Bitcoin tumbled 5% last week in its largest weekly decline since early October. The price started last week at 110k, briefly rising to 111.3k, then falling below the key 100k psychological level for the first time since June, to 99k, a 4-month low. The price picked up slightly over the weekend and is extending those gains at the start of the new week, trading at 106.3k at the time of writing.

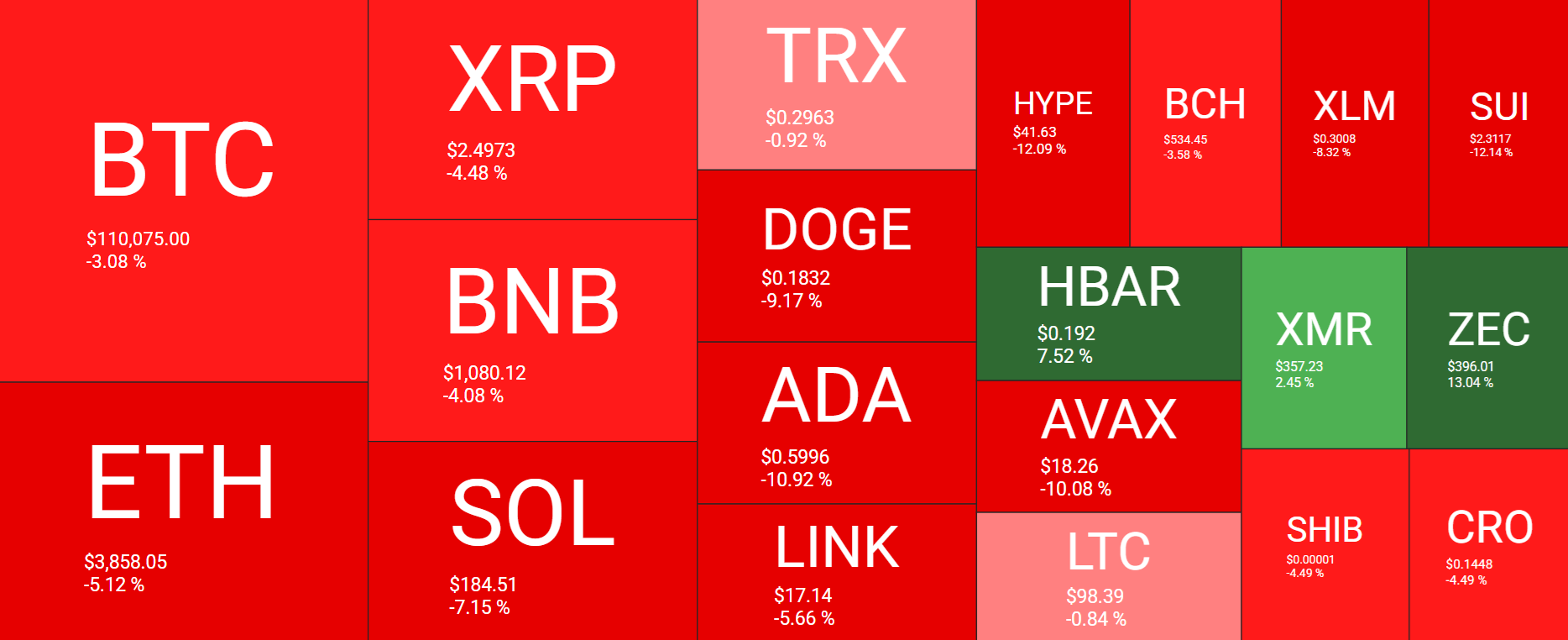

Major altcoins also traded lower over the past week. Ethereum sank to near $3000 before recovering to 3600 at the time of writing, but it still trades 7% lower over the past 7 days. Other altcoins also traded lower. BNB fell 7%, SOL 10%, and XRP 6%, although they recovered from lows of the week and pushed higher on Monday. There were some pockets of positivity, with ZEC up 62%, LTC up 13%, and XMR ending the week 23% higher.

As Bitcoin and other major altcoins recover from multi-month lows, the total cryptocurrency market capitalisation is also moving higher, rising from $3.31 trillion on Tuesday, its lowest level since early July, to $3.58 trillion – up 4.4% over the past 24 hours alone.

