Stocks caved lower for the fourth straight week after remarks made by FED Chair Powell during an interview on Thursday sent further chills down the spine of investors.

In an IMF panel discussion on Thursday, FED Chair Powell reiterated and further expounded that the central bank is committed to raising rates “expeditiously” to bring down inflation. That could mean an interest rate hike of 50 basis points in the upcoming May 4th meeting as prices rise at their fastest pace in more than 40 years.

As a result of those comments, market participants are now almost certain that the FED would hike 50 bps in May, with the probability of it now standing at 97.6%. Traders also priced in additional hikes through this year’s end that would take the fed funds rate, which sets the overnight borrowing level for banks, but also is tied to many consumers debt instruments, to 2.75%.

On Thursday itself, the Dow lost more than 400 points and the Nasdaq, with its rate-sensitive tech stocks, fell lower by more than 2%. Treasury yields pushed higher again, with the benchmark 10-year note topping 2.9%. The losses continued into Friday, with the Dow falling 981.36 points, or 2.8%, to 33,811.40, its worst day since October 2020. The S&P was 2.8% lower at 4,271.78, for its worst day since March. The Nasdaq declined by 2.6% to 12,839.29.

Those losses tallied put the Dow down 1.9% for the week, to its fourth straight weekly decline and its ninth losing week of the last 11. The S&P posted a 2.8% weekly loss, marking its third straight one-week decline, while the Nasdaq was the most badly affected, losing 3.8%.

The USD continued higher after a brief pullback early week, with the DXY closing the week at 101.10. Gold and Silver thus retreated, with Gold losing 3.4%, while Silver tanked 8.3%. Both precious metals have started the new trading week a tad weaker in early Asian hours.

After a very strong showing, Oil retreated almost 5% last week on concerns that an aggressive rise in interest rate adopted by many countries would dampen economic growth, which will eventually reduce the demand for oil. Extended COVID lockdowns in China is further exacerbating fears of a decline in oil demand, causing Oil to lose a further 2.5% at the start of this new week, where the WTI Crude has fallen back below $100 again, and Brent is at $103.

With the FED clearly emphasizing aggressive rate hikes in the works, BTC also came under selling pressure. After a technical rebound to $43,000 early week, BTC caved lower after Powell’s comments were made public. However, it has been well-supported and is hovering around $39,000 even when the Asian stock markets are plummeting at the open this week.

