Crypto prices saw one of its largest dips for the year after the price of BTC flashed dumped last Monday, while a slightly hotter-than-expected CPI released on Tuesday ruffled some feathers amongst short-term investors who exited the market possibly due to the year-end and the FED meeting event risk.

Borrowings amongst altcoins surged early week as airdrop farmers on several popular DeFi protocols borrowed heavily to short the market in order to generate trading volume to gain points to get future airdrops. This caused a wide price correction amongst the altcoins that had recently seen huge gains, like AVAX and SOL, which have been overbought.

The market wide correction was beneficial as it managed to reset the open interest and funding rates back to neutral territory just in time for the FED meeting on Wednesday, when the FED not only held rates unchanged as expected, but FED Chief Powell gave risky assets the icing on the cake by commenting that with inflation falling much faster than previously anticipated, the FED has room for more rate cuts in the coming year.

Most officials now expect three rate cuts in 2024 as inflation moves toward a 2% target. FED Governor Christopher Waller even said the central bank could theoretically start cutting interest rates in the spring if inflation performs particularly well, which gave investors a strong signal to start loading up their longs.

Crypto prices rebounded strongly post FED meeting, which saw BTC briefly touch $43,000. Altcoins also followed suit with an even stronger recovery, where many have completely erased Monday and Tuesday losses by the end of the week. Amongst the top performing coins, AVAX and INJ stood out as the strongest players that carved out even higher prices than before the early week flash dump, while most other altcoins, including ETH, did not manage to recover higher. The fact that neither BTC nor the majority of altcoins could make new highs was a tell-tale sign that the two-month rally was getting exhausted as we head into the final two weeks of the year which have traditionally been bearish.

As late leveraged longs got liquidated and short term traders took profits, long-term whales were still seen to be accumulating BTC.

Whales loaded dips but short-term profit taking in play

Large BTC whales are still taking dip opportunities to load up their BTC bags. Last week, we witnessed a large volume accumulation of around 150,000 units of BTC, one of the sharpest increases of purchasing within a week in BTC’s history, underscoring the level of confidence long term whales have over the price trajectory of BTC in the days to come.

