Upon Bloomberg’s revelation late Wednesday night that the SEC has opened an eight-day window after 9 November to approve spot BTC ETFs, and another rumor that Grayscale is in the final stages of communications with the SEC regarding its GBTC conversion into a spot BTC ETF, the price of BTC finally broke pass recent high of $35,800 to clock a new year high of $38,000 before a succumbing to a quick dip after FED Chair Powell gave a speech about US rates going to remain high.

At the same time, just before the sudden dip came, it was revealed that Blackrock had filed a spot ETH ETF, which drove the price of ETH finally breaking $2,000. The 10% surge in ETH may have caused the large dip of around 20% for most altcoins, as traders took profit on recent altcoin gains to funnel their funds into ETH. BTC similarly had a large dip of almost 10%, falling from its height of $38,000 to a low of $35,800 before regaining the $36,000 mark.

The quick 10% rise and subsequent loss within one day caused liquidations to spike on both sides, with around $270 million worth of short liquidations and $220 million worth of long liquidations. With this statistic, we can see that retail traders were still largely on the short side, although the long vs short ratio is becoming more balanced.

With the majority of retail traders holding a bearish view while institutional funds were the buyers, the market very quickly rebounded off the lows made on Thursday. BTC recovered to around $37,000, while a few top beta coins in this cycle like SOL and LINK went on to make new highs on Saturday before a second round of dip took place, especially after a quick run on SOL caused traders to take profits.

Despite the heavy second dip in altcoins, BTC managed to remain unaffected, continuing to build its base near $37,000 and ETH is still trading around $2,000 as at the start of this new week. This lack of a downward drawdown in the price of BTC despite a 5% to 20% pullback in the price of altcoins over the weekend may suggest that buyers of BTC are mostly institutional funds who hold a longer term view and are not concerned with taking small short-term profits.

