At the start of last week, after news broke that Binance founder CZ would not be able to leave the USA before his trial date on 23 February next year, crypto prices took a slight dip as traders worried that the seemingly tough stance taken by the DoJ towards CZ would be applied to other actors within the crypto space as US regulators pick up their regulatory oversight on the sector. Specifically, during the press conference to announce the indictment of Binance, US regulators singled out DeFi and unregulated stablecoins as the other components of crypto that they are looking into.

However, traders soon forgot about this concern after dovish remarks made by FED official Waller and FED Chairman Powell caused the dollar to dip, once again sending the price of BTC back above $38,000, this time, finally breaking through resistance convincingly with a Friday close above the key barrier of $38,500.

News of the SEC confirming that it had met with Grayscale again last week to discuss GBTC’s conversion, coupled with Grayscale updating the trust’s agreement for the first time since 2018 further egged the anticipation. With Blackrock also confirming that it had met the SEC last Wednesday, BTC holders were simply not willing to sell even as the price of BTC rallied.

In fact, long term holders like MicroStrategy continued to add more BTC, as the firm announced that it has purchased an additional 16,130 BTC for $593.3 million at an average price of $36,785 per coin. MicroStrategy now holds a total of 174,530 BTC acquired for $5.28 billion at an average price of $30,252 per coin, sitting on a comfortable profit.

