US stocks closed out a dismal April as investors contended with a slew of headwinds, from the FED’s more aggressive-than-hoped monetary tightening cycle, persistent inflation, COVID case spikes in China, the ongoing war in Ukraine, and the latest worry – the negative GDP reading for 1Q2022. The GDP number for the US economy released on Thursday shocked market watchers as it printed a -1.4% growth in 1Q2022, i.e. the economy contracted 1.4% compared to a year ago.

The upcoming FED meeting this Wednesday where the FED is expected to raise interest rate by 50 bps and talk hawkish again by FED chief Powell have investors rushing out to take cover.

The hot core personal consumption expenditures price index released on Friday underscores the difficult inflationary price pressures the markets are navigating — the reading rose 5.2% from a year ago, sending the yield on the benchmark 10-year Treasury bond rising another 6.5 bps to 2.928% on Friday.

As a result, the USD rose very strongly against all currencies, with the DXY almost hitting 104 for a weekly gain of 2%. The current flight to the USD is causing Gold and Silver to fall for the second consecutive week. Silver had a disastrous week, falling yet another 6% after falling 8% the prior week. Gold also fell more than 1% last week, taking its price back below $1,900. Both precious metals have started the new trading week down another percent in Asian trading.

The stock market selloff on Friday was led in part by investors dumping Amazon shares after its earnings miss, dragging the Nasdaq lower by 4.2%, the S&P by 3.6%, and the Dow by 2.77%. For the week, the indices were down about the same percentage as Friday.

For the month of April, the Nasdaq fell about 13.3%, its worst monthly performance since October 2008 in the throngs of the financial crisis. The S&P lost 8.8%, its worst month since the March 2020 COVID crash. The Dow was down 4.9% on the month.

The Nasdaq finished at a new low for 2022 and so did the S&P, with the main stock benchmark taking out its previous low in March. In 2022, the average drop in the S&P has lasted roughly 2.5 days, more than any year since 1974, while its returns following down sessions have been negative 0.2%. That is its worst performance in almost five decades.

Over in Europe, an unexpected rate hike by Sweden’s Riksbank sent shivers down the spine of investors in Europe as they worried that the ECB would follow the same path sooner than expected. Rising interest rates are coming on the back of slowing global economies, with Europe affected by power issues due to the sanctions on Russia, while China battles with a surge in COVID cases, forcing lockdowns.

Amidst the gloom and doom however, Oil managed to post a rebound last week, with the WTI Crude back firmly above $100 after surging 9%. Brent Crude was also about 6.5% higher after EIA reported a drop in February’s US oil output on Friday. The oil supply situation is very tight as Europe tries in vain to find alternatives to Russian oil as they start imposing their ban. While Oil has retreated slightly more than 1% in early Asian trading this new week, experts still expect higher prices ahead.

With tech stocks having a meltdown, weakness in the crypto market was expected. However, despite tech stocks falling deeper into the red, BTC managed to stay supported at around $37,000. Altcoins, though, were badly hit as most altcoins retreated double digits over the week, with many coins falling more than 20%. One previously popular coin, FTM, fell 40% after a suspected flaw in the blockchain allowed a hacker to steal more than $13 million worth of FTM tokens on DEUS, a DeFi platform built on the network. After this event was made public, the FTM token fell to the point that its founding members’ FTM holdings on other DeFi protocols were at risk of getting liquidated, which further exacerbated its price fall.

Other bad news that sent a bloodbath to altcoins included other projects at other blockchains suffering rug pulls, the very popular SOL blockchain suffering a 7-hour breakdown after yet another DDOS attack, and ETH gas fee surging more than 10x over the weekend due to the popularity of the APE-metaverse land sales. With one bad news after another hitting altcoins, how BTC performs this coming week will be especially crucial to determine market sentiment.

