Bitcoin is the talk of the finance world once again, beating stocks, gold, oil, and more in ROI over the last decade and more of its history.

But the cryptocurrency technology is still new, sometimes complex and confusing, and can be challenging for newcomers. In no time, the same novices can feel like pros after learning the ins and outs of what crypto assets have to offer.

What Is Bitcoin? The First Ever Cryptocurrency

Bitcoin is the first cryptocurrency and the first example of blockchain technology to ever be introduced to the world. The open source Bitcoin core code was released in 2009 and the Genesis Block mined.

Both Bitcoin and blockchain were created by Satoshi Nakamoto, who solved problems facing early attempts at digital cash, such as double spending, by developing the proof of work consensus mechanism that helps keep the network operating, secure, and participants incentivized.

Bitcoin is a decentralized protocol and network and bitcoins are the underlying asset, trading under the ticker symbol BTC.

How Bitcoin Works: Proof Of Work Consensus Mechanism Explained

Bitcoin was designed to work without the need for a third-party intermediary such as a bank or government. To achieve this and to avoid the double-spending issue plaguing previous attempts at digital cash, Satoshi Nakamoto developed the proof-of-work consensus algorithm.

Miners use specialized machines to solve complex mathematical equations at a fast rate to improve the chances of earning a BTC block reward. Miners provide processing power through hash rate to keep the network secure and validate each new block being added to the blockchain. Learn more

How To Use Bitcoin: Sending, Receiving, And Storing In A Wallet

Using Bitcoin involves interacting with the blockchain. This is typically done with a wallet interface. These vary from a hot, web, or software wallet, to a cold storage or hardware wallet that keeps assets offline instead of being connected to the internet.

Sending BTC involves a small transaction fee, and a recipient address. You can also receive BTC as your wallet’s public address. Finally, BTC can be stored in these wallets for safe keeping.

Is Bitcoin Legal? Regulations, Tax Guidance, And More

Bitcoin is perfectly legal in most countries, but you should always check with local and national laws to be certain. This guide is not a replacement for legal advice. Some countries such as India are planning to ban Bitcoin, Ethereum, and other cryptocurrencies.

There are also certain regulatory considerations. For example, US investors are restricted from trading some types of Bitcoin and crypto derivatives. Finally, there are also tax laws that inventors must abide by in order for tax compliance. Check with local certified public accountants to be sure you are properly reporting all earnings or losses related to crypto.

Bitcoin Price Guide: What To Expect With The Speculative Asset

Bitcoin price has set new highs at over $60,000 and has grown exponentially since its release more than a decade ago.

When the cryptocurrency first released it was virtually worthless. No one knew at first it would be worth anything at all, let alone be this valuable.

Nobody still has any idea how much Bitcoin should be worth, and that’s what makes it a speculative asset.

Why Is Bitcoin So Volatile? Rollercoaster Market Cycles Explained

As a speculative asset, Bitcoin is especially susceptible to price swings due to extreme shifts in market sentiment. When Bitcoin FOMO is in full effect, the price of the asset rises enormously as demand heavily outweighs the supply.

When things turn negative, people sell their coins at any price they can, often taking prices back down by 80% during each bear market. This has led to notorious volatility, but with volatility comes incredible profit opportunity.

Here’s more information explaining volatility.

Why Is Bitcoin Going Up?

Bitcoin is going up because it is a bull market once again, and demand is once again outweighing supply. Bitcoin’s halving was almost one year ago at this point, meaning that the bull rally is in full effect.

Because Bitcoin has been going up now for a year straight, it could soon be time to start thinking about when the top of this cycle is, and when Bitcoin will be back to crashing.

Here’s more information on Bitcoin going up.

Why Is Bitcoin Dropping?

Bitcoin dropping is just part of the game. Markets are always up and down, switching between bear and bull phases. Bitcoin dropping isn’t a bad thing, as there is a way to make money on the way down also, with shorting.

It also lets investors begin buying the asset again at lower prices. Here’s more information on Bitcoin going down.

What Will Bitcoin Be Worth?

Bitcoin could someday be worthless once again if all governments ban it, the protocol is hacked, or if quantum computing comes around and ruins all the fun. However, just as easily Bitcoin could be worth millions of dollars per coin.

Most Bitcoin price predictions are more realistic around $100,000 to as much as $400,000 per coin. Anyone making such predictions are mostly speculating, although technical analysis does help to predict markets with some degree of accuracy.