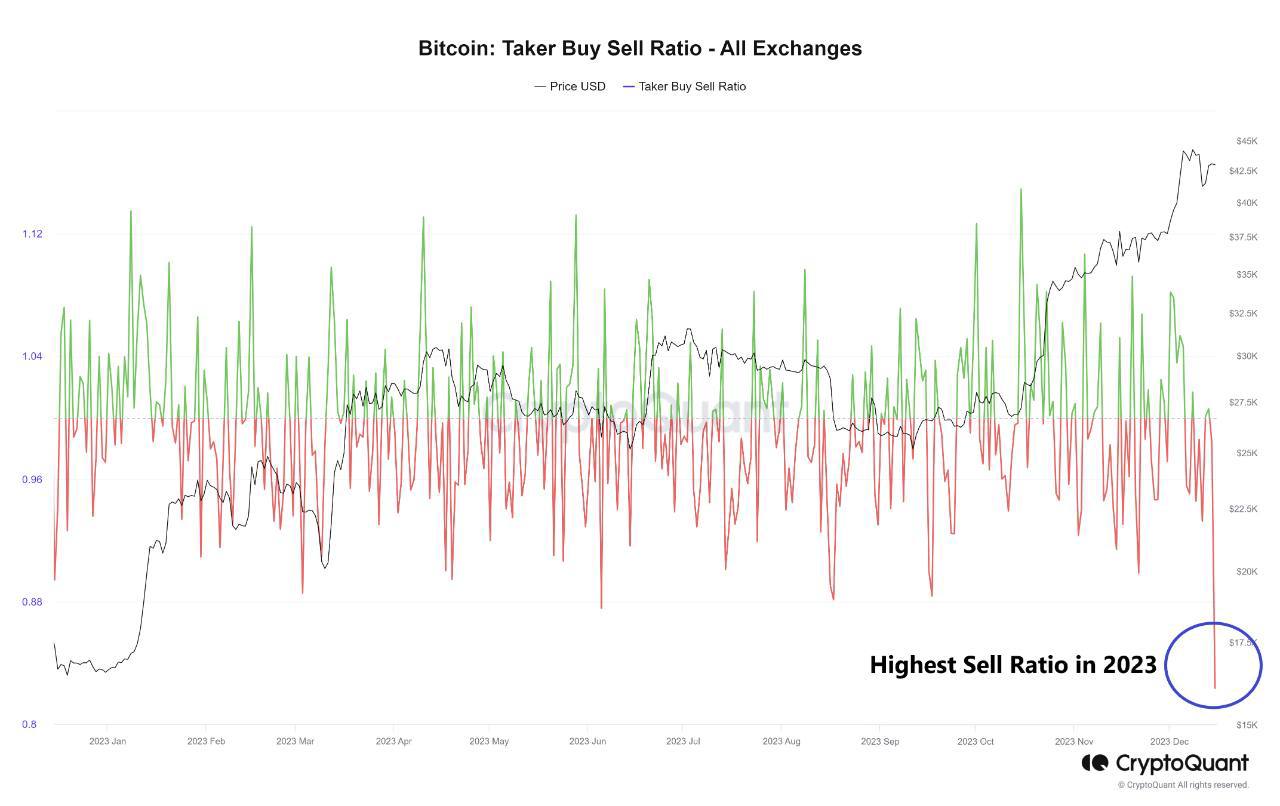

However, as the week and the main trading calendar drew nearer to the year-end holiday season, an increase in selling pressure was seen throughout the market, as traders quite naturally took profits and started to wind down their trading activities.

The highest ever sell ratio was spotted immediately after the FED meeting spike, which could have prevented the price of BTC from breaching the $45,000 mark. The selling eventually took the price of BTC down from $43,000 to around $41,000.

CME gap could be haunting BTC

As there is a CME gap at around $38,900, most investors will be watching to see if the price of BTC comes down to close the gap in the coming two weeks as some investors think that most price gaps in any trend have to be closed before the trend can continue. In this case, for the current uptrend in the price of BTC to be able to continue rising substantially, many investors think BTC’s price needs to come back down to close the gap at around $38,900. This fear of the gap could be one reason why the price of BTC had failed to pump higher after the FED meeting even when stocks were making new all-time-highs.