Tech-Selloff Hurting Small BTC Whales

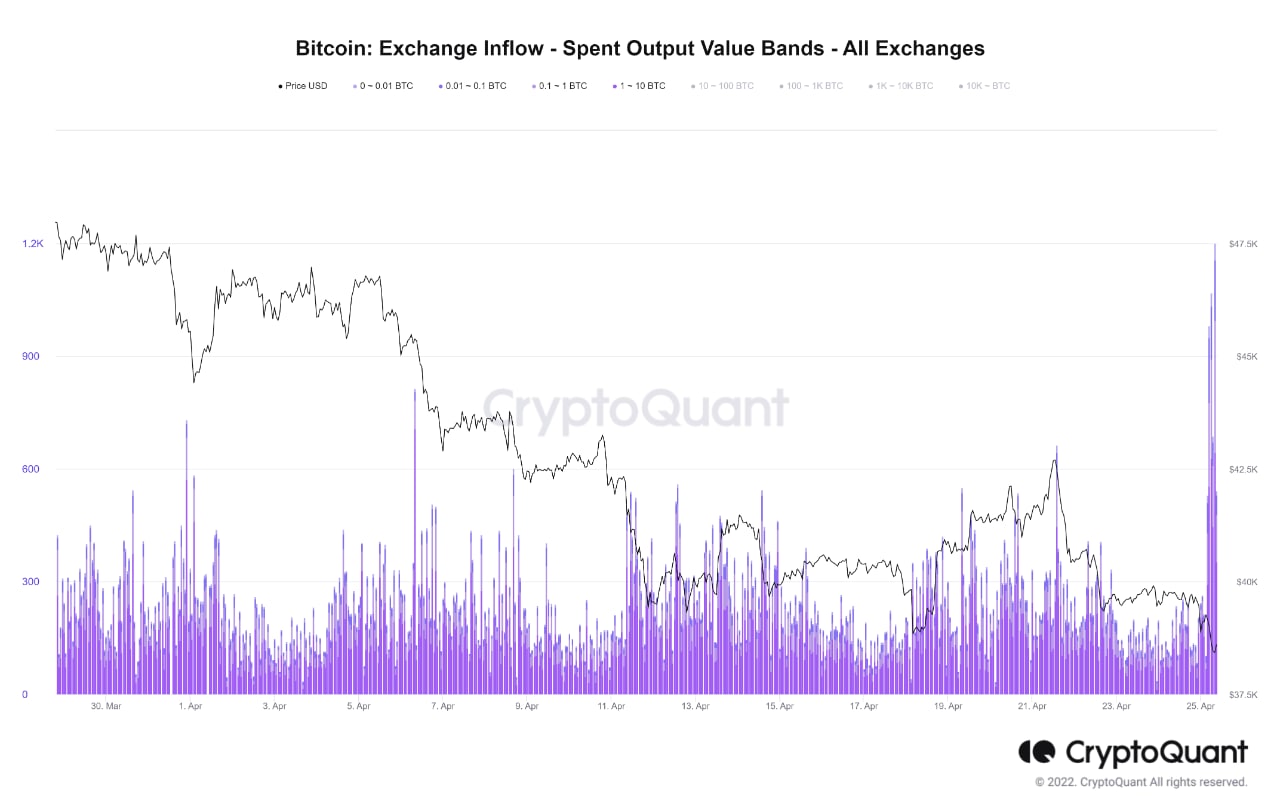

The onslaught of the tech-meltdown appears to be affecting the risk appetite of the individual investor, or smaller BTC whales. As can be seen in the diagram below, BTC Holders with 1 to 10 BTC were seen to be selling their BTC very actively last Tuesday. The spent output value band shows a sharp increase in the number of BTC sold on 26 April as the Nasdaq tanked lower.

