US stocks surged after Fed Chair Powell hinted that the Fed could slow its pace of rate hikes after raising the benchmark interest rate by 75-bps on Wednesday. While the central bank’s overnight interest rate is now between 2.25% and 2.50%, the markets cheered as the Fed Chairman has finally toned down his hawkish tone, while also pointing out that he does not think the US economy is currently in a recession.

The tech-heavy Nasdaq rose 4% after the announcement to its best one-day gain since November 2020 as Powell discussed a possible slowdown in interest rate hikes, revealing that while the Fed may hike another 75-bps in September, the magnitude would be data dependent.

The Fed comment comes as the US economy is showing signs of stress, as recent data releases have come in much weaker than market expectations. On Tuesday, the US conference board’s Consumer Confidence Index for June tumbled to 95.7 vs expectations of 97.0. Last month’s reading was 98.4.

The IMF also slashed global GDP forecast as economic outlook grows gloomy and more uncertain. The IMF now expects the world economy to grow 3.2% in 2022 before slowing to a 2.9% GDP rate in 2023 — marking a downgrade of 0.4% and 0.7% respectively, from April.

Indeed, even the US GDP figures for Q2 released on Thursday fell below expectations, falling 0.9% against consensus estimate for a gain of 0.3%. This is the second straight quarter of decline that follows a 1.6% decline in Q1 and thus, signals a recession right smack in the face of Powell who stated on Wednesday that the US is merely in a slowdown and not a recession.

President Biden even had to hold a press conference to convince Americans that they are not in a recession, which is poignant considering the Euro Zone economy apparently grew 0.7% based on figures released on Friday, even as they battle the energy crisis and surging inflation.

However, bad news is now good news for the markets as investors bet that the Fed would be pivoting sooner than expected, leading US stocks to rally three days in a row to close off their best month since 2020.

For the month of July, the Dow rose 6.7%, the S&P gained 9.1%, while tech stocks did the best by sending the Nasdaq up roughly 12.4%.

For the week, the Dow ended higher by nearly 3%, while the S&P and the Nasdaq gained about 4.3% and 4.7% respectively.

