The week started on a positive note for crypto as China cut its benchmark 5-year lending rate again for the first time since June 2023, injecting liquidity into the financial system that has been finding its way into the crypto markets.

However, post the release of FED meeting minutes which highlighted that FED officials were wary of cutting rates too soon, crypto prices pulled back as traders started to take profit amid the rising funding rates. As a result, the price of BTC retreated after almost hitting its next resistance level of $53,000.

BTC supply shifting from mid-term to long-term holders

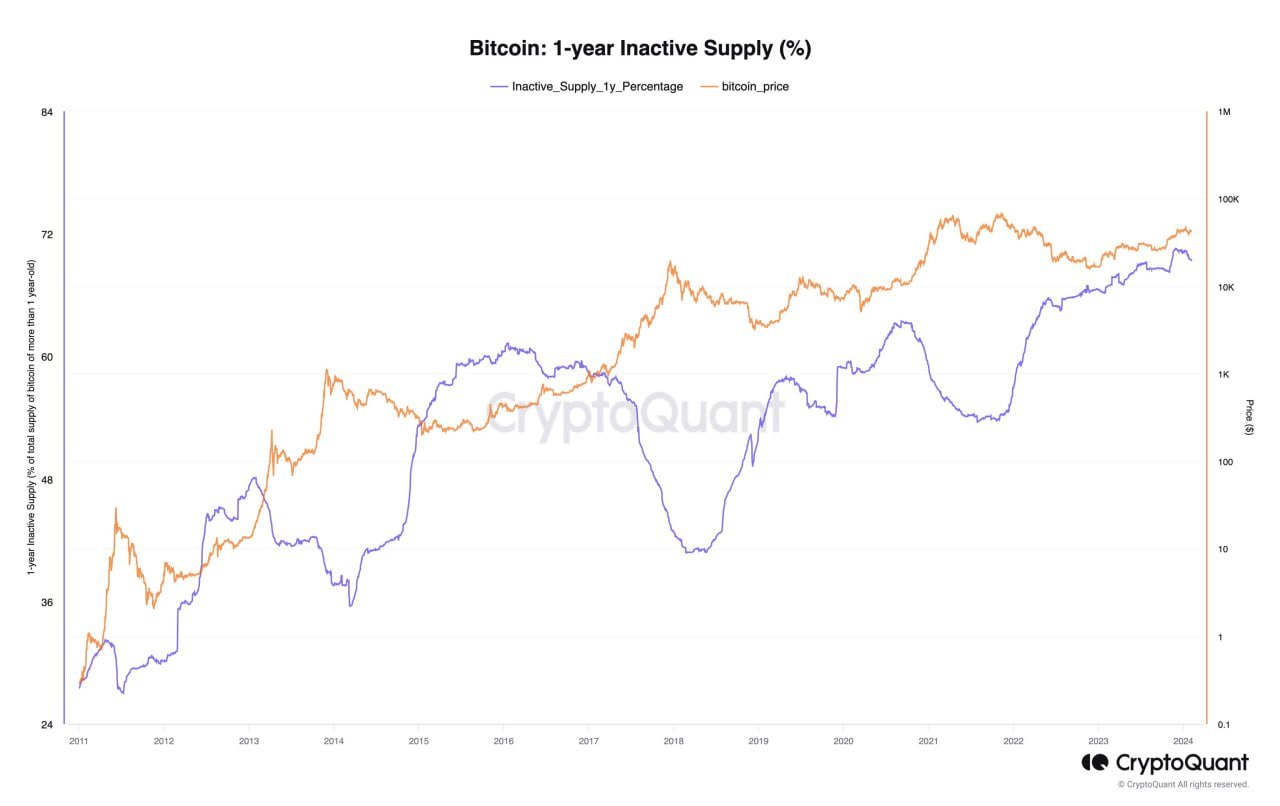

The profit taking moves of mid-term BTC holders who had bought BTC at the bottom early last year may have been the reason why the price of BTC has failed to break higher. As can be seen in the below diagram, the supply of BTC which had been inactive for at least 1-year made a big dip last week, implying that these BTC have been sold. Could this action by the bottom fishers mark a temporary local top as the macro narrative shifts back to rising inflation and a stronger dollar?