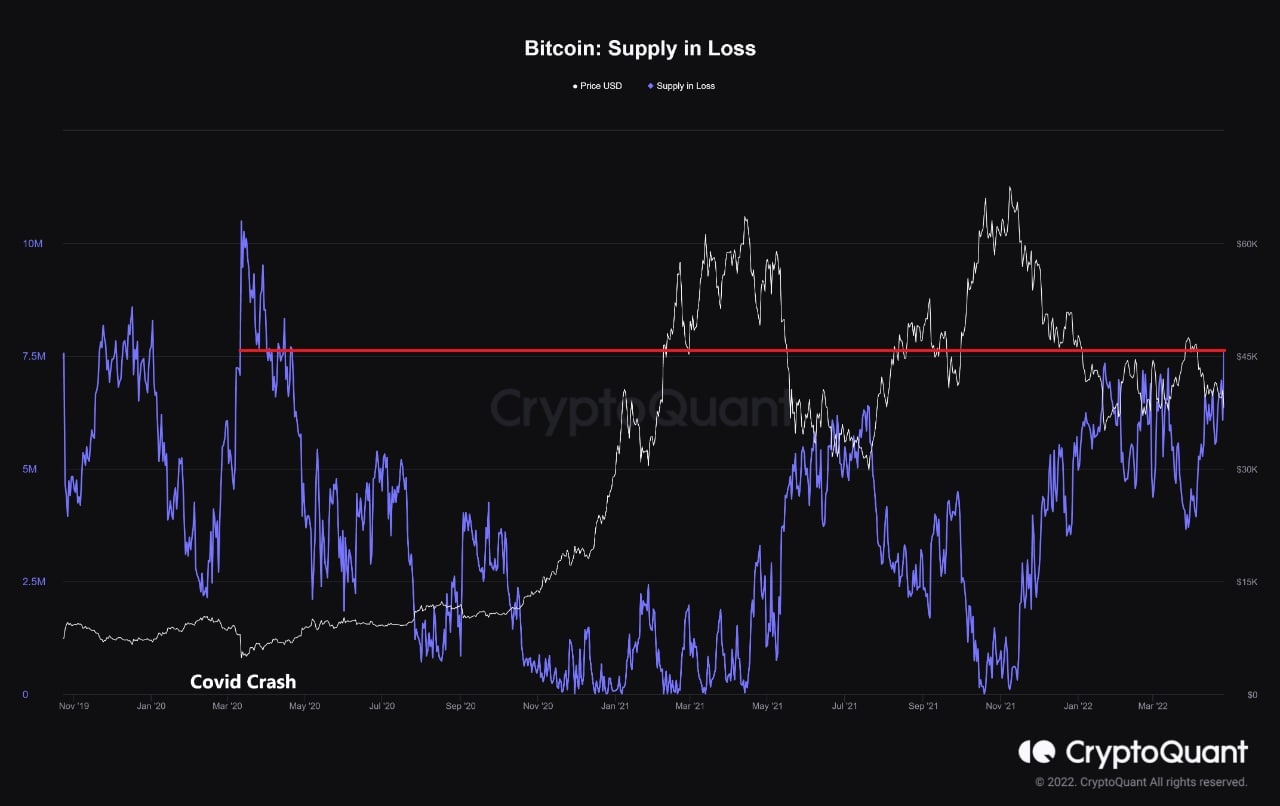

The BTC supply in loss has reached its highest level since COVID Crash. There are currently 7.59 million BTC in loss, which the market has not seen for a long time. The last time this amount of BTC was in losses was during the March 2020 COVID crash.