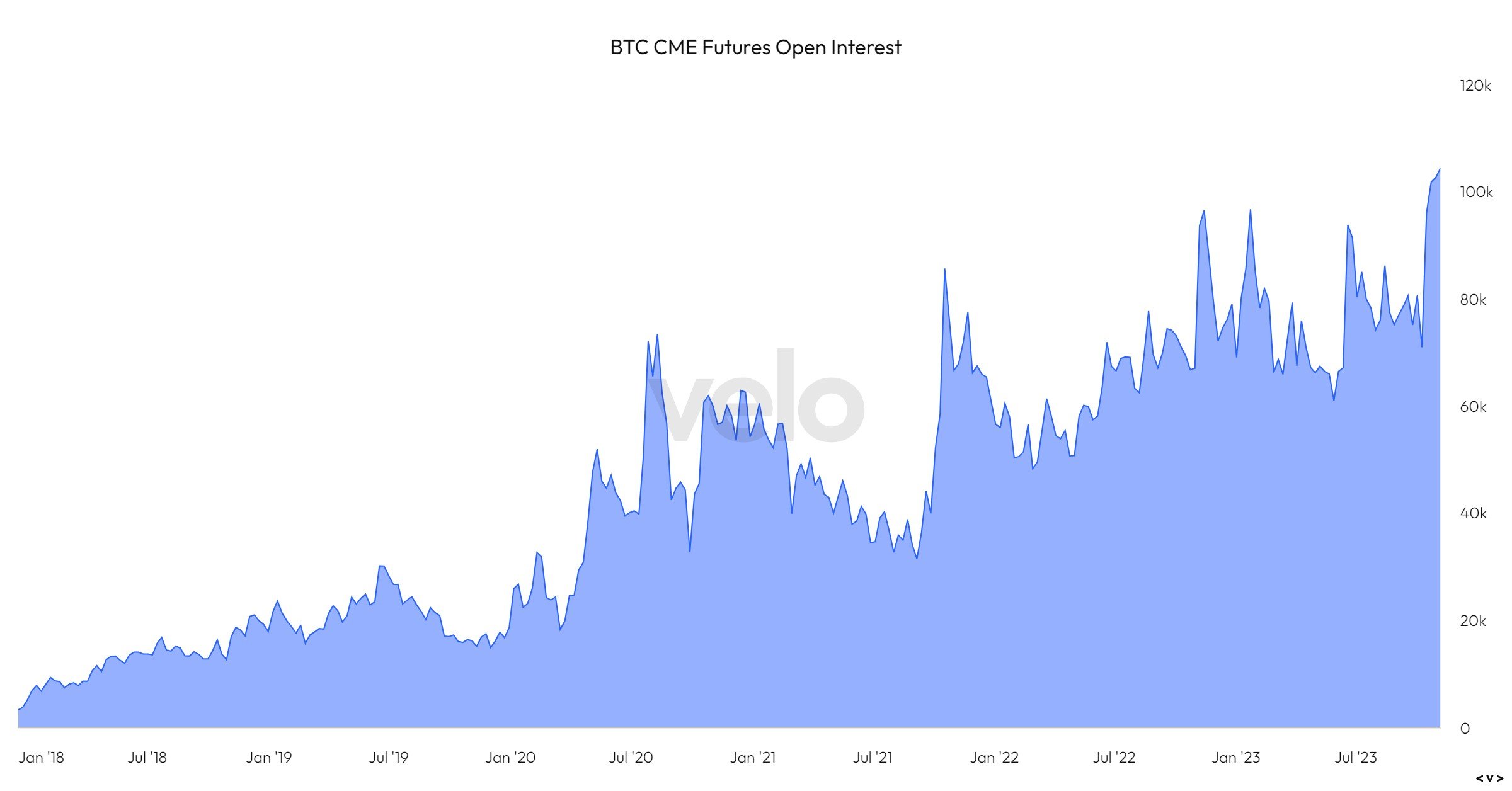

Surge in BTC CME open interest underscores institutional demand

Another sign that BTC buyers are institutions is revealed by the sharp increase in open interest (OI) at the CME, as the CME is a platform for institutional traders and not for retail participation. On Thursday, the CME BTC futures contract positions increased to 111,100 BTC, with a position value of $4.08 billion, accounting for 24.77% of the entire network.

For the first time in history, contract value at CME has surpassed that on Binance (103,800 BTC) and has become the exchange with the largest holdings of BTC futures contracts.

