Last week started on a sour footing for crypto as the SEC filed a new lawsuit against crypto exchange Kraken for the selling of 15 unregistered securities to USA clients. Meanwhile, the criminal case against Binance was also settled where the US Department of Justice fined the exchange $4.3 billion for money laundering, while the CEO Zhao Changpeng would have to step down and be replaced, and also faces a possible jail term.

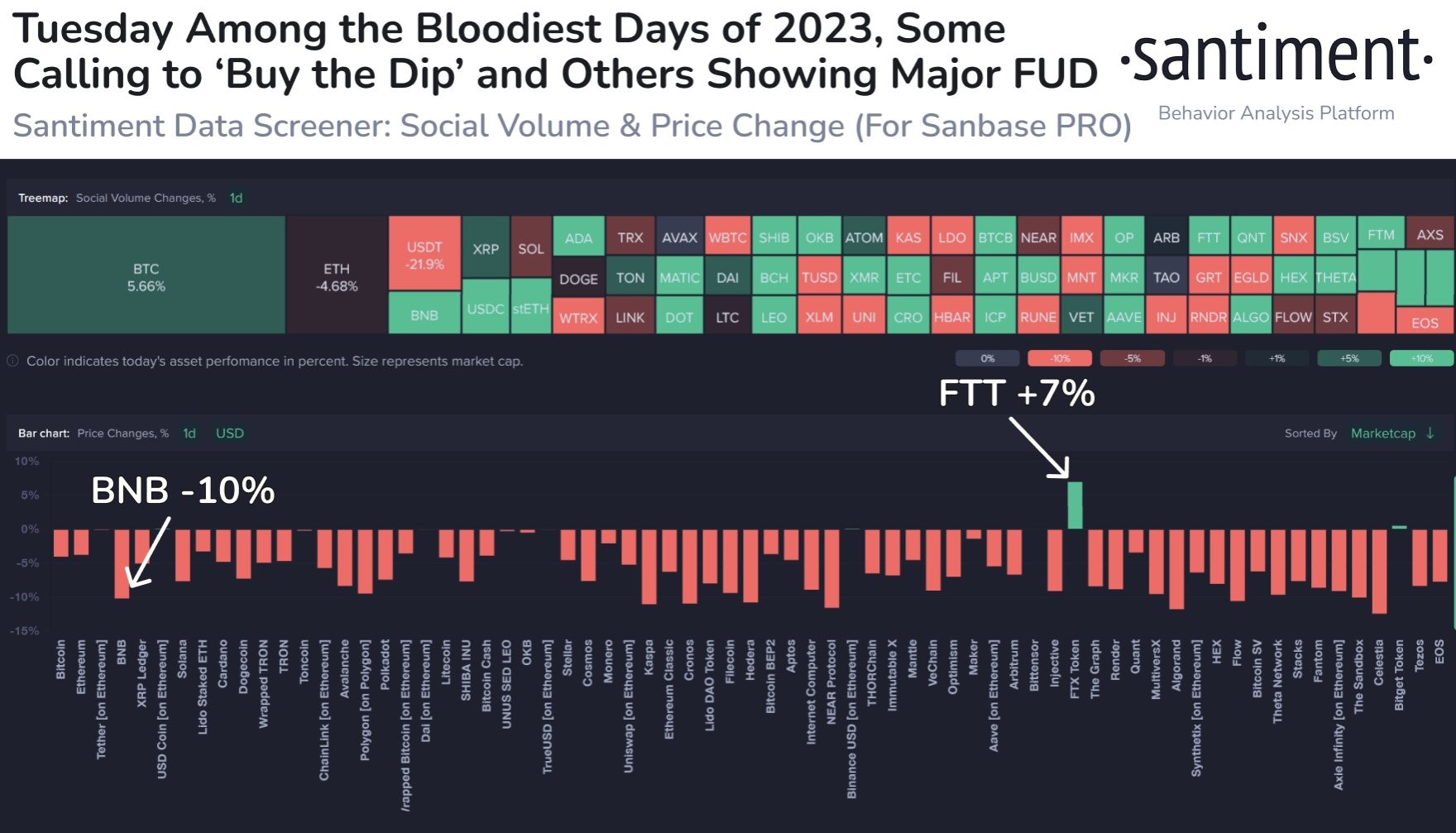

The revelation of both news sent crypto prices reeling, as the price of BNB, Binance’s native token, fell 10% following the announcement. The price of most other crypto also retreated, with the uncanny timing of the FED meeting minutes released on Tuesday showing that FED officials were not yet signalling for any rate cut and preferred a restrictive policy to be maintained in the near term.

