After the restructuring lawyers for Celsius Network revealed that the beleaguered firm owed twice the amount of crypto assets and would run out of cash by October, the crypto market started the week on a weaker note as investors worried about its impact on the market.

The passing of USA’s Inflation Reduction Act made things worse, as the bill could potentially make more crypto investors liable for tax. As the impact of the bill is still unclear at the moment, this could have prompted some crypto investors to sell and leave the market until the implications are clearer.

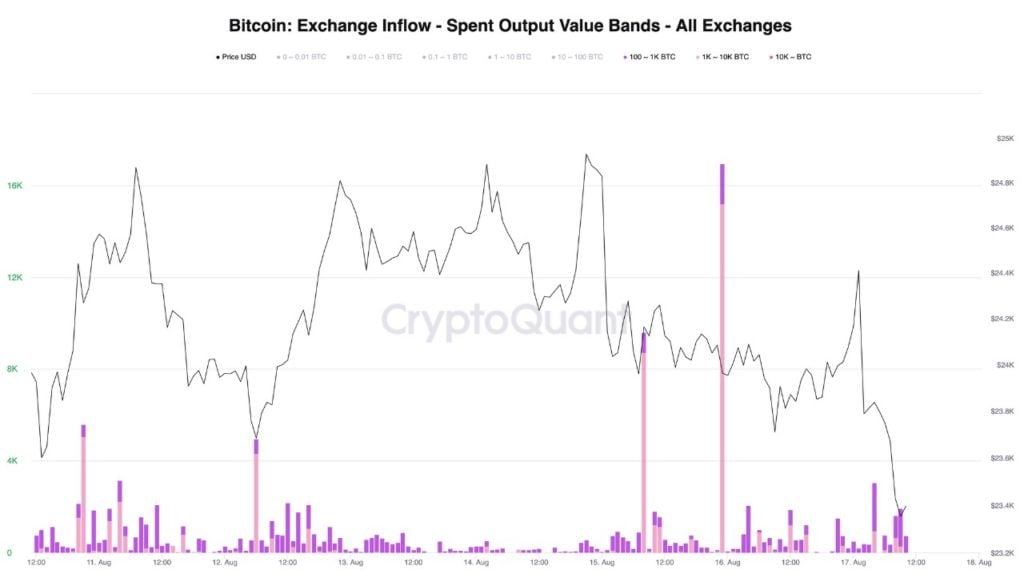

At around the bill’s announcement, more than 20,000 units of BTC were seen flowing into exchanges, which could have been sold over the last few days as the price of BTC retreated to around $21,000 from its peak of almost $25,000 at the start of the week, for a drop of more than 15%.

Late Crypto Bulls Flushed Out After Fed Minutes Release

The crypto market correction intensified after July’s Fed meeting minutes was released on Wednesday, which disappointed investors who were hoping for the Fed’s narrative to be less hawkish. The minutes revealed that Fed officials could be on a hawkish path for a long time, as they signalled that interest rates would continue to rise until inflation is significantly tamed. This move down appears to have flushed out some late bulls as liquidation volumes started climbing on Thursday as the price of altcoins started falling by double digit percentages.

More than $560 million worth of long liquidations were observed between Thursday and Friday, the highest amount since 12 June’s $685 million when the price of BTC crashed to $17,500. Short liquidations were substantially less, at around $79 million only.

However, despite the relatively large pullback, it could all be just a flushing out of overzealous bulls as the crypto market has been rising for almost two months.

BTC Long-Term Metrics Still Bullish

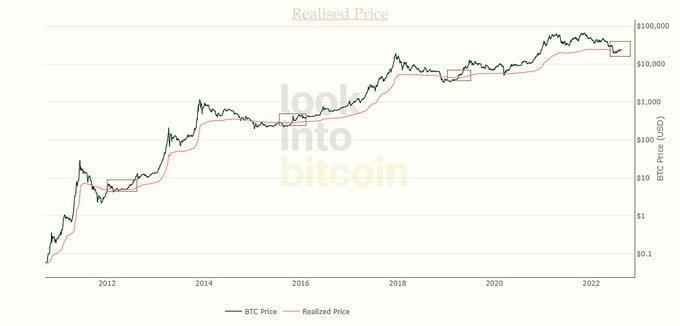

As we have mentioned before in our previous reports, this retracement is expected and does not alter the longer-term metrics of BTC. The trajectory of BTC’s price movement, at least according to its long-term holders’ realized price, is still showing a positive sign that price could have bottomed but could consolidate for a considerably more couple of months before an actual breakout to higher prices could come. Thus, investors may not need to chase rallies but could wait for good entry levels to come.