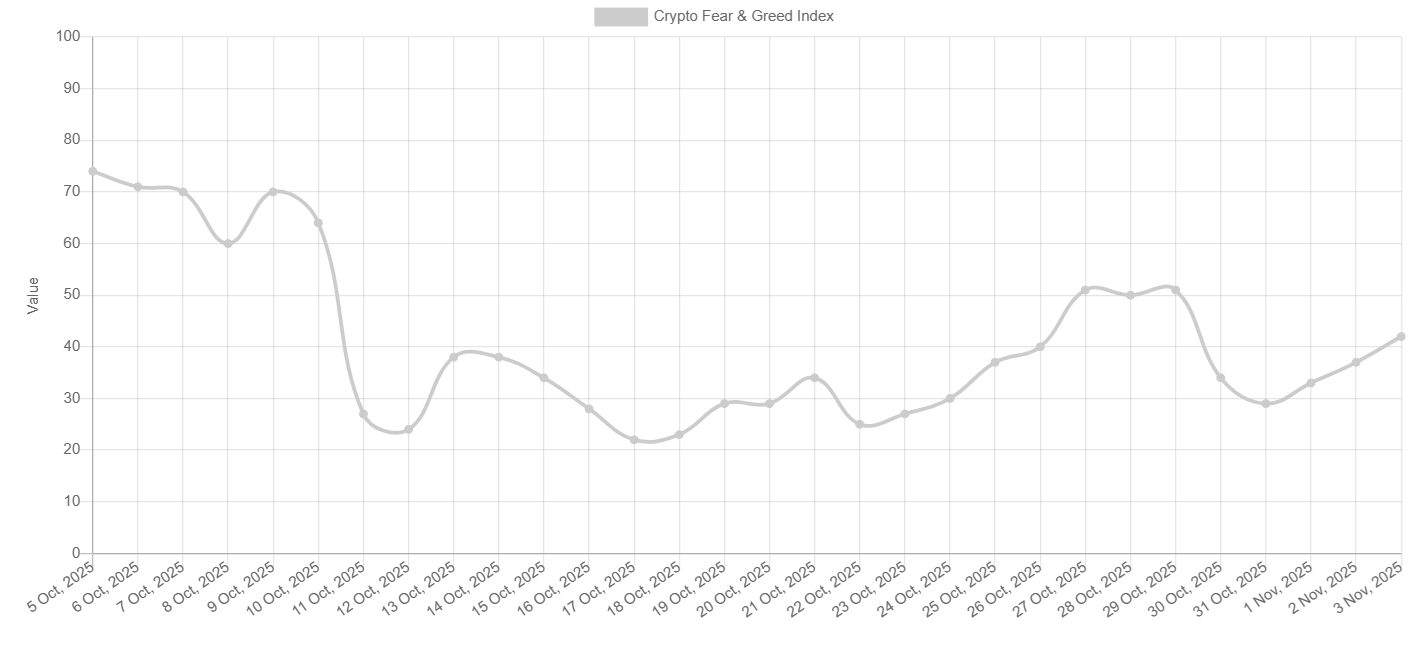

Sentiment analysis shows that the market mood has improved to Fear (29) up from Extreme Fear (22), where it has been for most of the week, but still down from Fear (37) last weekend. Improving sentiment could be considered bullish for the Bitcoin price.

As the Bitcoin price sank towards 100k on November 4th, crypto liquidations soared to over $2 billion, of which $1.62 billion were long positions and $398 million were short positions. Liquidations remained relatively lower for the remainder of last week. Over the past 24 hours, crypto liquidations totaled $343.07 million, with $261.5 million in short positions and $81.5 million in shorts.

Macro backdrop

Bitcoin fell sharply last week as the US government shutdown continued and amid a selloff in tech stocks due to concerns over stretched valuations, which then spilled into other sectors. US stocks fell, with the Nasdaq 100 experiencing its steepest weekly decline since April.

The risk-off mood accelerated amid mixed economic data and concerns about the health of the US jobs market, following the Challenger report. The report showed 153k jobs were cut in October, the highest level for that month in 2 decades, as companies adopted AI and cut costs. While the data lifted Federal Reserve rate-cut expectations to 67% from 62% at the start of the week, it failed to boost risk appetite, as investors fretted over the possibility of an economic slowdown.

Is the US government about to reopen?

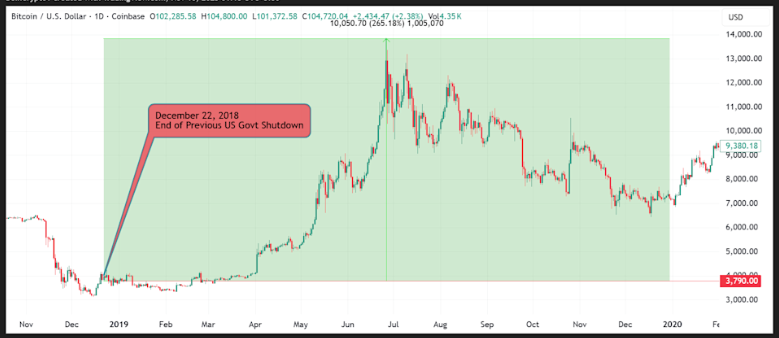

The US government shutdown is entering its 40th day of political gridlock, but could reopen soon. This is the longest shutdown in history, after the past lockdown lasted 35 days from December 22, 2018, to January 25, 2019.