How To Buy Bitcoin: A Step-By-Step Guide

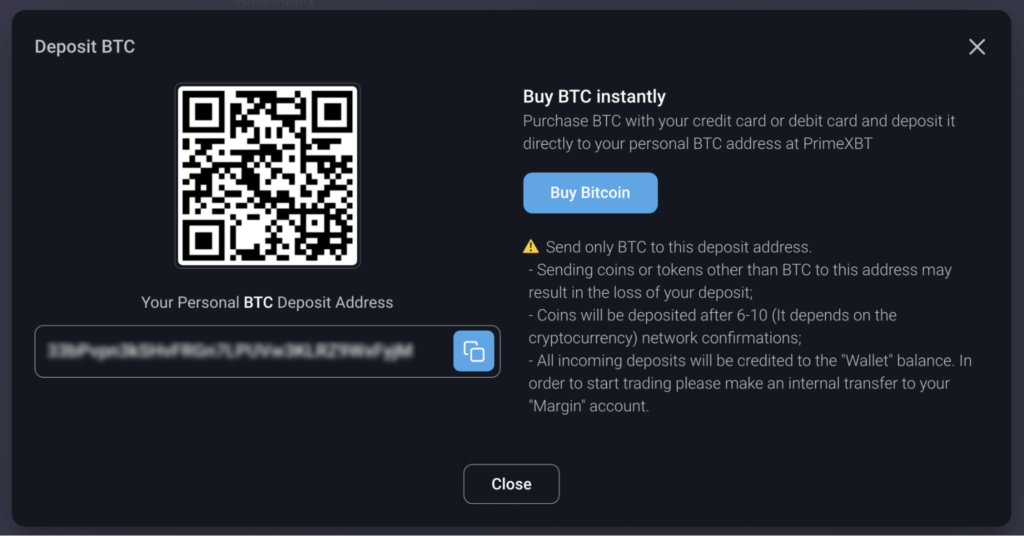

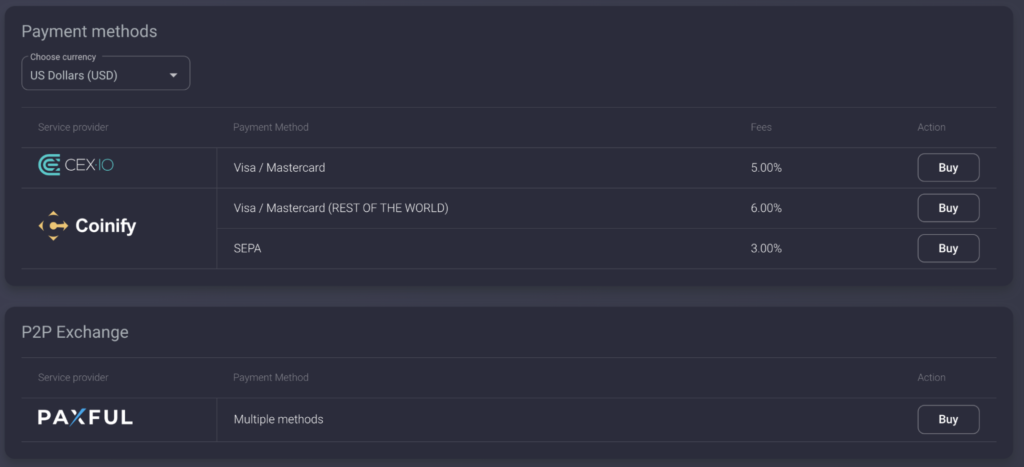

Buying Bitcoin is simple with PrimeXBT. Register for a free account, and complete the signup process. After confirming your email and logging in for the first time, users can buy BTC by visiting the BTC wallet section.

A variety of third-party modules will appear providing options to users to buy BTC. From there, users can send or store BTC in the secure wallet, or fund a margin account to begin trading Bitcoin and other cryptocurrencies.

When Should I Buy Bitcoin?

Buying Bitcoin is best right before or around the cryptocurrency’s halving. However, it is also a great buy whenever weekly RSI levels reach oversold levels.

The risk associated with buying Bitcoin rises each passing day, due to the fact the top gets closer and closer. That’s why buying BTC from PrimeXBT is best, because investors can hedge crypto holdings with a BTC short, or use their Bitcoin to trade and profit from any trend changes.

Is Bitcoin A Store Of Value? Understanding The Digital Gold Narrative

The digital gold narrative that first exploded in 2020 and into 2021 is due to Bitcoin becoming a store of value.

A store of value is defined as having a stable price, supply, and liquidity – which Bitcoin currently does not offer. It is more of a speculative asset, but in time will grow to become a store of value when volatility eventually disappears and the asset is highly adopted.

Is Bitcoin A Good Investment?

Bitcoin is a good investment just about any time in its lifecycle. But because another bear market will eventually happen, the cryptocurrency could soon be a bad investment for a short term.

Even though it will be a poor short-term investment, it will still have great long term investment potential

How To Invest In Bitcoin?

