The week for crypto started with CBOE announcing plans to launch trading and clearing in margin futures on BTC and ETH beginning 11 January 2024. This will make CBOE the first US regulated crypto native combined exchange and clearinghouse to enable both spot and leveraged derivatives trading on a single platform. However, the news did not do anything for the markets as a short-term overbought situation had caused prices to retreat drastically all throughout Monday, with the interesting effect of a US credit rating downgrade by Moody’s dragging down the crypto and US stock markets initially.

JP Morgan’s report about the bank having the opinion that this crypto rally is not sustainable further dampened sentiment, as were rumors about Congress planning to introduce measures to curb the use of crypto as an aftermath of the alleged use of crypto for terror financing.

The fear of the government shutdown also weighed on crypto as the approval for the spot BTC ETFs that was expected to come by 10 January 2024 would have to be postponed should a shutdown materialize, as that would render the SEC unable to hold operations.

As a result, the crypto market declined for two consecutive days from Monday into Tuesday, liquidating around $400 million worth of long positions. The price of BTC caved 5% while altcoins were bleeding between 10% to 25%. Even a more benign US CPI number released on Tuesday could not lift crypto prices.

However, the flushing out of leveraged positions turned out beneficial to the market as it managed to cool off the rising funding rates and at the same time, reduce open interests in the futures market by almost $1 billion.

On Wednesday when the US legislators managed to extend funding till end January next year to avoid a government shutdown, crypto prices regained their bullish trajectory as the extension kept hopes alive for potential ETF approvals since that would allow the SEC to continue evaluating the numerous spot BTC ETF to make it for the 10 January deadline.

The price of BTC revisited $38,000 and altcoins which had been greatly flushed the day before recovered all their losses. However, as there was a lack of fresh catalyst to carry the market higher, prices could not manage to break into higher levels as short-term sellers took profit across the board due to what looked like a double top appearing in the chart of BTC.

