Crypto prices jumped last week as the price of BTC tore through the year high of $31,800 after news that China would pump in more liquidity into their markets broke. Coupled with US yields easing off their highs and a credible looking sign that the Blackrock spot BTC ETF could finally be approved, the price of BTC rocketed pass $35,000 as the triggering of a series of stop losses above $32,000 propelled the price of BTC higher, slicing through the previous high of the year like a hot knife on butter.

The breakthrough happened on late Monday night when someone posted on Twitter that the Blackrock iShares Bitcoin Trust had been assigned a ticker code on the Depository Trust & Clearing Corporation (DTCC), which clears NASDAQ trades. This prompted traders to assume this to be a sign that the said ETF would be approved soon, which led to the breakout move in the price of BTC. While the spokesperson for DTCC later revealed that the ticker had been there since August, the price of BTC did not retreat even thereafter.

The breakout caused more than $300 million in short positions liquidated within the first 12-hours, the highest amount of short liquidations this year.

BTC’s breakout also sent the price of altcoins flying, with many popular altcoins rising by double digits percentage gains early on in the week. The increase in prices were in turn complemented by increases in onchain activities, which is generally a positive sign if the momentum can continue.

Later on in the week, it was further revealed that Ark Investment’s spot BTC Trust had also been assigned a ticker code by DTCC. Another good news was that Blockfi had emerged from bankruptcy and could start to process withdrawals, meaning that investors with funds stuck there could at least recover something, although it is still unknown how much they would be able to receive back. Regardless, the series of good news managed to keep the price of BTC elevated all through the week, with shallow retracements quickly met with more dip buying.

As the market has had a big move already early in the week, most of last week was spent on a consolidation mode, with coins which had moved more than 20% pausing to take a breather. Memecoins like FLOKI and PEPE took over the reins however, almost doubling in percentage gains as an increase in short-term profit-takers from the large cap coins rotated some hot speculative monies into these names.