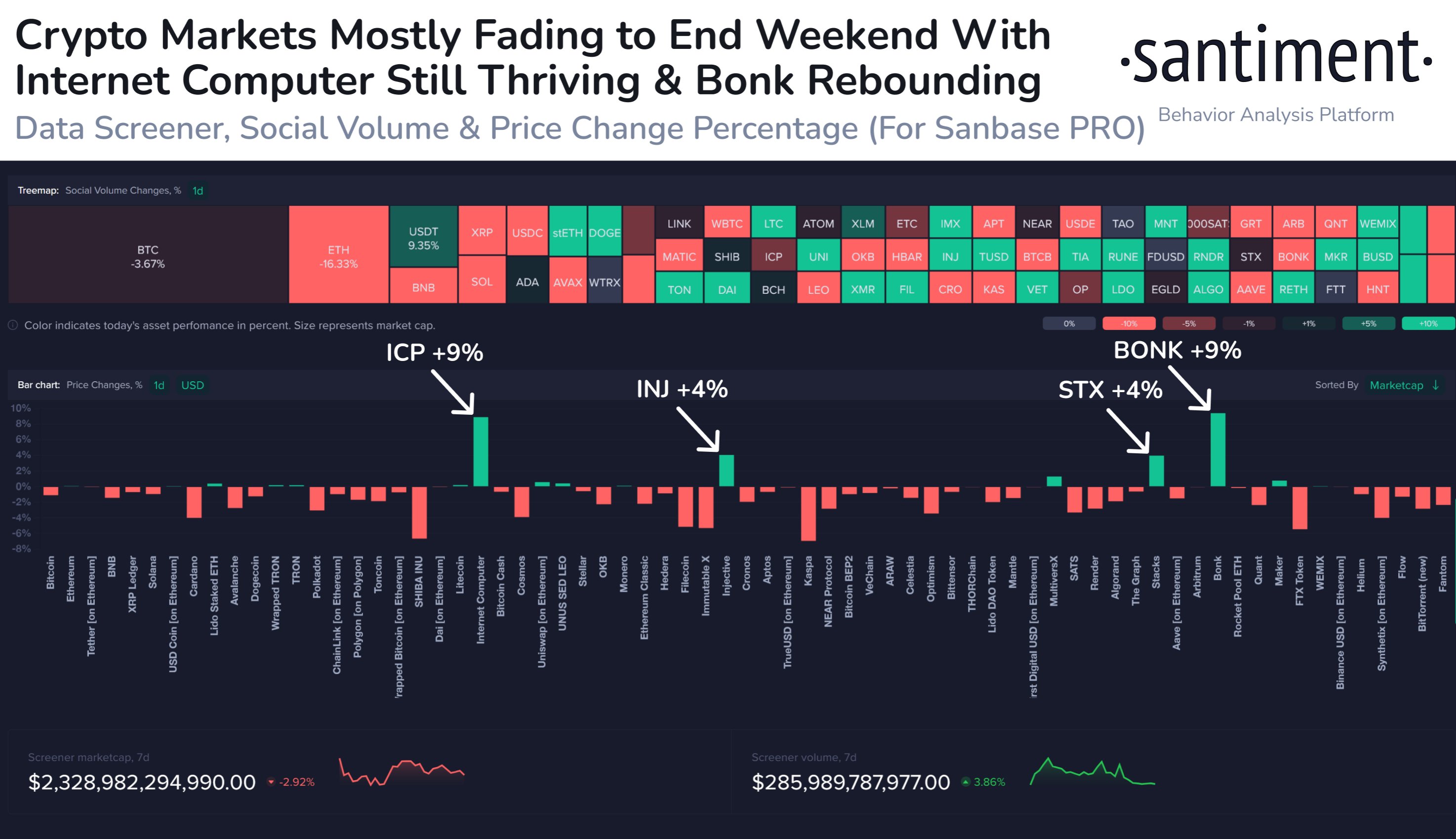

For altcoins, the year-end profit-taking appeared to have less impact last week, as many altcoins continued to move higher even when BTC was retracing. However, they too came under aggressive profit-taking this past weekend, with retracements of around 10-50% seen in coins that have been up several folds over the past two months. This retracement is expected to continue into the final two weeks of the year, however, there could still be random pockets of pump and dump expected to occur as trading volume dies down. Furthermore, with lower trading volume may come higher price volatility and as such, leveraged traders may need to take note of and manage your risks proportionately.

Some examples of random pumps include ICP and WLD, which saw sudden 50% overnight pumps over the weekend, which were followed by an equal magnitude dump back to pre-pump prices.

Crypto back alive in Asia

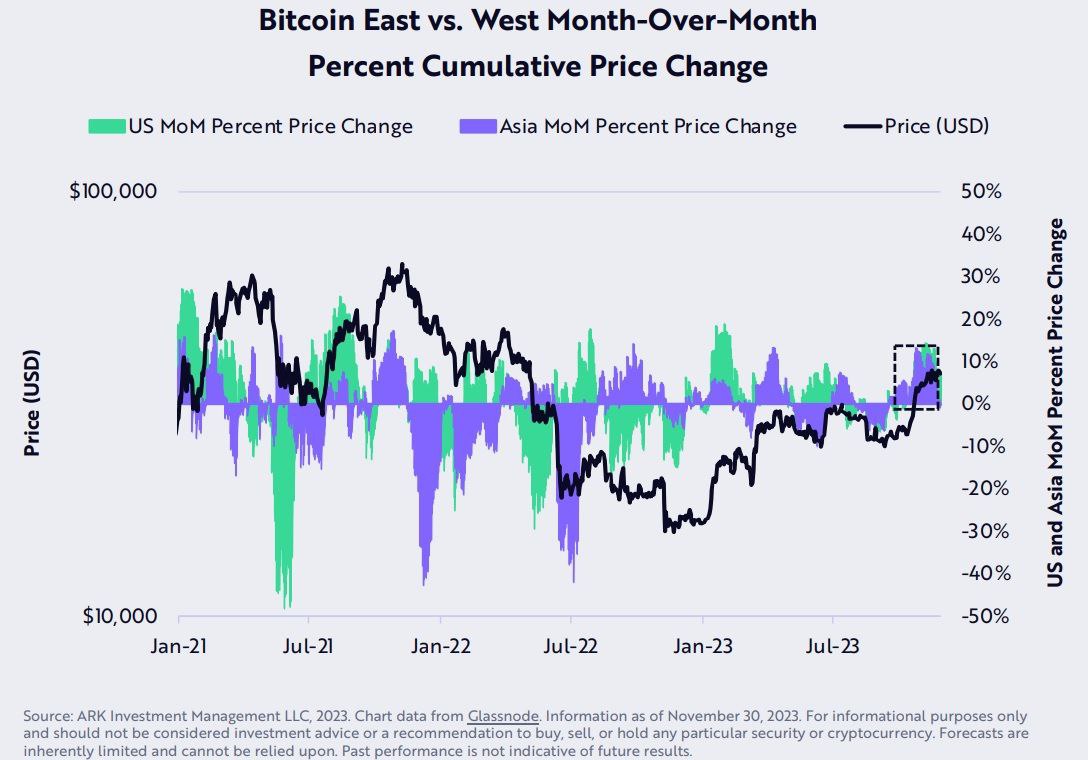

As crypto regulations start to gain more clarity over the last couple of years in Asia and high inflation grips most of Asian economies, there has been an increase in crypto trading activities in Asia, with price movements in the early Asian trading session recording the highest growth in 4Q23, with the bulk of flows being purchases.

