Crypto investors worried about the coronavirus and potential impact of a recession on the horizon are all asking themselves the same question. This guide will explain how to invest in cryptocurrencies in 2020 and make profit, even despite financial markets in utter chaos, and asset prices more volatile than ever.

Introduction: Coronavirus Impact on Cryptocurrency

On December 31, 2019, the last day of the year, a virus that caused severe respiratory symptoms and possible death was discovered in Wuhan, China. Since then, the world has never been the same.

In a short time, the virus that causes COVID-19 went from completely unknown, to well over 100,000 infected, and over 5,000 deaths. These numbers are climbing so rapidly, the entire global landscape is in a state of emergency and panic.

To counter the spread of the pandemic, nearly all travel has been shut down, sporting events, conferences, and other social gatherings have been canceled, and many businesses are instilling emergency work-from-home policies to ensure the safety of their workforce.

However, this is having a severe impact on the growth of the economy and is increasing the risk of a recession as each day passes which is causing extreme volatility in all markets, including crypto.

How Can Coronavirus Impact Cryptocurrency Prices?

Investors are in a panic. Not just over the coronavirus itself, but due to the fact that the pandemic could be the final blow to the economy that causes a total collapse of the US dollar and one of the worst recessions the world has ever seen.

Fears have spilled into financial markets, causing the Dow to experience its worst daily decline since 1987. Crypto markets were also hit hard, with Bitcoin setting a record for one of the bloodiest days in the asset’s history.

Bitcoin dropped from $7,500 to under $4,000 in less than 24 hours. The rest of the crypto market also fell, plummeting by as much as 70% in some altcoin assets.

Since then, Bitcoin has been rising and falling by over $1,000 within hours between movements, creating the strongest and most violent volatility the normally volatile crypto market has ever seen.

While volatility like this is frightening for investors, active traders can turn the rapid ups and downs of the market into substantial profits. And with a recession around the corner, piling up profit is especially important to preserve one’s wealth during a crisis.

How Can Coronavirus Impact Bitcoin Price?

As noted, when investors are in a state of panic, volatility explodes as terrified investors panic sell and capitulate into confident traders buying the “blood in the streets.”

The popular Warren Buffett even suggests being fearful when others are greedy and being greedy when others are fearful. With so much fear in the market, there’s no better time to trade Bitcoin.

The coronavirus is a black swan event – an unpredictable occurrence that surprises and shakes up the entire world, including Bitcoin.

As was witnessed recently, Bitcoin plummeted by over $3,000 in a matter of a few hours due to the extreme panic in the market.

With fears continuing to grow, and a vaccine still months to a year off, the COVID-19 scare could keep cryptocurrency prices at bay for some time to come.

However, an alternative take on this theory, is that Bitcoin could very well thrive in the event of a total collapse of the US dollar.

The asset was designed to be a store of wealth and a safe haven during a crisis, due to the asset’s digital scarcity. But even the coronavirus was too strong for this benefit of Bitcoin and even caused other safe-haven assets like gold and silver to drop as well.

With fear here for the foreseeable future, the coronavirus could continue to have a dramatic impact on Bitcoin price for many months to come.

Bitcoin Trading Strategies During Crisis

With markets in such uncertainty, traders should focus on scalping within any established trading ranges.

Bitcoin just fell to a new local low and must begin to build a base before any long-term long positions are built. Long trades, for now, should be short-lived, until the asset class shows more signs of strength or the COVID-19 scare begins to slow.

But with the Bitcoin halving ahead, the asset really could take off like a rocket, so watching for this signal that the market is turning is absolutely critical. Bitcoin price forecasts based on the halving such as the stock-to-flow model put Bitcoin at $55,000 within months.

At this point, a new trading range has yet to be established. During the last bottom in Bitcoin, the asset traded within the range for nearly three full months of sideways.

Most investors gave up, while traders who use 100x leverage were able to profit from these tight trading ranges.

Eventually, once a base was built, those who took out a long saw the asset rise from $3,000 to $13,000, making them a fortune.

For now, any rallies should be shorted at resistance, and any pullbacks should be bought at support. When either side breaks, it’s time to take a longer-term position and churn out some extra profits.

Traders can watch for the Relative Strength Index to reach oversold levels on lower timeframes, from the 1H to 1D, to understand when it’s time to close their trade in profit or open a new position.

Other traditional strategies can be effective as a Bitcoin trading strategy, such as MACD crossovers, and or breaking through Moving Averages to assist in understanding when the market is about to turn.

How Can Coronavirus Impact Litecoin Price?

Bitcoin is the leading cryptocurrency by market cap, and as the primary driver of the market, when it tanks, so does the rest of the market.

However, Litecoin is often said to lead rallies in the crypto space and can act as a leading indicator as to when Bitcoin and the rest of the crypto market may be turning around.

Fears over the coronavirus also crushed Litecoin recently, causing the asset to reach as low as $27.

Clearly, the pandemic can impact Litecoin price in a significant way.