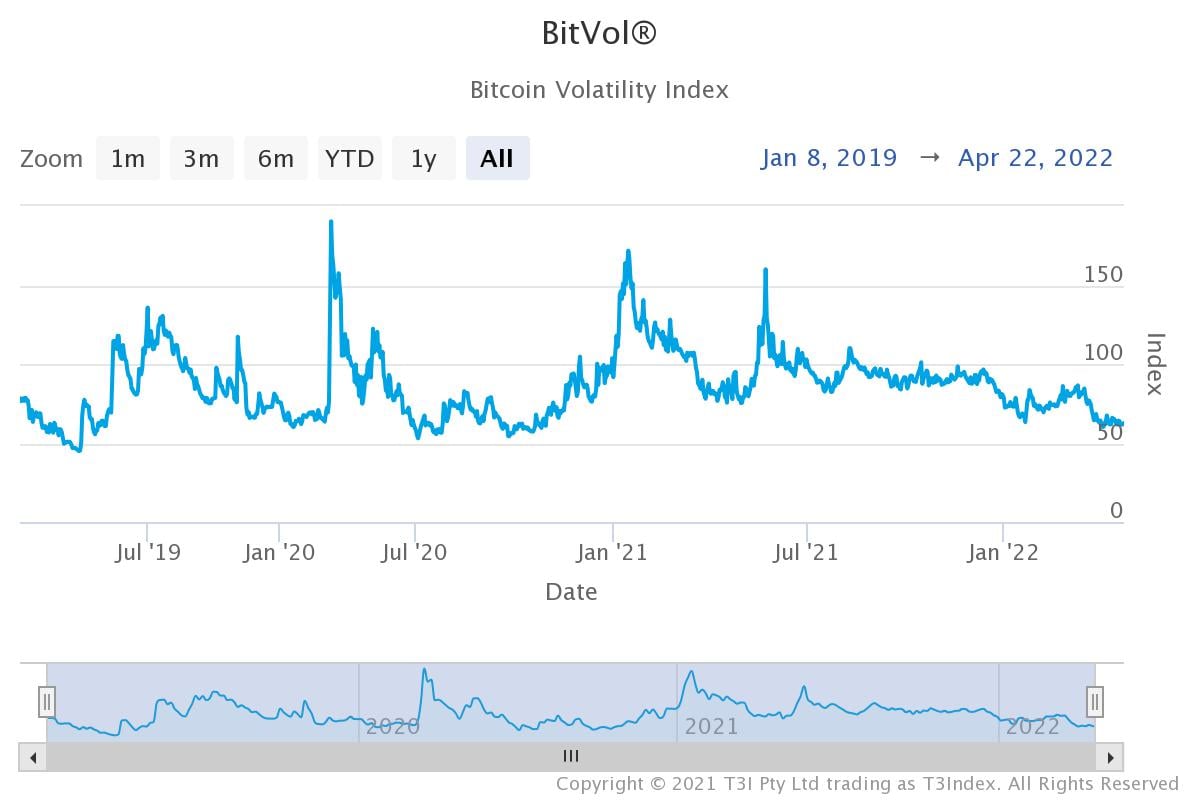

With BTC’s positive correlation to the Nasdaq at an ATH currently, it is within expectation that BTC will pullback in tandem with the Nasdaq. However, BTC does not seem to be falling as drastically as the Nasdaq this month, as the implied volatility of BTC is hovering around one of its lowest levels, while volatility in the stock market is near an ATH.

Hedge downside risk with leverage

Signs BTC Could Be Bottoming

Many crypto converts are hoping the relentless accumulation by long-term holders may support the price of BTC even when the Nasdaq continues to fall further. Afterall, this strange correlation to stocks is not native to crypto, but one acquired after the COVID crash of March 2020.

As it is, despite the broad altcoin market pullback as a result of BTC’s retreat, there remain pockets of strong positive price action in select altcoins. Newly listed tokens like GMT and APE stole the limelight by clocking more than 50% gains over the week, while TRX also did a quick 20% pump after Founder Justin Sun announced over twitter that he would launch a stablecoin on the Tron network. The presence of such speculative movements in altcoins and BTC’s lack of downside volatility could be an early indication of a bottoming taking place.

On top of price action showing an underlying strength in the price of BTC, other metrics are also showing positive signs.

