Crypto markets consolidated in the early part of the week as traders mostly focused on the strength of the dollar and its impact on crypto after remarks made by FED Chair Powell further confirmed that a rate cut was not forthcoming in March. However, as the pessimism grew and funding rates started to decline, the price of BTC broke higher, piercing above $46,000 as news that China would aggressively stimulate its financial market found buyers flowing into the crypto market. In fact, there was even a news report circulating that Chinese buyers were rushing to purchase cryptocurrencies to avoid the contagion effects from their crashing stock and real estate markets.

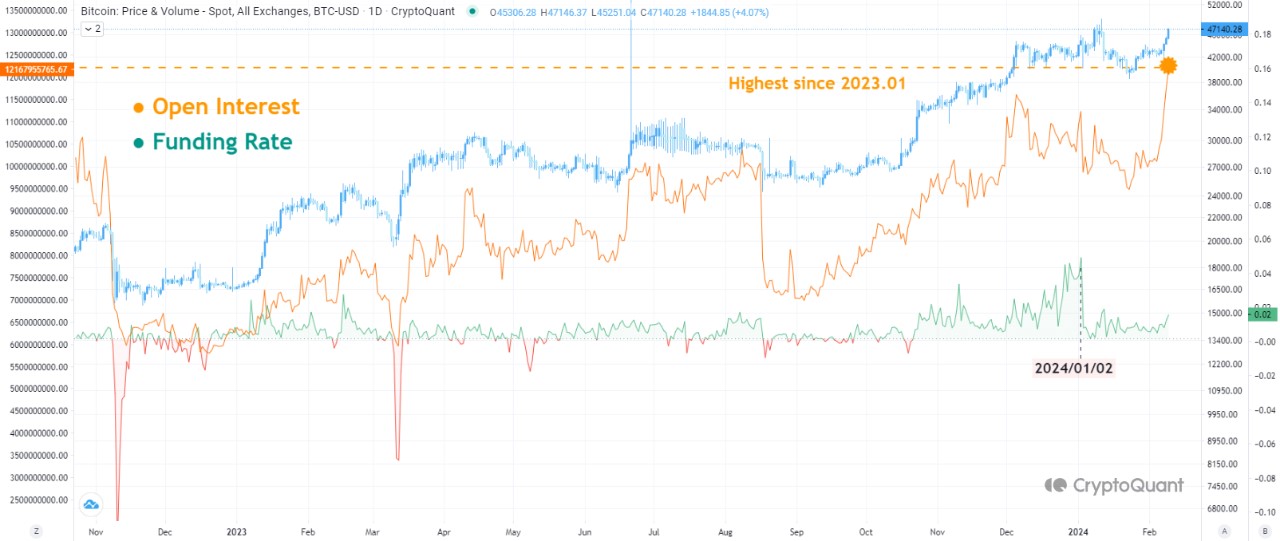

However, for the most part, rises in the crypto market continued to be the most aggressive during the US trading hours. In any case, as the auspicious year of the Dragon drew near, more than $1 billion of fresh money went into the crypto market via the futures market, propping up the price of BTC.

