Last Monday came news that the US SEC was officially suing the largest crypto exchange Binance for commingling of funds and listing of unregistered securities, causing crypto prices to dump, wiping out almost $300 million worth of long positions within an hour. BTC and ETH fell around 4%, while altcoins, led by BNB, Binance’s native token, bled an average of around 10%.

While an extensive list of PoS tokens were claimed to be securities according to the SEC’s filings, including SOL, ADA, MATIC, FIL, ATOM, NEAR, SAND, MANA, ALGO and AXS, there were no PoW tokens being mentioned, which may imply that the SEC does not think that PoW coins like BTC, LTC, DOGE, ZEC, AMR, or ETC are securities.

Despite a second similar lawsuit filed on Tuesday against Coinbase, crypto prices reversed almost all their losses by the end of the day. Notably, a US Court has ordered the SEC to respond to Coinbase’s rulemaking petition filed in April or explain why it should not, within the next seven days. In April, Coinbase filed an Administrative Procedure Act challenge asking the court to force the SEC’s hand and get the regulator to respond to its 2022 petition for formal rulemaking in the digital assets sector, arguing that the existing requirements are ill-suited for digital assets and that the SEC has no right to litigate against cryptocurrency exchanges if the rules have not been made clear.

However, traders were not comforted by the court ruling, as crypto prices resumed dipping lower over the week, before capitulating late Friday after news that Robinhood would delist SOL, MATIC and ADA by 27 June as a result of the classification by the SEC. Robinhood’s move is expected to be echoed by other exchanges with a USA presence, and a major selloff erupted across the crypto market as the weekend beckoned, with the price of altcoins plummeting by up to 25% within one hour in what appeared to be a liquidation event after days of slow blood letting.

Tokens that have been singled out by the SEC to be securities were the main casualties, as the prices of FIL, MATIC, SOL and ADA lost around 30% overnight, after having already lost around 20% before Friday’s dump. By the end of the week, these tokens lost around 40% of their value at their lowest point, but have since recovered slightly as the new week dawns.

In such a marketwide liquidation, no coin was spared and even the PoW coins like BTC, LTC and DOGE did not manage to escape unscathed. BTC lost around 5% while LTC lost 20% in the worst part of the selloff.

Around $350 million worth of positions were liquidated on Friday, more than the amount liquidated on Monday, with 95% of them being long positions, compared with a total of only around $100 million worth of trades being liquidated between Tuesday and Thursday.