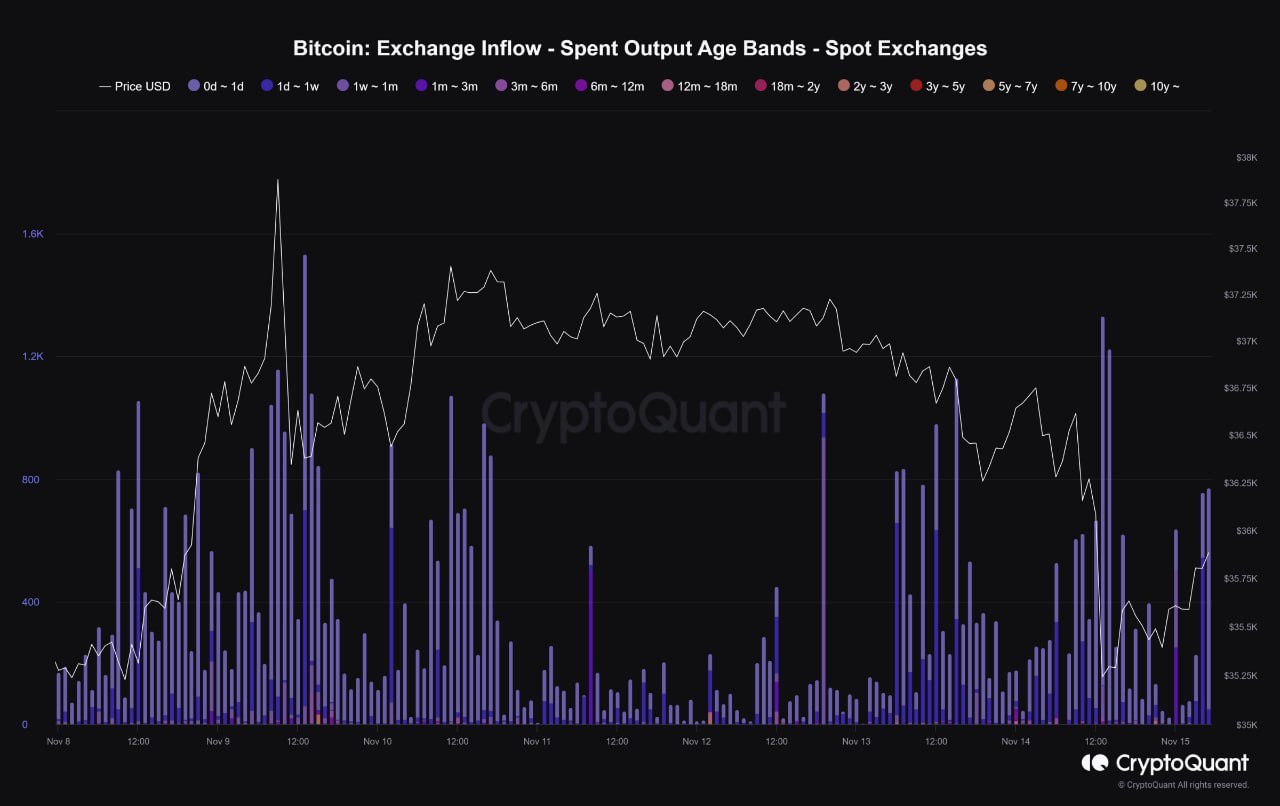

Short-term BTC traders take profit

As a double top is a warning of a potential reversal, short term traders took profit on their recent BTC purchases, as evidenced by the below diagram where the main sellers of BTC in the last couple of days had only held their BTC for between one day to one month. Long-term holders, however, were nowhere to be seen as having sold any BTC at all.

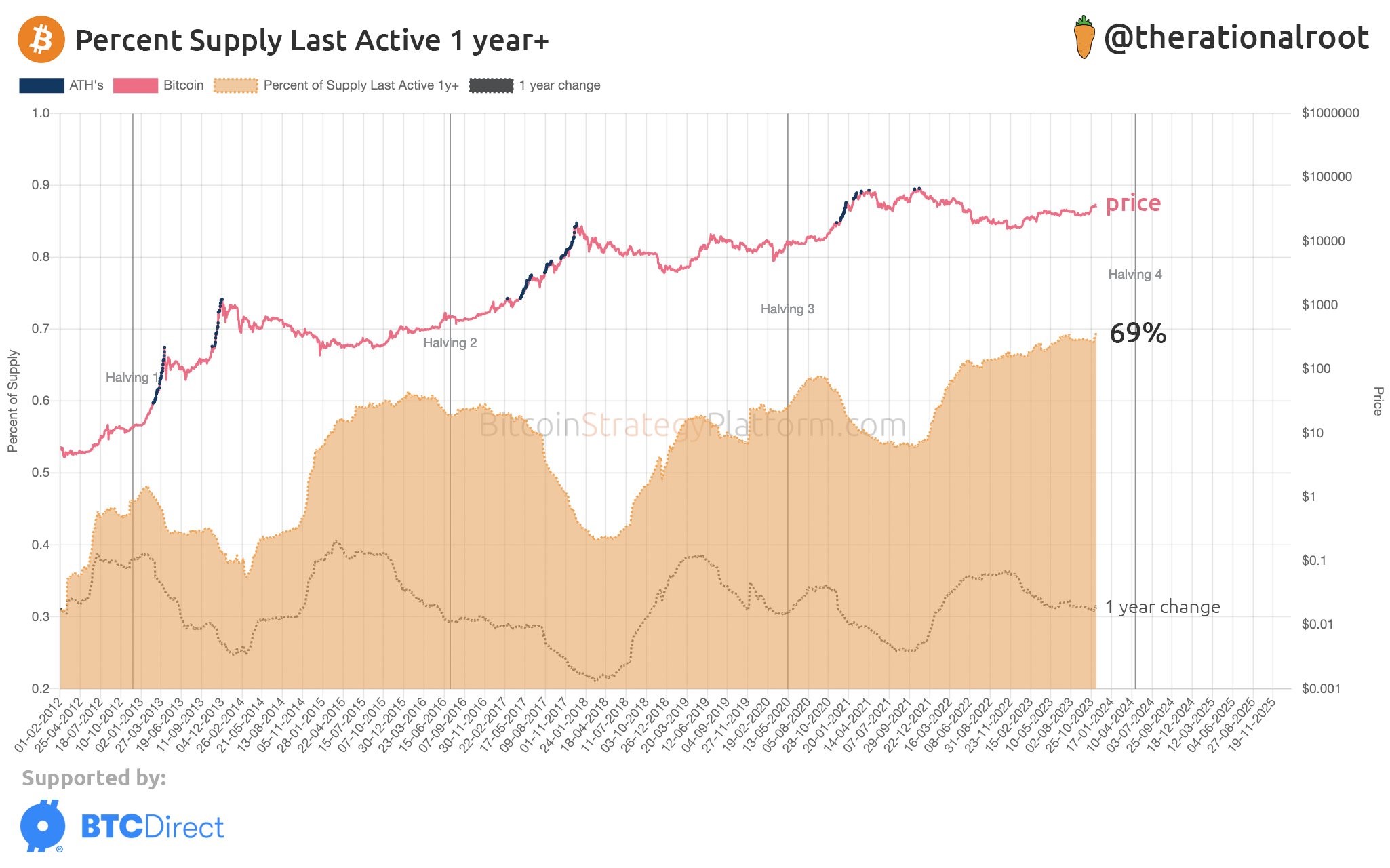

BTC long-term holder supply hits ATH

While short-term traders were happy to take between 10% to 20% profit on their BTC, long-term holders of BTC are increasingly unwilling to part with their prized possession even with the price of BTC hovering near the year’s high. In fact, from the chart below, we can see that the number of BTC that has been held for more than one year actually increased over November even when the price of BTC was climbing.