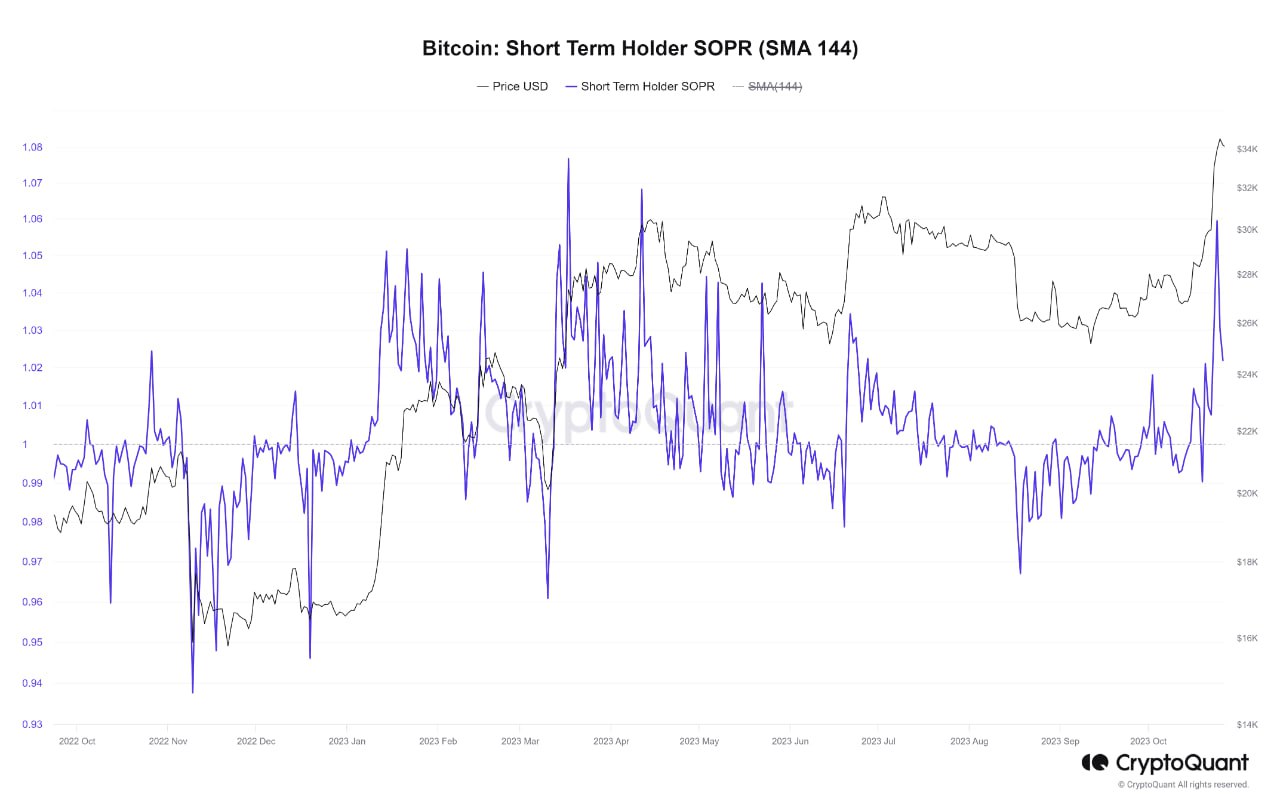

Short term BTC traders took profit above $34,000

As can be seen in the movement of the BTC short-term profit ratio (SOPR), a large number of short-term traders had taken profit when the price of BTC crossed above $34,000. While this may not necessarily be a bearish sign, in the past, such a big spike followed by an immediate decline in the SOPR often coincided with a period of price consolidation. Hence, there is a chance that BTC may need to pause for a short while before making its next big move. That said, the price of BTC is still hovering near the high point of $34,000, which is rather bullish for a period of consolidation, which could also imply that the consolidation period may not be as long as we anticipate.