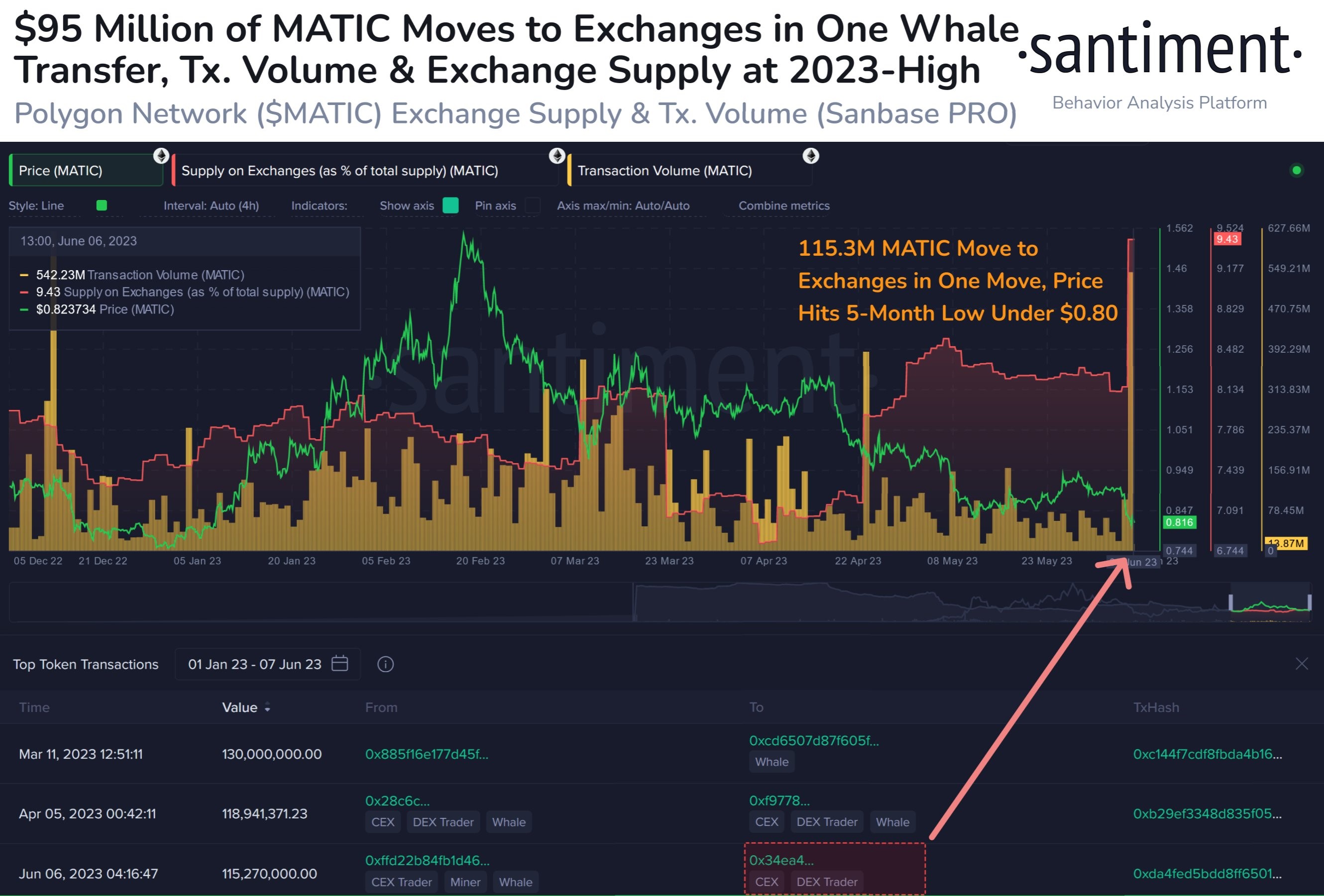

Large Whale Dumped MATIC, Token Lost 40%

In particular, MATIC saw a 700% surge in transactions worth more than $100,000 in value each, presumably from investors that were selling the token as it crashed more than 40% in the days after the SEC classification. Other popular coins that had been named securities by the SEC, like SOL, FIL and ADA, also lost similar percentages subsequently.

It was later revealed that the surge in MATIC transactions was caused only by one whale wallet, rumored to be Jump Trading, who had transferred 115 million of MATIC to an exchange for sale, and not due to an exodus of investors. While this could imply that this could be a one off incident, it also shows the vulnerability of MATIC’s price to the whims of a few large whale accounts. Similarly, Jump Trading was rumored to have disposed of their stake in SOL over the weekend, which suffered the same type of large volume selloff on Saturday.