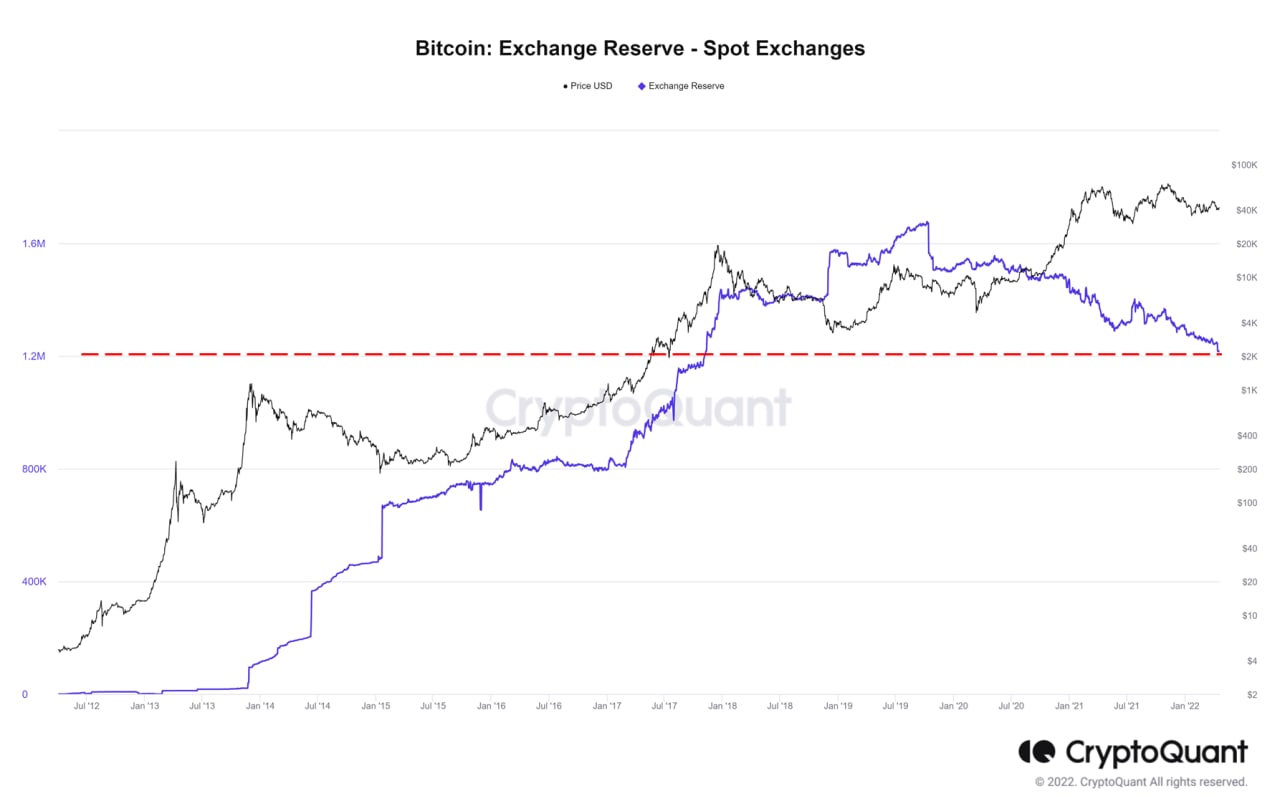

For instance, accumulation is not stopping as the BTC exchange reserve is continuing to fall, and has hit a 4-year low last week.

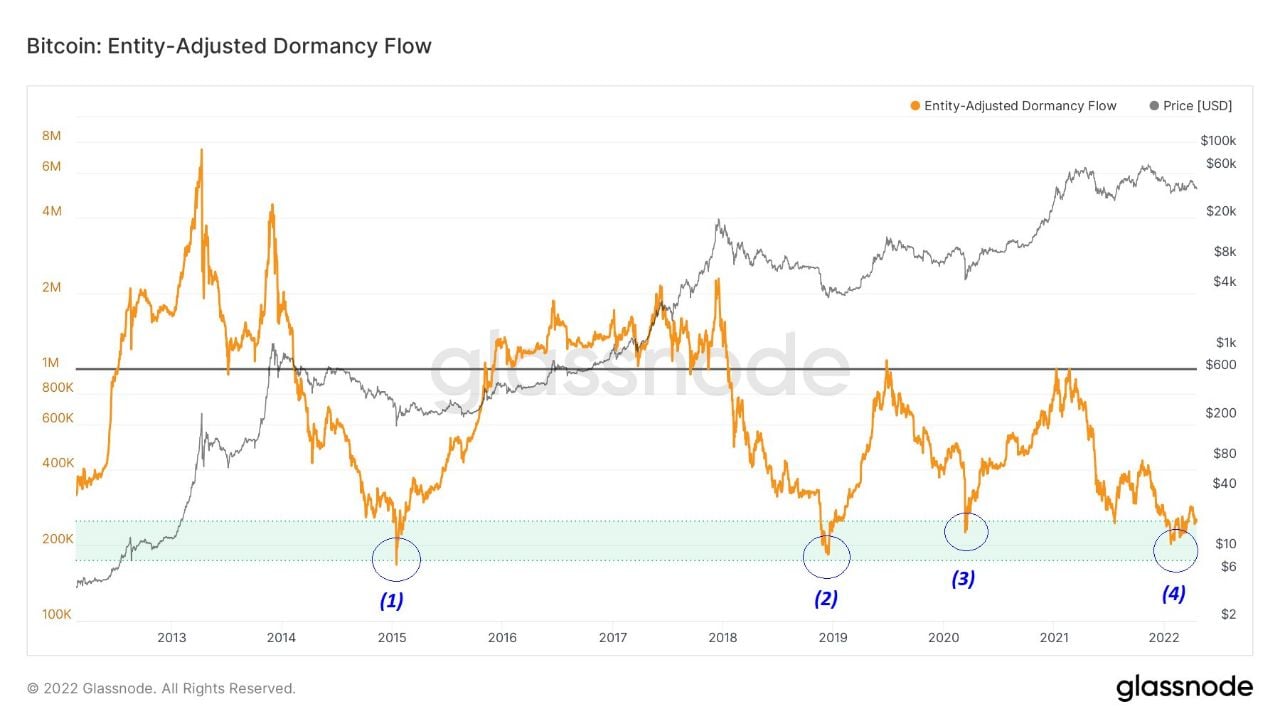

Another interesting metric to take note of is the BTC Dormancy Flow, which has fallen to the green zone and is rebounding. Typically, the dormancy flow at the green zone represents a good buying opportunity for buying to hold. The last three times this metric fell to the green zone and rebounded, the price of BTC began a gradual move upwards before eventually opening up into a more parabolical upward spike.