With flight cancellations rising as the key Thanksgiving holiday approaches, there could be greater motivation to reach a deal. Reportedly, Senate Democrats have signaled a readiness to advance bipartisan spending bills to end the record-long shutdown, which has furloughed 75k federal workers, disrupted key services, and withdrawn liquidity from the market.

One possible reason for Bitcoin’s 20% decline from its record high may have been the US government shutdown, which tightened liquidity conditions. During a shutdown, the government is essentially paralysed. Many payments are suspended or delayed, reducing cash outflows. As a result, the Treasury General Account (TGA) drains more slowly, and liquidity available to the financial system decreases. Bitcoin is particularly sensitive to liquidity.

As soon as the shutdown ends, the US Treasury must catch up on deferred spending, wages, contracts, and federal programs. This large disbursement results in a rapid decline in the TGA, equivalent to a direct injection of liquidity into the system. Risk assets often rally. After the US government reopened in 2019, BTC embarked on a 5-month rally, climbing 300%. Will history repeat itself?

In the meantime, optimism surrounding a possible end to the shutdown is driving risk assets higher.

Trump’s tariff dividend

Adding to the upbeat mood, Trump pledged $2000 to each household, a stimulus measure aimed at drumming up political support. If Trump follows through on this pledge, it could turbocharge investments, including crypto. However, this dividend will also have a steep cost, with the long-term effect being fiat currency inflation and a loss of purchasing power.

Is the bottom in? On-chain data suggests it is

Despite choppy BTC price action, on-chain data is looking more encouraging, suggesting that a bottom may be imminent.