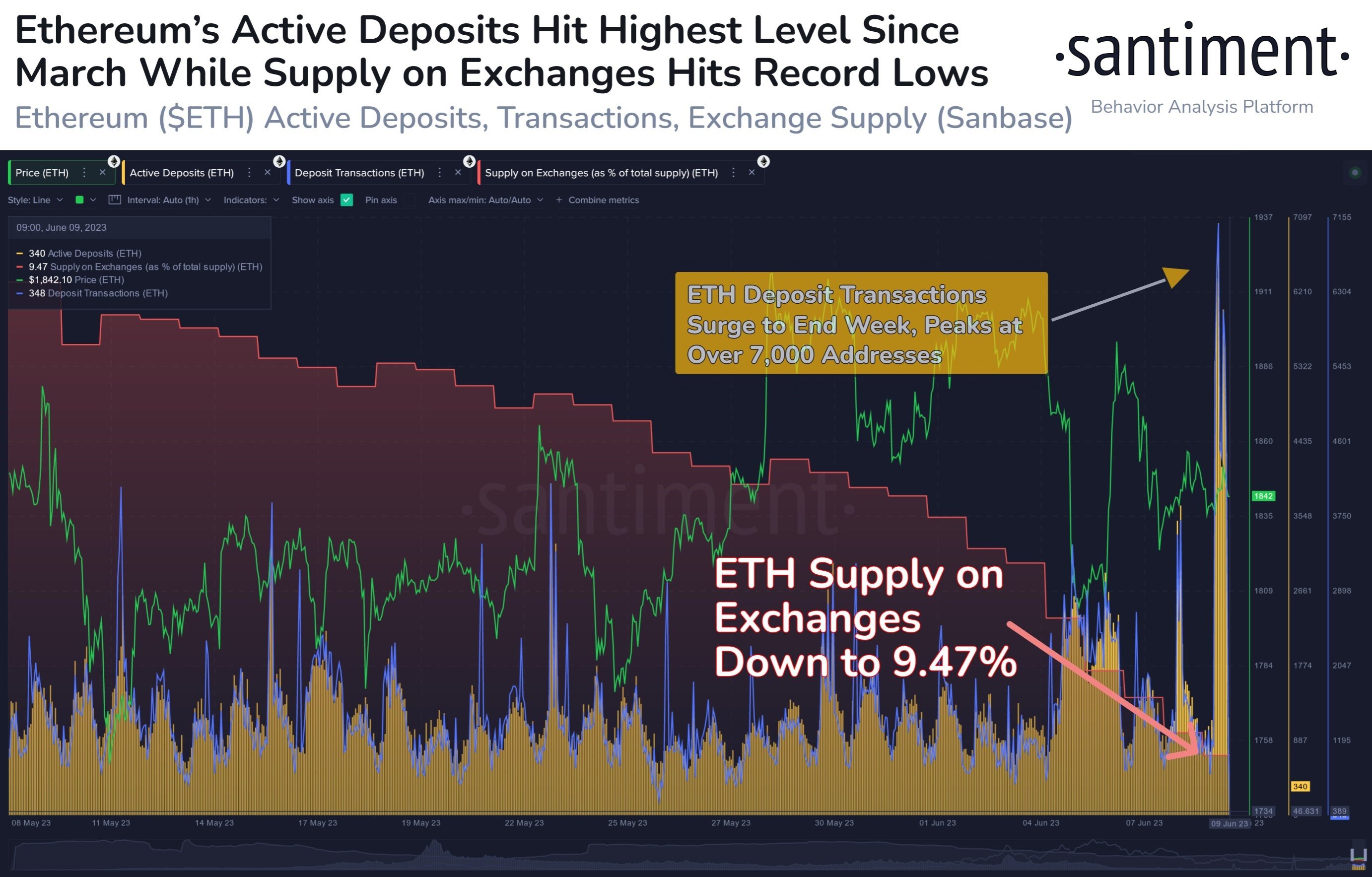

Exchange Deposit of Coins Saw Huge Increase

On the topic of whale selling, BTC also had an interesting episode immediately after the SEC lawsuits where a 10-year old dormant account had sent 1,433 BTC to an exchange. While 1,433 BTC is not by any means a size large enough to dent the price of BTC, the fact that this account has moved only now after 10-years of holding could affect market sentiment to a certain extent. However, it was later clarified that the old account merely sent the BTC to a new address and the coins were not sold.

On the other hand, ETH saw an influx of exchange deposits on Friday, which could spell trouble in the near-term for the largest crypto asset that has been labelled as a security by the SEC previously.