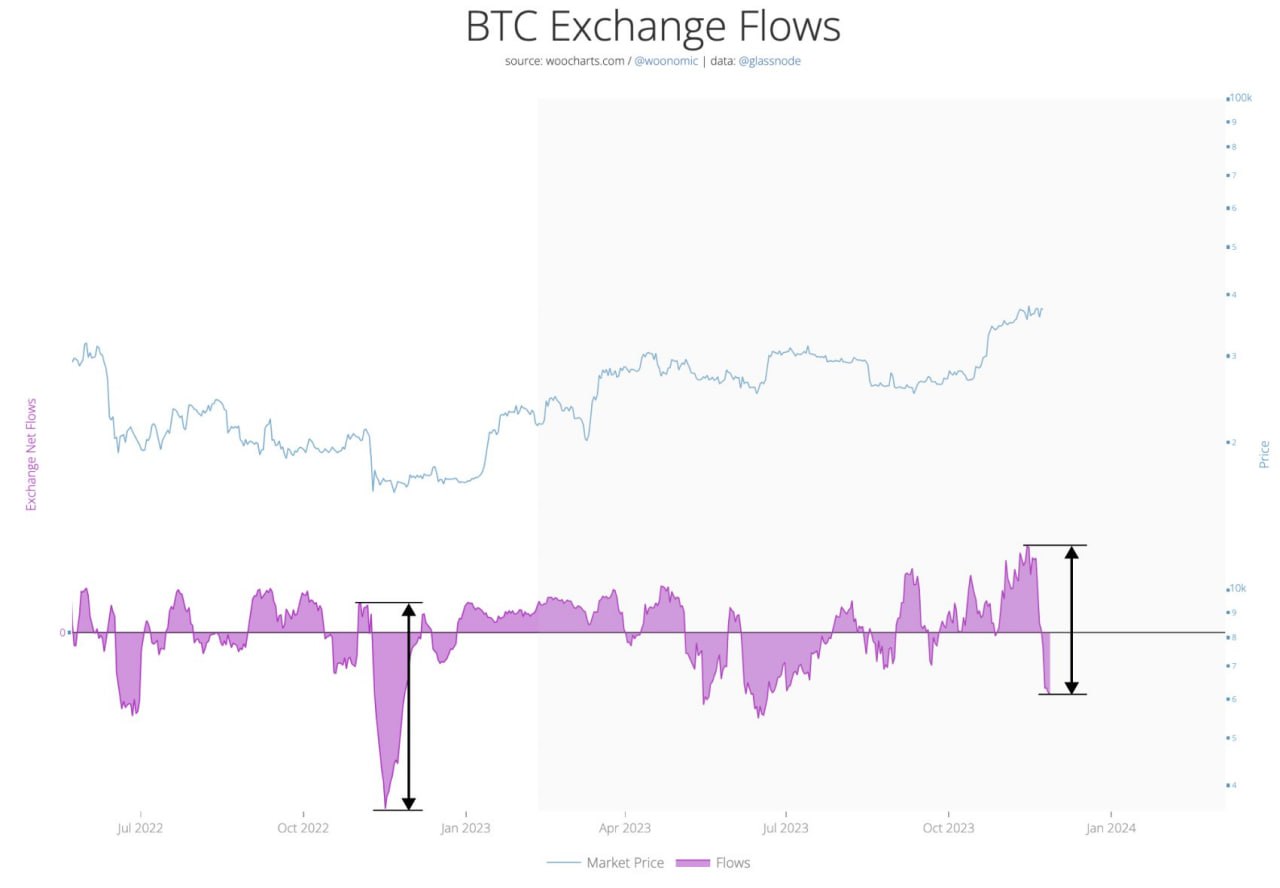

Last week, BTC saw the highest amount of BTC being removed from exchanges since December 2023 before its price started a quick 30% rise in January. So far, this trend has begun to play out over the weekend, with the price of BTC jumping above $40,000. Should a similar trend materialise, we could be looking at a possible high of between $45,000 to $49,000 BTC by the end of the year.

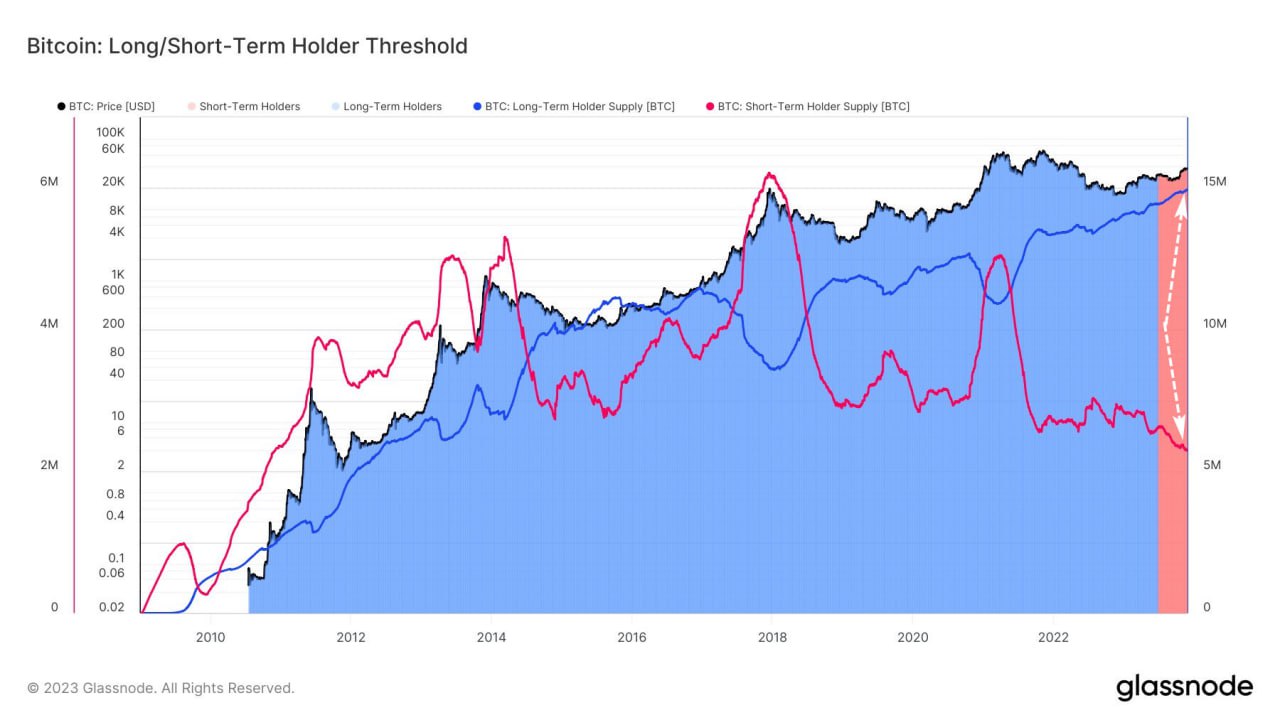

BTC LTH sitting tight, while STH take profits

With long-term holders (LTH) not selling and even adding to their BTC stack, what had been limiting the price of BTC to $38,000 up to this point appeared to be short-term holders (STH) taking small profits. As can be seen in the diagram below, the number of LTHs have been steadily increasing while STHs have declined as the price of BTC climbed in November. These STHs realizing profits could have been the main culprits behind BTC’s repeated failed attempts to break $38,500 previously. However, such a phenomenon is typical of an early stage bull market as LTHs accumulate and STHs sell into rallies. The reverse would happen at a market peak where LTHs sell and STHs buy. Thus, this development actually has a bullish undertone.