The price of BTC eased back by some 5% although it continued to coil above $36,000. ETH also failed to break above its overhead resistance of $2,150, once again pulling away from the $2,000 mark.

Interestingly, the drop in the price of BNB coincided with a jump in the price of FTT, the native token of rival collapsed exchange FTX, which is anticipated to make a comeback sometime in 3Q2024.

However, despite the seemingly bombshell piece of news and biggest percentage drop in prices for the year, liquidations were not particularly high as the crypto market already experienced weakness in the days before. Long liquidations amounted to around $200 million in the first 12-hour aftermath of the Binance news, still smaller in magnitude than the $300 million long liquidations experienced in the week before.

Several altcoins made commendable recoveries, with some investors taking the dip as an opportunity to load up on the FUD. For instance, coins like RUNE, SOL and AVAX, which have been retreating recently, made rather impressive rebounds. LINK in particular, did not drop beyond the low made over the previous weekend but instead bounced off a higher low during the Binance news, demonstrating underlying strength in its price.

BTC bursts through $38,000 led by US buyers

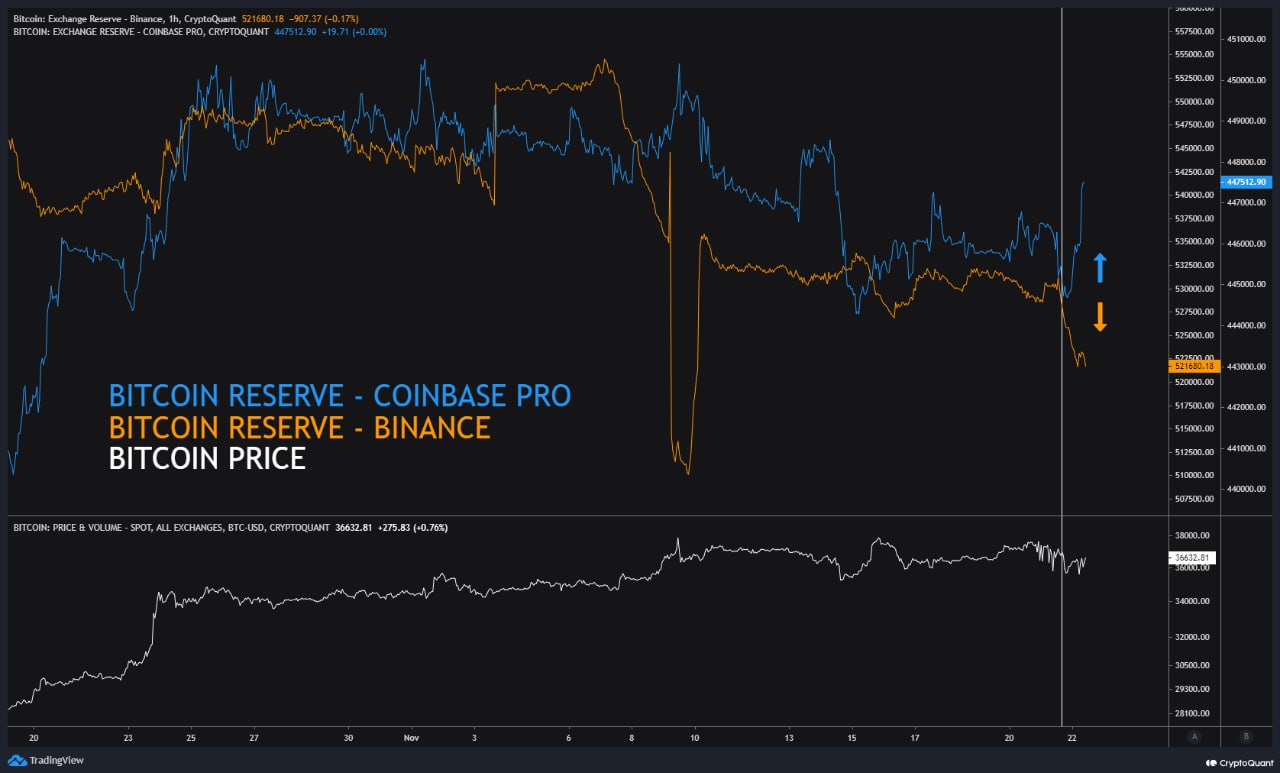

After the market got over the initial shock of the Binance indictment, BTC finally mustered enough firepower to break through the $38,000 barrier on Friday, albeit only temporarily as shorts started to pile up above $38,000. However, the buy orders appeared to be spot market driven, with the bulk of the buy orders going through Coinbase Pro. This aggressive bidding out of the US market could be ETF driven, as Coinbase Pro has been the appointed broker by most of the spot ETF applicants. This buying has greatly boosted investors’ confidence that at least one ETF would be approved by the next deadline of 10 January.