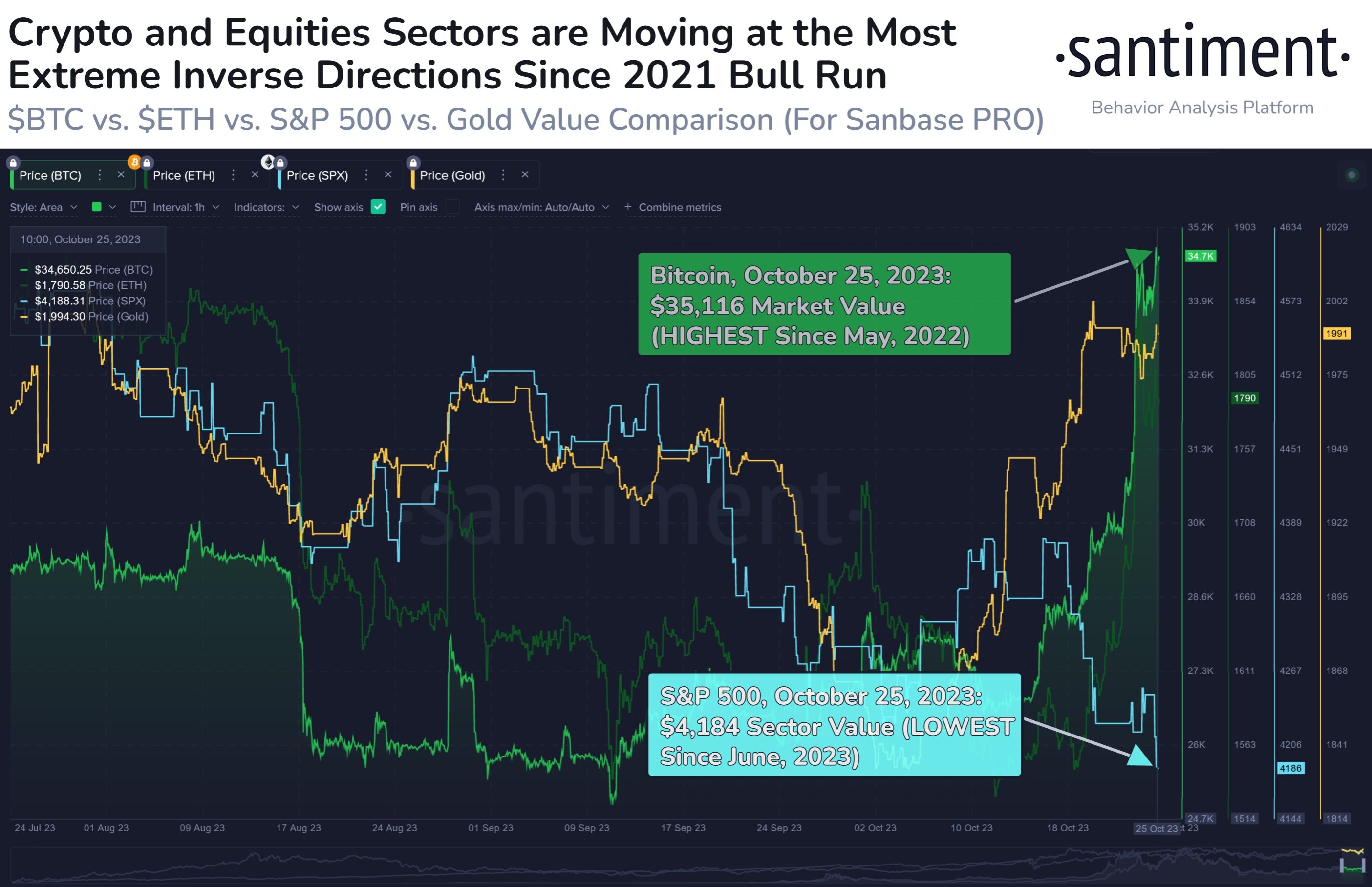

Crypto turning bullish as stocks falter

As BTC propelled its way to new highs last week, the US equities market, especially tech stocks, had a big decline. This stark difference in price action between the two asset classes may suggest that the crypto market’s past two-year positive correlation with equities has evaporated, which is typically a sign that points to impending bull market conditions for the crypto market. With this setup in place, it could mean that any dips in the crypto market in the near-term may be for buying instead of selling.