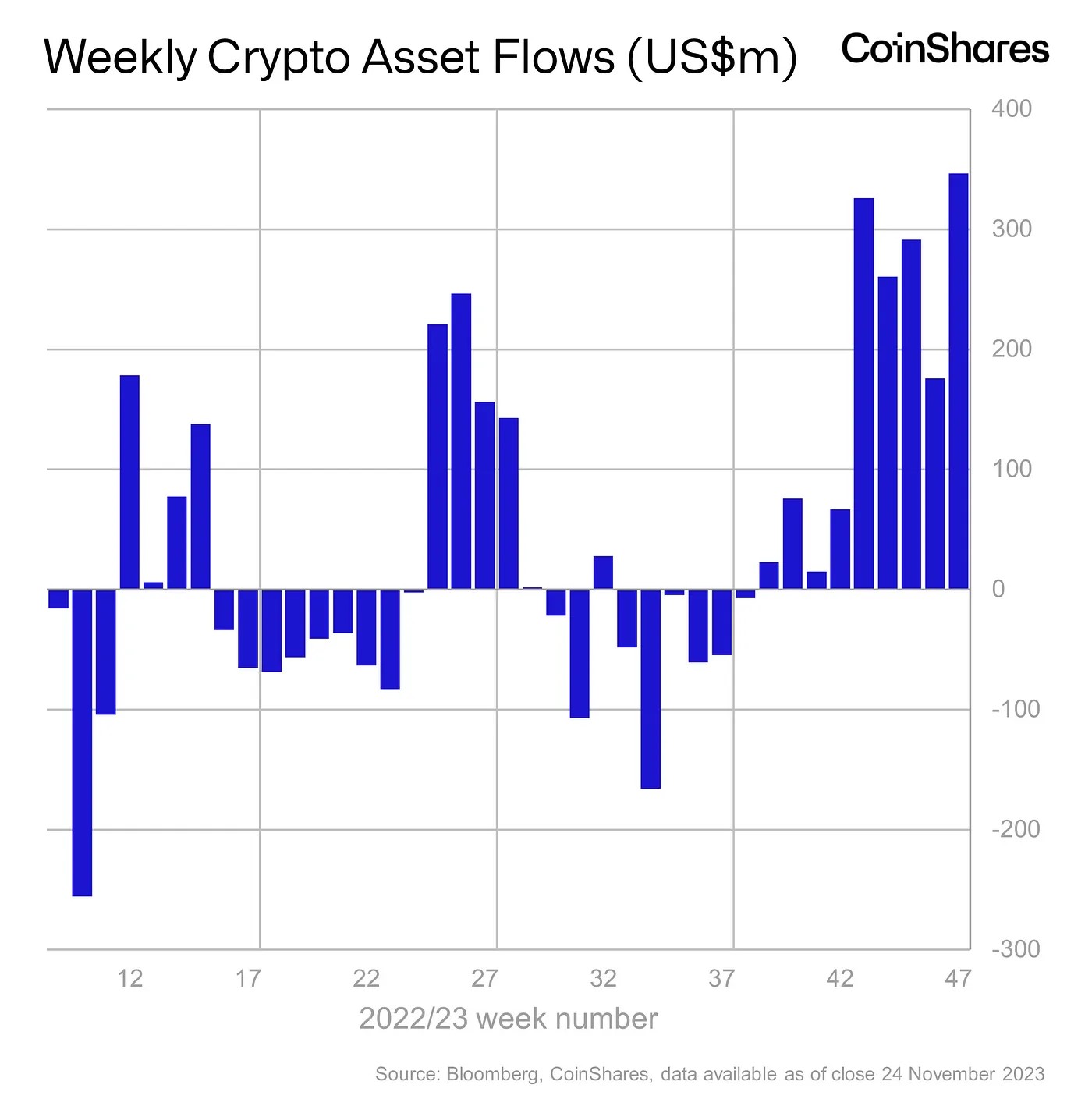

Crypto investment demand surges to two-year high

Investment into crypto funds continued to heat up as investors expect the approval of a spot BTC ETF soon. The final full week of November saw the largest inflow of funds into digital investment funds since late 2021, with inflows totalling $346 million. BTC saw 95% of the inflows, with the remaining 5% taken up by ETH.

