Early last week, the markets stabilized as no new bank announced that they were in dire straits ever since Credit Suisse was bought over by UBS, while the US Treasury’s backstopping of bank deposits could likely contain the troubles at US banks for the time being. Even though conflicting messages from US Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell regarding the guaranteeing of all bank deposits caused some confusion, the markets ultimately decided that the guidance from the Fed meeting was dovish, as the 25-bps rate hike as well as the standard press conference remarks had already been widely anticipated.

The markets did have a temporary scare from Deutsche Bank, which saw its credit default swap (CDS) move higher for no apparent reason on Friday, which caused stocks to come off. However, by the close of Friday, US stocks managed to recoup their losses while European stocks closed the week lower. For the week, the Dow was flat, while the S&P rose 0.4% and the Nasdaq gained 1.63%.

There was a noticeable flight to the US dollar since the Deutsche Bank scare started towards the end of the week, as the DXY reclaimed all its losses post the dovish Fed meeting to finish the week only 0.66% lower, while the EUR/USD and GBP/USD retreated off their mid-week highs. The dollar strength was also evident in the price of Gold, which ended the week flat after trying two times to break the $2,000 barrier but could not. In the end, Gold closed the week retreating back to the $1,977 level. Silver fared much better, gaining 3.75% to close at $23.22.

Oil prices moved higher on the back of the dovish Fed, with the WTI higher by 3.28% and Brent Crude gaining 1.76% by the week’s close.

The crypto market was seemingly just as range bound as stocks and gold, with the price of BTC not able to touch the $30,000 barrier. BTC tried twice to breach $29,000, only to be met by huge selling pressure which took its price back lower to around $27,000. Throughout the week, BTC danced between $27,000 and $28,800 a number of times without much conviction.

With BTC locked in a directionless consolidation, altcoins too suffered the same fate as prices merely drifted up and down without a clear direction over the course of the week, frustrating many traders who could not decide on whether to buy or to sell.

Despite the short-term lack of direction however, the fundamental argument for cryptocurrencies has improved materially since the series of banking system stresses. Even though the situation with the banks appears to be under control at the moment, the possibility of more troubles popping up is high, as we have seen in the case of Deutsche Bank. As such, depositors would likely want to diversify where they keep their money and deploy some funds to crypto, which could keep the price of BTC well-supported. With such a backdrop, the sharp falls in price which we have seen in 2022 may have come to an end, which implies that dips going forward, may likely be shallow. As we have seen early last Tuesday, even when the White House condemned the crypto sector in its annual economic report, prices failed to fall materially, showing an underlying strength.