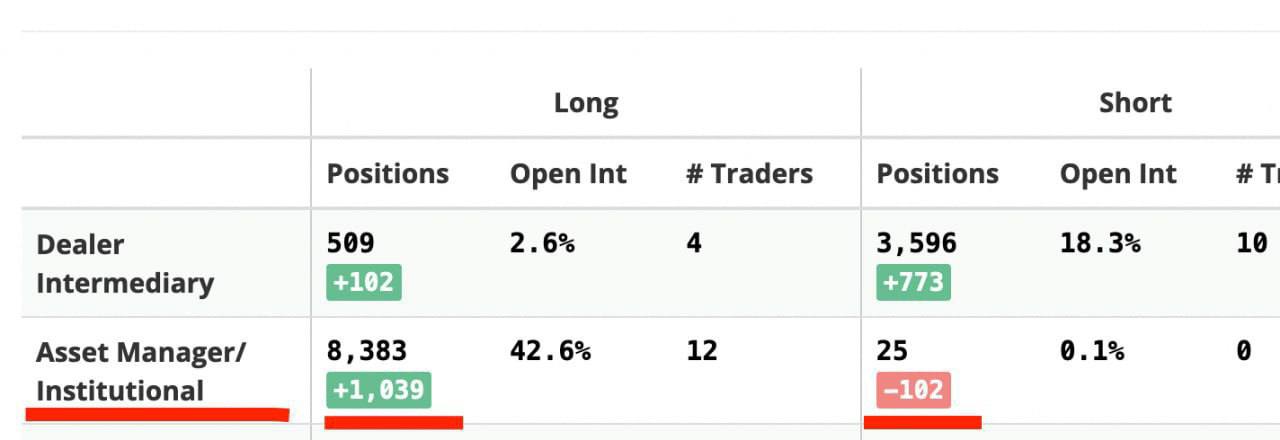

Furthermore, the open interest for BTC derivatives on the Chicago Mercantile Exchange (CME) had hit ATH of 100,000 BTC last week. This increase in volume for CME reflects growing interest in BTC from institutional investors, out of which a lot more long positions have been opened just last week alone, while the number of short positions have decreased. A broad bullishness from institutional investors should not be seen in the same light as bullishness from retail investors which is usually a contrarian indicator. Historically, price appreciates when the bulk of institutional investors are bullish, as evidenced during the last bull market which was sparked off by institutional investors buying.

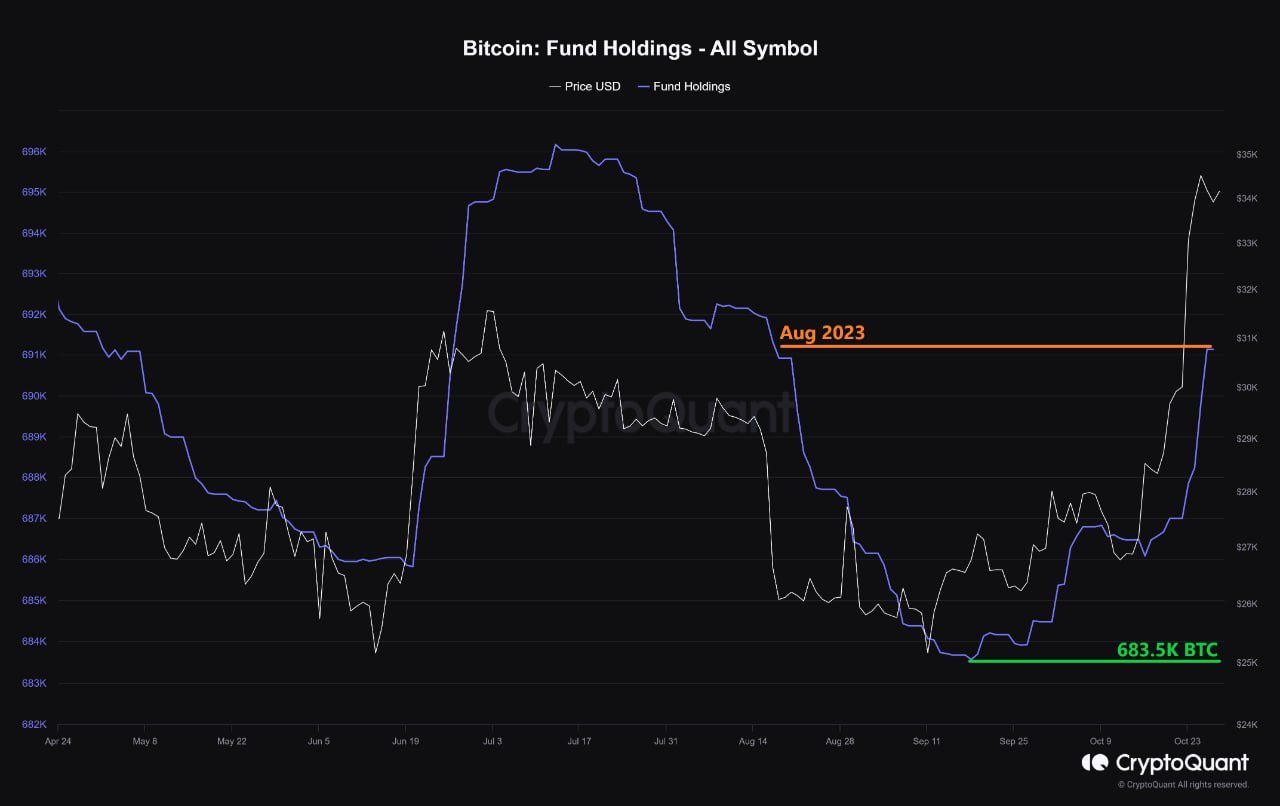

The amount of BTC holdings by institutional funds that hold BTC indirectly through investment in BTC trusts also showed a marked increase from its low of 683,500 units in September back to its August level of 691,000 units, a sign that optimism is back amongst corporate buyers.