However, despite having made significant losses, both BTC and ETH proved to be the blue-chips that they are, having kept their losses to within 10% in the week of crypto blood bath which saw even altcoins that were not listed as securities by the SEC losing up to 30%. As a result of BTC’s resilience amid a large-scale altcoin selloff, BTC’s Dominance has broken out of a one-year consolidation.

BTC Could Dominate In the Near-Future

As can be seen in the BTC Dominance chart below, BTC Dominance has just broken out of a year-long consolidation. Such a long-duration breakout for BTC could be bad news for the price of altcoins for the foreseeable future, as it means that the price of BTC would outperform that of altcoins from here onwards.

Indeed, being as only one of a few coins that have cleared the SEC hurdle, investors are likely to be hiding in the safety of the King of Cryptos until the SEC debacle blows over, which may take quite a long time.

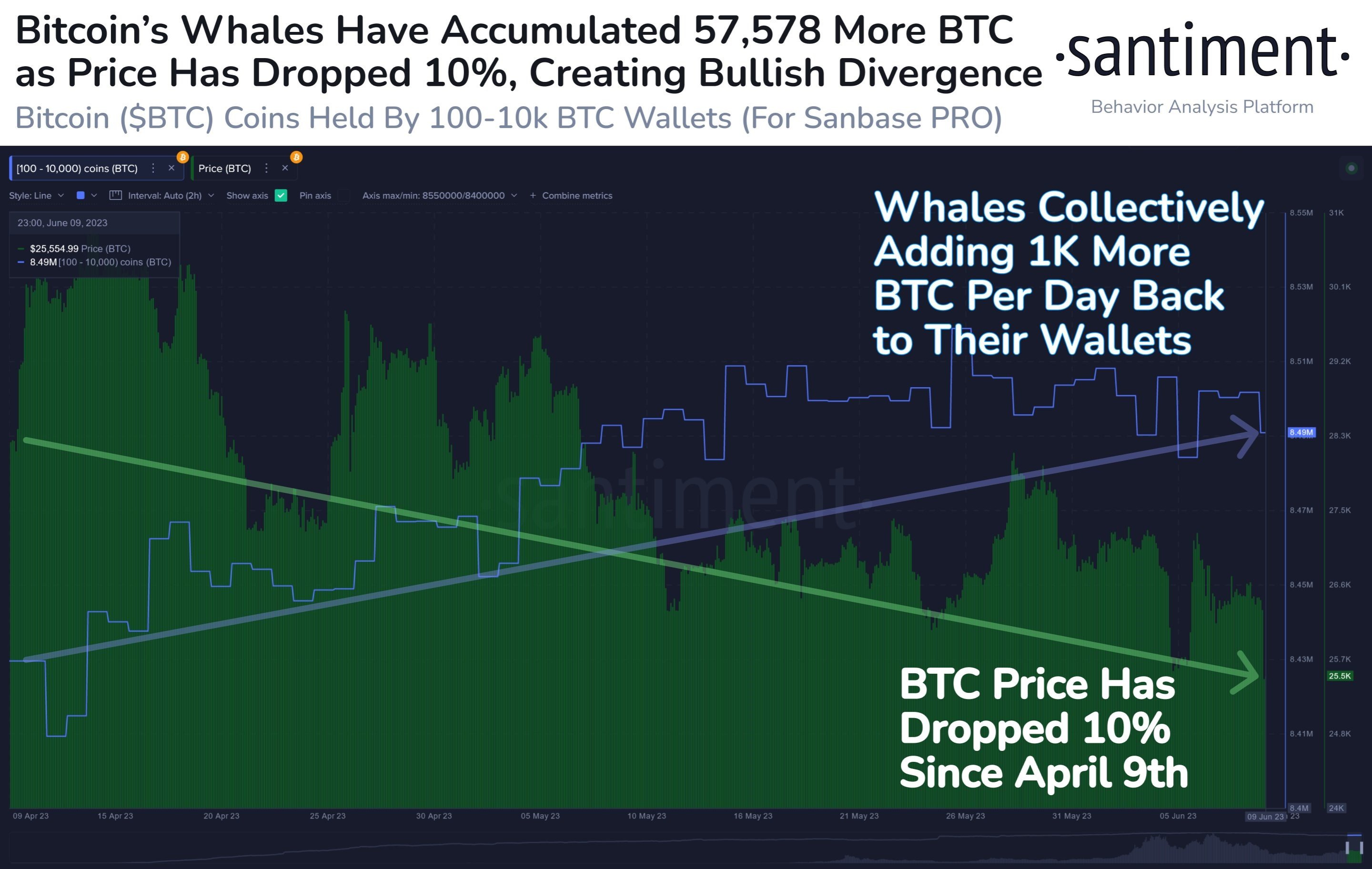

As it is, whales have been actively accumulating BTC during the dip from early April, adding around 1,000 BTC per day as price weakened. This creates a bullish divergence between whale holdings and price, which could ultimately spring a positive upside surprise for the price of BTC, and may even prop up the USD price of altcoins. However, the prices of altcoins are expected to weaken against BTC, which could open up shorting opportunities in altcoin vs BTC pairings.