Metrics Show that BTC Has Moved into Bull Market

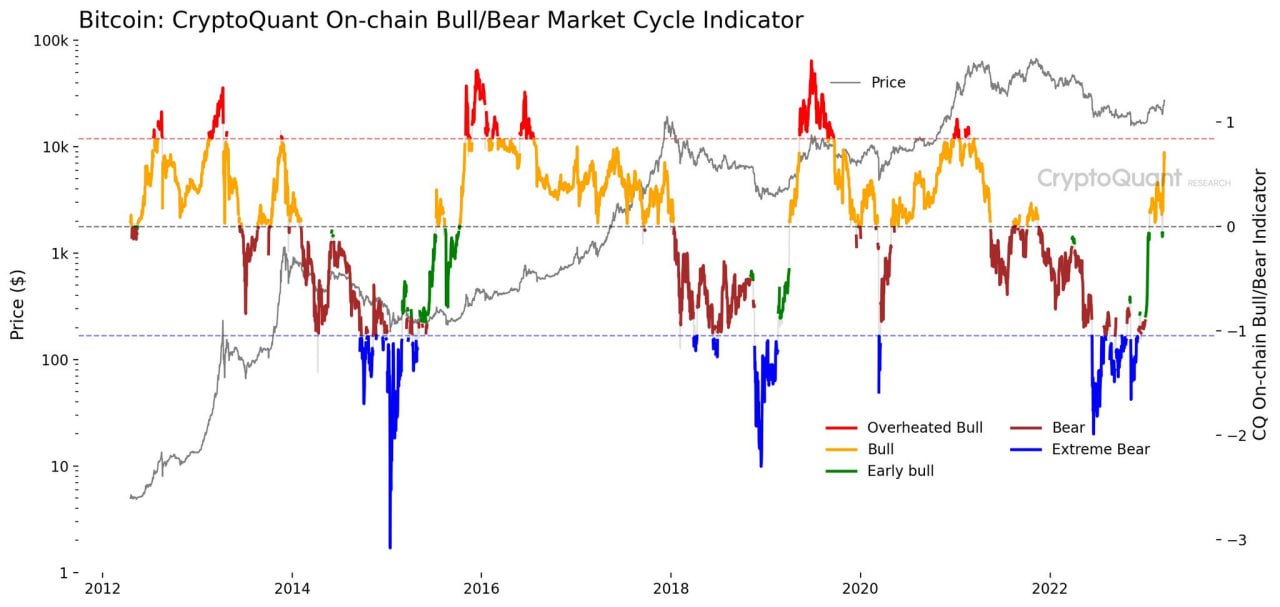

While we are still a year away from BTC’s halving, which traditionally have been seen as the main indicator that a new bull market had arrived in the previous cycles, the historically accurate bull-bear market indicator has already flashed the signal that BTC has entered the bull market phase. While it is still early to tell how sustainable the current bullish trajectory is, we note that the bear market started a couple of months early in the 2021 cycle. In that regard, it could also be possible that we are entering into a new bull market cycle a couple of months earlier this time around.