This lack of selling pressure may keep dips shallow and maintain support for the price of BTC as we move into the year-end, as the hopes of spot BTC ETF approval is still in play until 10 January 2024. This expectation that a spot ETF approval could usher in huge amounts of fiat inflow to purchase BTC has prevented holders from selling, to the point that the percentage of total supply of such illiquid BTC is at an all-time-high of 69%.

Furthermore, more companies appear to be willing to purchase cryptocurrencies as part of their Treasury holdings. Boyaa Interactive, a Hong Kong-listed company and China’s largest board and card game company, said it will purchase cryptocurrencies with a total amount of no more than $100 million within 12 months, mainly BTC and ETH. Recall that in the beginning of the 2021 bull market, the same thing happened with Meitu, yet another Hong Kong-listed company, which similarly used around $100 million to purchase BTC. Could the resurgence of such behavior be a sign that the bull run is upon us? Time will tell, afterall, we are merely six months away from the next BTC halving.

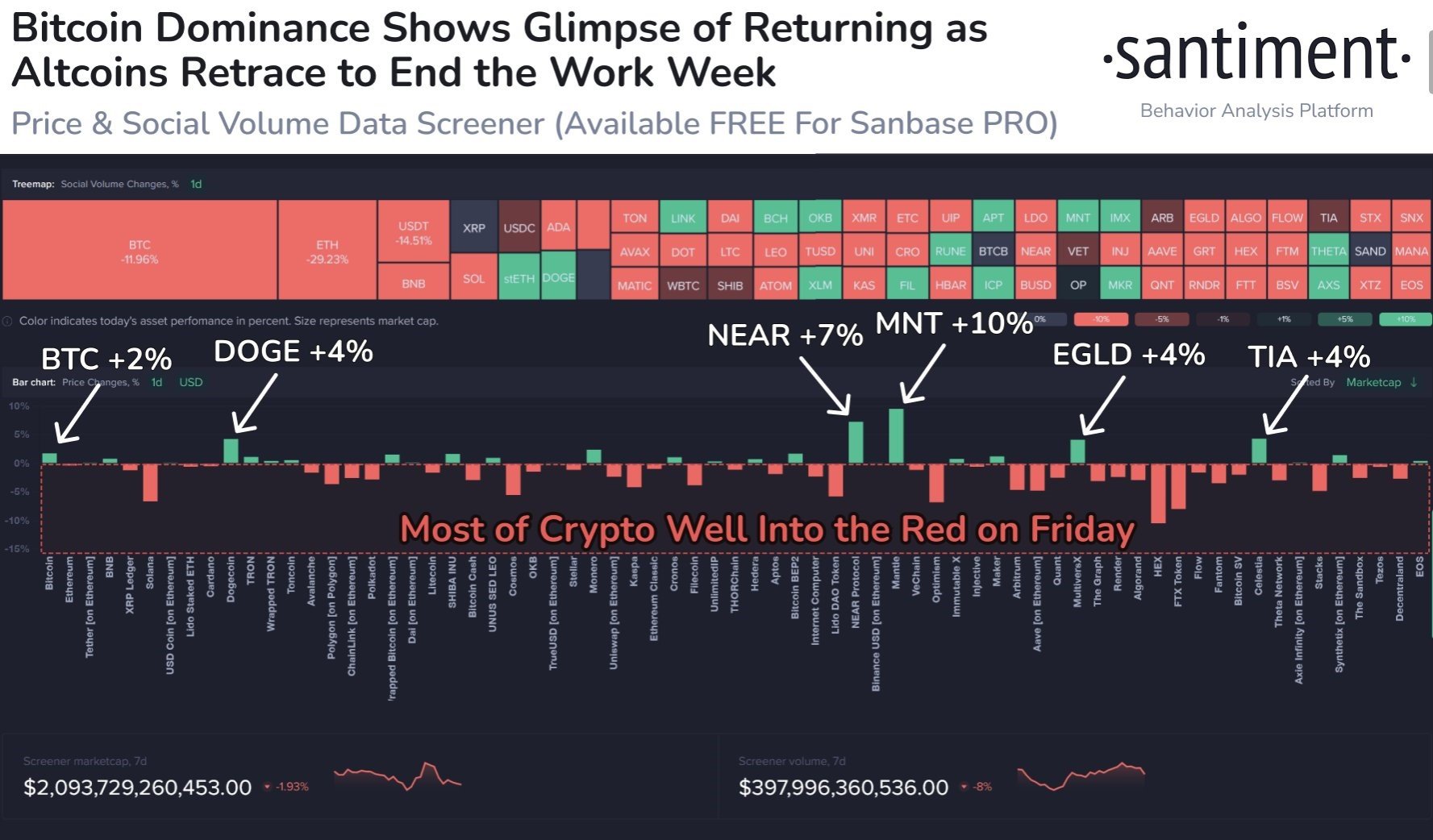

Altcoins experience first major pullback

After about a month of non-stop rallying, prices of most altcoins which have rallied intensely over the past month finally saw their first major drawdown, with many coins like LINK, SOL, AVAX, which have clocked more than 100% growth over the past month erase some froth by retracing more than 20% off their highs each.

The smaller decline in the price of BTC when compared with these altcoins has caused BTC to regain dominance. However, should the price of BTC continue to be well supported, altcoins are likely to rebound as there has not been a big outflow of funds as yet. Traders appear to be merely rotating from one altcoin to another, as can be seen above that other altcoins which have not had as phenomenal a gain over the past month are beginning to show signs of promise during the time when the big gainers experience a pullback.

For instance, DOGE, the star meme coin in the 2021 bull run, gained 10% last week as other popular top ten coins were falling. Most of its gains came late in the week, with a commendable $665 million worth of transactions done on Friday, its highest in three months. However, with the general pullback in prices over the weekend and a failed rocket launch by SpaceX on Saturday, the price of DOGE has given up all its gains made on Friday and is back into support zone at around $0.78.

With the recent surge in prices and corresponding popularity of several DRC-20 tokens minted on the DOGE blockchain that have seen more than 100% rises in prices over the past couple of days, the elevated transaction volume on the DOGE chain may continue and when market conditions improve, DOGE could revisit higher levels in time to come.

Stocks gain as inflation eases, Milei win aids crypto

Post more benign US economic numbers, stocks rose as bets that the FED has ended its hiking cycle sent investors clamouring to enter into long positions.