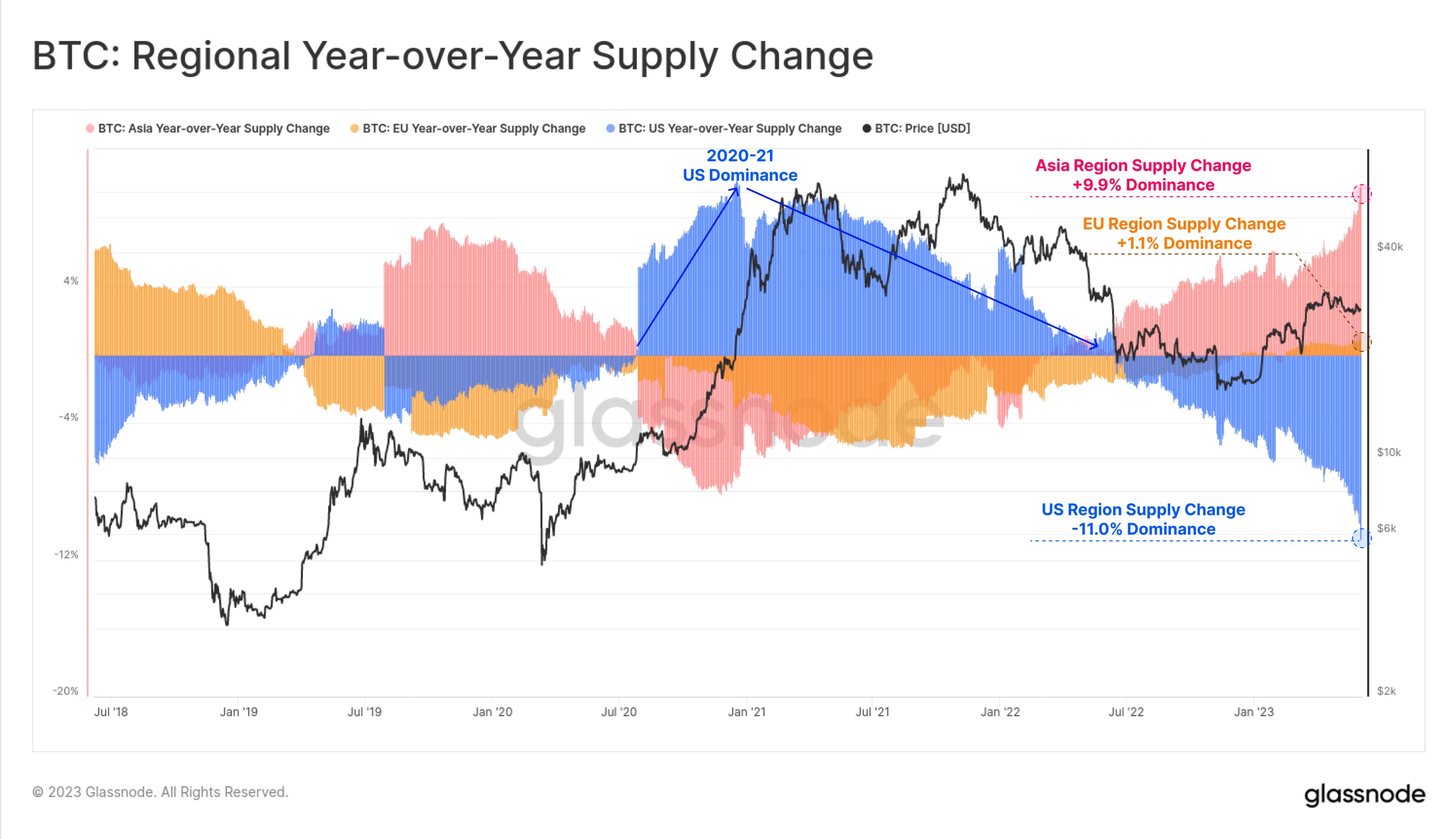

Next Bull Run Could Be Dominated By Asia

Ever since the ongoing crackdown by US authorities, the dominance of US investors on the supply of BTC has been on the decline. As it has been even before last week’s witch hunt, US investors’ dominance on BTC had dipped by 11% since the 2021 peak, while the dominance of Asian investors had increased by 10%. With last week’s intensified crackdown, US dominance is expected to fall even further at a time when China and Hong Kong are gradually opening up to web3 again. Until the USA gets their grip on proper crypto legislation, the pendulum could swing back into the hands of Asian investors, who may feature more prominently in the upcoming trajectory of the crypto market. As such, investors may want to pay more attention to the happenings within the Asian crypto market, especially within the Hong Kong and Middle Eastern landscape. In fact, it would not be a surprise if trading becomes more active in the Asian time zone in the upcoming bull market.

Stocks Flat As Traders Lay in Wait For the FED

As for the traditional markets, macro data released last week were generally weaker than expected, with the initial jobless claims for the first week of June to be 261,000 – much higher than analysts’ expectation of 235,000. Data out of China also showed that the Chinese economy could be slowing down more than expected. However, the PBoC is expected to cut rates and infuse more liquidity into their economy to cushion the impact of a downturn, which could in turn be positive for risk assets in time to come.