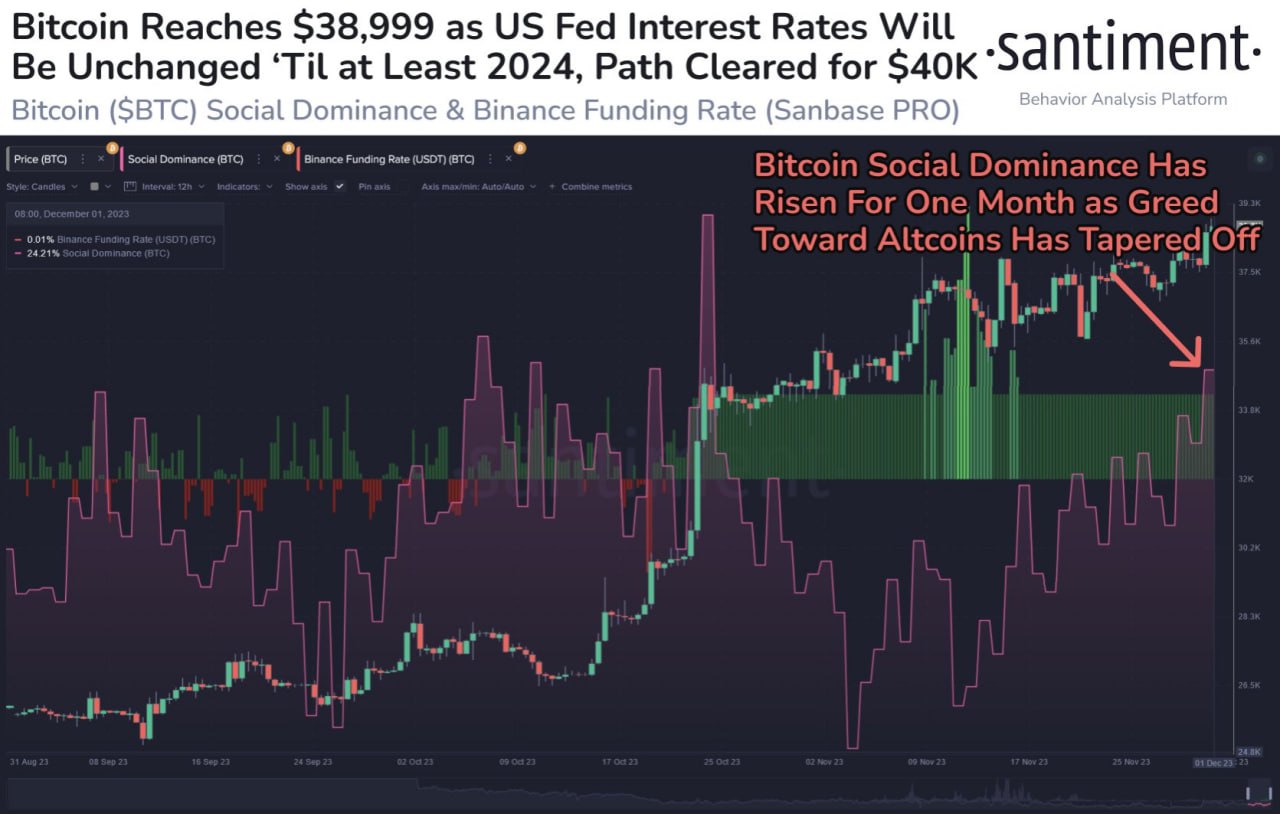

Altcoins could see next leg higher

As the late week price action centred around BTC, traders’ attention had shifted to BTC than altcoins, as the social dominance of altcoins tapers off and greed towards altcoins similarly retreated. This could be a good contrarian indicator that may signal more possible upside in the price of altcoins in the coming days as long as the price of BTC does not see a large dip.

According to data, the transaction volume on multiple Layer-1 blockchains experienced significant growth in the month of November. Citing one example, the transaction volume on AVAX increased by 167% month-over-month to $2.73 billion, the highest since July last year; the transaction volume of SOL also saw a significant increase, while that of RUNE and SUI hit record highs. Other than the aforementioned coins that could see interest return once the price of BTC settles down, let’s take a look at a couple of other interesting altcoins that could be worth a look as we move into the final weeks of the year.