First, the seasonally adjusted CPI came in at an annual rate of 3.2% in October, which was expected to be 3.3% and the previous value of 3.7%. The core CPI in October was at an annual rate of 4%, which was expected to be 4.1% and the previous value of 4.1%.

The PPI annual rate also fell sharply to 1.3% vs expectations of 1.9%, down dramatically from 2.2% in September. The core PPI annual rate in October was 2.4%, and it was expected to be 2.70%, and the previous value was 2.70%. Unemployment claims also increased by more than expected in the prior week, giving further signs that the economy was slowing down.

Overall, US economic numbers released over the past week showed that inflation is indeed easing and that the labour market could be cooling, prompting an increasing number of market participants to bet that the FED may have to cut rates from May next year.

Furthermore, US legislators also extended the government funding till the end of January next year, alleviating fears of a government shutdown by the end of Friday.

As developments over the week were what investors were hoping for, stocks cruised to their third week of gains as the Dow gained 1.9%, the S&P added 2.2%, while the Nasdaq jumped about 2.4%. The dollar that had been persistently strong all of 2023 finally retreated, with the DXY losing about 1.9%.

Not only is inflation in the US easing, inflation for the UK is also easing dramatically. Data released on Wednesday showed that the UK’s CPI fell sharply in October to 4.6% from 6.7% in September, hitting a two-year low.

While the dollar declined, Gold gained 2.16% and Silver rose 6.6%. Even though the IEA raised the demand outlook for oil next year, oil prices still declined. The WTI was weaker by 1.37% and Brent dropped 1% after Wednesday’s EIA crude oil data showed an unexpectedly large build in US oil inventories over the last two weeks.

This week, market action is likely to decrease after mid-week as traders head into the Thanksgiving weekend that begins on Thursday. Even though markets will still be open on Friday, trading activity is expected to be muted. The PMI will still be released on Friday, which may bring about heightened volatility in a low liquidity condition as most traders will likely be off for the holidays.

For the interested, Tuesday and Thursday will see the monetary policy meeting minutes of Australia and the EU released respectively.

As for the crypto market, a possible fresh catalyst to support prices emerged at the start of the week as crypto-friendly candidate Javier Milei officially won Argentina’s presidential election; he will take office on 10 December. Milei has vowed to abolish the central bank and adopt USD as their reserve currency. While he has not yet announced that he would make BTC legal tender in the country, Milei is pro-crypto, having said that BTC represents the return of money to its original creator, the private sector, and that it prevents politicians from robbing people through inflation.

Thus, his win has notably excited crypto investors, as the price of BTC jumped by $1,000 as news of Milei’s win made the headlines and altcoins too are rebounding from a weekend retreat that saw funding rates reset back into neutral territory.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.