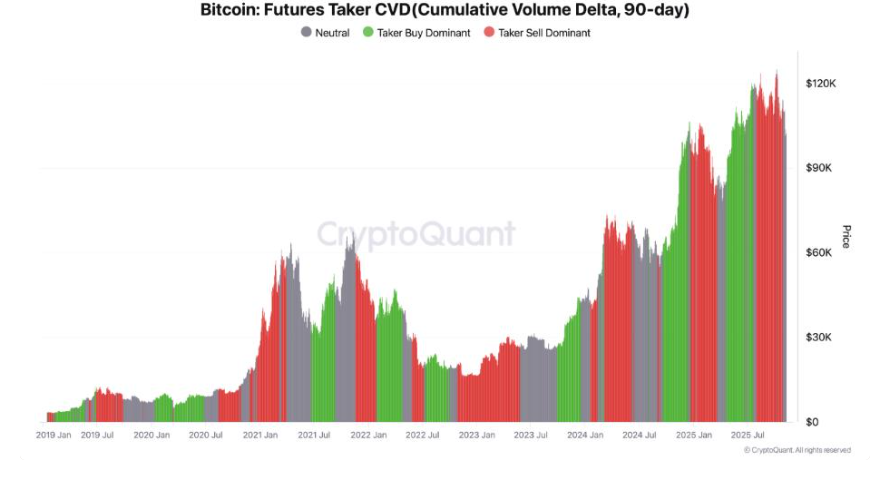

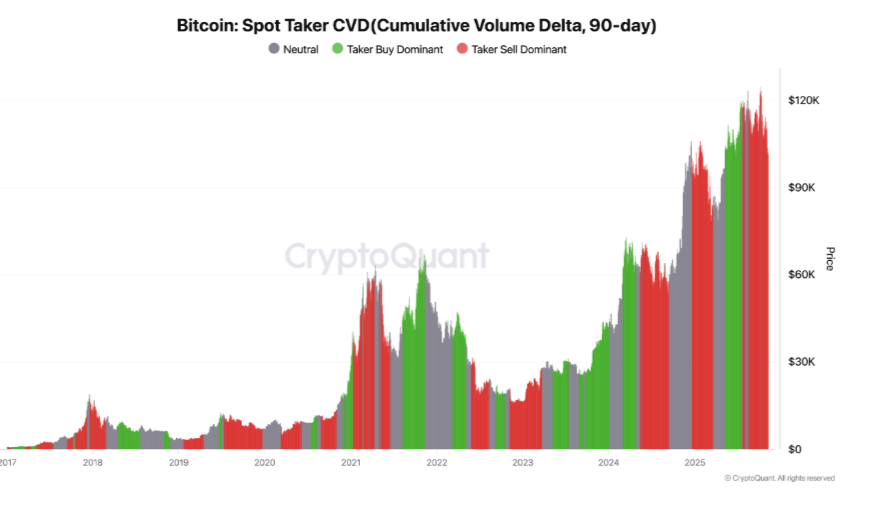

According to CryptoQuant, Bitcoin is showing signs of having bottomed. The first chart that supports this thesis is the cumulative volume delta (CVD) metric, which tracks the net difference between aggressive buy and sell volumes in the Bitcoin futures market over the past 90 days. The CVD chart shows that speculative selling pressure is fading as the red turns neutral. This means that leveraged short positions are slowly taking their exits; therefore, these speculative hands are weakening.

Meanwhile, the spot taker CVD metric shows that the number of speculative sellers is declining. The spot price of CVD remains in the red, suggesting Bitcoin holders are still selling their coins.

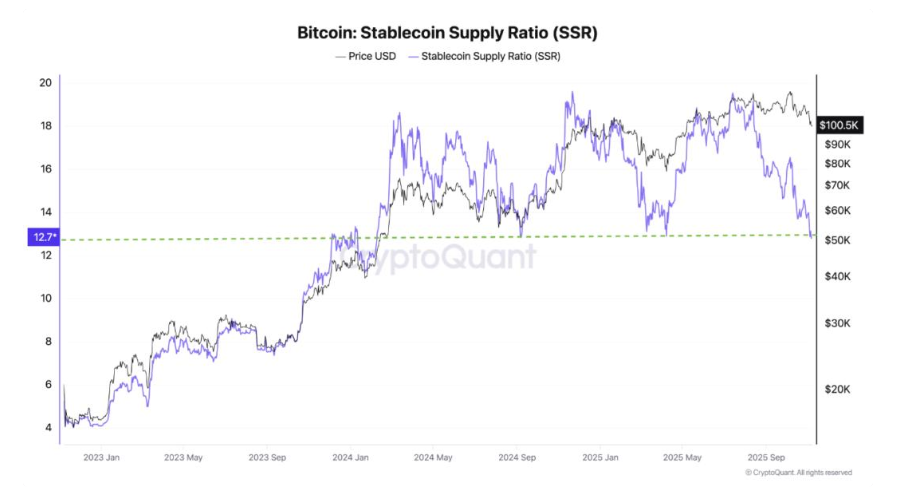

Another interesting data point is the Stablecoin Supply Ratio, which has hit a historical low. The metric measures the ratio of Bitcoin’s supply to the supply of stablecoins (such as USDT).

A high SSR indicates that there are fewer stablecoins than Bitcoin. This indicates a lower buying power to purchase Bitcoin in order to send its price to the upside. On the other hand, a low SSR indicates a relative abundance of stablecoins compared to BTC, suggesting greater potential buying power in the Bitcoin market.

Previously, a low SSR has often preceded a BTC rebound. If history is anything to go by, this could mean that we’re on the cusp of another rebound as the SSR currently hovers around a historical low.

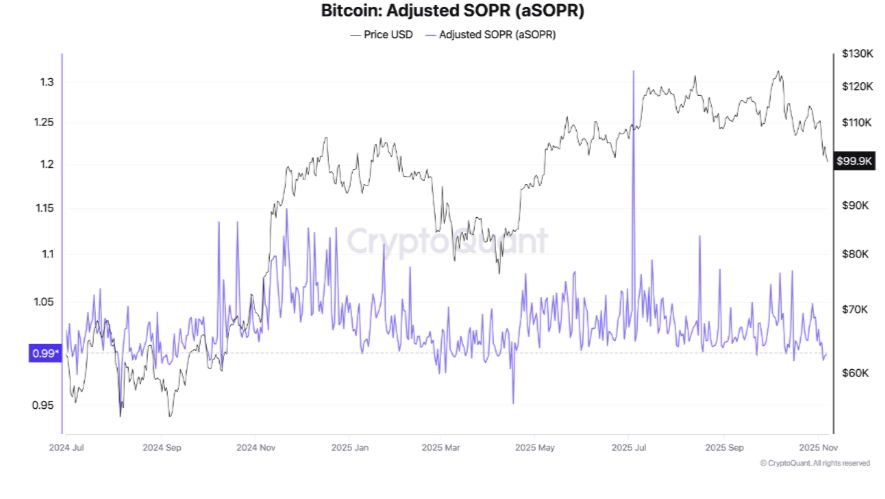

Finally, the Adjusted Spent Output Profit Ratio aSOPR also supports the likelihood of a price bottom. Currently, the aSOPR reads around 1.0, a level that was breached in April 2025, which preceded a significant price reversal.