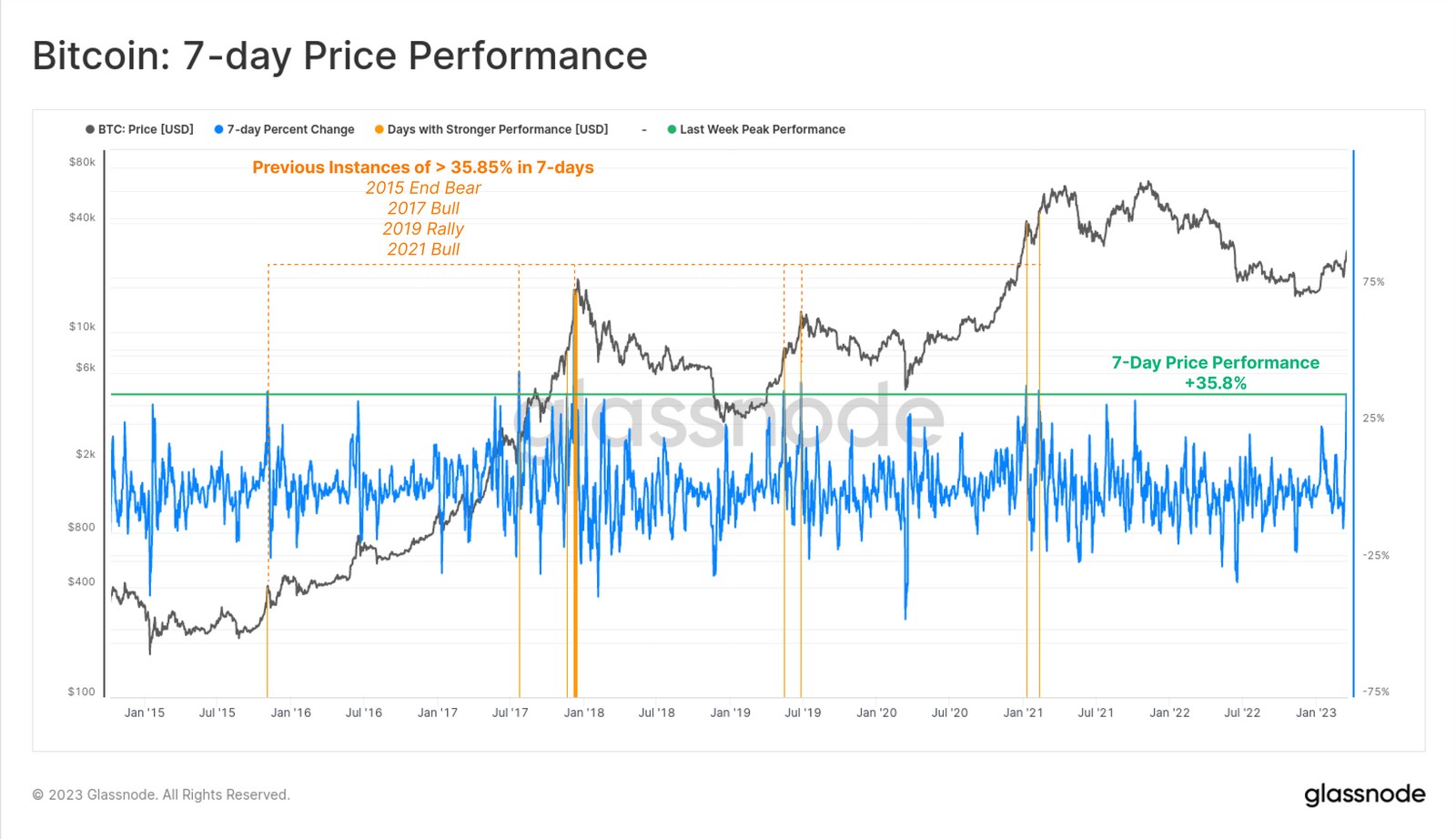

Even the 7-day recent price performance of BTC when compared with its previous cycles is showing a price increase style that had only been observed in the early stages of a new bull market.

According to Glassnode data, BTC has jumped by 37.85% mid-March, and such a big price appreciation within one week has only been seen four other times in the past, and all four such instances occurred at the beginning of a new bull market cycle.

The one macro event that may bring forward the bull market is definitely the current stress in the banking system, which has brought about a compelling case for crypto.

Regulatory Risks Back in the Forefront

However, regulatory risk is still lurking behind the scenes as the SEC has relentlessly continued to take on crypto firms. In fact, the regulatory body for securities seems to be upping its ante as it issued a Wells Notice of impending legal action to Coinbase for its Earn product and even sued Tron Founder Justin Sun for fraud and market manipulation. Earlier in the same week, the SEC issued a subpoena to the team at SushiSwap for selling unregistered securities even in spite of the mess within the banking sector.

Thus, while the tide does appear favorable to crypto, investors will still need to be mindful of regulatory challenges ahead.

OTC Desks Report Overwhelming Demand for BTC

At the moment though, market flows are still showing a bullish inclination as even large OTC desks are reporting inflows to buy being almost twice the size of sellers for BTC and ETH. Cumberland, one of the largest crypto OTC dealers globally, reported that their orders to buy are twice the size of sellers and there has been no profit taking seen from buyers yet.