Time to Buy The Dip

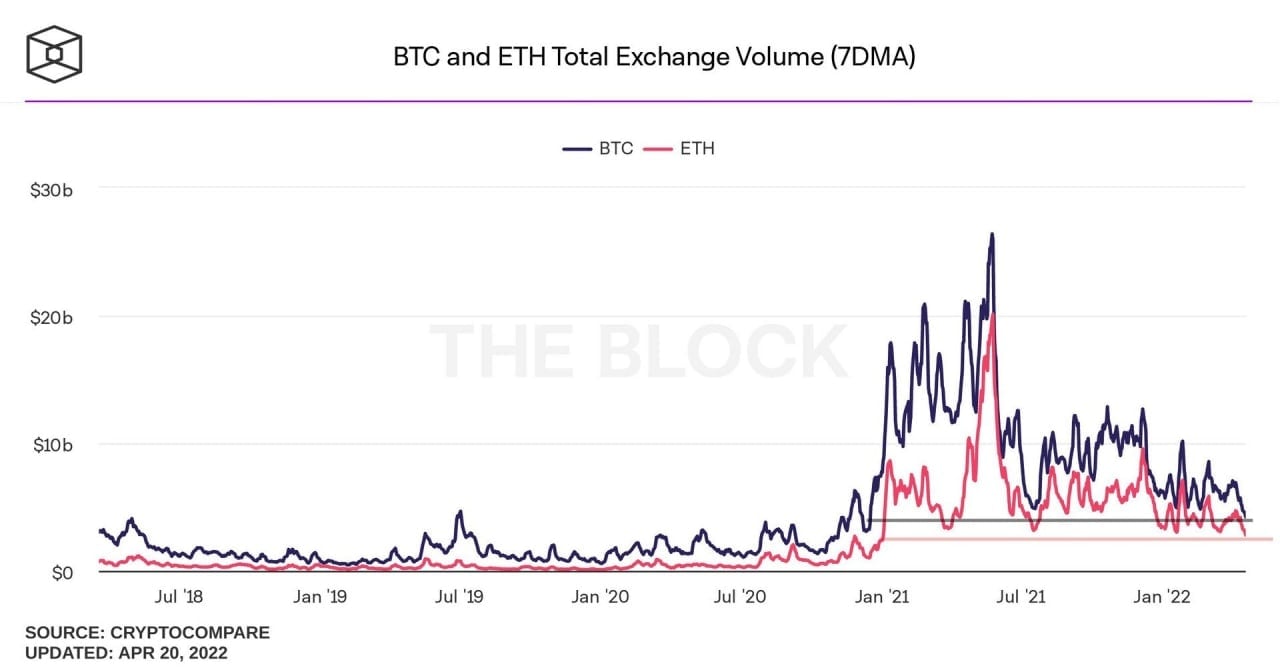

Even the trading volume on centralised exchanges seems to be showing signs of nearing a market bottom as the trading volume has been declining to the region during previous bear markets. A lack of interest in trading cryptocurrencies often happens in a bear market consolidation period when price volatility is low, and rises as price rises.

Both BTC and ETH have seen trading volumes fall drastically over the last 6 months. However, despite a lack of trading, interest in using ETH for DeFi has not waned.