Hence, taking into consideration the amount of new institutional bullishness, there could be room for the price of BTC to appreciate after the current period of consolidation ends.

Such a bullish outlook for BTC will definitely also benefit altcoins which generally have a higher beta than BTC, as we have seen last week how high beta coins outperformed BTC even when BTC had risen by more than 10%. Rotational play on altcoins will likely continue as long as this optimism is maintained into November, as we have seen over the weekend that as last week’s top beta players like LINK and SOL consolidated, new sectorial players like the Gamefi coins like GALA and AXS took over the rein to keep the market pumping.

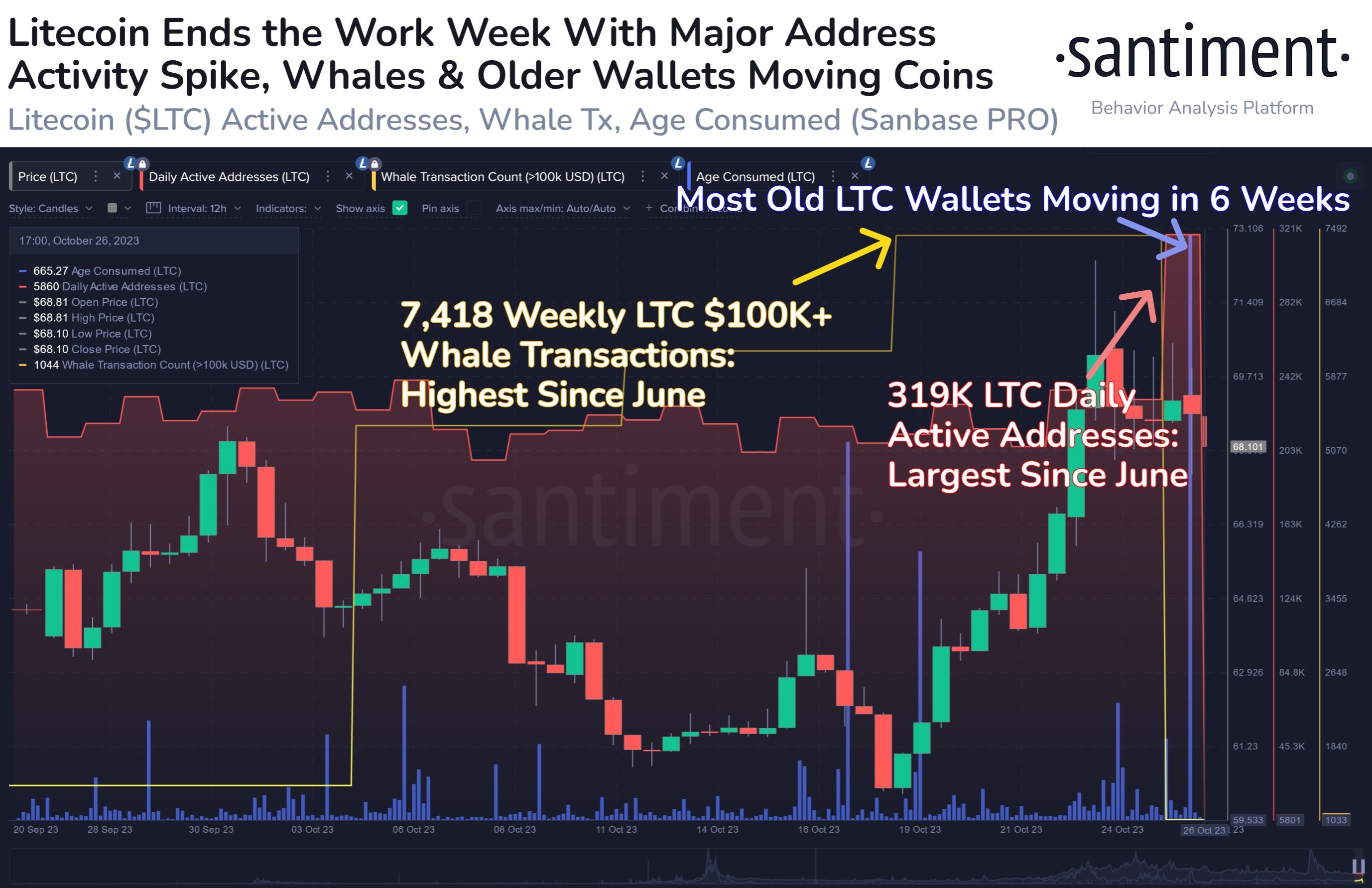

LTC onchain metrics show encouraging signs

As more popular altcoins that have made remarkable gains start to consolidate before making their next large moves, laggard altcoins could use the opportunity to make a comeback. One possible candidate could be LTC, which saw a rapidly rising onchain movement towards the end of last week. Address activity and whale action both hit levels last seen in June when the price of LTC had a 30% spike within a week.

Stocks plummet on recession fears as earnings disappoint

While it was all cheers and excitement in crypto, the US equities market, in contrast, had an awful week after companies reported a set of mixed results. Tech stocks were especially hard hit after earnings misses by a few large tech bellwethers like Alphabet and Meta, dragging the Nasdaq firmly down into correction territory.

Even better than expected data did nothing to lift stocks, as the US economy saw a higher than expected 3Q GDP number and a slower than expected inflation figure from the core PCE index. The 3Q GDP rose by an annual rate of 4.9%, ahead of estimates of 4.7%, while the annual core PCE price index in September was 3.7%, a new low since May 2021. While the benign PCE index managed to ease rising US yields, they did nothing to console stock investors as US stock indices have now firmly entered correction territory. JPMorgan CEO Jamie Dimon’s revelation about him planning to sell 1 million shares of the bank next year definitely did not help matters as well.

