Crypto prices started the week in a small correction as news of Nancy Pelosi’s visit to Taiwan conjured up a risk-off sentiment across all markets. And as Fed officials started talking up the USD which has fallen rather drastically last week post Fed meeting, crypto prices pulled back slightly to the tune of the dollar’s advance.

However, after Friday’s release of much better-than-expected US jobs data, crypto prices surged together with the USD instead of falling, showing that the correlation between crypto prices and the USD could be decreasing.

While the USD rebounded strongly, BTC managed to hold firm above $23,000 and ETH fared even better, managing to climb back above $1,700 on Friday after retracing to $1,560 mid-week. Both cryptos do appear to be facing some fierce resistance, with BTC sellers appearing every time it moves close to $25,000. ETH could similarly face some resistance near $1,800. Once these levels are breached, crypto prices could continue their move higher, but a failure to break those levels may spell some weakness ahead. So, who could these sellers be?

LTHs and Miners Reselling Some BTC, But Dips Could Be Shallow

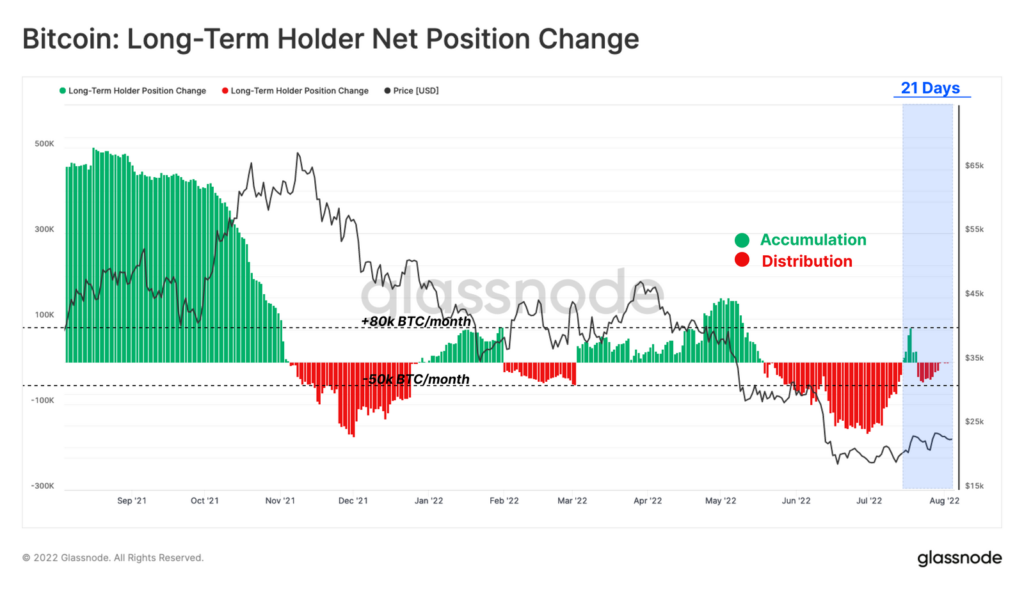

After making some purchases at the end of July, some BTC long-term holders have started to sell some of their BTC again into August, as can be seen in the LTH net position change below. This could be one reason why BTC has consistently failed to touch the $25,000 mark.

Another group of sellers are the miners. The miners’ net position change is also revealing that BTC miners are selling some BTC, albeit at a lower intensity than the LTHs.

The miner net position change represents the transactional flow of mining pools; when the metric is positive, the total number of BTC being sold by miners is less than the amount being held, while a negative reading implies that more BTC is being sold than held. As the figure has just turned negative again after very high positives in the month of July, this means miners are beginning to sell more BTC again. However, as the amount they sell is not big, BTC’s price correction, should there be any, may not be drastic.

This is because the BTC MVRV ratio appears to have bottomed out. Since MVRV is a measure of Market Value vs Realized Value, while the bottom could be in, its low value still implies that BTC at current market price is still very cheap compared to the on-chain average cost basis, which could support BTC’s price even if a dip does materialise.