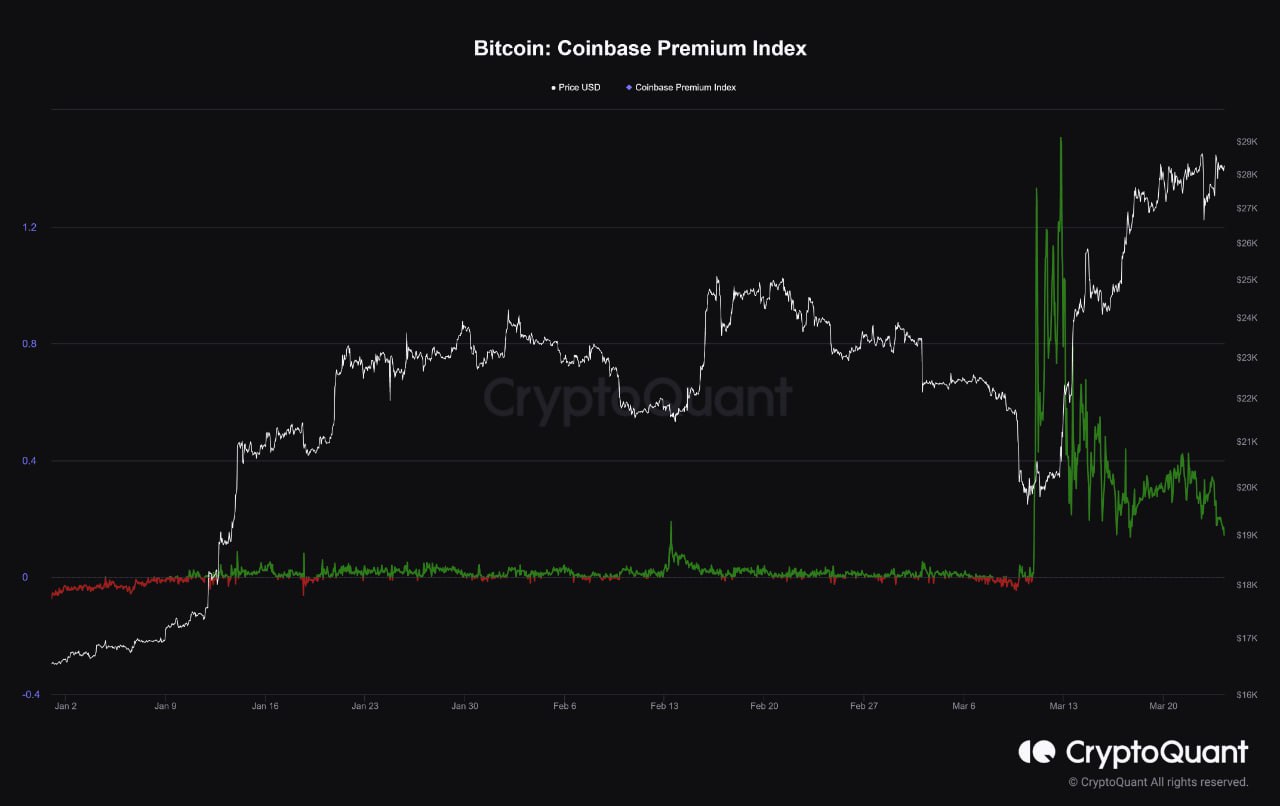

However, the Coinbase premium, which has spiked to one of its highest ever since the first case of bank trouble, has declined significantly to-date, which is a sign that the aggressive buying out of the USA is abating. This may reduce the buying pressure on BTC and cause the price to be slightly weaker in the near-term.

However, should the price of BTC remain near its current level as it consolidates, altcoins could start seeing increased activity as funds start shifting into other cryptocurrencies. One example of this was LTC, which has risen by around 13% last week even as the broad market headed lower into the weekend.

Altcoins To Watch Out For

Many altcoins had interesting updates last week. Let us take a look at some of them, which may help traders identify what altcoin to trade should prices of altcoins start to move.

Last week, FTM rallied after revealing in a tweet that the network has achieved the lowest transaction fee of $0.0003 while having the capacity to process transactions with finality much faster than other blockchains like AVAX and ETH. The recent rally may also be attributed to FTM’s mainnet upgrade earlier this month, which introduced improvements such as 3x faster batched Genesis block processing, 5x faster EVM log searching, and 30% reduction in P2P and block processing time. FTM has been outperforming the altcoin market this year, having risen 200% this year and is still 150% higher even after a sharp pullback in February. However, momentum appears to be building back as its price is making a recovery.

Next, XRP also had an encouraging week, rising 20% as the SEC-Ripple case has been anticipated by legal experts to be near a verdict. Furthermore, there was another airdrop announced for the XRP community which could have prompted some investors to buy XRP ahead of the snapshot date of 24 March to get the airdrop. Even though the price of XRP retraced half of its up move after the snapshot, with the prospect of the legal case coming to an end anytime, the price of XRP is expected to remain volatile.

Lastly, LINK showed promise as ChainLink Labs entered a strategic partnership with PwC Germany to accelerate blockchain adoption on an enterprise level. ChainLink Labs will support business clients of PwC Germany that want to integrate into the blockchain economy but lack the technical knowledge to run nodes and develop smart contracts. The partnership ultimately aims to improve transactional security, transparency, and efficiency for key enterprise sectors, such as capital markets, using LINK’s blockchain technologies.