In the near-term though, the slew of negative data has dented the markets a little, as investors attempt to digest the data and wait out for the FED meeting to take place this week before taking on large positions. As a result, stocks largely traded flat for the week, with the S&P 500 gaining only 0.39%, the Dow advancing 0.34% and the Nasdaq only up about 0.14%. Even though the major US indices were higher again for many consecutive weeks, the magnitude of their increase has slowed down, which could be a sign of exhaustion. To continue on their winning streaks, stocks will need a boost from the FED in Wednesday’s meeting, where 70% of experts anticipate a pause in rate hike. However, a pause is not 100% baked in and the chance of a hike is still there, especially if the CPI data scheduled for this Tuesday’s release comes in way hotter than expectations, while a cool CPI reading would almost confirm a pause in June.

With most traders anticipating a pause, the US dollar inched back last week, losing around 0.5% against its peers, which gave Gold and Silver a chance to breathe. Gold edged up a similar 0.6% while Silver gained 3%, but both precious metals are opening the new week a tad weaker as the dollar appears to be finding some buyers.

Oil prices slumped last week after the release of weaker data from China as demand from the world’s largest importer of oil is expected to slow. Brent lost 3.7% and the WTI was weaker by 4.2%, and are weakening a further 1% in early Asian trading in the new week.

Other than the US CPI data out on Tuesday and the FED meeting this Wednesday, forex traders should also keep watch on Friday as the BoJ will also be having its monetary policy meeting on that day, which will influence the direction of the yen.