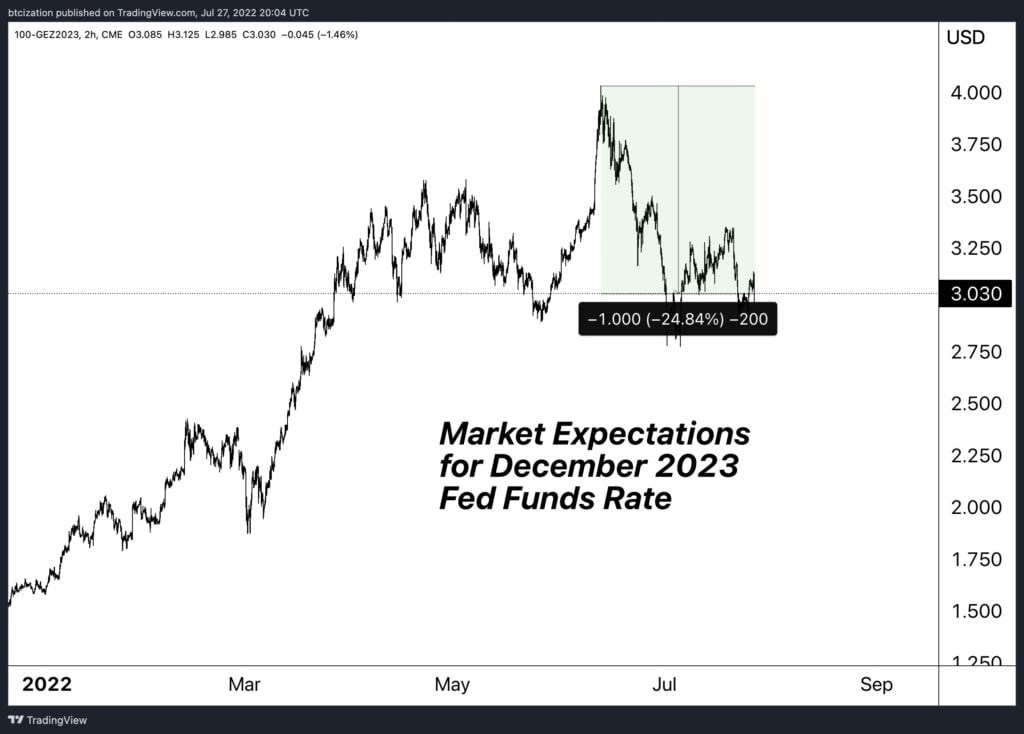

The worst hit was the USD, slipping sharply lower amid a less hawkish Fed and a pending recession. The US 10-year Treasury yield dipped to 2.65% as rate expectations fell significantly. Market expectations for Fed Funds Rate in December 2023 have fallen 100-bps from the highs set on June 13. The anticipated rate now is at a meagre 3.03%, signalling that traders expect the Fed to at the very most, hike by another 50-bps this year, or be forced to cut rates next year.

Recession as a Growth Trigger - Use It

The DXY thus fell to 105.50 as the month-end flow adjustment further contributed to USD’s weakness. The USD rout has in turn given other currencies a boost, with the AUD/USD outperforming as traders loaded up on longs in anticipation of another 50-bps rate hike by the RBA this Tuesday.

As the USD retreated, Gold and Silver rallied, with Gold gaining 2.3% and Silver surging 11% back above $20 as hopes of a Fed pivot sent risky-assets flying. Both metals are seeing a tad of profit-taking as the new week beckons in early Asia trading.

Oil gained in line with the USD weakness, with both Brent and WTI Crude gaining around 5.5% each. Brent Crude is now back comfortably above $100, closing the week at $103.50 while the WTI settled at $97.70. However, prices are opening the new week retreating about 0.7% after news broke late on Sunday that Europe is easing back on efforts to curb Russian oil in a renewed effort to contain inflation.

Oil companies like Chevron and Exxon have reported record earnings last week as surging oil prices contributed greatly to their top-line. Even in the face of a global recession, energy experts reveal that recent data is not showing any slowdown in oil demand.

Crypto Short Liquidations Surge Post Fed

Crypto markets started the week in cautious trading as traders await the Fed decision but rallied strongly after Fed Chair Powell was less hawkish than expected. Short liquidations surged as traders who put out short trades hoping to ride the Fed decision were short squeezed.

Liquidation volume climbed above $270 million within 24-hours of the Fed meeting, a high value by today’s standard due to the lower overall trading volume in July. 72% of the 88,140 traders who got liquidated were holding short positions, implying a short liquidation of around $200 million.

ETH led in the liquidations, with nearly $165.52 million liquidated of which $120.34 million were short positions as ETH’s latest strong rally appears to have caught many traders on the wrong side. Apart from the leading two cryptos, altcoins also had a great week, with many alts clocking gains of more than 20% off their mid-week lows.