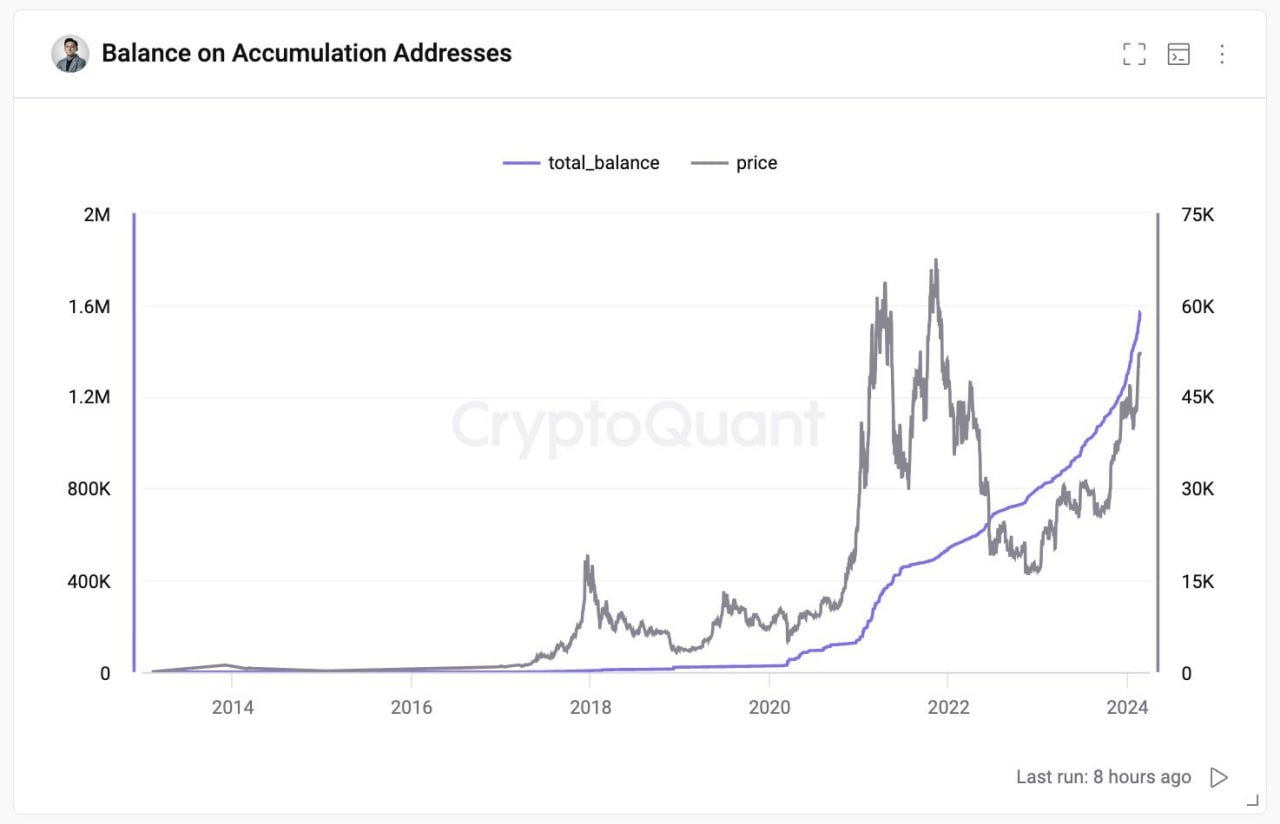

However, long-term holders have been buying the dip, as can be seen in the diagram below which shows that the accumulation address, i.e. addresses that have little to no selling activity, has risen very significantly since the start of this year. This shows that the supply of BTC is being shifted into even stronger hands, which could mean the supply shock that the market had been anticipating could happen even sooner than most would expect.