Litecoin had its halving last year, so there is less ahead for the asset to be bullish on than Bitcoin, however, given its low prices, it may be among the first to rebound in the crypto market as investors start out with low-risk investments when they’re ready to get back into the market.

Like Bitcoin as the digital counterpart of gold, Litecoin is said to be digital silver. These assets carry unique attributes that make them deflationary and possible safe-haven assets.

With the Fed printing more and more money, devaluing the US dollar, it could cause crypto valuations to skyrocket. Litecoin price forecasts point to the asset eventually reaching over $500 per LTC, so there’s far more room to the upside than downside.

These are unusual times, where crypto assets like Litecoin could truly shine, or continue to get wrecked in the volatility.

Litecoin Trading Strategies During Crisis

As with any asset during a crisis, taking it slow and trading within a range is the key to profits. Waiting for a base to be built and signals that a bottom may be in before taking a longer-term trade is a best practice recommended to all.

Litecoin is an altcoin and can be traded against USD or BTC pairs, this makes the asset especially interesting, as there is room to profit from both ebbs and flows in USD value, as well as BTC value.

When Bitcoin rises, oftentimes, altcoins like Litecoin fall, while other times, these assets rise alongside Bitcoin.

In addition to trading the peaks and troughs of the new trading range that gets established in the coming months on the LTC/USD pair, there will be plenty of opportunities to go long or go short on the BTC pair also.

Common trading strategies using the RSI, MACD, Stochastic, Moving Averages and more are effective here, however, remember to focus on lower time frames until more accumulation has taken place.

How Can Coronavirus Impact Ethereum Price?

Ethereum kicked off 2020 with one of the strongest rallies the crypto market has ever seen, rising by over 100% in a matter of two months.

The skyrocketing price was largely fueled by the massive growth of the decentralized finance industry.

The growth in Ethereum locked up in DeFi applications reached a new high, causing investors to FOMO into the asset.

But the coronavirus cut the rally down to size, causing the asset to set a new yearly low.

Things are looking bleak for Ethereum in terms of price action, but given the fragility of the economy and the current monetary system, the asset has never been more bullish fundamentally.

If the economy collapses and centralized finance goes under, DeFi will reign supreme and the value of Ethereum will skyrocket. Ethereum price forecasts suggest that the smart contract asset will eventually reach prices of well over $35,000 in the long term.

Because there is such potential upside, taking a position in Ethereum may be scary now, but could pay off in the long run.

Ethereum Trading Strategies During Crisis

For now, trading a tight range is best, scalping each high and low with a leveraged short or long position.

Until Ethereum builds a base like the rest of crypto, it’s best to stay scalping and taking a wait and see approach. But be ready to take a long-term long position the moment Ethereum looks primed for a breakout.

Common low time frame trading strategies using the RSI, MACD crossovers, and more are recommended for the time being, until Ethereum starts to show signs of a new bull rally once again.

How Can Coronavirus Impact Ripple Price?

The coronavirus caused a ripple effect across financial markets, no pun intended. Not only did this cause the stock market and Bitcoin to collapse, but the number three cryptocurrency by market cap also fell to yearly lows.

XRP, the native crypto token of the Ripple protocol is poised to disrupt the multi-trillion dollar cross-border payment and remittance industry. With such potential, it’s shocking to see XRP falling amidst even the worst crisis the world has seen in ages.

But like Bitcoin, Litecoin, Ethereum, and others, Ripple fell in price by a large margin.

Given the state of panic the market is in, XRP could fall much further. But with such potential, and with the collapse of fiat currencies possibly on the horizon, Ripple could rise in value significantly in the days ahead.

When Ripple breaks out, in the past it has gone on an over 6,000% rally. The last time this happened, Ripple went from under a penny each to $3.50. Ripple price forecasts put the asset at $14 in the near term and over $1,000 in the long-term.

Ripple Trading Strategies During Crisis

The potential for profit is incredible, but like other cryptocurrencies, XRP is likely to trade sideways in a tight trading range while it establishes a bottom base to bounce from.

After such a break in market structure, the asset could stay trading within a tight range for the next few months.

Due to this, scalp trading on low timeframes using 100x leverage to take rapid long or short positions, and getting out of those positions as soon as the trade is in profit is recommended.

This active trading style can help lower fees on some platforms that reward users for the more trading turnover on their account.

Using the RSI and other common indicators, traders can play the trading range for profits for as long as it holds. When it breaks out, it’s time to take a long or short for the longer-term.

How Can Coronavirus Impact Other Cryptocurrencies’ Price?

The crypto assets listed above, are the primary movers of the entire crypto market. If they are in decline, so is the rest of the crypto market.

The coronavirus and rapid spread of COVID-19 are causing such panic, there is no cryptocurrency that is safe from potential collapse. But volatility like this is the best possible opportunity to profit, so traders are drooling over the potential gains these speculative assets provide.

Still, anything outside of the top ten cryptocurrencies by market cap is especially risky and may struggle in the months ahead compared to Bitcoin, Litecoin, Ethereum, and Ripple, which have better use cases and more adoption.