Short-term Metrics Signals Possible BTC Correction

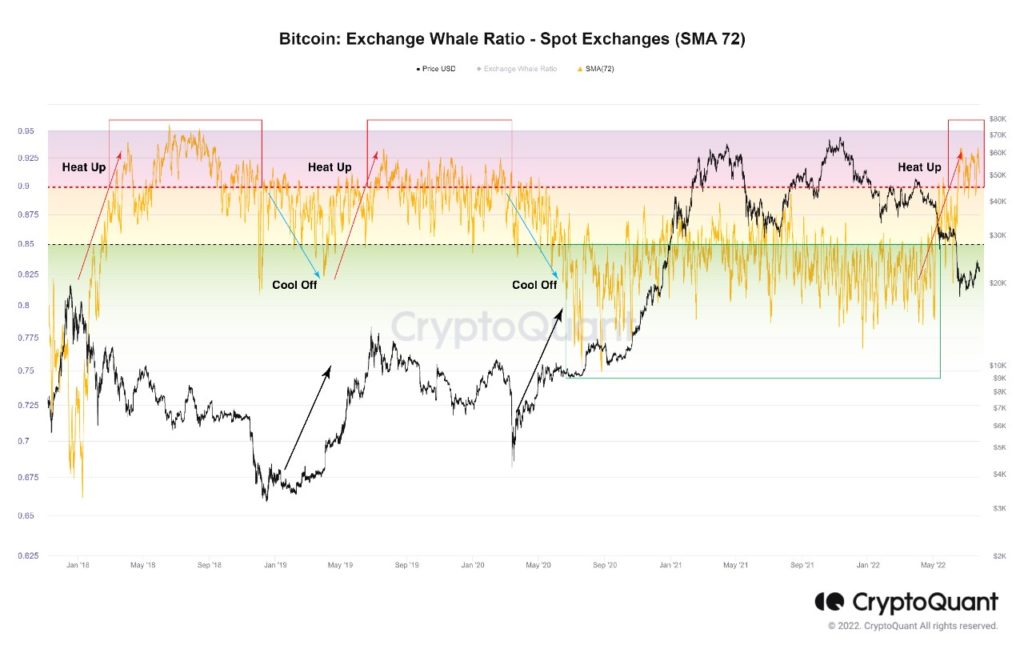

After being in the ‘Cooling Off’ stage since the end of 2021, the BTC exchange whale ratio has gone up to the ‘Heating Up’ region again, which has historically been an advance indicator of a possible price decline in the near-term, especially as the price of BTC has surged beyond 20% over the last couple of days.

Long-Term Metrics Show BTC Bottoming

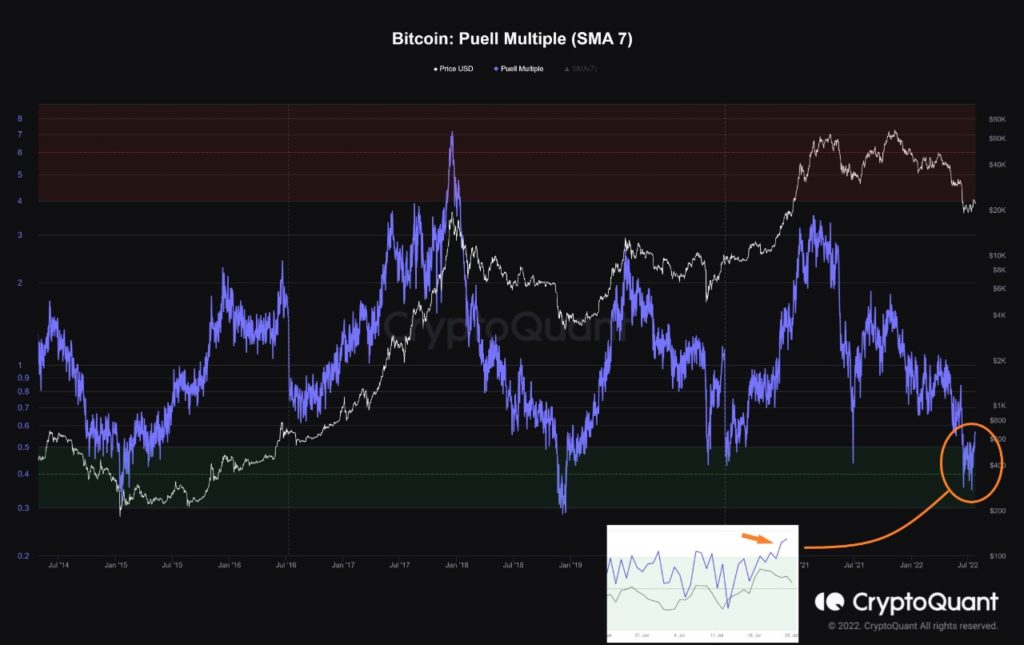

Longer-term metrics, however, show that BTC may have already bottomed, or is currently in the bottoming out process.

One signal that indicates BTC has bottomed out is the Puell Multiple, which tracks miners’ buying-and-selling activity on BTC’s price. The Puell Multiple, which we have covered before in one of our previous week’s report when it was in the “Buy Zone”, has bounced off its low and appears to be moving higher. This could imply that BTC has already bottomed and could be on its way to a higher price for the longer-term even if price retraces in the short-term.