Whale Transactions in Altcoins Increase

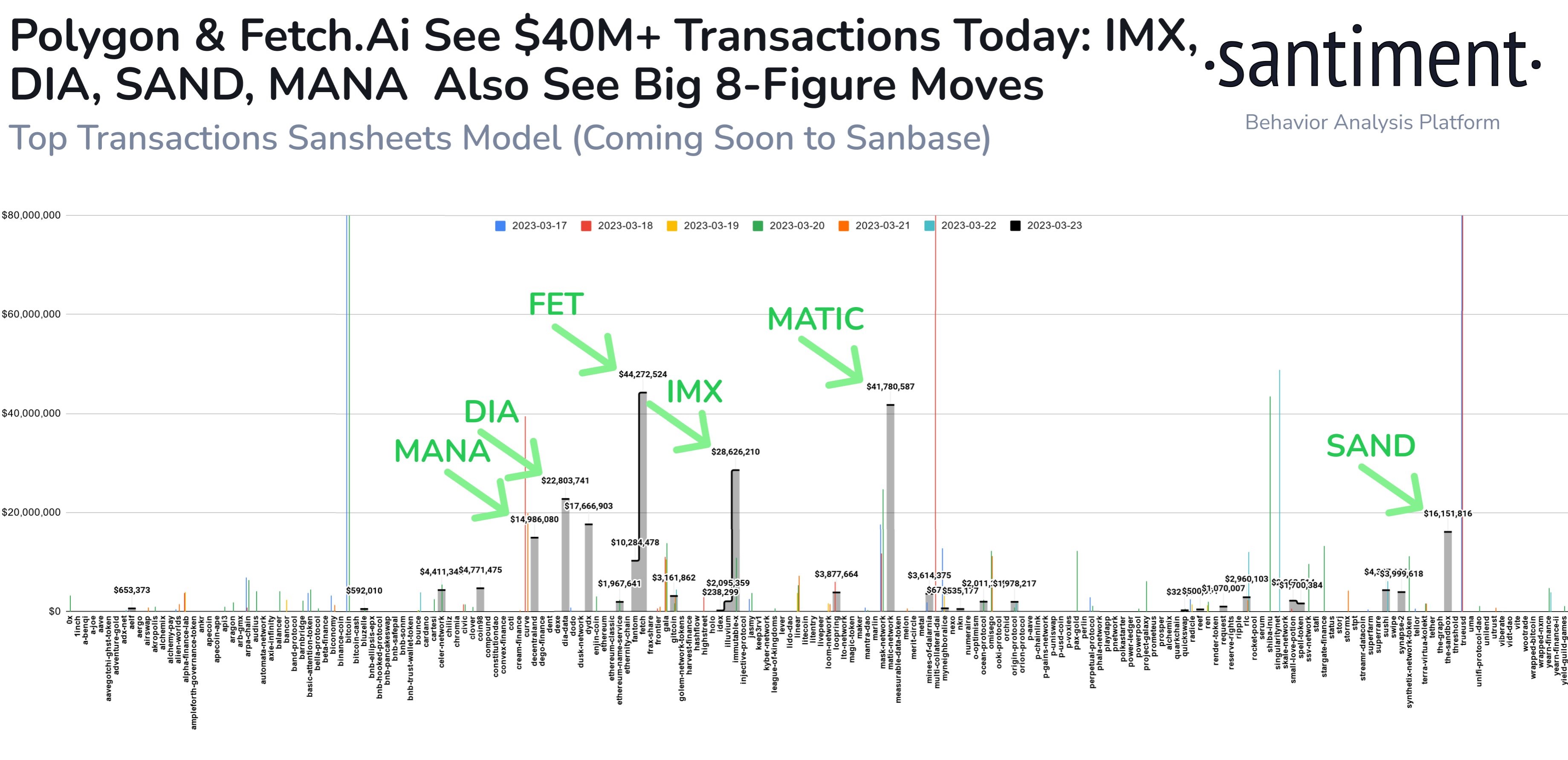

In terms of whale transactions, last week also saw notable activities in several tokens that could have implications for their prices. MATIC and FET have both seen a transaction valued at over $40 million each on their networks. MANA, DIA, IMX, and SAND also witnessed exceedingly large whale movements which may cause higher than usual volatility in their prices.

Investors Are Buying ETH Again

As we move towards Shanghai’s implementation on 12 April, investors are beginning to reaccumulate ETH. 310,000 ETH have been withdrawn from a crypto exchange wallet on Wednesday after the Fed meeting. This withdrawal subsequently followed with a sudden 5% jump in the price of ETH, reigniting the price action of the number two crypto. However, ETH’s price failed to keep up with the rising momentum and fell back into the $1,750 region by the end of the week as the flight to the dollar caused crypto prices to weaken.

Even though this week will bring the release of the US final GDP number for last quarter and the PCE inflation index reading on Thursday and Friday respectively, the markets’ direction will likely be dependent on the latest installment in the banking sector saga as this event has become the dominant risk for the coming days ahead.

Backstopping Deal For First Republic Bank Rumored

Over the weekend, US regulators held an unscheduled meeting behind closed doors again. While details of the meeting are not known yet at the point of writing, Bloomberg has reported that US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet. First Republic’s stock has plunged more than 90% this month as the troubled lender is another bank that is plagued with a bank run similar to that of Silicon Valley Bank. How this development will impact markets shall be seen this week when traders return from the weekend. There is a possibility the dollar may be impacted while the anti-dollar trade, like crypto and gold, could find legs to move higher.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.