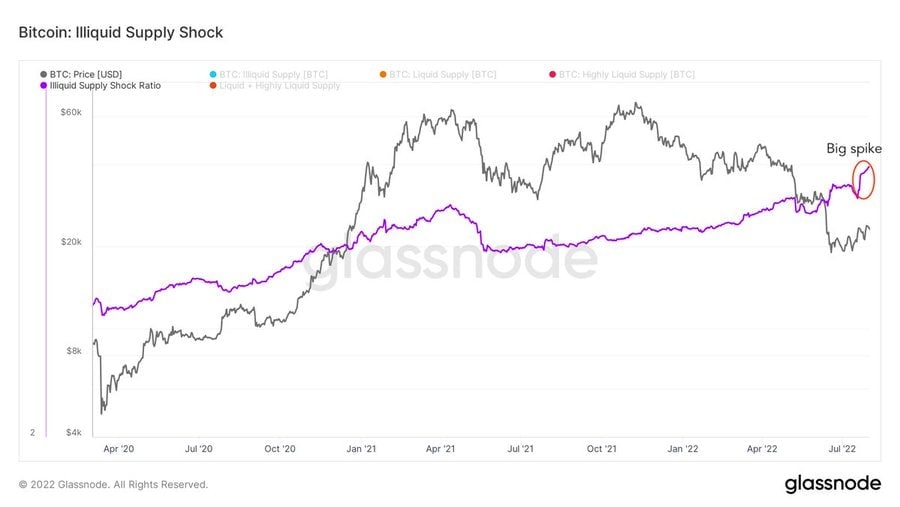

Another metric that supports a resilient BTC price is the illiquid supply shock ratio, which has seen a huge spike over the last two weeks. This increase has been the sharpest since 2018 which means that long-term hodlers are accumulating BTC at a pace not seen since the bear market of 2018. While it may not necessarily mean that a bull market is imminent, it nonetheless gives traders an early glimpse into the supply shock situation of BTC ahead of time. When the next bull market comes, the BTC supply in circulation could be very limited, which may drive a disproportionate move in price.

It is not just BTC that is showing signs of coming off a bottom, metrics on ETH are showing a similar picture of the altcoin having bottomed out.

Has bitcoin finally reached a bottom?ETH Bottomed but Short-term Correction Possible

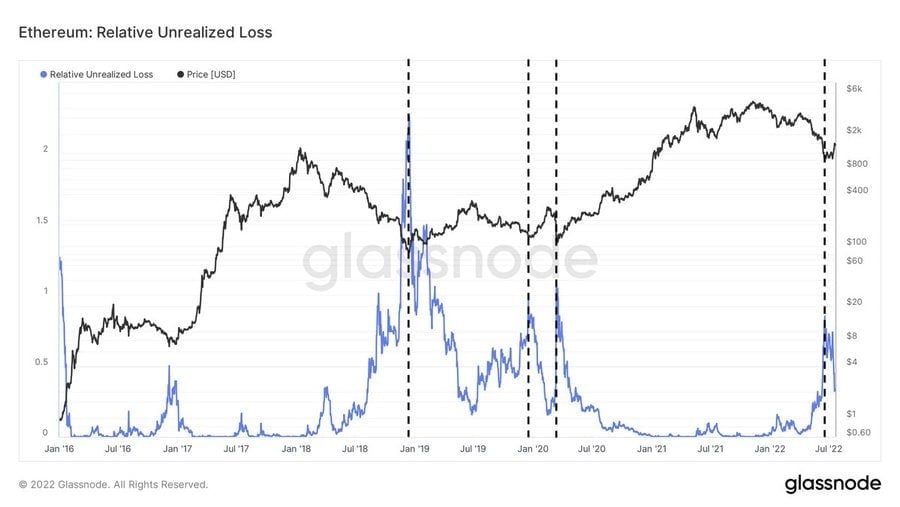

ETH’s relative unrealized loss metric has dipped sharply after its meteoric rise in the second half of July. Historically, this type of sharp dip in holder’s losses has indicated that price has bottomed. Thus, even if the price of ETH were to dip again, it may not revisit the $800 low that was seen in June.