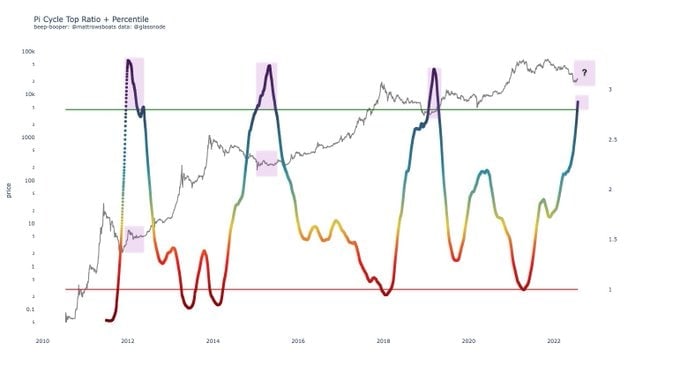

Another metric with a positive signal is the Pi-cycle, which is yielding a bottoming signal.

This indicator previously stayed 3 times above the green line for 3-6 months, and the times when the indicator hit the top previously was often a sign of a market bottom. While we are not yet at the previous peaks as seen in the diagram below, the indicator is moving in that direction. This could mean that a bottom in BTC’s price could be nearby.

Difference Between ETH and XRP’s Active Address Surge

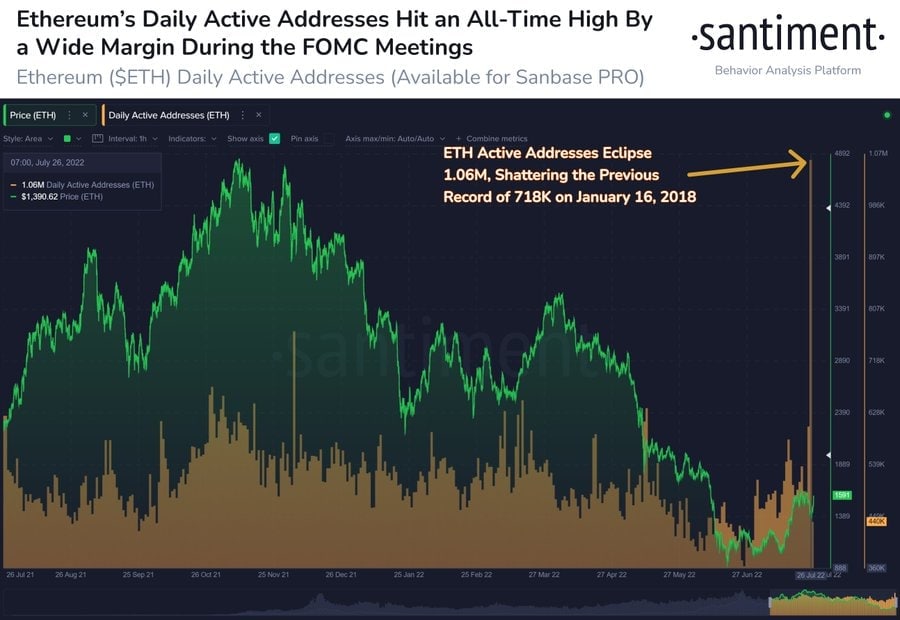

Cryptocurrencies often do not move without giving traders hints. Just before ETH’s big surge in price post Fed meeting, ETH whales were already lining for the leg up as active addresses on the ETH network spiked sharply on Tuesday. In fact, the number of active addresses broke record and surged to a new all-time-high of around 1.06 million, doubling the previous all-time-high of only around 600,000 made in January 2018.

This very big surge is a not a common occurrence and traders ought to keep a close watch on ETH in the coming days, as in previous cases of such sudden spikes in active addresses, the price of ETH often rose initially, but subsequently retreated sharply when the number of active addresses could not be sustained. How do we know how to gauge sustainability then?