DOGE-1 mission creates adoption for DOGE

The DOGE-1 mission, which has been years in the making by the DOGE community to send 1 physical Dogecoin literally to the moon, has finally been approved by the National Telecommunications and Information Administration (NTIA). This crucial step paves the way for the mission to secure the final Federal Communications Commission (FCC) license before its scheduled takeoff on 23 December aboard Astrobotic’s Peregrine Mission One.

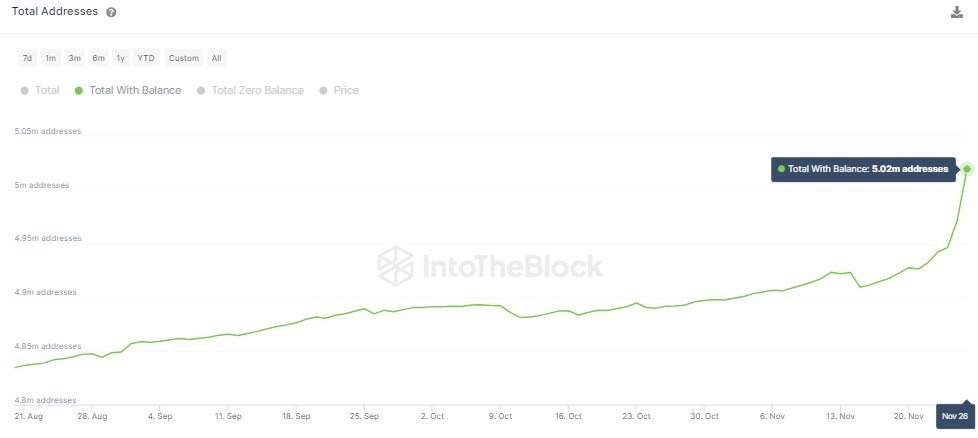

The exciting news appears to have been positive for the price of DOGE, which has been slowly inching upwards in recent days, possibly led by a wave of new buyers. As can be seen in the graph below, the number of DOGE wallets have risen significantly over the past week, in line with the approval of the DOGE-1 mission.

As such, we can expect the price of DOGE to continue to react positively when the mission finally gets the FCC license and heads towards the grand finale of takeoff.