ETH PoS Raises Centralization Controversy

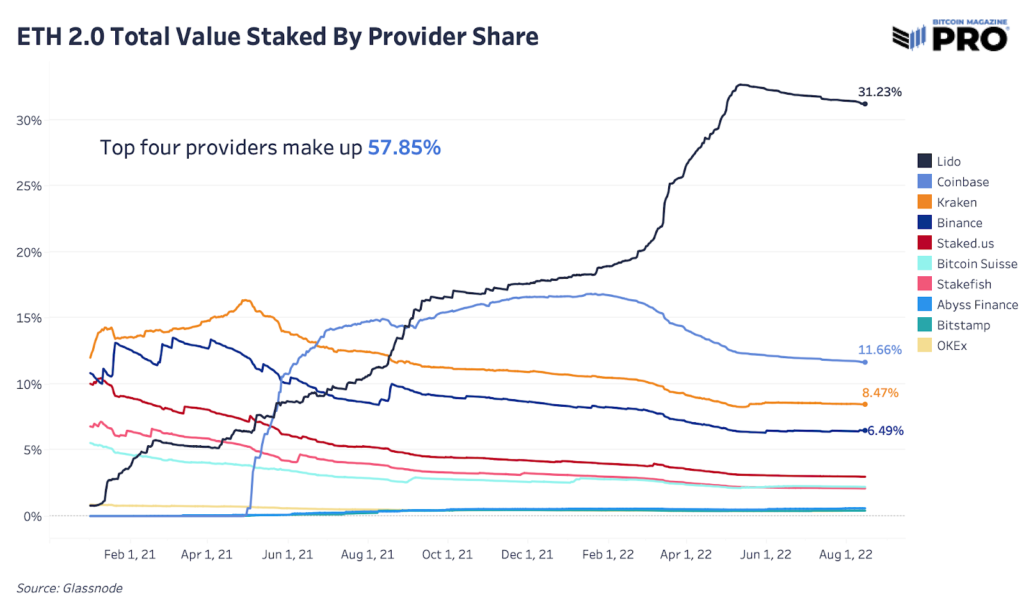

After the euphoria of the ETH Merge, some market watchers are beginning to raise questions about ETH 2.0’s centralization after Ethermine, the largest Ethereum pool, has refused to pack Tornado Cash-related transactions into blocks in the past week. This is coming after Tornado Cash has been banned by the US Treasury. This issue where onchain transactions can be censored by entities has become a hot contentious topic as recent data breakdown is showing that there is large centralization of validator power on the ETH PoS chain. Going by the current status, the top four stakers could together control 57.85% of the PoS blockchain, which could make a 51% attack possible. While penalties could be it too expensive for the top four validators to coordinate an attack on the blockchain, the possibility of this happening has raised some eyebrows within the crypto community, and, when taken in conjunction with the Ethermine censorship issue, has some market watchers questioning how ETH 2.0 would stray away from the original blockchain ethos of being censorship resistant and decentralized. Could this issue cause some PoS supporters to start supporting other versions of ETH then? Only time will tell. The price of ETH meanwhile, has retreated around 18% last week as late bulls who chased the rally were getting flushed out.

Other Interesting Crypto News

Despite the market washout, last week wasn’t without positives. One happy news is that Australian convenience store chain, “On The Road”, with more than 170 locations, has begun to accept crypto payments – another step in the right direction for real-world crypto adoption.

Also, despite the broad market correction, soccer related tokens still managed to rise an average of 25% on Thursday after Elon Musk said he is buying Manchester United Football Club. The hype was short-lived, and most tokens started retreating by Friday afternoon. However, most tokens are still up by around 10% for the week after the dip.

Soccer tokens were not the only tokens that had a good week, so did some old favourites like EOS and the dog-themed coins like DOGE and SHIB, who jumped around 30% to hit recent highs before crashing back down after the Fed minutes were released on Wednesday.

EOS Jumped 28% Following Desired Court Ruling

EOS had a good week after a judge in the Southern District of New York court denied the approval of a $27.5 million settlement that Block.one, the firm behind the EOS token, had to pay. This settlement was supposed to be a penalty that Block.one had to pay investors who had sued Block.one for selling an unregistered security during the EOS ICO. However, this proposal was denied on Wednesday after the New York district judge dismissed the proposal, citing that the plaintiff did not adequately represent the interests of all investors, which meant that Block.one did not have to pay. However, due to the broad market correction, the price of EOS was soon back to where it was before the leap by Friday.