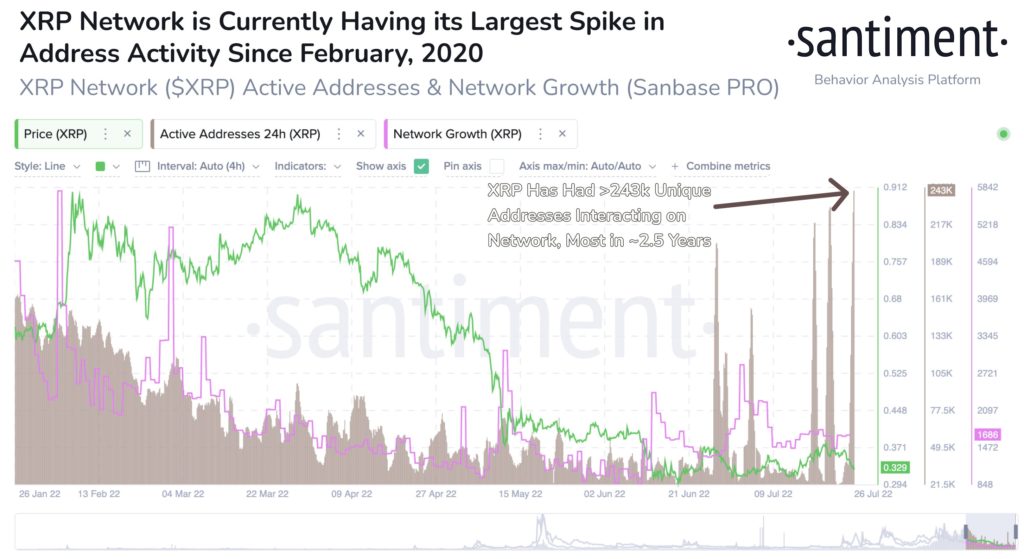

One example of a healthy active address growth sustainability is XRP, which has seen a consistently high number of active addresses over a month-long period. This is often seen as a sign of healthy adoption and could pave the way to a healthy price increase in XRP should this trend continue.

Now moving back to ETH, would there be any potential risk that could send its price lower?

One possible complication with ETH could be the very news that has been causing its price to surge – the Merge. ETH miners unhappy with the move to PoS have proposed to fork a new PoW ETH chain, and this news is quickly picking up momentum within the crypto sphere and could create some controversy within the ETH community in the coming days.

However, the controversy will not be able to affect ETH 2.0’s timeline, as ETH developers have fixed the date for the final Goeli testnet. The final testnet before the Merge goes live on ETH mainnet is estimated to begin on August 4 and is projected to be complete anytime between August 6 to August 12. During this period, the price of ETH may come under slight pressure as some traders may choose to stay out of the trade. However, price could soon recover once the good news of a successful merge is announced, after which the mainnet Merge would very likely be scheduled for September, which may give some traders butterflies again when that time comes.

AXS Surges After CEO Revealed as ‘Good Guy’

After a period of lull price action since May as news of its Ronin Bridge hack was revealed, AXS, the token of the world’s most popular NFT play-to-earn game Axie Infinity, finally saw some reprieve as more juicy news surrounding the hack in March 2022 surfaced.

The CEO of Axie Infinity, Trung Nguyen, had been accused of insider trading by removing around $3 million worth of AXS tokens from the Ronin Bridge before the company announced the news of its hacking. However, the CEO clarified on twitter that the move of the tokens to a crypto exchange was in fact a liquidity provision to protect the token from short sellers as he expected bears to want to short the token once news of the hacking was revealed. Nguyen went further to elaborate that he is proud of the fact that operations have been restored and all victims have received their stolen funds, while referring to Axie Infinity and its community as his “life work”.

The move appears to sit well with crypto traders as the price of AXS rebounded shortly after Nguyen made the clarification, rising about 25%. However, how long this rally can last may depend on market conditions as the crypto market has been rising for the past 5 days. However, even if AXS retreats, it is likely that the worst PR nightmare for the platform could be over.

As we move into the new week, retail traders are getting excited about the crypto market again. This is reflected in the BTC average funding rate, which has been decidedly positive after 5 straight days of price gains, implying that most traders are in long positions.

Since funding rates are a contrarian indicator, and with tension building up between the US and China, it is possible crypto and even stock prices may see some de-risking this week as the markets re-align ahead of the important US non-farm payrolls report due out on Friday.