Seasoned BTC Whales Remain Unaffected

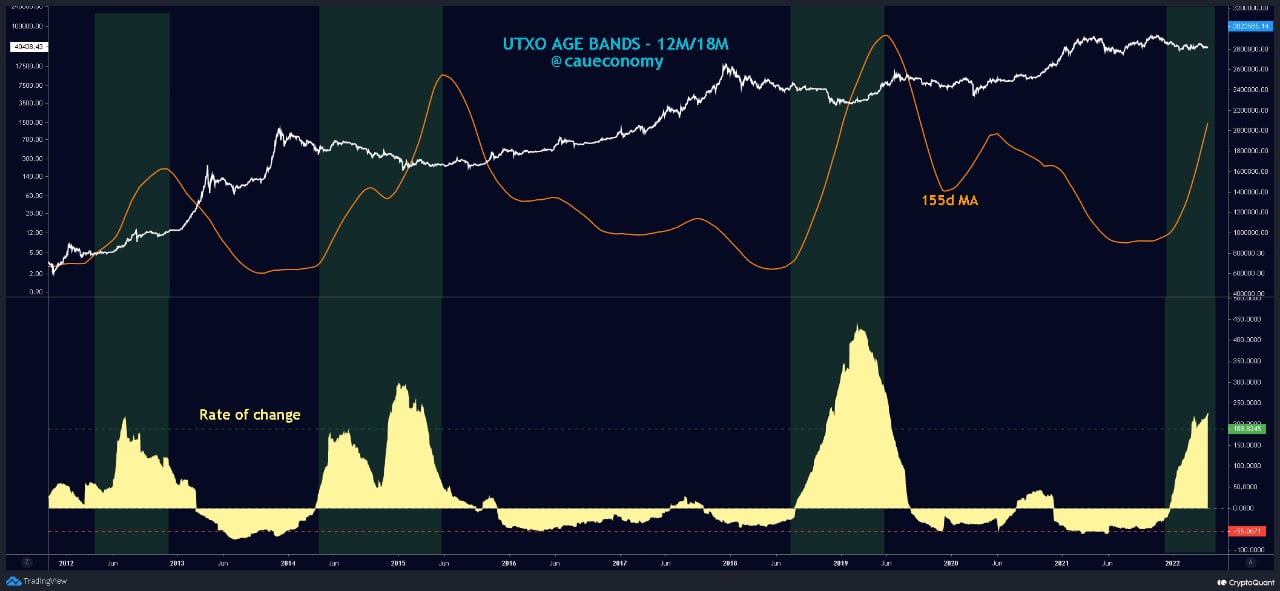

However, longer-term holders show no sign of panic. Coins between 12m-18m dormancy usually are the real smart money of BTC. At the moment this portion of coins is still in an accumulative season that sees no signs of reduction.

Other than long-term holders, large whales are also not disturbed. In fact, the number of large wallets containing more than 1,000 BTC have been on a sharp increase since early April, a sign that they are aggressively buying.