Stablecoin Chain Battle Intensifies While ETH Maintains TVL Lead

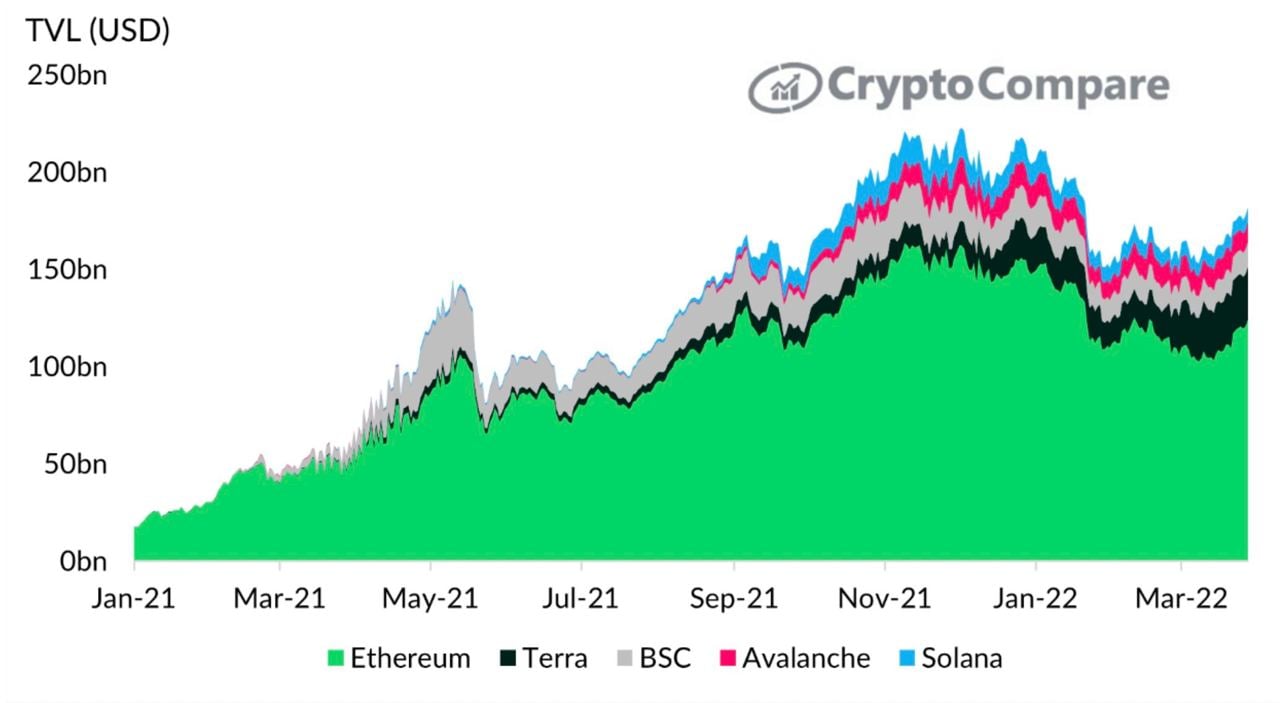

Despite increasing competition from newer blockchains like Terra (LUNA), ETH has maintained its TVL dominance in DeFi, with a 55.6% market share at $150 billion. While Terra (LUNA) has been the most successful challenger to ETH in terms of TVL, with a quarter-over-quarter TVL growth of more than 72% to $35.2 billion, it is still miles away from coming near to the dominance of ETH. It is at the same time, facing intense competition from other blockchains in the field that has brought it the success it is witnessing.

Taking a cue from the algorithmic stablecoin business model that has made LUNA one of the top ten coins, another blockchain, the NEAR Protocol, has launched its algorithmic stablecoin USN on testnet on Wednesday. The NEAR token price has doubled since March when rumours of this development started going around within the crypto community.

Not letting the current investor interest in algorithmic stablecoins go to waste, even Tron has jumped into the hype by announcing on Thursday that it will be introducing its own algorithmic stablecoin, the USDD, very soon. Tron will set up a Tron DAO Reserve to raise $10 billion for use as the reserve fund for the USDD, and will pay a APY of 30%. While Tron founder Justin Sun has said that the $10 billion will be used to acquire other crypto assets, he has not revealed which cryptocurrencies the Tron DAO would be buying. The USDD is slated to begin issuance and circulation on May 5. The price of TRX however, only managed to jump around 10% on the announcement as most seasoned crypto investors do not take Justin Sun very seriously.

Even though the volatility in crypto majors currently is low, it would not be surprising should the out-of-norm volatility in the traditional markets eventually spill over to crypto. While stocks and bonds are likely to continue unwinding to adjust to the latest rate hike expectations, crypto market metrics appear to be sending positive signals.

Many other factors could come into play in the short-term however, as the current geopolitical situation is still very fluid and could impact the way different asset classes move.