.

This week will be quieter on the economic front, with only the final central bank meetings for the year that will be in focus. However, before the FED’s meeting on Wednesday, there will be one more US CPI data released on Tuesday, which is not expected to affect bets that the FED will not raise rates in this meeting. A “Super Thursday” will be in the works in Europe as three major central banks will be holding their final monetary policy meetings for the year on the day. These countries are, the EU, Switzerland and England.

As the traditional markets start to wind down activities for the year-end holiday season, more attention could shift to the crypto market, especially on the altcoins segment which has just started to show new signs of life again after staying relatively quiet throughout November.

At the start of this new week, traders’ adjustment of positions before the FED meeting has led the dollar higher, causing the corresponding prices of commodities to dip further from last week’s prices. In particular, crypto prices witnessed a sharp drop as the price of BTC lost 3% in the Asian hours, pulling back the price of altcoins by around 10%, liquidating around $271 million worth of long positions within an hour. However, such dips are often healthy corrections to flush out late leveraged longs, which will improve the leverage ratio of the market and allow for healthier organic growth to persist longer.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.