BTC Metrics Actually Turning More Bullish

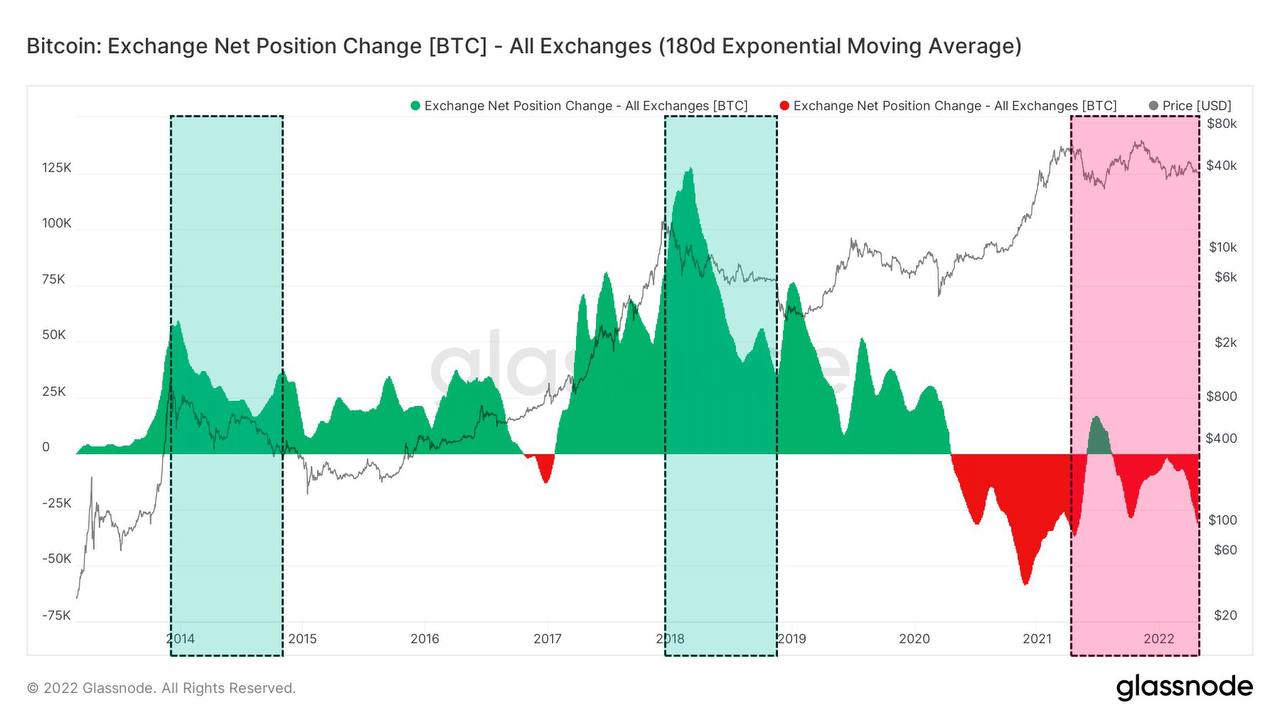

In the 6 months leading up to the last two major bear market capitulation events, we saw large amounts of BTC moving into the exchanges.

The last 6 months we have seen in 2022 however, were the exact opposite. Instead of inflows to exchanges, we are seeing large amounts of BTC being taken off of the exchanges.

The BTC exchange reserve is showing declines, implying that BTC is being taken off the exchanges.

Thus, could it be possible that, based on this phenomenon, that the past 6 months of was not a bear market, but merely a consolidation within a bull market? If this is the case, then a new ATH could possibly still be achieved in the imminent months ahead.