In fact, the institutional desk of Coinbase had been buying BTC all of last week, as its reserve increased by at least 12,000 BTC, out of which 5,000 were outflows from Binance, which means that a possible 7,000 BTC could have been bought from the market.

Optimistic ETF updates could keep prices elevated into year-end

With the latest update on the spot BTC ETFs still very much positive, traders still expect the price of BTC to inch higher despite its failed attempt on Friday as we move into the final month of the year, as the latest news from both Blackrock and Grayscale have been encouraging. According to Bloomberg analyst James Seyffrat, both Blackrock and Grayscale have met up with the SEC last week to put in the final touches on their ETF applications.

Apparently, Blackrock was trying to convince the SEC to allow them to do in-kind settlement against the SEC’s recommended cash settlement, while Grayscale had filed in its latest amended S-3 prospectus, in what looks like putting on the final touches ahead of an approval. The optimism that Grayscale would get the approval to convert its GBTC trust into an ETF is so strong that the discount to NAV of the GBTC has reduced to only 9.77%.

Furthermore, the SEC Commissioner was also quoted to have been saying that there is no reason for the SEC to stand in the way of a Bitcoin ETF in an interview shortly after the Binance indictment.

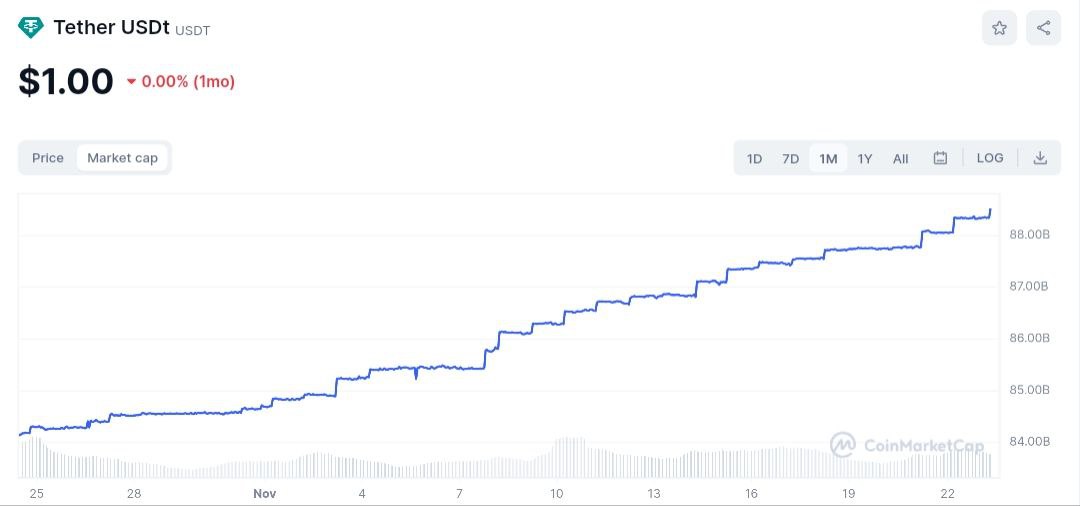

Tether adds $1 billion of fresh buying power

The market’s ability to bounce back almost immediately after the Binance indictment shows that there is underlying strong support for the asset class. While altcoin prices have been volatile as BTC consolidates between $36,000 and $38,000, there has been generally a sense of bullishness towards an eventual break of $38,000.