Common Trading Tips To Take Advantage of Volatility

The common theme throughout all that’s recommended above is to focus your cryptocurrency trading strategy on scalping. In such volatility and with such unpredictability in the world right now, it’s not the time to take a long-term trade.

Instead, being an active trader, taking out long and short portions at support and resistance level using high leverage, then closing out the moment targets are reached, is the best way to profit.

Focus on low timeframes, and watch for things like oversold or overbought conditions on key indicators before taking action. During this type of volatility, chart patterns hold less weight, and indicators can be more effective to find success in these conditions.

Experimenting and finding which indicator works best, is ideal.

Conclusion: PrimeXBT Has All the Tools Needed to Profit During Crisis

There’s no denying that these are scary times. The coronavirus is a black swan event and pandemic taking the entire world by surprise and disrupting life itself.

A possible recession could happen as a result of a halted economy, and it is causing markets to catch fire with the most extreme volatility seen in a decade of trading action.

There’s never been a better environment for active traders to profit from the markets, but the right strategy is critical. And so is choosing the right platform.

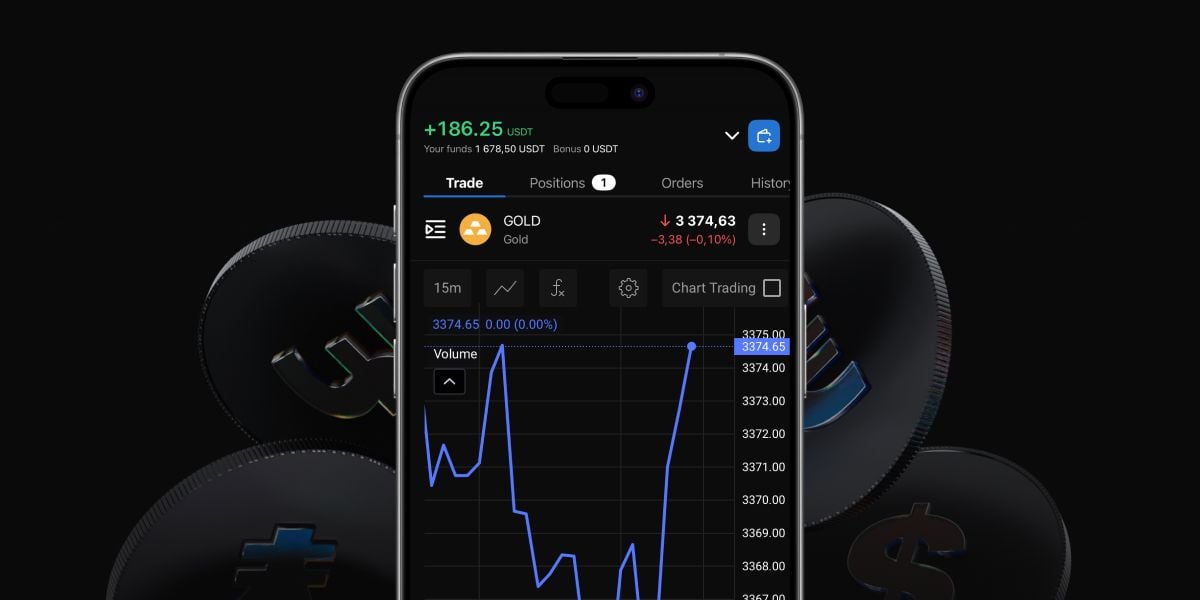

PrimeXBT features all of the tools necessary to help traders not only survive in this new environment but succeed and grow their profits like never before.

The platform features long and short positions, even simultaneously to build hedge positions, and up to 100x leverage on crypto-assets to take advantage of even the tiniest movements when locked in a tight trading range.

There is also an abundance of trading tools designed to lower risk and increase profitability, so traders can prepare in advance for any upcoming breakouts of the trading range.

Platforms like PrimeXBT are ideal in volatile times. By using 100x leverage, less capital is put on the line, so less can be lost when risk is high. And with the reward so high for being on the right side of the trade, taking a calculated and structured risk with tight stop losses can lead to enormous profits.

PrimeXBT also features built-in charting software with dozens of top technical analysis indicators so that traders can ensure safe entries and exits based on oversold or overbought conditions.

Beyond this, the platform also offers many additional ways to earn income – especially helpful if a recession does hit. CPA offers, a referral program, and much more are available for partners to take advantage of. Top earners have already generated over 50 BTC in revenue.

In addition to cryptocurrencies, PrimeXBT also offers exposure to gold, silver, stock indices like the Dow Jones, NASDAQ, and more, as well as oil, gas, and even forex currencies like the US dollar and Japanese yen. These markets are also extremely volatile, letting traders profit from more than just crypto alone.

There’s no better platform to take advantage of the markets and profit from the extreme volatility than PrimeXBT. Registration is fast, easy, and requires no personal information. Sign up today and get started trading.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.