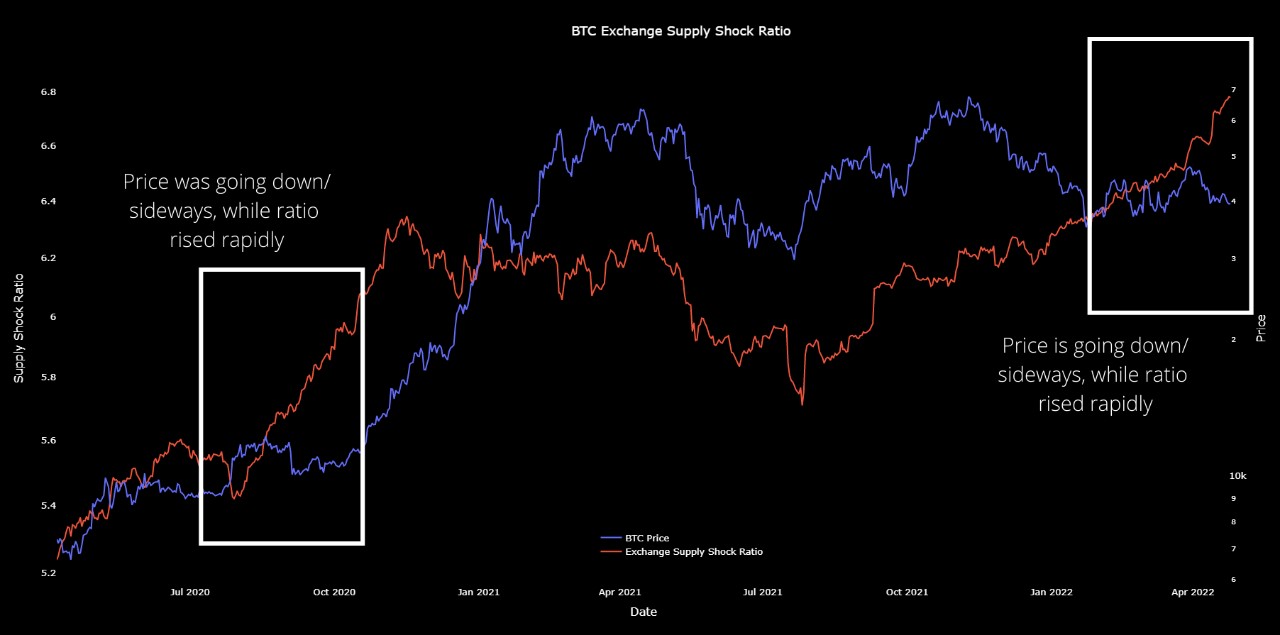

A way to illustrate BTC exchange reserve movement and their impact on price is to observe the Exchange Supply Shock Ratio, which measures the ratio between coins that are unlikely to be sold against the ones that are. In this instance, it plots the ratio of BTC on exchanges versus BTC in cold wallets. A rising ratio hence represents a sign of accumulation while a falling ratio would suggest distribution. From the diagram, even though the price of BTC has been stuck in a range, the ratio is rising rapidly, revealing aggressive accumulation and storage. The same situation happened in the summer of 2020 where the price of BTC was sideways, while the ratio rose sharply. The price of BTC subsequently rose spectacularly to begin the bull run.

Intriguing New Whale Scoops Up Plenty Of BTC

Another interesting observation was the emergence of a new whale wallet showing an aggressive accumulation of BTC. This wallet started buying BTC from 22 April with a zero balance, and has since amassed more than 25,000 BTC, worth around $1 billion, in less than a week. No one has managed to identify who this wallet belongs to, nor has any company revealed a huge BTC purchase as yet. However, this all but confirms the accumulation of BTC from people with deep pockets.

Get ready for ATH - buy now

From all the metrics shown, it would appear that the current market decline is flushing out BTC from small and weaker holders (most likely retail) to large whales with holding power.

Major Crypto News Last Week

Last week saw several notable positive updates from the real world’s adoption of crypto assets. First, two more countries have made crypto legal tender.

Early last week, the Central African Republic accepted BTC as legal tender. It is the first country in Africa to make BTC legal tender.

Following this, on Saturday, Panama passed a bill to regulate and circulate cryptocurrencies. It will accept the payment for goods and services with a list of approved cryptocurrencies in the country, and has also legalised all digital currency businesses. The list currently includes eight cryptocurrencies namely, Bitcoin, Ethereum, XRP, Litecoin, XDC Network, Elrond, Stellar, IOTA and Algorand.

More important than making crypto a mode of payment is that Panama will classify crypto gains as income from foreign sources. Thus, income from cryptocurrencies in Panama will not be subjected to capital gains nor income tax.

While other countries are just at the beginning, Dubai continues to be at the forefront in crypto acceptance. This time, Dubai-based real estate behemoth DAMAC Properties announced that it will accept BTC and ETH as payment for the purchase of real estate.

Other than for use in payment, crypto as an investment also saw a leap of faith coming from retirement portfolio managers.

US-based financial services firm Fidelity Investments said on Tuesday that will allow investors to put BTC into their 401(k) retirement savings accounts later this year. Fidelity held an estimated $2.4 trillion in 401(k) assets in 2020, and as such, their allowing of investors to put part of their retirement savings into BTC could usher in a large amount of fiat inflow to BTC. However, it is expected that Fidelity would impose a cap of up to 20% of investor funds that could be invested into BTC. Regardless of the limit, it nonetheless is a good start for better things to come from traditional finance.