According to the diagram below by Ark Investments, it is noted that the Asian trading session has witnessed the sharpest price increases in recent times, a phenomenon which traders may want to take note of to increase your trading alpha.

That said, the US trading session has seen the most consistent demand over the past year, a trend which is likely to continue as the chances of BTC spot ETFs increase.

US stocks rally to record highs as rate cuts expected

Tuesday’s release of slightly hotter than expected CPI numbers did nothing to foil the stock market rally, as US stocks continued to rise to make new highs with traders trying to front-run the FED, which was expected to be dovish.

Traders were not disappointed as the FED kept rates unchanged and signalled at least three rate cuts next year due to inflation falling faster than expected. The central bank also formally lowered its inflation forecast for 2024, seeing a 2.4% rate, down from its previous 2.6% forecast, giving traders ammunition to go piling up the long bets. By the end of the Wednesday session, the Dow already made an all-time-high by piercing the 37,000 mark for the first time.

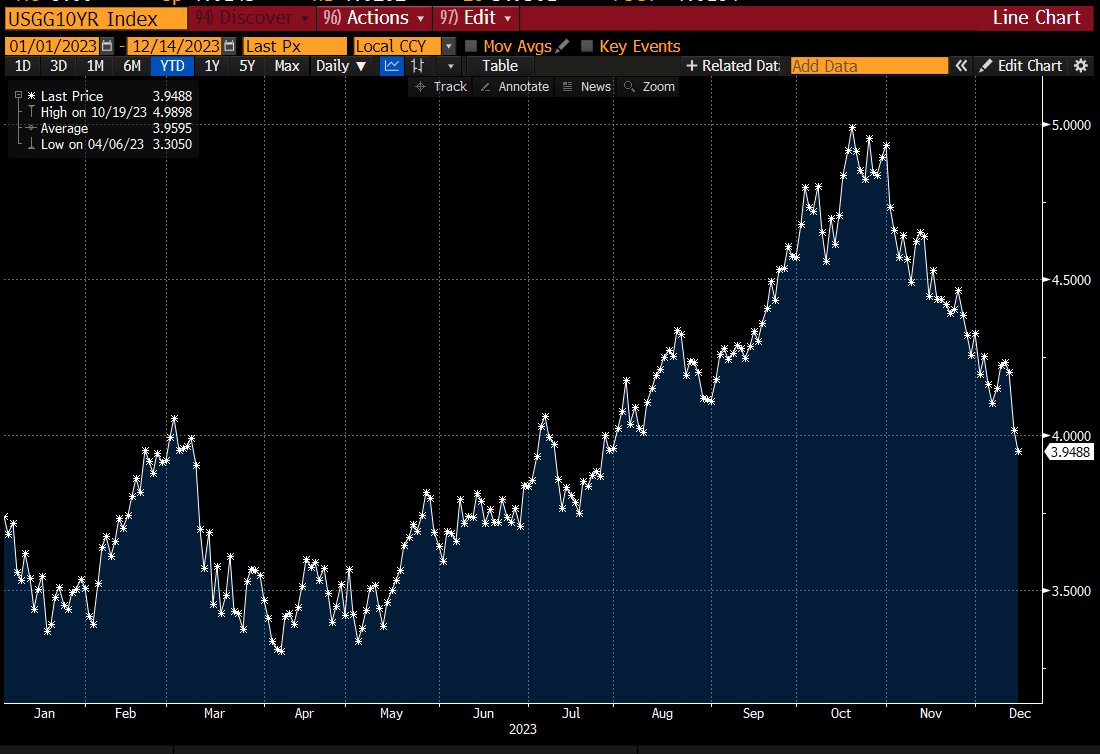

US yields toppled post the dovish FED remarks, with the 10-year Treasury breaking below 4%, leading to a big dollar selloff.

Meanwhile the Bank of England and the ECB both kept rates unchanged, resulting in an even bigger drop in the dollar in relative terms. By the end of the week, the DXY lost more than 2%.

Gold gained about 0.73% on the back of the weaker dollar, while Silver edged up around 0.5%. Oil prices traded higher by around 1%, its first week of gain after seven consecutive weeks of losses after the EIA raised its 2024 demand outlook.

This week, it will be quiet on the economic front in the US, with only the final 4Q GDP figure that will be released on Thursday, however, that is not expected to move the markets. In terms of central bank meetings, we will see the Bank of Japan meet for the last time this year late Monday before trading activities start to level off for the Christmas weekend as traders are expected to have already taken good profits this year and are not expected to increase risk until after the new year.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.