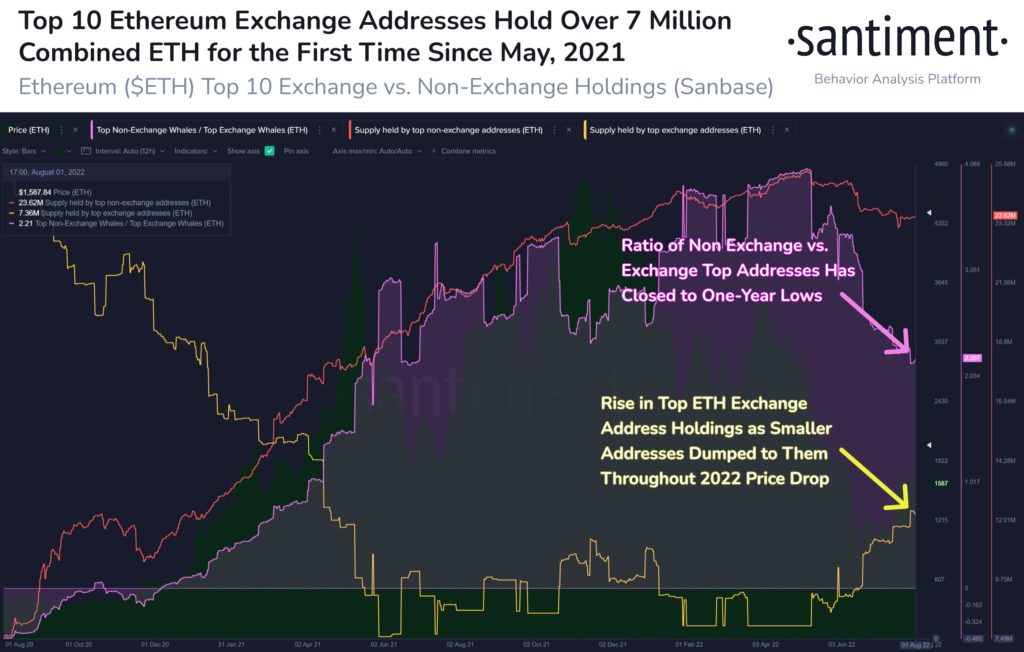

Looking at the amount of ETH held at exchanges suggests that the price of ETH could indeed undergo a retracement in the near-term. This could be seen with top 10 exchange address reserves of ETH rising with a corresponding drop in the top ten non-exchange addresses, which implies that ETH whales may have deposited their ETH to exchanges, this usually happens when whales are lurking in the background waiting for a good chance to sell.

Ripple’s ODL Records Explosive Growth in Q2

Ripple’s XRP-powered cross-border payment product, called the On-Demand Liquidity (ODL), has seen yet another massive year-on-year volume growth after the product started recording a large growth last year despite the company’s ongoing legal battle with the US SEC.

According to the latest market report from Ripple, the ODL had a 900% growth compared with the same period last year. This shows that usage of the XRP token is growing massively, which could increase its demand as Ripple has continuously been ramping up its partnership with various international payment firms to use the ODL.

The firm recently partnered with FOMO Pay, a Singapore-based payment solution provider which will use the ODL to improve its cross-border treasury flows. In March, Ripple also partnered with FINCI, a Lithuanian fintech firm, to use the ODL to facilitate cross-border money transfers.

Last September, Ripple announced it was working with Bhutan to create a central bank digital currency (CBDC), and in November it partnered with the Republic of Palau to develop a government-backed stablecoin to ease cross-border money transfers.

As partnerships continue to grow, XRP appears to be shaking off the SEC issue that has been casting a shadow on its reputation, which could benefit its price in time to come.