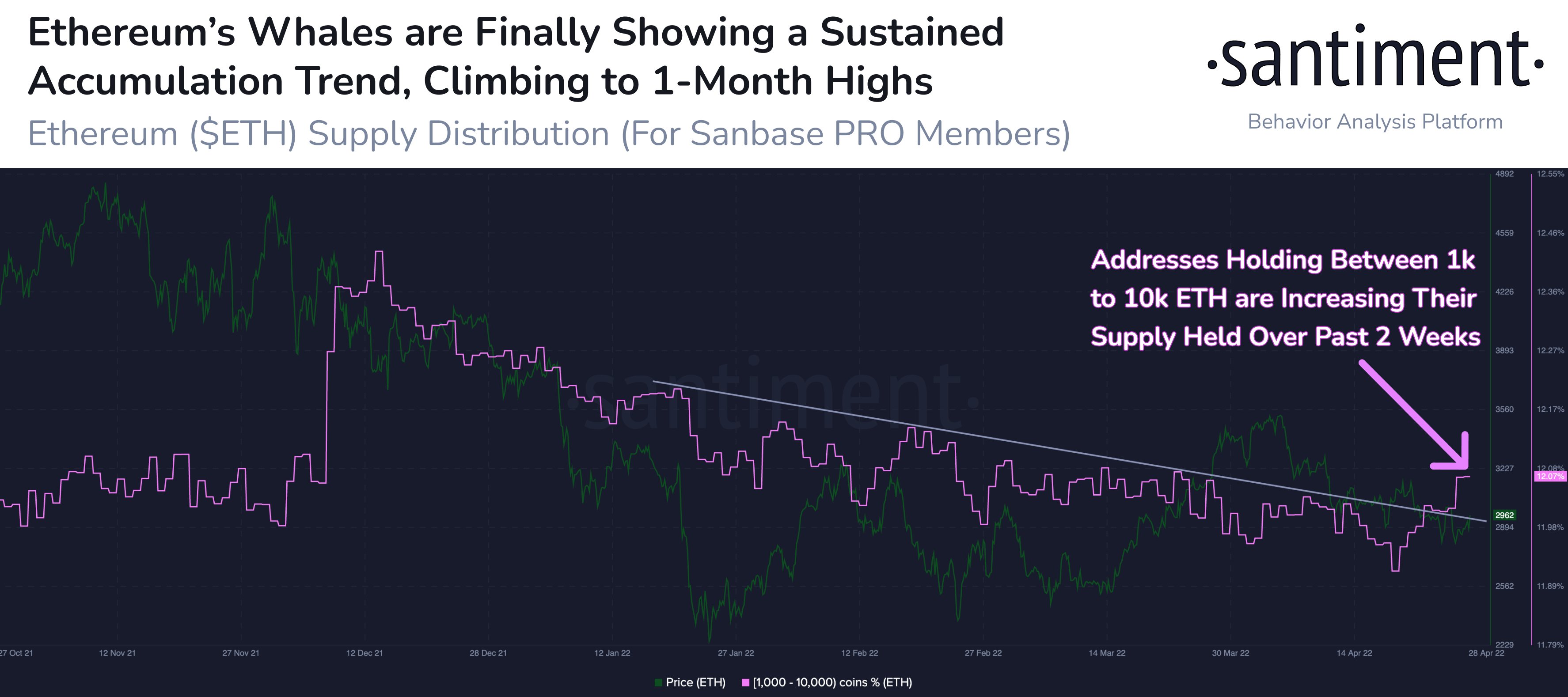

Whale Purchases Spotted in ETH and DOGE

ETH whales are finally showing some accumulation after reducing their stake since December last year, buying 142,000 more ETH over the past 10 days. This is the most sustained level of accumulation in ETH from this group of whales in four months, which could be something to pay attention to.

Having caught more attention though, was DOGE, after the Doge-Father was at it again.