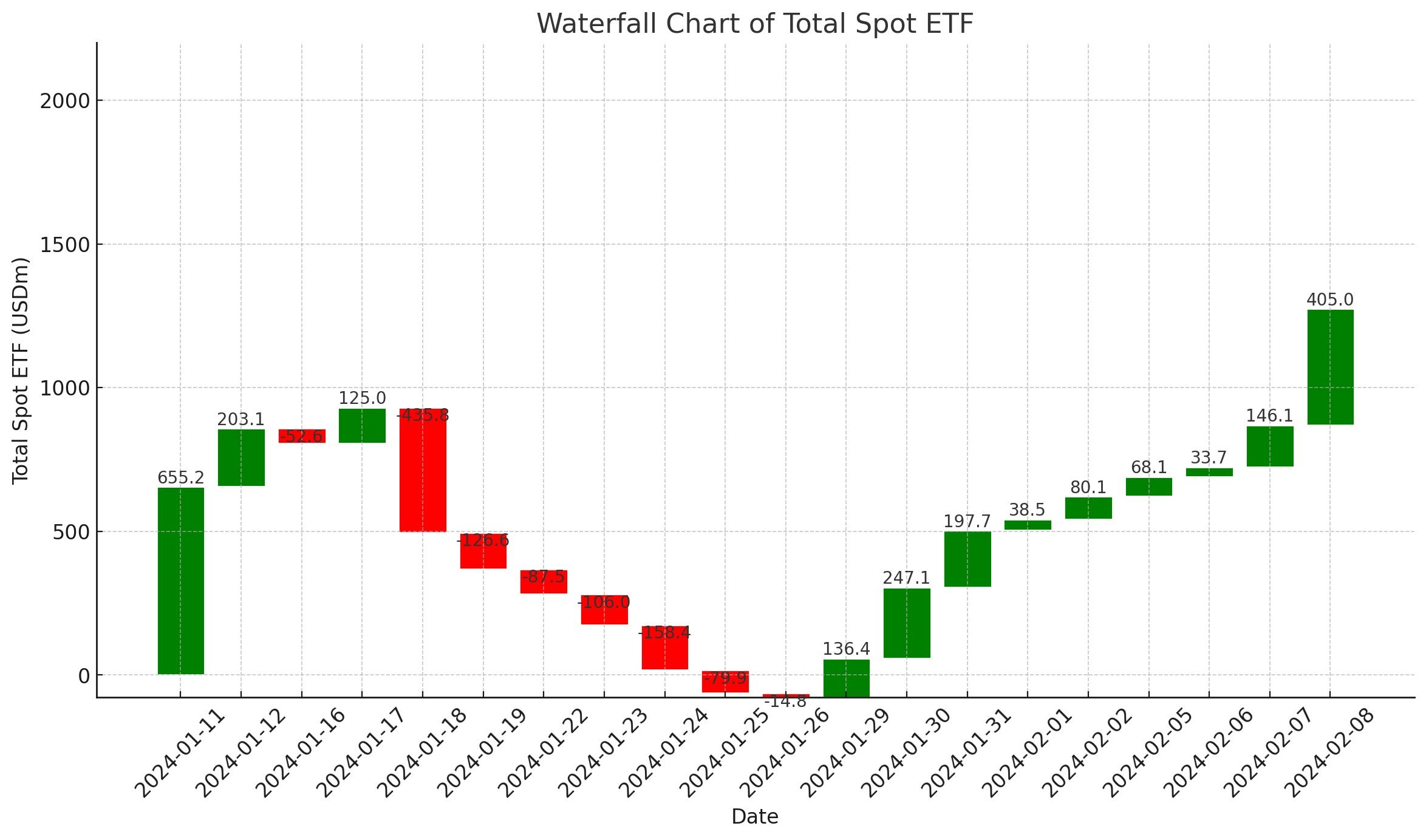

A reduction in the outflow from GBTC has also helped with the recovery in the price of BTC. Last week, the spot BTC ETFs experienced the highest amount of net inflows since inception.

However, the spot BTC ETF flows remain fluid as the outflows could return at any moment. However, in the short-term, it appears that the current market momentum may continue, which may possibly see the price of BTC test the $50,000 barrier.

Altcoins could see weeks of rally

Despite the strong BTC dominance, some large altcoins are showing signs of promise after a two month consolidation.

Some of these coins include SOL, AVAX, BNB, which have shown remarkable resilience in the face of big selling pressure over the past two months but have bounced well above their lows. Of the altcoins, LINK stood out, having broken out of a three month consolidation and has risen to $20, its highest level since November 2021.

Should the price of BTC not do a big retracement this week, altcoins are expected to play catchup and we may see the Lunar New Year altcoin rally continuing into this week. Amongst the popular themes, GameFi coins have shown tremendous strength over the weekend. ETH-related plays like the Layer-2 coins could also see a play coming up as the Dencun update gets the go-ahead.

The altcoin weekly market cap has shown a strong bounce after hitting support, which could mean that there is a good chance that altcoins could have a big run-up if the index manages to break its immediate resistance at around $849 billion.

A check on the amount of froth in the market shows that while the amount of BTC Open Interest has surged to its highest since January 2023, the funding rate is still in a low region, suggesting that the market is not overheated yet. In January 2023, the crypto market had a nice three week bounce after forming a double bottom. Could we then see a similar three week marketwide rally this time?

Dencum’s March upgrade could buoy ETH betas

After Thursday’s bi-weekly coordinating call regarding the Dencun upgrade, ETH developers have set a target date of 13 March for the long-awaited upgrade, triggering the countdown to the blockchain’s biggest changes since April 2023. The decision was made after the upgrade was successfully added to the Holesky testnet, the final of the three required testnets, without any hiccups.

The Dencun upgrade is primarily known for its “proto-danksharding” feature, which is supposed to reduce costs for transactions on Layer-2 networks built atop ETH by providing a dedicated space for data storage.

This development has brought about a much-needed optimism boost to the price of ETH, which has been under pressure in recent times due to the selling pressure from Celsius. With attention now shifting to the Dencun upgrade and the spot ETH ETF approvals in 2Q, while ETH may still come under selling pressure from Celsius and FTX, ETH-beta plays, especially Layer-2 networks like MATIC, ARB and OP, may start to come alive. Other ETH-beta plays may also include ETH DeFi like UNI, DyDx, COMP, SNX, and even NFT projects, especially when a new token standard called erc-404, which allows for the fractionalization of NFTs, was introduced last week to much fanfare.

S&P closes above 5,000 for the first time

A solid earnings season, easing inflation data and a resilient economy have brought US stocks to yet another supercharged rally as the S&P closed at its highest level ever, finishing the week by rising 1.4%. The Dow finished flat, while the Nasdaq gained 2.3%. All three major averages notched their fifth straight winning week and 14th positive week in 15, a sign that the unrelenting strength in the US stock market does not seem to be weakening at all.

A revision lower in December’s CPI helped keep sentiment bullish as investors waited with bated breath on Janaury’s CPI numbers due to be out this Tuesday, and also the PPI and consumer sentiment, both to be out this Friday.

With inflation numbers easing and economic numbers strong, the dollar remained well positioned on both sides, eventually closing the week flat, while Gold retraced around 0.75%. Silver eased back 0.36% and Oil recovered from the large dip the week before after it seems clear that the Israel-Hamas conflict will not be ending anytime soon. Brent rose 5.15% while the WTI gained 5.3%.

This week, as the major Asian markets with the exception of Japan will remain closed for the lunar new year holidays, activity in the traditional markets could be quieter early in the week, while China market will remain closed all week. However, activity in the cryptocurrency market, especially on altcoins, could heat up should the price of BTC maintain a certain level of calmness ahead of the psychological $50,000 barrier.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.