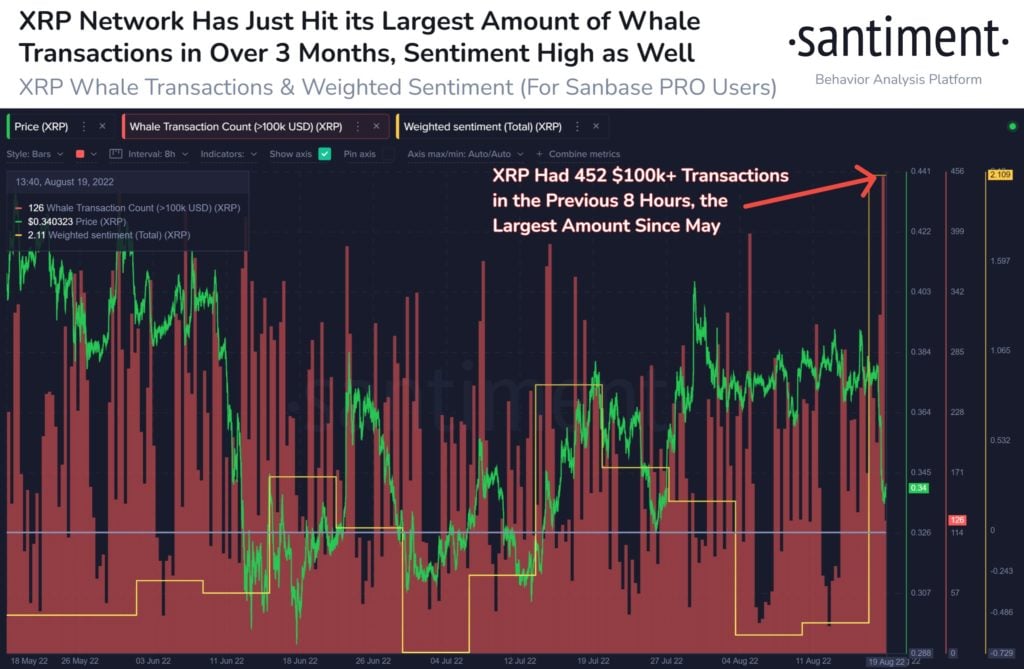

XRP Transactions Surge Amid Price Drop

Interestingly, even as the price of XRP fell in tandem with the market late week, activity on the network continues to surge. In the closing hours on Friday, XRP saw a surge in whale transactions worth more than $100,000. This is the highest amount of such transactions since 13 May. While the price of XRP did not do very much after that surge in large transactions, the frequent occurrence of such transactions could imply that either whales are accumulating as price is declining, or that adoption of XRP for use as a payment token is picking up steam. Either way, this bodes well for XRP in the medium to long term.

Traditional Markets

After China unexpectedly cut interest rates on Monday, US markets were higher initially as market participants welcomed an easing bias by one of the world’s largest central banks, and further expected that the China central bank would ease more, which could send money flowing into capital markets into other parts of the world.

However, after the Fed meeting minutes was published, disappointed investors sold stocks and other risky assets as the minutes revealed that Fed officials would continue to hike rates until inflation slows down considerably. Target’s result miss also prompted investors to sell stocks as worries of economic recession returned even though retail sales in July did not show any sign of consumer spending slowing down.

As a result of the hawkish Fed, US yields surged as bond prices retreated again in a repeat of the early year’s rout. The 10-year US Treasury yield rose back near 3%, leading the USD significantly higher – the DXY rose 2.5% over the week in a move reminiscent of its early July rise, while the EUR/USD and GBP/USD are looking poised to retest their lows of the year again on the back of the USD’s strength, even when UK’s inflation reportedly gained more than expected again. The BoE expects inflation to continue rising until October where it is expected to peak at around 13.3%, which could mean more rate hikes for the UK.

For the week, US stocks closed in negative territory after four straight weeks of gains. The S&P lost 1.21%, the Dow slipped 0.16% and the tech-heavy Nasdaq closed the week down by 2.62%.

Gold and Silver had five consecutive days of losses on the back of rekindled rate hike fears, with Silver leading the declines, losing a hefty 10% to close at $19 and Gold dropping 3% to $1,746. Both metals are opening the new week flat.

Oil had been similarly affected, losing around 1% as Brent closed the week at around $95.40, while WTI closed a tad below $90. The weakness in price is continuing into this week, with both distillates opening the fresh week down around 1.3% each.

This week’s key market risk event will be the release of preliminary US GDP figures on Thursday, while the Jackson Hole Symposium beginning on Friday and lasting through the weekend could spring up some surprises as various Fed officials are expected to speak about the US economy. Most attention, however, could come at 10am on Friday, where Fed Chair Powell is slated to speak about the US economic outlook, which could cause volatility to surge.