Demand for crypto surges significantly

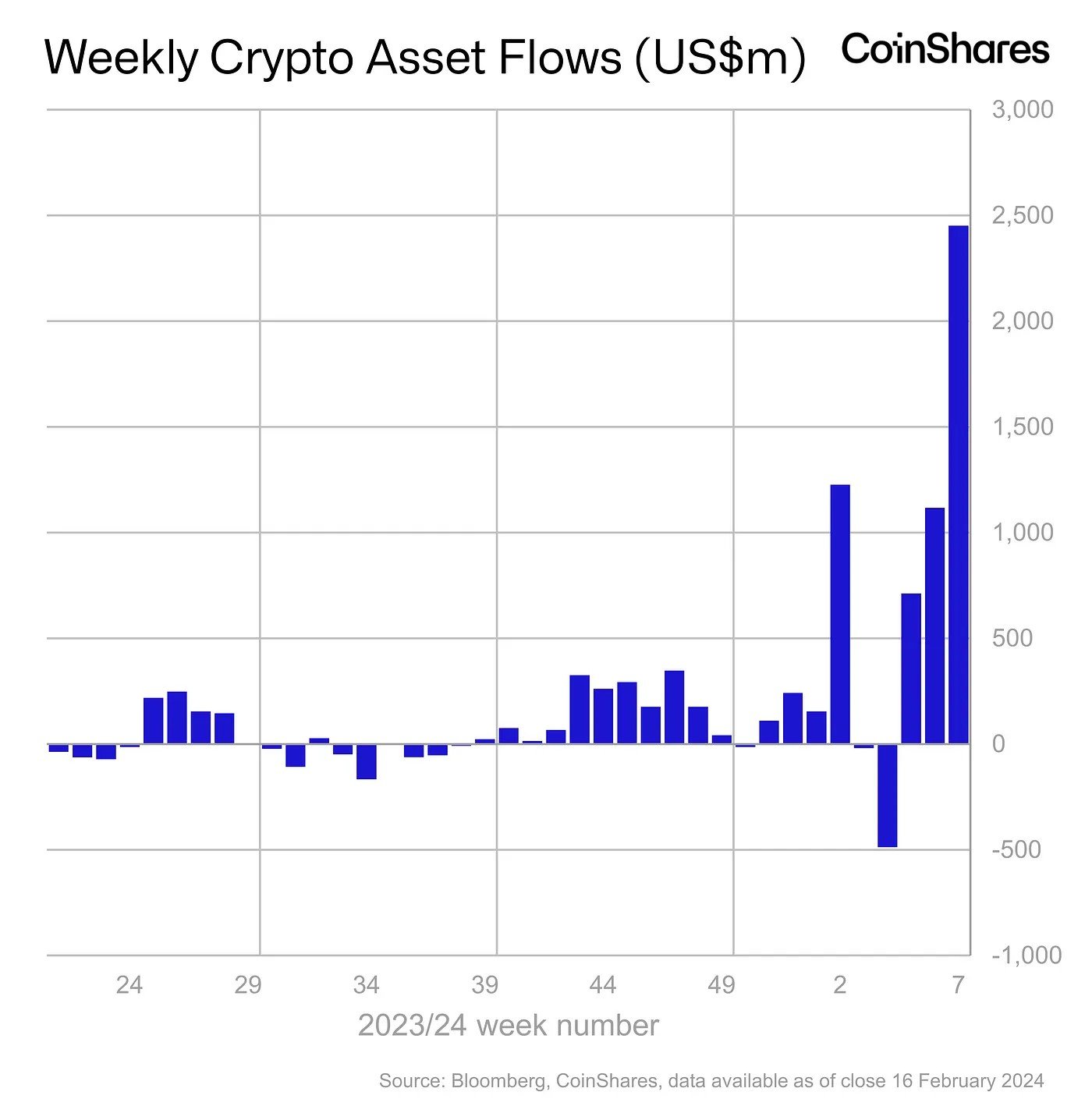

On the institutional front, the demand for BTC and crypto investment products continued to see remarkable growth, as digital asset investment products saw yet another record weekly inflow totalling $2.45 billion. The inflow for the year to date since the inception of the spot BTC ETFs slightly over a month ago is now standing at an impressive $5.2 billion.

Most of the inflows were again from the USA, with 99% out of the $2.45 billion from the USA alone, which explains why crypto prices have been trading at higher prices during US hours.

Other than BTC, other coins which have seen inflows included ETH, with $21 million inflow, as well as AVAX, LINK and MATIC, which saw inflows of $1m, $0.9m and $0.9m respectively. SOL, which had recently had its first downtime in 2 years, saw $1.6 million worth of outflow.

Another positive for MATIC was that the token had completed its final token unlock last week, which means that there is no more inflation for MATIC’s token supply, i.e. all of MATIC’s supply has entered circulation, which means there will no longer be any new supply coming in to dump on token holders.

However, for AVAX, the Avalanche C-chain suffered a 1-hour downtime last Friday due to a surge in the number of inscriptions minted on the chain. Thus, it will be interesting to see if AVAX investors will also remove their investments from AVAX like what SOL investors did after Solana experienced a downtime.

Other than demand from institutional investors, demand for crypto from the corporate scene is also returning. This can be seen in Reddit’s filing for an IPO last week where the firm disclosed that it has invested some of its excess cash reserves in BTC and ETH and is using ETH and MATIC as payment methods for the sale of certain virtual goods. However, the company clarifies that it holds no other digital assets other than BTC and ETH for financial management purposes, which means that Reddit disposes of the MATIC it acquires from customers.

Buying of ETH picks up pace this year

This thus brings our attention to ETH, which has been outperforming BTC this year, with the ETH/BTC pair finally bouncing strongly off its range low. With the Dencun upgrade on 13 March nearing, as well as hopes of a spot ETH ETF being approved in 2Q, it looks like ETH may continue to outperform BTC in the days to come.