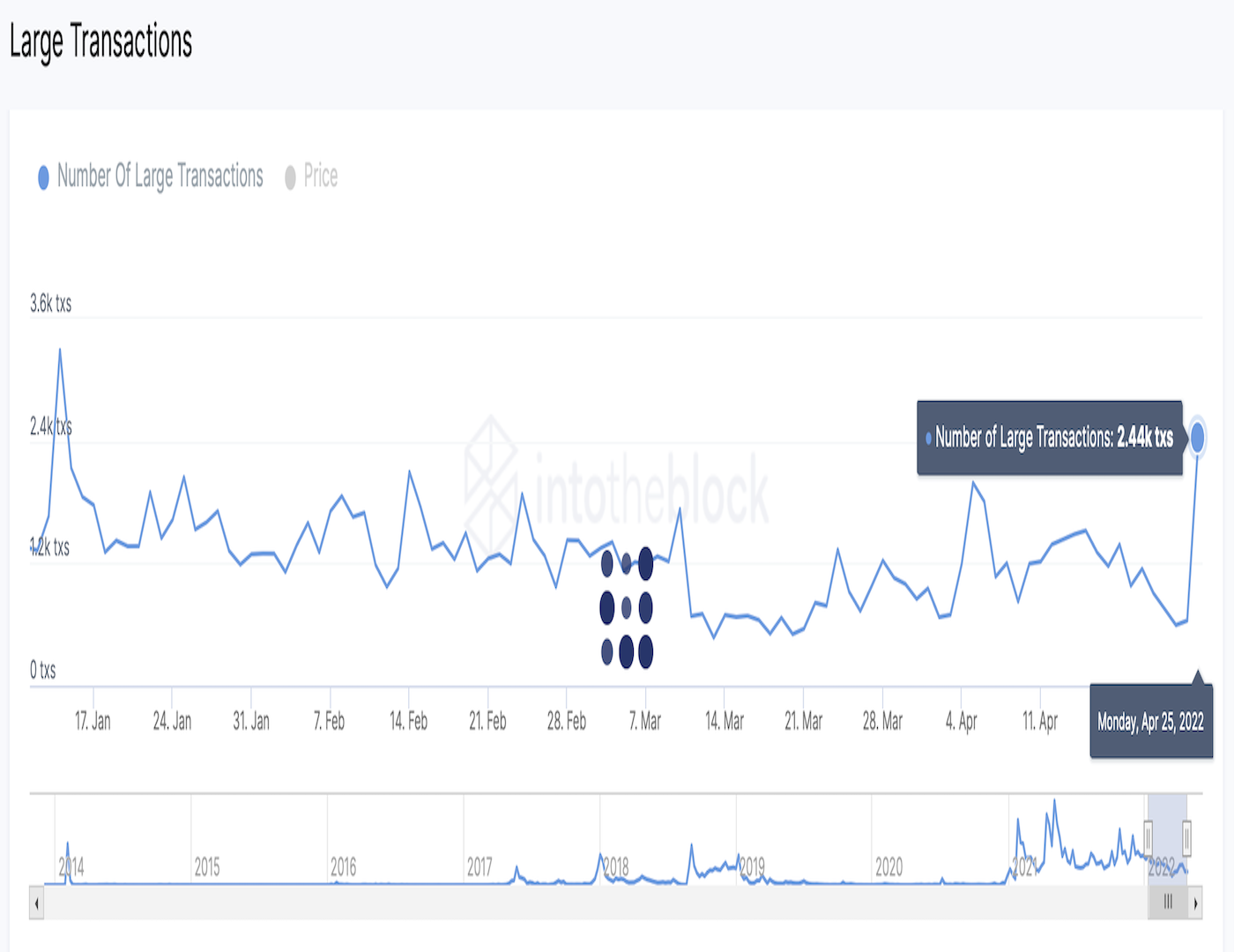

DOGE saw renewed activity from whales, or large holders of the meme-focused cryptocurrency after the Doge-Father’s bid for Twitter was accepted by Twitter’s board.

The number of transactions with a value of at least $100,000 rose to 2,440 on Monday, the highest since 14 January. The key point to note about such a phenomenon is that $100,000 is not typically a retail investment sum, which could imply that whales or larger investors could be piling into the meme-token.

The agreement to buy Twitter by Elon Musk could have galvanized whale activity in DOGE, as it jumped 20% on Monday. Although price subsequently retraced all of its gains, the purchase has nonetheless spurred worldwide speculation about possible implications by investors as well as media outlets, as Elon Musk has previously mentioned that he would like to integrate DOGE for use in Twitter. Hence, these new DOGE investors could be gearing up their positions in anticipation of new possibilities for DOGE.

With two major risk events coming up on Wednesday (FED Meeting) and Friday (Non-farm payrolls), funds may start adjusting short-term positions and cause volatility to spike in the coming days. This however, could create good trading opportunities for the seasoned trader.