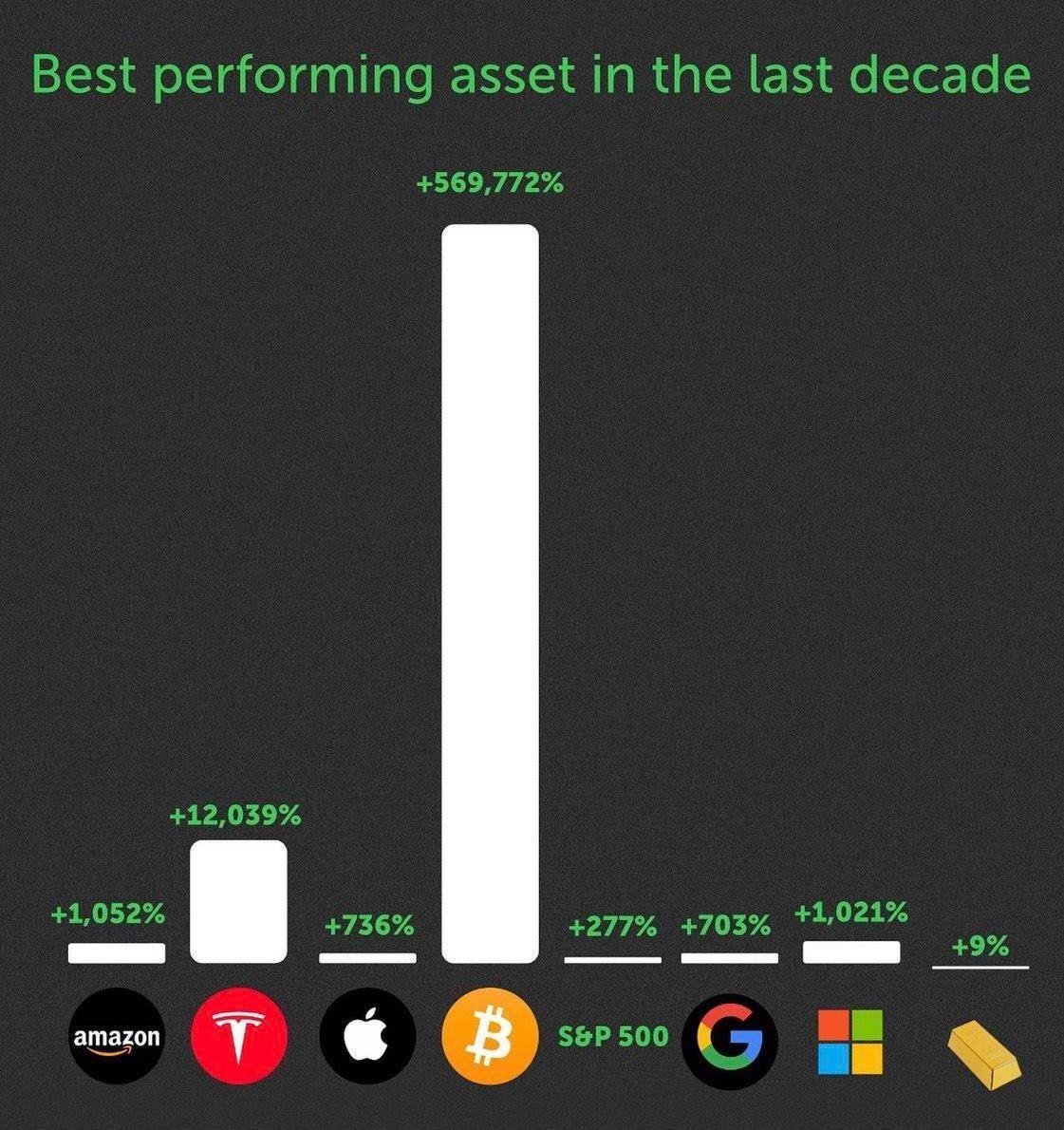

This surge in institutional participation is only natural, as BTC has been the best performing asset since its inception, rising by more than 500,000% within the last decade. To put its phenomenal potential into perspective, the next best performing asset was Tesla shares, with a growth of only 12,000%. While by no means is this growth a small amount, when compared with BTC’s 500,000%, it is still a far cry.

In terms of network fundamentals, the BTC network fees exploded last week, clocking an impressive 243% week-over-week increase as the number of ordinal inscriptions started recovering. This rise in activity on the BTC blockchain could continue to bid up the price of BTC.

SOL unfazed by FTX sale, rockets 50%

Early last week, after an impressive surge in the price of SOL, FTX unstaked more than 4 million units of SOL and started sending them to exchanges for sale. The selling pressure initially weighed on the price of SOL, causing it to underperform the rest of the high beta altcoins like LINK and INJ early week. However, that dent was temporary and the price of SOL quickly regained lost ground as renewed buying pressure was able to not only absorb all that SOL that FTX dumped, institutional demand was so large that the secondary market price for the Grayscale SOL Fund (GSOL) exploded more than 146.34% on Friday alone.

The premium on GSOL is now around 870%, the highest among the Grayscale group of altcoin trusts. The second next highest premium are MANA and LINK, at 310% and 250% respectively.