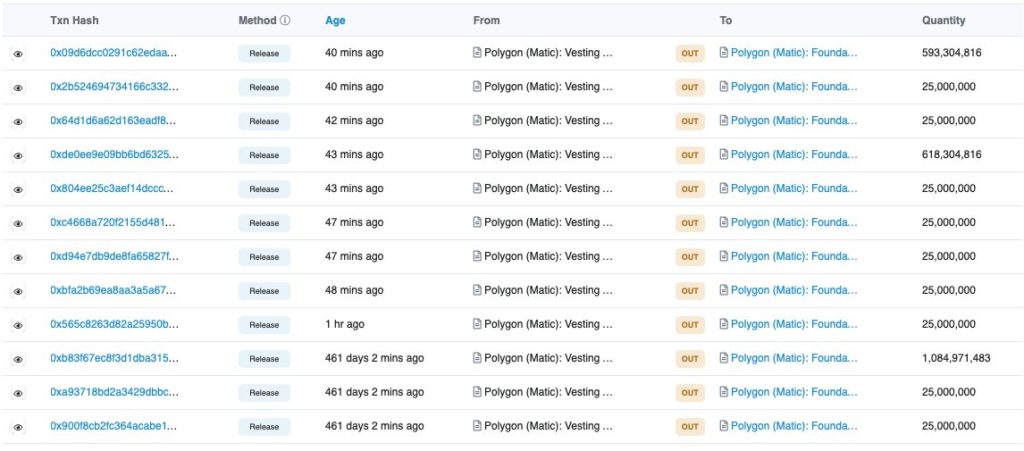

MATIC Price Holds Firm After Supply Unlock

On August 1, Polygon contract address released 13.87% of the total supply to the foundation contract address. Officials said 640 million are allocated to the team and staked directly; 546 million are allocated to the foundation; 200 million are used for staking rewards. However, despite the large increase in circulating supply, the price of MATIC remains unaffected, at least for the moment.

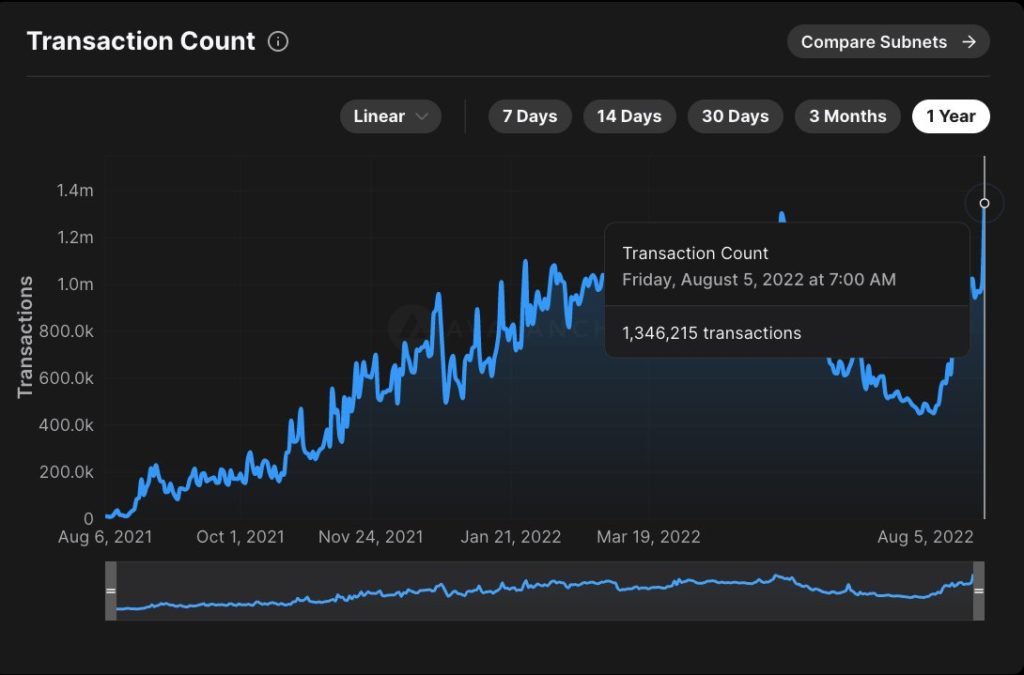

SOL Unfazed by Wallet Hack, AVAX Transaction Hits ATH

On August 3, key Solana browser wallets Phantom and Slope were exploited, with user private keys being made available to attackers who were able to withdraw funds from these wallets without the owners’ knowledge. At least $15 million of funds have been lost in the attack, and the situation is evolving as more information is being revealed. Despite news of the hack, the price of SOL has held steady as the fault does not appear to lie with the Solana core code, but in software used by several wallets popular among Solana users.

Meanwhile, there is good adoption for another crypto that seems forgotten by traders – AVAX achieves a new milestone in its daily transaction count, hitting 1,346,215 transactions on Friday. Should this trend continue, we could see the price of AVAX moving higher in due course. However, one day of high transaction count does not necessarily reveal a lot so traders may need to continue monitoring this metric.