All three major US stock averages registered losses by the end of the week. The Dow dipped by 2.1% and the S&P lost 2.5%, while the Nasdaq fell 2.6%. However one good thing that happened was that US yields finally eased off their highs, putting on pause the soaring dollar trajectory for now at least, until the FED meets later this Wednesday.

The weaker dollar aided Gold, helping it close above the psychological $2,000 mark after gaining 1.27% for the week as tensions in the middle east continue to put a bid under the safe haven asset. Silver similarly fared positively, adding 0.6% to its price over the week to close above $23.

Oil prices however, fell after the US EIA reported an inventory increase of 1.4 million barrels for the week to 20 October, compared with an inventory drawdown of 4.5 million barrels for the week prior. The WTI lost 3.2% and Brent slipped by 3.4%. Both the ECB and BoC central bank meetings resulted in no change in their respective interest rates as they adopt a wait and see approach towards monetary policies amid the fast evolving geopolitical situation in the middle east.

As far as this new week is concerned, trading in the early Asian session has been quiet, with oil continuing to slip by about 1% and precious metals flat as traders await for the US market to come in to set the tone. However, action could be muted as traders may wait until after the important central bank meetings later on before making big trading decisions as the FED will meet on Wednesday, while the BoE will be meeting on Thursday. Before that, the BoJ will meet on Tuesday and all traders’ eyes and ears will be with the BoJ to see what the central bank would do as the USD/JPY is trading very near to 150, a level that traders thought was a crucial level to not cross for Japan.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.