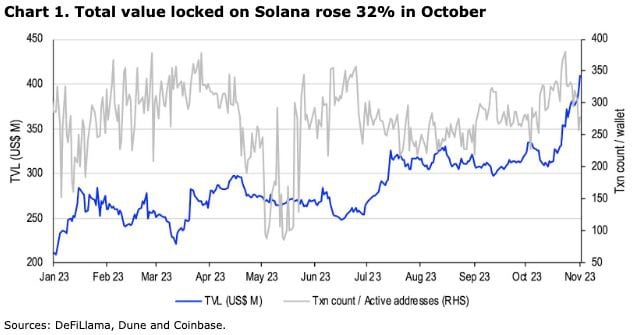

This large surge in demand for SOL is not without reason, as the fundamental picture of SOL has improved immensely since October.

One metric that has seen a sharp improvement is the TVL on the Solana chain, which rose 32% in October and has continued to increase in November. This increase may be due to a return of confidence in the Solana chain as it has not had an outage in more than a year.

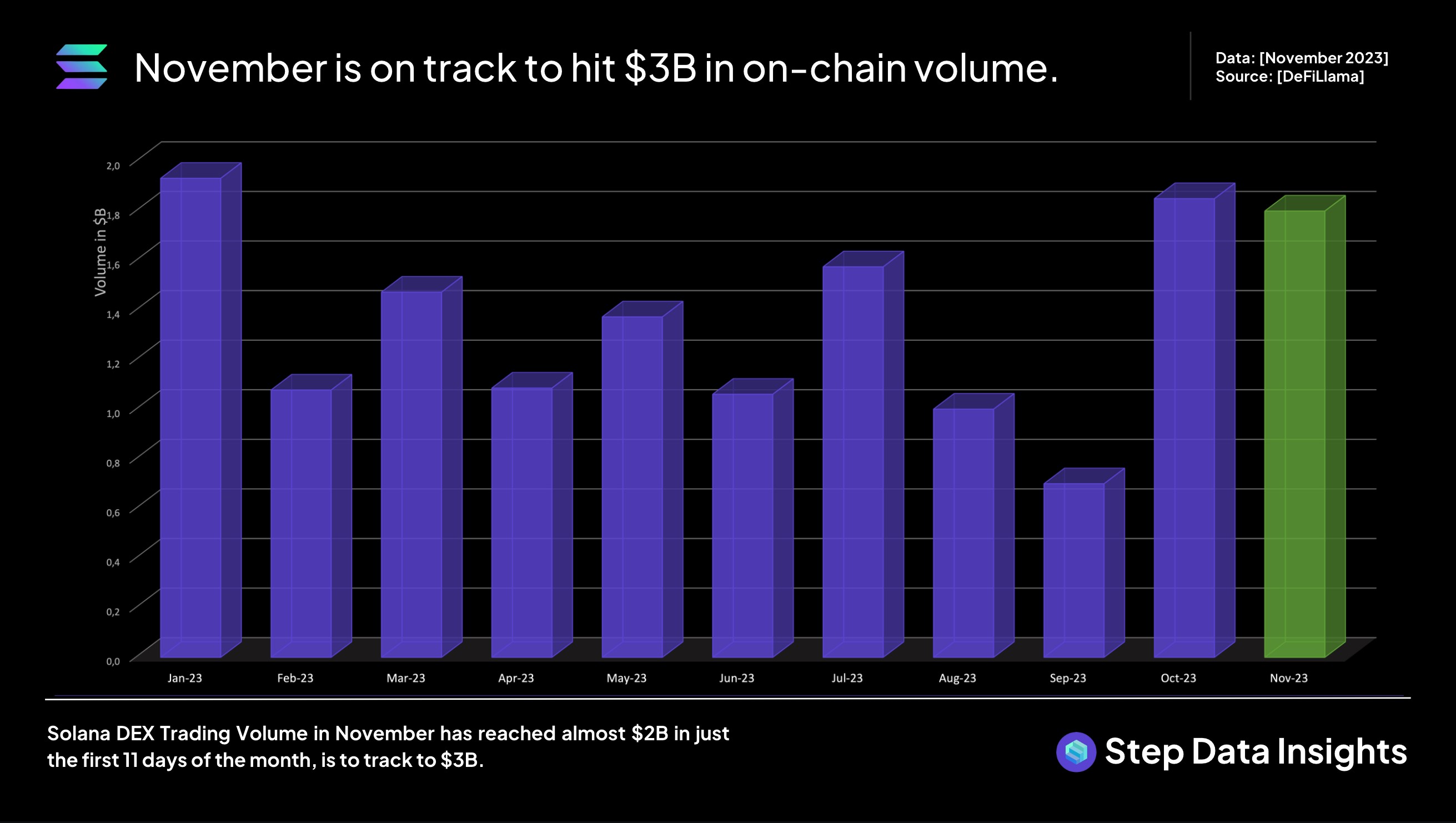

The transactional value on SOL has also exploded in November, with around $1.8 billion worth of on-chain value transacted in the first 11 days of November. To put things into perspective, the on-chain value transacted in the entire month of October was only slightly above $1.8 billion, which means to suggest that the on-chain value transacted for November could double that done in October, which was already a sharp increase from previous months.

Furthermore, its annual meetup Breakpoint which took place last week was a success, with incoming airdrops and points programs being implemented, and an interesting ecosystem of dApps to pay attention to. All these perks have given investors incentives to support the Solana ecosystem, which would be positive for the price of SOL and as the market continues to bid with excitement regarding the spot BTC ETF approval, the price of SOL has marched grossly higher last week and is still likely to continue to rise in spite of FTX having another 2 million more units of SOL that it can sell. The market appears to wish to challenge expectations by running the price of SOL up higher and higher, leaving many traders in the dust. After breaching a strong resistance at $48.30, a high never seen since August last year before the FTX collapse, SOL went on to rocket higher by 50% to a high of $64 by the weekend before a slight retracement.

MATIC whales back in accumulation

While SOL is currently taking most of the limelight, traders should not forget other coins that show good promise. One such potential coin could be MATIC. In the last 2 weeks, key MATIC whale wallets holding between 100,000 to 10 million MATIC have been quietly accumulating as the rest of the market was focused on chasing other coins. Improving metrics like recovering transaction volume and whale accumulation could buoy the price of MATIC higher.