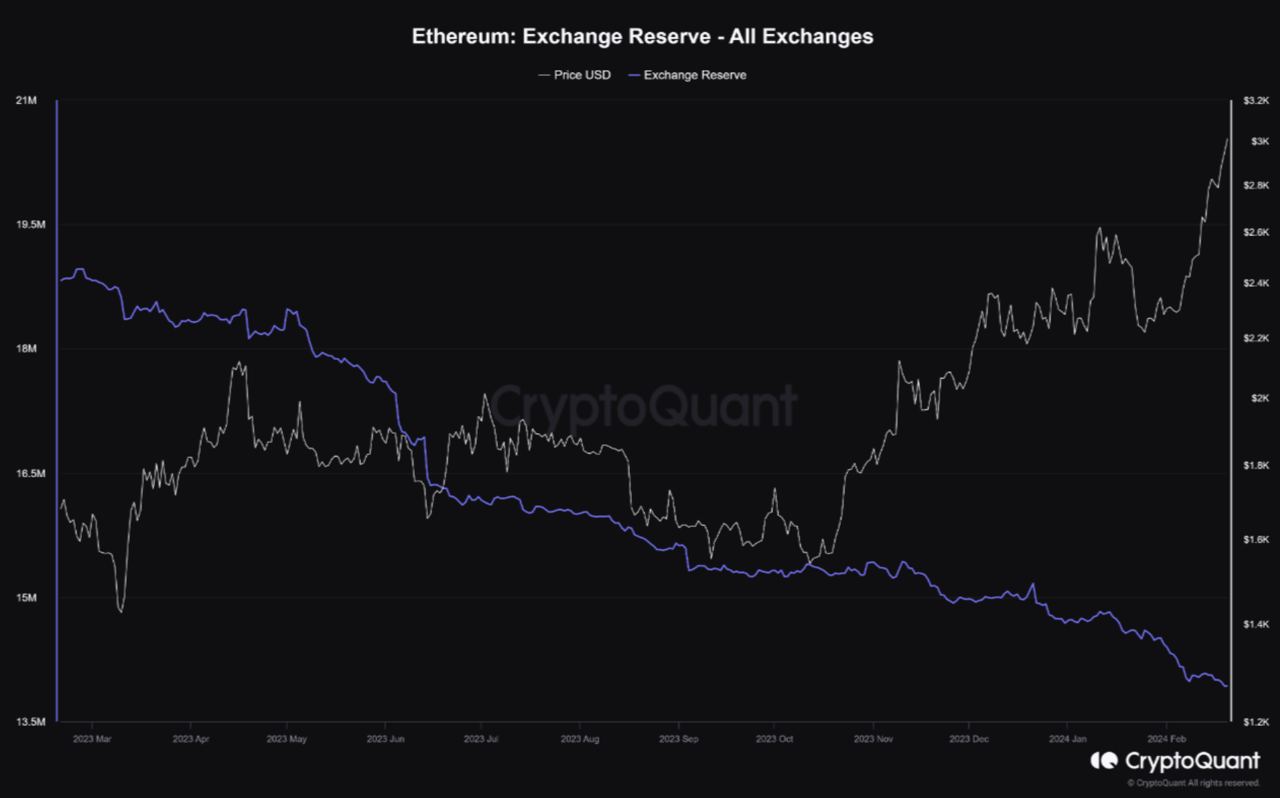

The fundamental picture of ETH is also looking increasingly favorable. In the first seven weeks of this year, more than 200,000 units of ETH have been withdrawn from exchanges, a sign that the buying of ETH is more aggressive than the selling. With such a situation, given time, the price of ETH would eventually reflect this demand outstripping supply situation.

US stocks rise to another new ATH led by earnings

In the latest FED meeting minutes released on Wednesday, officials were seen expressing caution about lowering rates too quickly, noting that they wanted to see more signs of inflation easing before starting to cut rates. This reminded traders of the most recent CPI and PPI released the week before, which both exceeded expectations, causing an initial dip in the markets, which turned out to be an excellent buying opportunity.

By Thursday, after Nvidia posted another set of expectation crushing results, the entire US equity market was led higher, with the Dow rising to close at another fresh record, and the S&P hitting an all-time high. As of the close of the week, the Dow gained 1.3%, the S&P rose 1.66% and the Nasdaq advanced 1.4%, with all three indices ending the week near their highs of the day.

With regards to other assets, the dollar was modestly lower, losing around 0.4% as profit-taking on the greenback pulled the price of Gold back higher by 1.1%. Silver too saw some profit-taking, losing 1.85% after the magnificent 3.5% gain the week before.

Oil prices inched lower, with both Brent and the WTI losing around 2.2% each.

This week, the Bank of New Zealand will meet on Tuesday, while Thursday will see the important month-over-month US PCE inflation gauge released. Should the data show a much stronger than expected inflation rate, there is a chance the stock market could see some short-term downside volatility as the market approaches the end of the month of February.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.