LINK v2.0 goes live, whales add more to stake

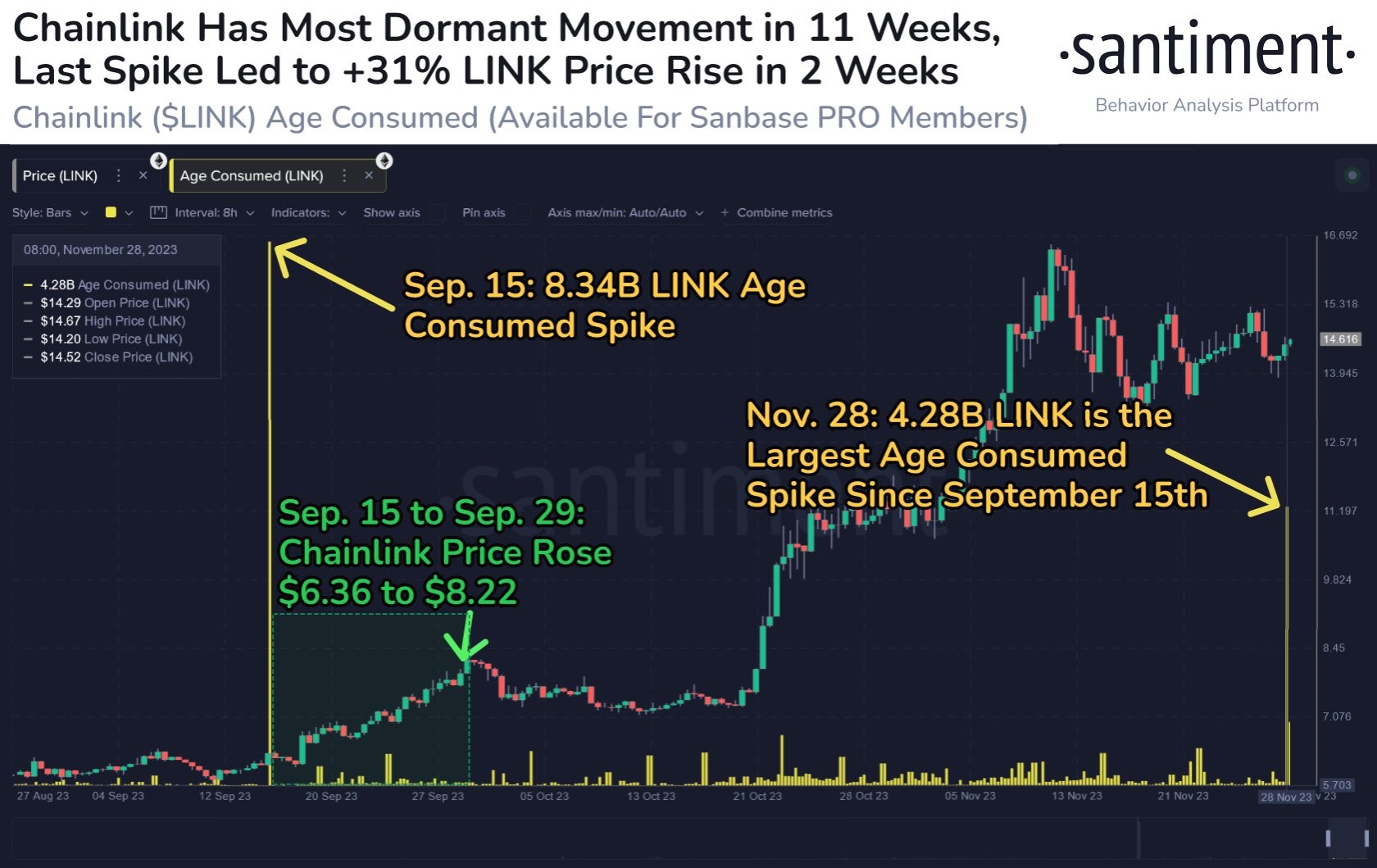

The much-awaited Chainlink staking v2.0 has finally gone live last week, with a nine-day “priority migration” period which began on Tuesday for existing stakers, and early access and general access phases following on 7 December and 11 December, respectively.

LINK whales were seen to be actively moving their coins on the same day, likely to stake into the new program. The locking up of such a large amount of LINK may be beneficial to its prices in time to come, as previously in September, a large movement of old coins eventually led to a 30% rise in price in the preceding two weeks.

In fact, after the launch of the “priority migration”, LINK whales were adding to their portfolio, accumulating another close to 4 million LINK, possibly to top up their staking.

Weakening dollar sent gold and stock prices higher

Dovish comments from FED official Waller, who was noted for being hawkish, led the markets higher as traders took his comments to mean that the FED was done with the hiking cycle. In fact, traders were surprised by his dovishness as he signalled that not only was the hiking cycle possibility over, and that the inflation rate easing off in recent times could open the way towards the start of rate cuts next year.

Indeed, the PCE index for October came in softer than expected, as its monthly rate, which was expected to be 0.1%, came in at 0%. The previous month it came in at 0.4%. The core PCE was also in line with expectations, easing to 0.2% from 0.3% in the previous month. The core PCE price index annual rate was 3.50%, versus an expected 3.50%, and the previous value was 3.70%.

FED Chairman Powell’s dovish remarks made on Friday further boosted the price of risky assets as the dollar continued to retreat. Powell struck a cautious tone on further interest rate moves, saying that the risk of under- or over-tightening is now more balanced.

The market viewed his comments as dovish, with investors convinced that the FED is done raising rates. Now, some traders are even starting to price in a 57% chance of a rate cut in March, even sooner than the previously predicted May, which may be a tad too optimistic. Regardless, the dovish overtone given by FED speakers throughout the week managed to drive yields lower, weaken the dollar and prop up stock prices. The end result was that the Dow added 2.4%, the Nasdaq rose by 0.38% and the S&P gained by 0.77% for the week.

The dovish FED benefited precious metals prices the most, with Gold surging by 3.6%, once again breaching the $2,000 mark and Silver rose by almost 5%.

As for oil, the falling dollar did not have an impact as the weak fundamental picture of the commodity sent prices lower. Despite Saudi Arabia’s extension of production cut by 1 million barrels per day to 1Q24, the price of oil eased amid a higher than expected number of rig counts in the USA. As a result, the WTI lost 1.9% and Brent Crude slipped by 2%.

This week, the main data that investors will be watching will be the ADP private payrolls due out on Wednesday and the non-farm payrolls out on Friday. In the meantime, the Reserve Bank of Australia and Bank of Canada will be having their monetary policy meetings on Monday and Wednesday respectively.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.