Investing in Bitcoin involves several strategies, such as dollar cost averaging, buy and HODL, trading and more. A new trend is emerging where investors invest in Bitcoin through companies that have BTC exposure, such as MicroStrategy.

Bitcoin Trading: The Best Bitcoin Exposure

There are also several different ways to go about Bitcoin trading, ranging from spot, futures, CFDs, and more.

Here is a brief explanation breaking down each of the various types of trading.

What Are Bitcoin CFDs?

Bitcoin CFDs are a type of cryptocurrency derivative product that stands for contracts for difference. These contracts allow a trader to long or short Bitcoin, Ethereum, and other assets, making profiting from both directions of the market possible.

What Are Bitcoin Futures?

Bitcoin futures are another type of derivatives product that requires an investor to settle the contract at a specific future date, hence the name. This allows traders to further speculate on the future price of Bitcoin.

What Are Bitcoin Options?

Bitcoin options are a crypto derivatives product that gives an investor an option, but not requirement to settle a contract when the contract expires. Options typically charge a high broker fee but are considered lower risk than futures.

How To Trade Bitcoin?

Trading Bitcoin involves either buying and selling assets or longing or shorting via derivatives contracts like CFDs. Traders try to extract a profit from the difference in price movements as a result of volatility.

Anyone can trade Bitcoin with very little starting capital and make money trading cryptocurrencies by registering for PrimeXBT. PrimeXBT is an award-winning multi asset exchange offering margin accounts with BTC, ETH, USDT, and USDC.

How To Read Bitcoin Charts?

Reading Bitcoin charts involves something called technical analysis. Technical analysis is the study of candlesticks, price patterns, indicators, overlays, and oscillators.

There is also a price ticker, time intervals, increments, and all kinds of other information. For an in-depth look at how to read Bitcoin charts, be sure to reference this guide.

Bitcoin Trading Strategies

Bitcoin trading strategies are abundant and involve some of the tools mentioned above. For example, traders could wait for price action to form a certain candle structure before expecting a reversal.

The most popular indicators to create successful Bitcoin strategies with include the following:

- MACD

- Relative Strength Index

- Moving Averages

- Parabolic SAR

- Ichimoku

- Average Directional Index

- Williams Alligator

Bitcoin Vs. Other Cryptocurrencies

When comparing other types of cryptocurrencies like altcoins, the difference is substantial due to first mover advantage. Because Bitcoin was first, its network is the most secure and widely adopted. It also is the most favorable from a regulatory standpoint, and has been the most proven successful.

Still, the debate will always go on so long as these other coins exist. Here are some of the most common crypto comparisons and how they stack up against one another.

Bitcoin vs Bitcoin Cash

Bitcoin versus Bitcoin Cash is the battle for the crown to be the one true Bitcoin, which BTC is clearly winning. Bitcoin Cash was created as a hard fork of the original Bitcoin core code. The blockchain split, resulting in the BTC asset and Bitcoin blockchain, as well as the Bitcoin Cash blockchain and BCH.

Bitcoin Cash has now fallen from grace and is nowhere near the crypto market top ten. It also has been forked again, to create Bitcoin SV.

Ripple vs Bitcoin

When comparing XRP versus Bitcoin, things really started to get different. The code of these two is completely different. Bitcoin is also fully decentralized, while Ripple owns the majority of XRP tokens making it more centralized than most coins.

Ripple is in a legal battle with the SEC, making Bitcoin the clear winner when it comes to regulatory support alone.

Ethereum vs Bitcoin

Here’s where things start to get interesting. Technically, Ethereum has been more profitable than Bitcoin over the last several years, even outperforming BTC since its launch. However, Ethereum is still in second place and is unlikely to replace Bitcoin.

Ethereum is a massive ecosystem at this point, and the basis of DeFi, NFTs, and more. It uses smart contracts to let developers code all kinds of crypto-based experiences that rely on ETH. Ethereum makes a great complement to any Bitcoin trading portfolio.

Bitcoin vs Litecoin

Litecoin is considered digital silver next to Bitcoin as digital gold. The digital gold narrative has been working, but silver in both senses has been left behind. Litecoin is still a great alternative to Bitcoin and another complement to a trading portfolio.

During phases, Litecoin will outperform Bitcoin, but that has been for some time. Perhaps that means another such phase will happen soon. That’s what’s great about crypto – speculating and trading your expectations.

Summary: Get Into Bitcoin With PrimeXBT

Bitcoin really is the future, that much is clear. But those days are still far off, and for now the asset is still speculative and therefore a volatile asset best left to trading.

For those wanting exposure to Bitcoin but want the safety of being able to control positions and manage against risk, trading CFDs with PrimeXBT is the way.

Getting started is simple and requires no minimum deposit. With very little starting capital, users can trade forex, crypto, commodities, and stock indices all under one roof.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.