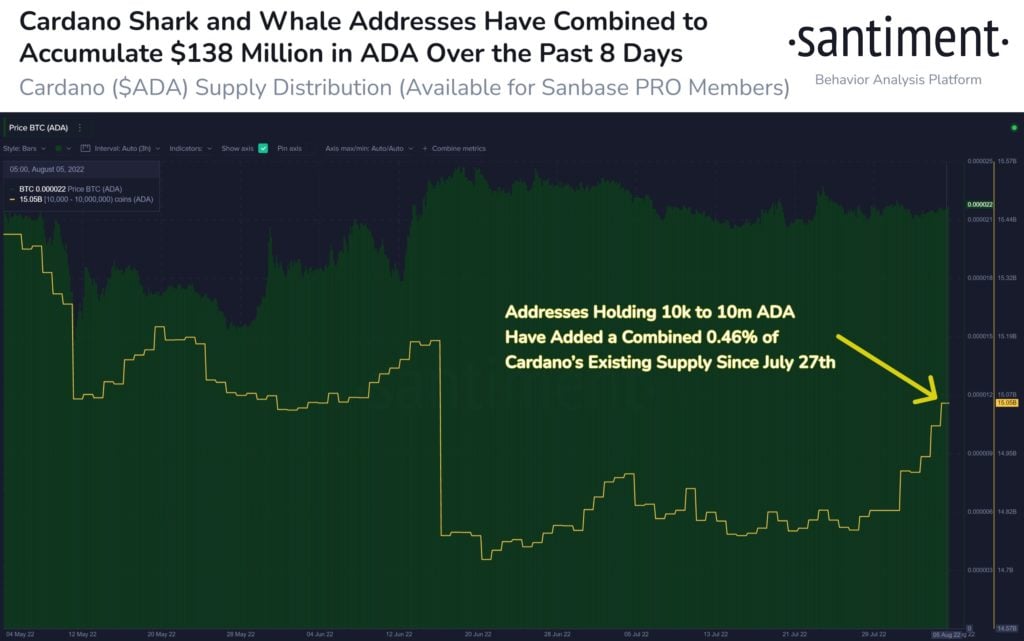

ADA Whales Start Moderate Accumulation

After the price of ADA formed a low in June, ADA whales holding between 10,000 to 10 million ADA have started to accumulate the altcoin again. Over the last 8 days, they have purchased a combined $138 million worth of ADA. While this is not by any account a large amount, it will not do traders any harm to keep ADA on their radar in the coming days.

Traditional Markets

Over at the traditional markets, US stocks had a mixed week after a small scare early week when US House Speaker Nancy Pelosi was revealed to be visiting Taiwan. Afraid of what China would do, global stocks lost ground early in the week. The bulk of the losses came from Asia, although US equities were not spared either. Up till now, China has not done anything rash.

After the jobs number released on Friday showed a far stronger labour market than what market watchers were expecting, stocks rebounded. Non-farm payrolls surprisingly rose 528,000 for July, topping expert estimates of 258,000 by a wide margin.

By the end of the week, the Dow was 0.13% lower, the S&P was up around 0.36%, while the Nasdaq did the best, posting a gain of 2.15%.

Traders are now pricing in a higher likelihood of another 75-bps hike by the Fed in September, which has led the USD to rebound strongly, with the DXY closing the week above 106. US 10-year Treasury yield has risen to 2.83% from 2.6% before the jobs data.

The stronger USD was a bane to other currencies, particularly the AUD/USD, which dropped after the RBA raised rates by the expected 50-bps but turned less hawkish. Similarly, the GBP/USD also fell after the BOE raised rates by 50-bps but warned that the UK will enter recession from 4Q 2022, and that the recession will last five quarters.

Oil prices dipped sharply last week, posting its biggest weekly decline since April after US data showed crude and gasoline stockpiles unexpectedly surged last week, sending the WTI Crude tanking almost 10%. Weaker data out of China further stoked investor fears that global demand could weaken. By the end of the week, the WTI closed below $90 for the first time in 6 months at $89, while Brent Crude settled at around $94 after losing similarly about 10%.

Silver dipped 3.4% due to fears of global slowdown while Gold was relatively unchanged for the week.

Ahead in this week, the main risk event would be the CPI figures that is scheduled for release on Wednesday. A higher inflation number could pop the fed-pivot hopium and drag risky assets like stocks and crypto lower, while the USD could continue to rise.