However, big BTC holders are still selling. Can demand catch up?

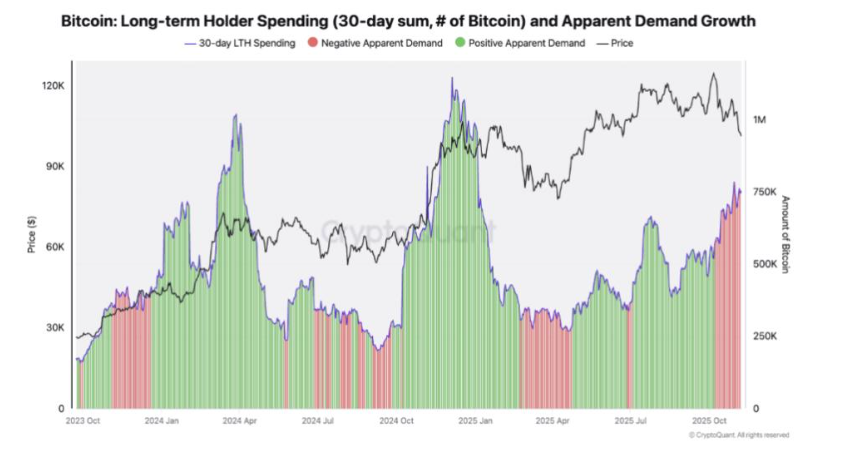

According to data from CryptoQuant, long-term holders have been actively booking profits, and the market has shown limited capacity to absorb the sell-offs.

Long-term holder selling is a normal pattern in bull markets, as investors take profits when Bitcoin approaches all-time highs. The data shows that the 30-day sum of long-term holder (LTH) spending represented by the purple line has been increasing since early October. This behaviour follows previous bullish rally phases, as seen in early and late 2024, when profit-taking coincided with expanding demand.

In the chart, the green area represents periods of positive demand growth, while the red area represents contraction. Since October 2025, the trend has turned red, showing that even as long-term holders sell, demand decreases, highlighting the market’s inability to absorb the selling pressures. This would need to change for BTC to hold above 100k.

BTC ETF demand is key

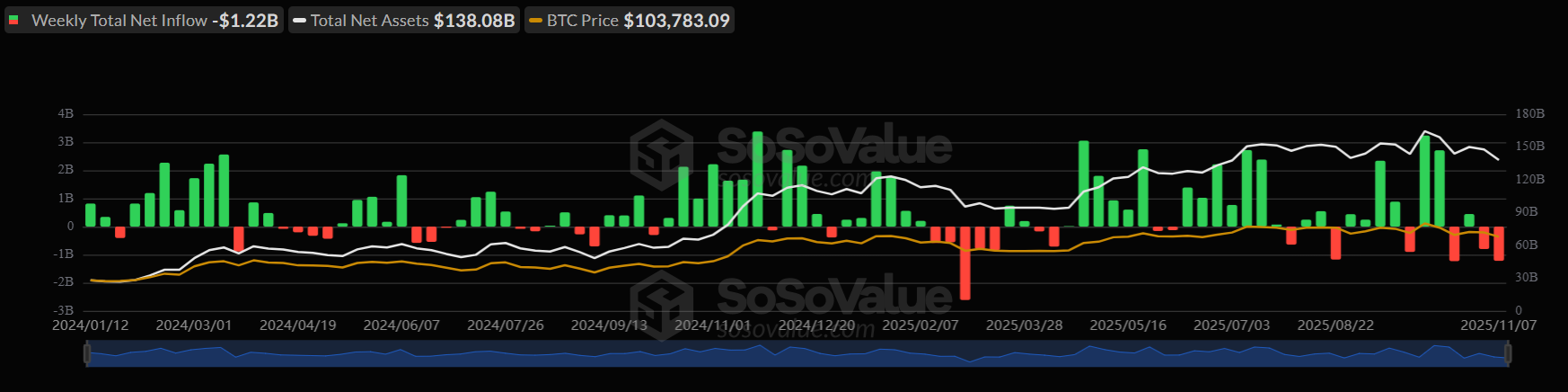

A large portion of demand now comes from the spot Bitcoin ETF, which has seen a sharp slowdown in inflows. Data from so-so values showed that the US spot BTC ETF recorded net outflows of $558.4 million on Friday, one of the largest single-day outflows in recent weeks, and $1.22 billion across last week.

Should LTHs’ sell-off continue, apparent demand must start to recover in the coming weeks to help stage a recovery; otherwise, BTC could consolidate around 101k-103k.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.