Stocks rise as end of rate hiking cycle beckons

Even though stocks had a brief pullback on Thursday after rising for two weeks following FED Chair Powell’s hawkish comments at an IMF function, the market quickly recovered by Friday after US yields retreated.

At the event, Powell said that the ongoing progress toward their 2% inflation goal was not assured as inflation has given them a few fake retracements. Powell further elaborated that in the event it becomes appropriate to tighten policy further, the FED will not hesitate to do so. These comments caused US yields to rise, however, they quickly retreated by Friday, which helped the stock market regain lost ground.

By the end of the week, stocks were higher again, with the S&P gaining 1.3%, the Dow advancing by 0.7%, and the Nasdaq the top performer again, rising around 2.4%.

The Silver still managed to eke out a small gain of 0.7%, while Gold retreated 2.7% as the war in the middle east is not expanding as fast as anticipated. Similarly, silver also lost about 4%. Oil too, dipped as a result of the war not turning out as bad as imagined, at least for the moment. The WTI lost 4.65% and Brent dipped by 4.3%.

In a surprise move, the RBA raised rates by 25 bps from 4.1% to 4.35% late Monday night. However, instead of rising, the AUD/USD fell as the central bank hinted at the end of its hiking cycle. Such dovish comments by central banks lately has investors gaining confidence that the global rate hiking cycle is over, which traditionally will benefit risky assets like stocks.

This week, at the Asia market opening, the dollar is slightly firmer while gold, silver and oil are showing signs of weakness. Oil in particular, has weakened by a further 1% as market participants await the important US CPI data due out on Tuesday. Wednesday’s release of the US PPI will also be keenly watched. Should both data sets show that the rate of inflation is easing, risky assets like stocks may continue to pump as investors will be even more certain that the FED will not hike rates in December. According to the CME Fedwatch tool, around 85% of traders currently do not expect the FED to hike rates at its final meeting of the year on 13 December.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.