This general bullishness can be seen in the market cap growth of the largest stablecoin, the USDT. As can be seen in the below diagram, supply of fresh USDT has come into the market in the aftermath of the Binance saga. Around $1 billion of new USDT has been minted, which means that an additional $1 billion of fresh capital has come into the market, ready to be used to make purchases. While we will not be able to know what tokens this new money will be buying, it nevertheless is a sign that buyers are entering the market, which will be bullish for the entire crypto market.

Mt Gox and Celsius ghosts to keep in view

However, as we move into the final weeks of the year, it is important to not get overly excited as the cryptoverse will have new challenges it needs to overcome, as the supply overhang from Mt Gox and Celsius could be entering the market soon.

As if the timing cannot be more impeccable, the rehabilitation trustee team at Mt Gox sent a letter to creditors last week to inform them that the redistribution of their BTC would start from late December and continue into next year.

Specifically, the trustee plans to start repaying creditors that have opted to receive cash repayments by the end of 2023. The letter did not mention when creditors who opt to receive in-kind repayments will be getting their crypto back, however, the letter did state that due to the different modes of repayments, the return of creditor assets will continue into 2024. Mt Gox will be distributing 142,000 BTC, 143,000 BCH, and 69 billion yen, among others.

Similarly, bankrupt crypto firm Celsius will also be due to start its reorganization process and emerge from bankruptcy. This reorganization has been proposed to involve the returning of around $2 billion worth of BTC and ETH to creditors, together with shares in the new company. However, this proposal will be subject to court and the SEC’s approval, with the next hearing to be on 30 November, this Thursday. Should an approval not be obtained, Celsius may have to liquidate its assets, which could affect market prices even more, unless it sells its assets through the OTC mode. Thus, this week’s hearing could be an important event to take note of.

With both Mt Gox and Celsius supplies of crypto that could potentially come into the market beginning from end December 2023 to early 2024, it is looking likely that there could potentially be challenges that crypto prices may need to overcome in 2024.

LINK largest whale not sold a dime

Despite a price correction of more than 20% off its high, the largest LINK whale has not sold a dime, as he holds on to the 40 million units of LINK acquired on 17 October. The whale has not budged even during the Binance FUD, which could be a sign that this whale is confidently waiting out for more positive developments out of Chainlink.

With this, long-term investors could consider adding some LINK to their portfolio, especially when there is a market dip.

Stocks rose as dollar eased, but oil slipped on delayed meeting

After the release of FED meeting minutes, stocks eased back some gains as FED officials appeared to still prefer a restrictive monetary policy, citing that inflation is still well above their goal of 2%. However, a point to note is that the FED meeting was held before the release of October’s CPI and PPI figures, which may not have taken into consideration the latest inflation figures which have eased.

Indeed, after a lower than expected durable goods order number released on Wednesday, US yields retreated as traders prepared to go away for the Thanksgiving holiday. The yield on the 10-year Treasury fell to 4.476% by the end of Friday, which was its most significant drop after it crossed the 5% mark in October, influencing traders to expect that a rate hike in December would not be happening.

With yields falling significantly, the dollar eased by around 0.32% while stocks rose for the fourth consecutive week, where the Dow gained 1.27%, the S&P advanced 1%, and the Nasdaq added 0.89%.

Gold and silver rose, as Gold gained around 0.5%, in line with the dollar’s fall, while Silver edged up 2%. Oil, on the other hand, slipped by around 1.5% as US stockpiles once again showed a more than expected increase. Furthermore, OPEC+ postponed its meeting which was scheduled for 26 November to 30 November as producers were rumored to be struggling to agree on output cuts.

As for economic numbers, this week sees the release of the US PCE price index, the FED’s preferred gauge of inflation, on Thursday. Should the numbers be lower than expected, we can expect stocks to continue rising as that would almost certainly mean a no-hike in the FED’s upcoming 12-13 December meeting. Before that on Wednesday, the preliminary GDP for 3Q would be released, while Friday would see FED Chair Powell give a speech again.

On the currency front, the Bank of New Zealand would be having its policy meeting on Tuesday.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.